Investment Summary

Shagun, we were very clear in the first quarter that our plan is front-end loaded. And if I’m an investor, I would want to have a front-end loaded plan from a company rather than a back-end loaded plan for a company.”

That was the CEO of Teleflex Incorporated (NYSE:TFX) on the firm’s Q1 FY’23 earnings call, answering a sell-side analyst, and illustrating the current state of affairs in doing so.

In October ’22, I published a note showing a “more constructive” posture on the investment prospects of TFX. This was based on a myriad of factors. In June 2022, things have changed, and there are several new moving parts that must be factored into the rating (which, was a hold back in ’22 by the way). As a result, a parallel change must be folded into the critical facts underpinning the TFX investment debate.

One, the stock has taken out my previous $240 price target with an 18% advancement off the November ’22 lows. Investors have poured into the TFX equity bucket and priced the company at a ~$3Bn higher market value since then.

Two, projected growth rates for TFX’s top-line are above historical ranges, as you will see here today. To me, this suggests the company is poised for a cyclical upswing in both sales and earnings, backed by management’s forecasts. The Street has made 13 revisions upward on sales forecasts and 6 to earnings targets within the last 3 months, chasing the tail of a company that is exuding shareholder value.

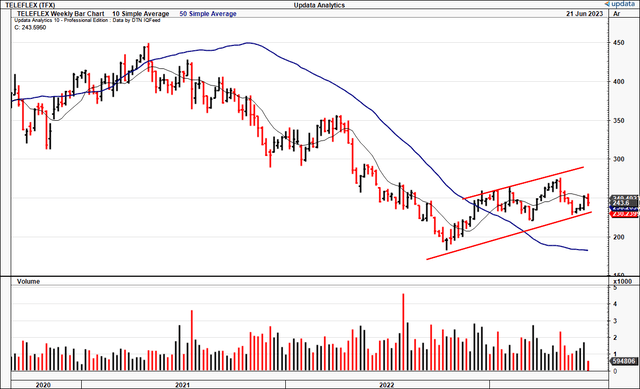

Three, the firm’s economic characteristics are attractive, and when analyzed under the lens of an intelligent investor, reveal why the institutional crowd has remained constructive on TFX- despite the drawdown from its FY’21 highs [Figure 1].

Most important to my investment cortex, is that, in spite of sluggish sales growth, it has compounded owner earnings at roughly double the rate of turnover since 2018. Based on the latest data, there is reason to expect this to continue moving forward. The character of the latest buying thrust is also telling, one with potentially strong hands and long-term conviction, evidenced by the gradual climb in equity value TFX has captured since bottoming with the market in October last year.

Figure 1. Recovery on ascending volume in last 4-weeks

Data: Updata

Four, the company’s latest earnings are indicative of the full-year expectations, where management calls for growth above historical rates, as mentioned earlier. However, several other factors are gleaned from the firm’s Q1 FY’23 numbers that will be discussed in further detail here.

Net-net, on earnings power and asset factors, TFX appears undervalued, and this suggests there could be a mispricing. From the analysis presented below, TFX comes to a valuation of $384 per share, suggesting >55% upside potential if the assumptions come to fruition. Rate buy.

TFX recent catalysts for price change

On aggregate, TFX has made significant strides in attracting future investment, evidenced in part by its latest numbers and recent collaborations. Both of these factors have the potential to see TFX trade at higher market values in my estimation.

Partnerships and product offerings:

TFX secured two group purchasing agreements with Premier, Inc (PINC), (check my hold rating on PINC here), effective from July this year. These agreements allow PINC’s members to access selective pricing and terms for TFX’s central venous and arterial vascular access products.

PINC has also granted TFX a national tender for its haemodynamic monitoring products and accessories, as well as granting the firm sole source agreements for PINC’s AscenDrive line, along with its SURPASS central venous catheters (“CVCs”). With respect to the group purchasing agreements mentioned earlier, in my opinion, TFX’s offerings have been significantly improved under the contracts by the inclusion of the Arrow+gard Blue Plus CVCs , and the Arrow ErgoPack complete systems.

