Investment thesis

Our current investment thesis is:

- Jack has difficulty ahead achieving consistent growth, which will allow for the business to net increase its locations.

- Margin improvement will come from increasing the number of franchise locations. This is dependent on improving the commercial attractiveness of the business.

- Jack’s valuation does not cover the execution risk around this.

Company description

Jack in the Box Inc. (NASDAQ:JACK) operates and franchises Jack in the Box restaurants, as well as Del Taco, whose acquisition it announced in Mar22.

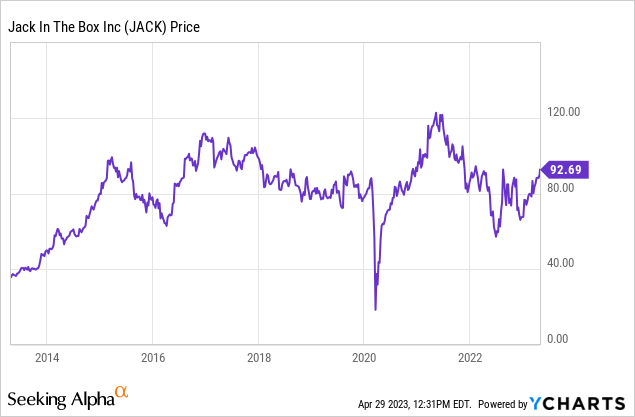

Share price

Jack’s share price has gained over 100% in the last decade but has traded sideways since 2015, reflecting what has been a period of stagnating growth and poor prospects.

Financial analysis

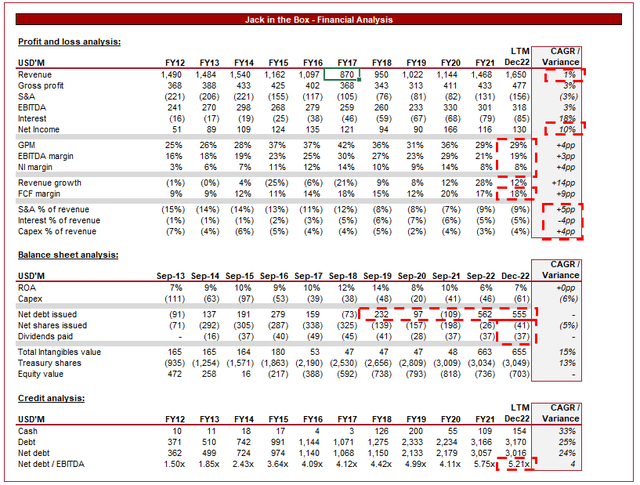

Jack Financial performance (Tikr Terminal)

Presented above is Jack’s financial performance for the last decade.

Revenue

Revenue has grown at a disappointing 1%, reflecting what has been a lost decade for the business.

The current business is primarily a management company, with over 84% of its locations franchised (Jack & Del Taco). This is a trend that has taken over the QSR industry, resulting in a decline/flatlining of growth, but an expansion of profitability. The reason the model is attractive is that it reduces risk, as the business no longer has to own/lease the location and hire the employees. Further, it improves growth as it is quicker to increase stores when several franchisors are financing locations. Finally, margins improve as the business essentially monetizes its brand, with the costs incurred at a franchise level. Jack is looking to extend this further with its Del Taco locations. Franchising to this degree is possible as Jack is the 5th largest burger chain in the US, with Del Taco also a leading taco brand (Source: Jack IR).

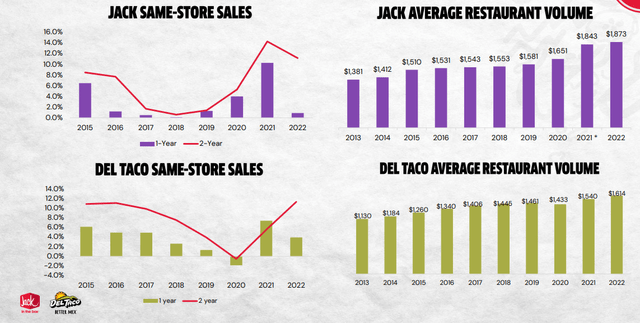

A key risk in this industry is changing consumer trends. What is preferred in some years can quickly find themselves out of favor, or less popular. Jack and Del Taco are leading US brands, which means it is unlikely that consumers will stop frequenting these locations. However, Jack’s same-store sales do suggest a slowdown has occurred. The Covid-19 period is deceptive due to the bounce back in demand. If these 2 years are excluded, growth remains in line with inflation during the period. Del Taco has performed better, but its restaurant volume growth is lower, diluting Jack’s performance.

