New York Stock Exchange

Summary.

Not long ago, I posed the question.. how can an investor own a piece of the financial exchanges themselves, and that led to my first analysis covering a major owner of derivatives exchanges, Chicago’s CME Group (CME), one I have personally visited in Chicago’s financial district, along with options exchange operator CBOE Global Markets (CBOE).

Continuing on the theme of exchange operators, today I am rating the NYSE’s owner, Intercontinental Exchange (NYSE:ICE).

This stock is getting a Hold rating.

Its strengths are a solid cash position, revenue diversification, and stable dividend growth for the dividend investor.

Its headwinds are overvaluation, and potential macro risks of a looming recession that could affect trading volumes in general as investors hold on to cash in that scenario, causing less transaction volume for the exchanges.

Company Brief.

ICE crosses the spectrum of data, technology, and financial markets. According to Wikipedia, the company has 12 regulated exchanges & marketplaces, including the New York Stock Exchange, which it acquired in 2013.

Besides operating stock exchanges, they also have a mortgage technology segment and a fixed income & data services segment.

On the data side, one notable solution the company offers is to “enhance risk management, maintain compliance and maximize operational efficiency with high-quality reference data on over 35 million financial instruments covering more than 210 markets.”

This ability to make a business out of mountains of data flowing through exchanges also sets them apart, which is why I mention it.

Rating Methodology.

Albert Anthony & Co is an equities research & analysis firm I run remotely, and the approach to research analysis we use on Seeking Alpha is to find stocks trading cheaply but who otherwise have strong financial fundamentals, and we primarily cover the financial & technology sectors.

I ask the following 5 questions, and each yes answer is worth 20 points. A total score below 60 is a sell, a 60 is a hold, and above 60 is a buy.

- Is the stock suitable for dividend-income investors?

- Is there a value buying opportunity based on the price chart & valuations?

- Is revenue diversified across more than one source or business segment?

- Is the company in a healthy position in terms of capital & liquidity?

- Does the current macro environment help this business?

Stable Growth for the Dividend Investor.

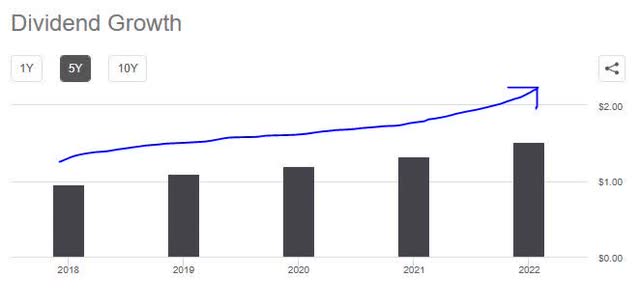

The first category being rated is dividends, and the reference data comes from Seeking Alpha.

This stock currently has a dividend yield of 1.50%, as well as having 5 years of steady dividend growth, as shown below:

ICE – dividend growth (Seeking Alpha)

Consider that the annual dividend was $0.96 per share in 2018, and went up to $1.52 in 2022. In addition, the quarterly payouts have been steady and consistently reliable.

Only one of its peers, however, is more competitive on dividend yield. For example, CME Group current yield is 2.42%.

For this reason, I think yes ICE could be a good stock to add to a dividend-income portfolio.

Currently Looks Overvalued.

The following is this stock’s price chart before market open on Wednesday June 21st:

ICE – price chart June 21 (StreetSmartEdge trading platform from Charles Schwab)

As analysts, we look for bullish and bearish trends and try to predict what the trend will do the next day, week, quarter, and year.

In this chart, I am tracking the 50-day SMA (blue line) vs the 200-day SMA (red line).

My chart shows a lagging indicator (death cross) occurred in May 2022 showing a bearish price trend already having formed, which reversed to a bullish price trend indicated by the golden cross formation in January 2023.

At this time, the stock price is still in that bullish pattern, and trading well above its 200-day SMA, having also quickly rebounded from the “dip” in March.

Next, let’s talk about valuation metrics such as forward Price to Earnings (P/E) and forward Price to Book (P/B), with data from Seeking Alpha.