In addition, on the same day this report is being written, TFX established an exclusive distribution partnership with Shenzhen Insighters Medical Technology in the U.S. This collaboration enables TFX to distribute the company’s Insighters Video Laryngoscope system, which is a camera scope that facilitates endotracheal intubation, and offers real-time high-resolution imaging during various surgeries. Based on these two updates, it’s clear TFX still has a major standing within the industry.

Financial drivers

TFX clipped Q1 revenues of $710.9mm, a YoY gain of 10.8%, with ~240bps of FX wind baked into this result. It pulled this down to adj. earnings of $3.09, up 7.3% YoY. Despite the impact of 5 additional shipping days in the quarter, TFX’s core business grew at 7.1% when adjusted for the extra days. Alas, that informs us that each extra shipping day contributed just over 1% growth in Q1.

- Regional insights:

- Regionally, the spectacle was the 9.2% YoY gain in turnover to $411.9mm in its Americas segment in Q1. Surgical revenues were the main driver of revenue change, likely due to the rebound in hospital/surgical patient turnover in my opinion, as backlog built up through the pandemic gets filled.

- Similarly, EMEA regional revenues were up 10.5% YoY to $143.3mm.

- However, it was the firm’s APAC markets undergoing the highest quarterly momentum, clipped ~23% growth to $78.7mm for the quarter.

- Divisional highlights

- Individual segments of the portfolio corroborate the fundamental momentum as well. The vascular access business for instance, reported a 9.2% increase in sales, reaching a total of $177.7mm.

- Interventional access sales also came in to $116.9mm, eclipsing a 23% growth schedule that was backed up by another 9% growth in anaesthesia sales.

- For me I am very intently watching the firm’s surgical business, as I opine a combination of (a) underlying market economics and (b) TFX’s offerings offer potential value here. It pulled in $99mm in surgical turnover, an increase of 14.3%. Management said that metal ligation clips and instruments were key to this number.

Looking ahead, management expects ~5-6% top-line growth in FY’23, calling for $2.9Bn in sales on adj. earnings of $13.60. That represents a c.5.6% forward yield at the time of writing.

Business economics

For those long of stocks, it helps to think in first principles in the process of security selection. A firm with desirable economic characteristics will typically be rewarded by the market with higher valuations over time. In order for this to happen, the market must deem capital valuable in a business’s hands. That occurs when a firm can incrementally grow the profits it produces on its incremental investments, higher than the market rate of return.

Hence, before committing capital to any company’s equity stock, you would want to know of its capacity to appreciate capital over time- as this is what creates additional value in the first place. You give a firm your capital, and it is investing at rates higher than the market return, that is surefire to attract sophisticated investment.

Those points in mind, you’ll see the economic features listed above, in the returns TFX has produced on its capital over time. On first glance, the savvy investor might be able to see TFX’s ability to create shareholder value in the record below:

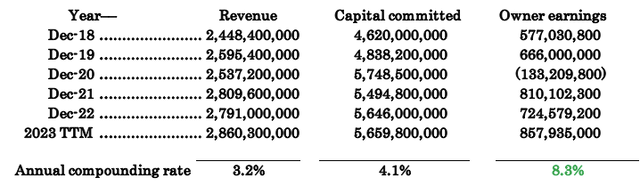

Table 1. TFX long-term revenue, capital + earnings statistics

Note: The year 2023 is shown as the TTM to Q1 FY’23. (Data: Author, TFX SEC Filings)

Taking a composite over the last 5-years of performance (i.e., a long track record), the following positives glare out:

- The firm has compounded top-line sales at an average 3.2% per year dating back to 2018

- In contrast, the capital TFX has committed to growing operating assets had grown by 4.1% on average each year

- Hence, in view of points (1) and (2), the firm has compounded the earnings distributable to its owners at a rate of 8.3% over the same time [note: owner earnings is defined at post-tax earnings, plus depreciation + amortization, less investments made each year (inc. NWC)].