Same-store and volume growth (Jack)

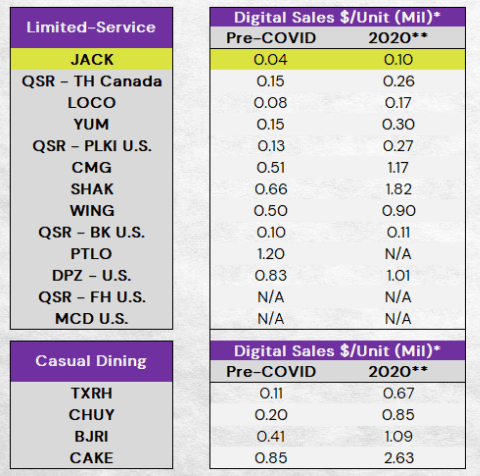

One of the reasons for this could be the lack of digital penetration. The company’s performance has been dire compared to many of its QSR peers. Management is impressed by the growth post-Covid but they have already lost ground.

Digital sales (Jack)

Further, we are concerned that the business has only recently expanded its offering across multiple delivery apps. Our view on delivery apps, such as DoorDash (DASH), are the new gatekeepers to QSR consumption. Consumers are increasingly scrolling through apps as a means of choosing where to eat when historically they would pick from a handful of leading brands. This has increased competition significantly and driven the likes of McDonald’s (MCD) to innovate their marketing to remain relevant. Our view is that this is one of the reasons Jack is slowing, the business is less popular relative to others.

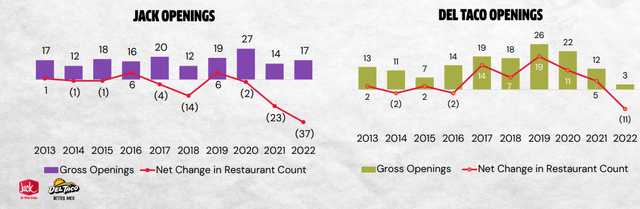

This is best reflected in its store openings. Although there are some new locations, the net impact is an increasing decline. This is highly problematic as it means growth must come from same-store performance, which we have seen to be mild.

Stores (Jack)

Management expected positive net growth in FY23, with new markets also opening. Management has been focused on a “transformation strategy”, which involves these new markets, Del Taco franchising, online penetration, and improving popularity. This should help reinvigorate growth but only if net new stores continue to be positive over several years, which is not necessarily the case.

Economic considerations

The US is currently experiencing a period of economic uncertainty, mainly because of an extended period of high inflation. This has led to a slowdown in demand across many industries as consumers see their cost of living increasing. This has the potential to slow Jack’s near-term performance if consumers forego spending for cheaper meals. This is more likely to be an impact if things weaken further, as so far, the QSR industry has been robust from what we have seen.

Margin

Increased franchising has contributed to an improvement in margins, although they are not at the level achieved in FY16-FY20. A degree of slippage is due to Del Taco, which is a less profitable business, with a restaurant-level margin of 16.1%, compared to 19.8% at Jack. Further, its franchise-level margin is 39.6% compared to 44.4% at Jack.

Management believes both restaurant and franchise-level efficiencies are possible, which should support margin expansion. Further, a decline in inflationary pressure should improve restaurant-level trading, contributing to further earnings flowing up.