Its forward P/E (GAAP basis) is currently 24.59, or over 162% higher than its sector median. Also, it is over 10 points above the May 2023 benchmark of 14.93 for the S&P 500, which would make it overvalued on this metric.

Its forward P/B is currently 2.67, or 175% above its sector median. This is over 2 points above the benchmark I use of 1.0, so it appears to be slightly overvalued on this mark.

So after looking at the price chart, and the two valuation metrics discussed, the answer is No this stock does not show a value buying opportunity right now.

A better opportunity would have been to scoop it up during the March dip, as it ended up rebounding quite nicely after that.

I would wait on the next dip or death cross formation to seize on a good buying price, and this could also mean an even better dividend yield.

Revenue Diversification Across 3 Segments.

The next category is whether this firm has adequate revenue diversification, which I believe lessens the risk of it depending overly on one product or solution.

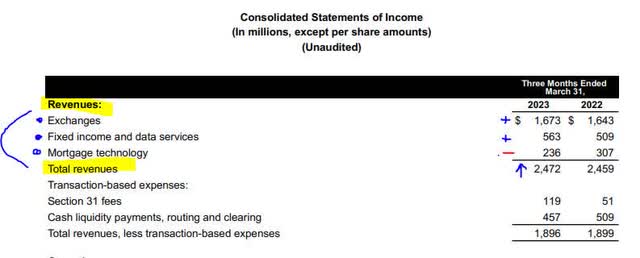

In the case of ICE, the following table from Q1 results shows revenue diversification across its three revenue segments, which are exchanges, fixed income and data services, and mortgage technology:

ICE – revenue by segment (ICE)

In my understanding of the exchanges business segment, since that appears to be the largest revenue driver in the above chart (68% of total revenue), it is important to note that this segment also has revenue substreams. Since the main ways a stock exchange makes money is through transaction fees on each trade, and listing fees for getting an equity listed. Also, members on the floor of the NYSE have to pay a fee to be able to trade on the exchange.

All of these various revenue streams bode well, I think, for the exchange’s parent company, in this case ICE, since “the house” will earn transaction & membership fees regardless of whether investors & traders win or lose on those trades. However, adequate trading volume still has to exist.

From a forward-looking viewpoint, ICE CEO Jeff Sprecher set a positive tone in his Q1 commentary:

As we look to the balance of the year and beyond, ICE’s diverse platform is well positioned to continue to serve our customers, generate growth and create value for our stockholders.

So although the exchanges business segment is well over half of revenue, there is still a decent mix of revenue coming from their other segments, hence the answer is Yes they appear to be revenue-diversified enough.

Strong Capital and Liquidity.

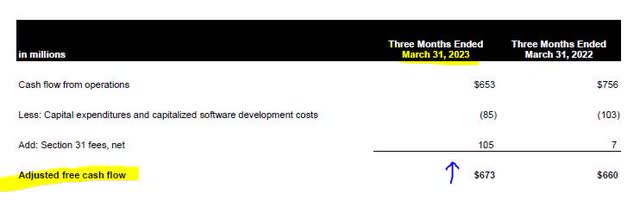

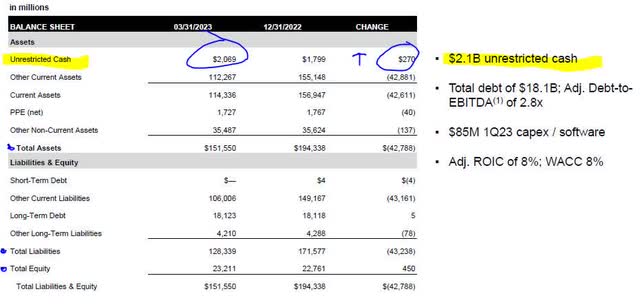

The Q1 results showed both positive adjusted free cashflow that increased YoY, as well as a balance sheet with positive equity and $2.1B in unrestricted cash:

ICE – free cashflow (ICE Q1 results presentation) ICE – balance sheet (ICE – Q1 results)

Further, according to its Q1 earnings presentation, “through the first quarter of 2023, ICE paid $236 million in dividends.

