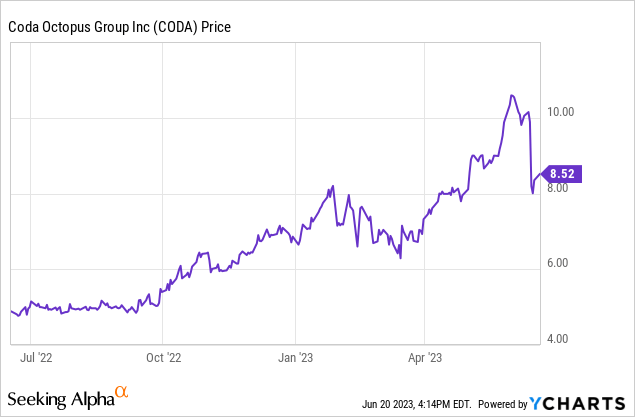

Following the Q1 2023 earnings report, Coda Octopus Group, Inc. (NASDAQ:CODA) saw its stock rise quite a bit. The report was released on March 16th and the stock was bid up 57%, from $6.29 to $9.89. However it dropped after the Q2 2023 earnings report was released and I think this drop has left the stock at more of an attractive entry point for those that believe they will execute on their growth plan.

The two key components of its growth plan are its diver augmented vision display (DAVD) and its Echoscope products. The Echoscope is an underwater imaging sonar technology and DAVD is a heads up display for divers. Echoscope customers include major oil and gas companies, renewable companies, underwater construction companies, law enforcement agencies, navies, ports, mining companies, defense bodies, diving companies, research institutes and universities. DAVD’s main customers are military and naval customers.

While it is at a more reasonable valuation, questions remain about their growth prospects despite generally positive commentary from management and spending tailwinds from the industries that use these products (renewable energy, law enforcement, military). In this article I’ll discuss why the stock rose so much following the Q1 report, why it dropped after Q2, and where it could go from here.

The Rise Following Q1

I would attribute the 57% rise in the stock price to some comments Coda’s CEO, Annmarie Gayle, made about DAVD’s total addressable market. After an analyst asked a question about this, Gayle responded:

We’ve kind of modeled something like 15% of that market over five years, and it might be conservative, but for just the way the adoption curve is, and as I said, when you phase in new technology, it will take time. And so 15% of that addressable market in the U.S. would be about $47 million. And we think that – and that’s just 15% we have targeted.

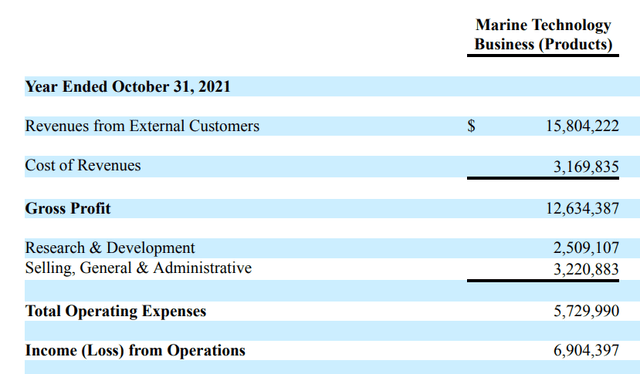

This is a very promising forecast given Coda’s total yearly revenue has ranged between $16m and $25m. The DAVD product is in the Marine Technology Business segment which had an operating margin of 44% in 2022.

Coda Full Year 2021 Marine Tech Business Results (Coda 2021 Annual Report)

Using the 43% operating margin the segment achieved in 2022 and the $47m of the addressable market that Gayle forecasted Coda will capture in 5 years, operating income just for the DAVD product would be $20m in 2027. With its current $69m enterprise value, Coda is trading at a little over 3 times 2027 DAVD operating income. This is already cheap but looks it’s even cheaper when including the other products in the Martine Technology Business segment and the Marine Engineering Business.

This type of addressable market comment is difficult to refute as the DAVD product is a very niche product that requires some level of expertise on deep-water diving, which most analysts and portfolio managers don’t have. This is clear on quarterly conference calls too, as many of the questions are relatively basic questions about the products and the industry.

This isn’t a bad thing; this is what these conference calls are for. I’m also not claiming that I have any deep knowledge on the industry or products as I see myself as more of a generalist investor. I’m just bringing this up because without as much industry knowledge it’s more difficult to poke holes in these forecasts and easier to run with the numbers given.

I think this is what happened after Q1 and led to the 57% rally. Q2 results and commentary however, brought investors down to Earth.

The Fall After Q2

Q2 results fell short of expectations with the other growth product, the Echoscope, seeing a decline in sales in Q2. This was Gayle’s update in the conference call:

In the second quarter, Echoscope sales were down and this is largely due to anticipated sales in Asia territory that did not come through in the second quarter as expected. We, however, continue to focus on our overriding strategy to increase our market share of the imaging sonar markets.

Coda also missed revenue and earnings estimates for the quarter. This quarter was a bit of a wet blanket for the growth story and investors reacted as such. The stock dropped about 20% following the results and earnings call. This is not a surprising reaction; the stock was trading at a trailing 12 month EV/EBIT multiple of 18 prior to the results coming out and multiple has since dropped to around 13. Given Coda’s financial history, this multiple still looks to be relatively high but if you believe in the growth story this is a much more reasonable valuation.