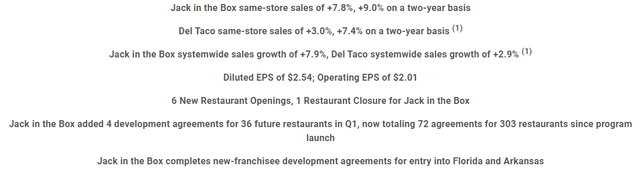

Q1 performance

Q1 performance (Jack)

Jack’s Q1 performance is stellar. The business experienced strong same-store and systemwide sales growth. We can no longer attribute this to a Covid bump, the business is showing evidence of a transformation story. Management has been working hard to modernize the business and achieve operational improvements to drive value. This looks to be the case as the business expands into new markets and brings on a new franchisee for the first time in 10 years.

Del Taco continuing to act as a drag is disappointing but Management’s continued effort to franchise company-run operations should contribute to an improving performance in the medium term.

Balance sheet

Jack’s balance sheet is heavily levered, with consistent debt raising in recent years. This has not been to fund distributions or expansion but is a reflection of what is weak cash generation.

Our view is that an ND/EBITDA ratio of 3x is a good maximum for a generic business. A franchisor can push above this due to the lower risk profile and greater earnings certainty, but 5x is still too high. This will restrict its distribution potential and requires the business to use its slim cash to deleverage.

Outlook

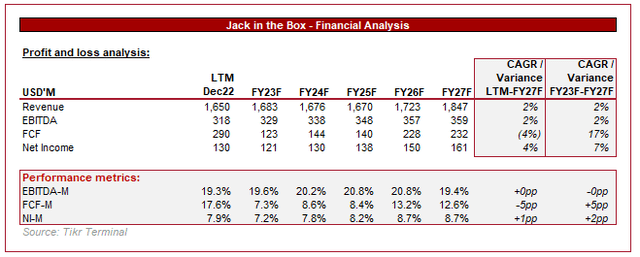

Outlook (Tikr Terminal)

Presented above is Wall Street’s consensus outlook for the coming 5 years.

Revenue growth is expected to be mild, reflecting the company’s unattractive commercial profile in our view. This looks reasonable as we do not see a clear reason to suggest popularity will immediately improve. Instead, the online expansion, transformation strategy, and new stores will help stop the decline.

Margin expansion is also forecast, which is reasonable on the assumption that franchising can continue, which so far looks to be the case.

Peer analysis

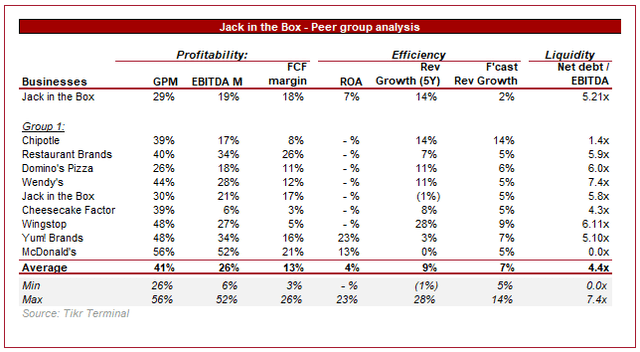

QSRs (Tikr Terminal)

Presented above is a financial comparison of Jack to a cohort of QSR/Casual dining businesses.

Jack underperforms on a profitability basis, with a GPM delta of 13%, and an EBITDA-M delta of 7%. A degree of this is a reflection of the fact Jack operates a c.16% of its locations, which is not the case for many of the QSRs above (Domino’s (DPZ) franchises over 95% of its locations).

Further, we know growth has been poor, although the 5Y performance is somewhat deceptive. In the forecast period, Jack is expected to be the biggest underperformer, while being highly leveraged.

Valuation

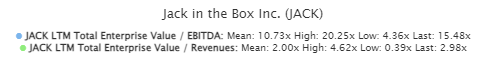

Valuation (Tikr Terminal)

Jack is currently trading at a noticeable premium to its historical average multiple. To a degree, this is warranted as it is increasing the number of franchises, which we believe to be a good thing. This being said the transformation is far from complete and it is too early to suggest alpha is possible. Analysts concur with this view, with a target downside of 1.1%.

Final thoughts

Jack is a business in transition. The company is looking to revitalize growth, alongside achieving operational changes to maximize shareholder value. Growth is looking good on a quarterly basis but there is still progress to be made. This needs to become consistent and margin improvement is required. Currently, we are struggling to see value to speculate on this upside.

Read the full article here