This appears to me to be a cash-rich firm in no liquidity dangers, so in terms of capital strength the answer is Yes it has it.

Potential Recession in Macro Environment.

How could a potential recession in 2023 affect stock exchanges? That is the key question now.

I would argue that it could decrease the volume of trading as more people begin hoarding extra cash rather than deploying it to trade stocks. This lessened trading volume could impact the exchanges segment of this company, which I have shown is well over half of revenue.

Consider the following from a Feb. 2023 article in Investopedia that highlights the potential recessionary impact on investors:

During a recession, stock prices typically plummet. The markets can be volatile with share prices experiencing wild swings. Investors react quickly to any hint of news-either good or bad-and the flight to safety can cause some investors to pull their money out of the stock market entirely.

So, it is not the volatility that is bad for exchanges, but the potential for a decrease in trading volume itself due to skittish investors hoarding cash.

So far this week, CNBC has said on June 21 that “despite recent good news, many on Wall Street still see a recession coming”. Barron’s also said that same day that “California is signaling a recession.”

Although ICE has a diversified revenue mix, it is still fundamentally an operator of exchanges and dependent heavily on trading volume.

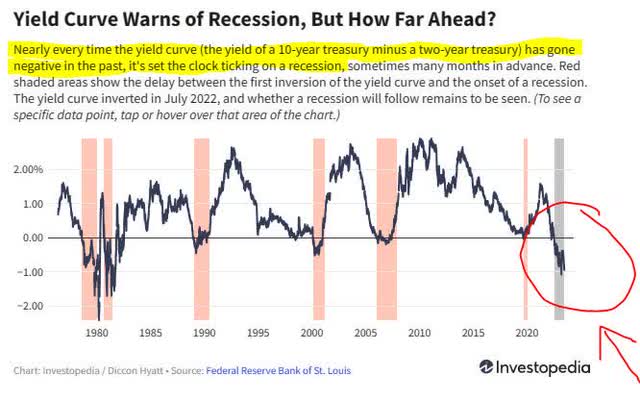

Consider the possibility highlighted in the chart below from Investopedia, published in a June 21 article, which is highlighting the negative yield curve as a recessionary alarm bell:

Yield curve (Investopedia)

For this reason, I am not overly bullish on this stock at this time and would say, No, the macro environment will not be overly in its favor in the event of a recession.

Risks to my Outlook.

A risk to my neutral outlook on this stock would be that recession predictions are actually wrong, and we see a massive bull market occur sometime this year. This would make my rating overly cautious on this stock.

There has been talk of a potential bull market, however let me point out what Money magazine had to say not long ago in a May 30th article which shares my hesitation on the bulls:

While some experts expect stocks to keep climbing, others say not so fast. Stocks’ recent gains don’t necessarily mean a major rally is around the corner, Morgan Stanley equity strategist Michael Wilson wrote in a note to clients last week.

Wilson says earnings estimates are too high, which could lead to losses down the road when investors encounter lower-than-expected earnings reports from companies.

I think the upcoming Q2 results and guidance from ICE should be waited on with excitement, as I think it should set the tone for this stock in the next few months.

Conclusion.

This stock scored a total of 60 points in my rating methodology, and is given a Hold rating for this reason. This is in line with Seeking Alpha’s own Quant system that also rated this stock a Hold, despite the consensus among analysts giving it a Buy rating.

Its positives are stable dividend growth, revenue diversification, stable capital & liquidity position.

Its headwinds are that it currently appears overvalued, and the macro risk of a moderate recession could impact trading volumes as people trade less and hold on to cash more, as a safety mechanism.

I continue to say, however, on a positive note that data is the new economy and has been for a while now, and if exchange owners like CME and ICE can continue to capitalize on that segment further then I think looking forward there is potentially limitless growth opportunity with data, so for that reason both of these stocks continue to be on my watch list in 2023 as companies to keep an eye on and look for the value-buying opportunities to pick up shares and add to an existing portfolio of financial stocks.

In a sentence, like ICE says on their website, “we connect data, technology and expertise.”

I couldn’t have said it better myself!

Read the full article here