By Fawad Razaqzada

A hawkish BoE could push the cable north of 1.2800 and potentially pave the way for an eventual rise towards 1.3000. The key risk is the potential for a dollar rally – if the market takes Powell more seriously this time than it did post-FOMC last week.

Hot UK Inflation Cements BoE Rate Hike Expectations

In the UK, we have seen yet another inflation report that has surprised to the upside, forcing the BoE to further tighten its contractionary monetary policy at its upcoming policy decision on Thursday. Core CPI unexpectedly jumped to 7.1% from 6.8%, while the headline inflation was unchanged at 8.7%, confounding expectations for a decline to 8.4%.

Worryingly, it was services inflation that caused the rise in core CPI, which will worry the hawks and discourage the doves at the MPC to push back against the very aggressive market pricing for further policy tightening. A 25 basis point rate hike is now almost certain on Thursday and thus priced in.

How the pound will react to the BoE’s rate decision will depend on how hawkish or otherwise the Bank is going to be about future policy. It goes without saying that if the BoE decides to surprise with a 50 bps hike, then that should send the cable surging higher. I, however, doubt that this will be the case.

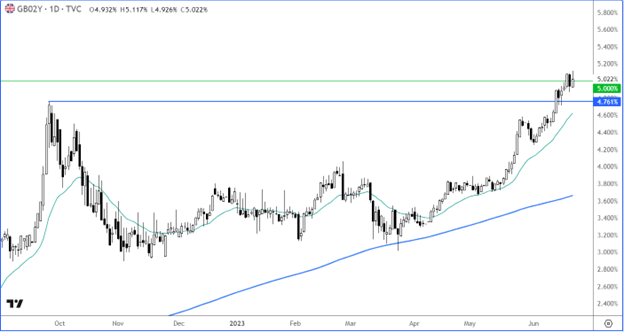

Hotter UK inflation means tighter policy for longer. For that reason, we have seen UK government bond yields rise across the board. The policy sensitive-two-year popped to a new high for the year and held above the key 5% level at the time of writing. Rising yields should keep the pound supported on the dips.

Source: TradingView.com

Powell in Focus After Fed Paused Rate Hikes

In today’s US economic calendar, Fed Chair Powell starts two days of Congress testimony, and his comments could impact the financial markets.

The Fed was hawkish last week, but markets barely priced in one final 25 bps point hike after the US central bank decided to pause for a breather as it held rates unchanged.

The US dollar initially rose but it has since given back all its gains and some (except against JPY), thanks to the rest of the major central banks being more hawkish than the Fed (except the BOJ).

The recent softening of ISM PMIs and a jump in jobless claims has also left investors wondering whether the US economy is now finally starting to cool sufficiently enough to bring inflation back down to the target range and lift the unemployment rate further, and thus discourage the hawks at the FOMC to push for another hike.

Well, given that Powell was quite hawkish following the FOMC’s decision last week, I very much doubt he will have changed his rhetoric much and will once again probably try to push back against rate cut expectations.

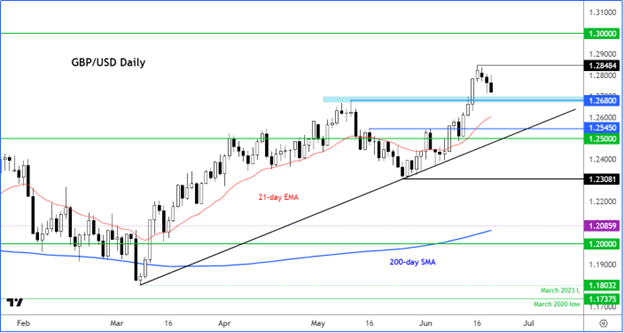

GBP/USD Approaching Key Support

There is no doubt about the GBP/USD’s trend, with price holding above the upwardly-sloping 21- and 200-day moving averages, and no obvious bearish reversal patterns to consider.

The bullish overall structure therefore means we could see dips, such as this one, being bought at or near support – as we have consistently seen in the past. Once such level is approaching around 1.2680ish, which was previously strong resistance.

If we don’t see a bullish reversal around 1.2680 and the GBP/USD closes lower, then we could see a deeper pullback towards 1.2550 or even 1.2500, where a bullish trend line meets the base of the prior breakout.

On the upside, there are not many obvious major resistance levels apart from 1.2800. The bears will need to hold their ground here to prevent a run towards the next big level at 1.3000.

But you get the feeling that standing in the way of the cable is a bit like holding a ball in a pool. The deeper you push it down, the faster it will pop higher. And that is the best way I can describe what I think the cable might do next.

Source: TradingView.com

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here