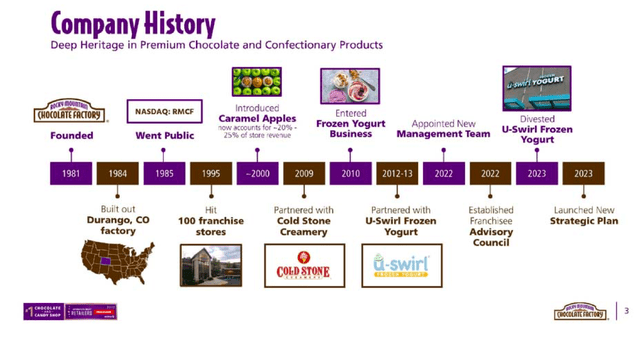

In late 2022 Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) appointed a new management team after a prolonged and expensive proxy battle. The team aims to revitalise the business, which has experienced stagnant revenue growth and declining profits for over a decade. Although we continue to see a decline in earnings, the management team is clear on its strategy, do more with less and stay focused on its core strength, its chocolate factory. It has divested one of its non-core businesses, aims to shut down underperforming shops, add new shops in high viability areas and increase e-commerce sales distribution through third-party distribution partnerships. We can expect cost-cutting efforts and an increase in e-commerce sales for FY24. However, the management speaks of three to five year turnaround plan. Due to the financial efforts required to make the required operational changes happen, I believe the company will be burning a lot more cash before we see any positive outcomes. Therefore I maintain a wait-and-see hold rating on this stock.

Company update

Since my previous article, Rocky Mountain’s stock price has dropped 3.77%, and the company has sold off its yoghurt business, U-Swirl, which accounted for 8.8% of sales in FY23. While U-Swirl showed healthy YoY growth of 66.17%, it does not make part of the management’s 3 to 5-year strategy, which focuses on exiting non-core businesses, streamlining operations and increasing its online presence. The company was accumulating many low-volume and often time and cost-intensive products. Over the next eighteen months, it has a $1.2 million savings target by closing down non-essential warehousing, minimising SKU and process improvements.

Company timeline (Investor presentation 2023)

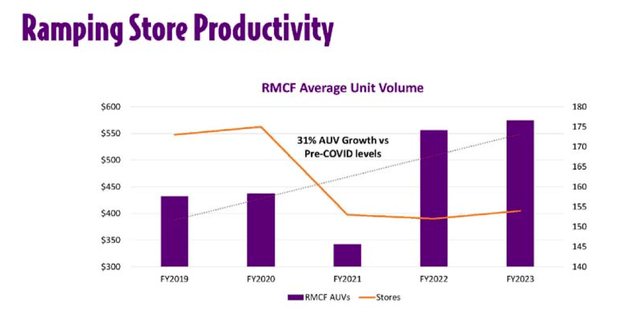

The company’s main revenue generator is its flagship manufacturing business. It also generates revenue through its franchisee brands and retail. Management plans to close 25 to 35 underperforming retail stores, which have a unit volume well below $574,000 per store, and add up to 100 new stores in high-visibility locations over the next few years. The management team has ambitious goals to have stores generate $800,000 in revenue annually, restore gross profit margins to 25 to 30% and increase e-commerce sales to 10% of total sales. Currently, e-commerce accounts for less than 2% of total sales. It aims to sell through third-party supplier partners such as Amazon (AMZN) and Costco (COST).

Store productivity (Investor presentation 2023)