The arithmetic is clear- with each $1 turn in revenue growth, it produced ~$2.60 in additional owner earnings, which bodes in tremendously well for the forecasted growth estimates. As you see, the 5-6% projected revenue rates for FY’23 are above historical range, creating a potential tailwind to the cash TFX can spin off to its shareholders. With that, presuming it could keep the same kind of earnings leverage described above, the 5-6% growth may contribute an extra $4-$6 of every additional $1 in sales, otherwise 16% compounding growth.

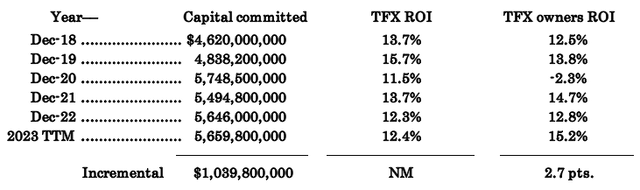

To put this into perspective, I’ve tabulated the series of investment returns TFX has generated for itself as a corporation (“TFX ROI”) and compared this to the return it has produced for its owners (“owners ROI”). TFX ROI is calculated using the company’s post-tax earnings, whereas the owner’s ROI is taken as the owner earnings produced from the firm’s operating capital each year.

Noted, is that each year –bar 2020– TFX has had no trouble beating the market return on capital (10-12% on long-term average), nor have its shareholders. Returns have cruised above the hurdle rate. More importantly, it has added another 2.7 percentage points of incremental gain in owner’s profits, that’s $280.9mm extra owner earnings since 2018 off the $1.03Bn investment.

Hence it is clear, through the company’s business economics, that it has the scope to create tremendous value for its shareholders going forward. On the assumption it maintains the average owner earnings ROI into FY’23, you’d be looking at another $880-950mm in the free cash it could throw off to its shareholders this year into the next.

Table 2. TFX returns on capital committed

Data: Author, TFX SEC Filings

Valuation

Based on the factors of earnings power and asset productivity listed thus far, that investors are selling TFX stock at 15x forward EBITDA and 19x forward earnings is far too pessimistic in my view. Based on this, I believe the company is undervalued.

At the current market cap of $11.8Bn and assuming a 12% discount rate, the market expects $1.42Bn in post-tax earnings from the company (1,142/0.12 = $11,880). At the TTM pre-tax number of $713mm, it would imply the market expects ~26% compounding growth in the firm’s earnings over the next 5 years, (at the current market cap). Is there a reason to deviate from this? My numbers call for the firm to do another $880-950mm in owner earnings this year, with a reduction in NWC density and a reduction in incremental investment. That would imply a 33% growth rate, and therefore a step above the market’s view. Hence, I would expect a valuation of $384 at 19x forward earnings (19×950/47 = $384), or 57% upside potential. This supports a buy rating.

In short

Oftentimes one has to lift back the superficial layers and look deeply into the subterranean layers of a company’s land surface. That involves deep scrutiny of history, and a thoughtful analysis of the future, whilst thinking in first principles. In that vein, TFX demonstrates that it compounds the cash it throws off to its shareholders faster than its top-line, a type of earnings leverage. It can achieve this, because it produces a return on its capital investments higher than the capital charge made on them. Hence, it can focus on growing the amount of cash it can throw off to its shareholders (including its dividend, not discussed here) without jeopardizing growth, and vice-versa.

In that vein, TFX’s attractive business economics warrant it a buy in my view, attracting a valuation of $384 per share. This is supported by 1) recent fundamental momentum, 2) asset factors of productivity, 3) earnings power from the company’s incremental investments, and 4) projected growth rates above historical range. Net-net, I am revising my position on TFX to buy.

Read the full article here