Financials and valuation

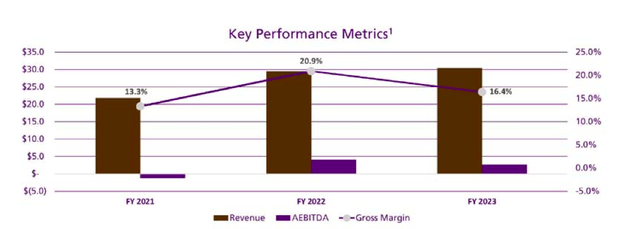

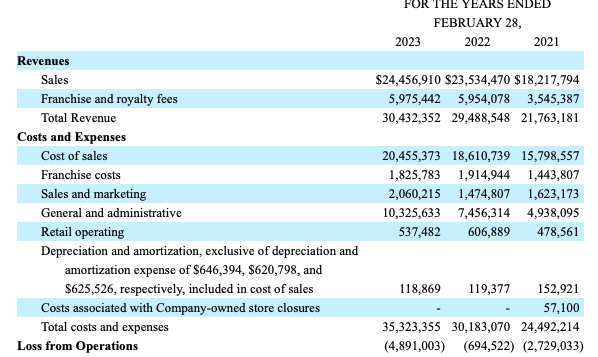

Rocky Mountain’s top and bottom line fundamentals decreased YoY. We saw a gross profit of $4 million compared to $4.9 million in 2022. Gross profit margins decreased from 20.9% to 16.4% in FY23 due to increased expenses, higher raw material costs, reduced production volumes, a one-off write-off in Q4 2023 of obsolete inventory worth $577,000. The company increased its net loss to $5.5 million for FY 2023.

Annual financials (Investor presentation 2023) Annual financial overview (SEC)

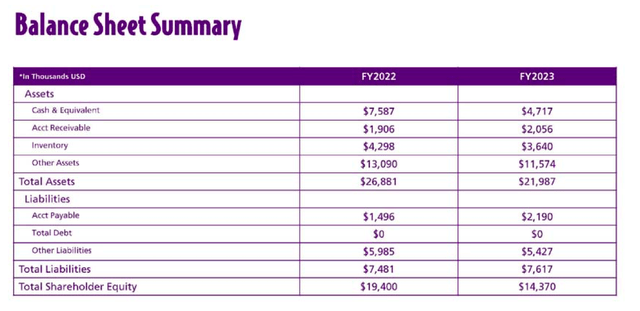

Rocky Mountain had a negative levered free cash flow of $1.4 million for its FY 2023 and it burnt through $2.1 million in Q4 2023 due to higher expenses and lower gross margins. The company has historically had a strong balance sheet. We can see that cash was $4.7 million and zero debt. However, the balance sheet has reduced YoY, partly due to the costly proxy battle and the current efforts to transform the business, divesting businesses, removing obsolete inventory, and closing down operations that are not benefiting the core operations.

Balance sheet FY23 versus FY22 (Seeking Alpha)

Rocky Mountain is a risky stock to consider, it has not shown major revenue growth in over a decade and has not produced positive earnings since FY14. Furthermore the company’s stock value decreased following the release of its FY23 Earnings. As of now, the stock has a market cap of $33.80 million and a low short interest of 0.06%. One of the major attractions is that a shareholder lead proxy has brought forward a new management team hungry for change and improvement. Although the company has not generated any earnings yet, its enterprise value to sales ratio of 1.03 suggests that it may be a reasonably priced and promising investment opportunity if the new management team can achieve its goal of increasing revenue and generating profits.

One year stock trend (Seeking Alpha)

Risks

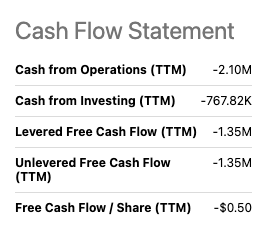

Seeing an enthusiastic management team with a clear drive to improve a once-loved company such as Rocky Mountain is exciting. However, investing in this stock, especially early in the process, can be risky due to its micro-cap volatility, size, and lack of liquidity. It burnt through more cash in the last quarter than in the previous nine quarters. Divesting, closing down shops, removing obsolete inventory and investing in the changes the management team has put forward will likely mean that the business will be taking on debt or raising capital which could impact shareholders. We can see that cash from operations and investing are negative over the last TTM.

Cash Flow TTM statement (Seeking Alpha)

Final thoughts

Rocky Mountain’s new management team has a clear strategy in place to focus on its core strength chocolate and to do more with less by streamlining processes and divesting from non core businesses. While we have yet to see an impact on the financials, it is exciting to see clear actions taken and a strategic three to five year plan regarding increasing top and bottom line growth. I maintain a hold rating as we wait on the financial implications of the management’s actions in the coming months.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here