What makes the valuation even more intriguing is that most of the disappointment in growth came from Echoscope sales. DAVD commentary was quite positive. Gayle mentioned in the call that:

The tethered DAVD system has now moved from the Navy’s R&D phase to their field adoption phase. And in the second quarter, we sold $1 million DAVD systems which will be distributed to new commands with the Navy, within our 2023 financial year fiscal projections, we have $2 million revenue targeted for DAVD.

Thus, in the second quarter, we have achieved 50% of our targeted revenues for this product and with the opportunities we are currently pursuing, we believe we will meet our 2023 fiscal year target for the DAVD.

This is interesting for investors because I believe the stock rallied after Q1 due to DAVD addressable market commentary in Q1 and the commentary on this product remained positive in Q2. So the main growth story that provides $20m in operating income by 2027 has not changed.

Valuation

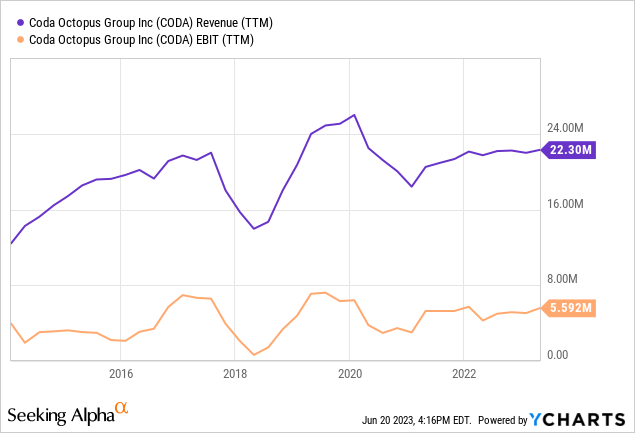

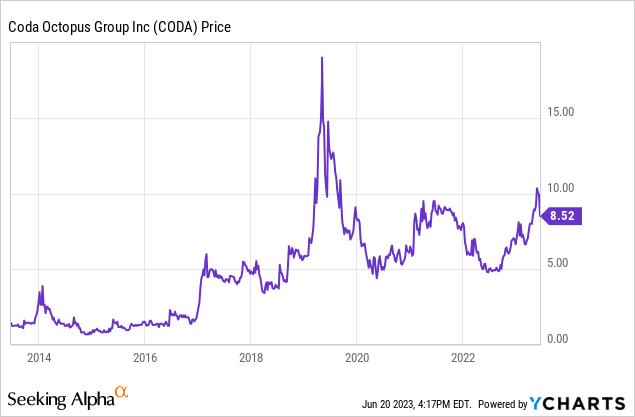

I mentioned above that 13x EBIT is a high multiple for Coda given its historical performance because sales and earnings have been essentially flat since 2013. This type of financial performance does not warrant a growth multiple.

While operating income has not changed since 2013, there have been ups and downs and subsequent ups and downs in the stock price. Obviously it was best to buy during a down earnings period and sell during an up period. For example in 2019, operating income rose 88% over the prior year and the stock rose almost 180% at one point due to the earnings growth and multiple expansion. At its peak, the trailing EV/EBIT ratio was upwards of 50. However the following year operating income dropped over 50% and the stock dropped at one point 70% from its peak due to both the decline and earnings and multiple contraction as investor exuberance waned.

What’s interesting is that the commentary regarding 2019 financial results had many of the same talking points as the ones today. The following is an excerpt from the press release detailing full year 2019 results:

During the 2020 fiscal year the Company expects to release a number of new and innovative products to the market. Among these releases will be a number of significant advancements around the Company’s flagship sonar technology, Echoscope. We believe these will bring a step change in the underwater sonar market. The Company will also focus on commercializing the Diver Augmented Vision Display’s (DAVD) Gen 1 Head-Up Display Unit for naval and commercial diving operations, following recent acceptance of the GEN 1 DAVD prototype by NAVSEA. We believe that this new product will significantly advance diving operations management and, given its truly revolutionary nature, that this product could become the standard for diving operations.

Despite this positive commentary, earnings fell in 2020 and have not recovered since. It’s difficult to fault anyone for underperforming in 2020 due to the pandemic and subsequent pullback in investment from many companies that use its products, but the fact that they have not recovered to their 2019 peak is concerning given how they’ve been pushing for growth in their Echoscope and DAVD products since then.

Forecast

I think it makes most sense to understand a best and worst case scenario, apply probabilities to both scenarios, and compare to the current price to determine if the stock warrants an investment. Historically, the times it usually warrants an investment is when investor excitement, which we can gauge with the earnings multiple, is low.

To me, a worst case scenario looks like an a EV/EBIT multiple of 8 with $6m in EBIT in 2027. This implies flat earnings, and low investor excitement as the growth story does not play out. This lines up with past financial performance. The enterprise value with these assumptions would be $48m.

A best case scenario would be $25m in EBIT with an EV/EBIT of 18 in 2027, which is the peak multiple reached in the past 12 months. The enterprise value with these assumptions would be $450m.

Given the historical financial performance and in order to be conservative, I will assign a 70% chance to the worst case scenario and 30% to the best. This brings me to an expected enterprise value of $169m in 2027. Compared to the current $69m EV, an investment today would provide 145% upside over the next 4.5 years, or a little over 20% per year. These are very good returns but may be even better for investors that are more bullish on DAVD and Echoscope growth potential.

Risks

As I mentioned above, the main risk I see is a continuation of past financial performance given the current earnings multiple. If another decade passes with no earnings growth, investors will be exposed to multiple contraction risk. I believe that there may be 50% downside as the multiple could be cut in half from where it stands currently.

One potential cause of the no growth scenario playing out is a bad recession that could push back investment into Coda products. This is what happened in 2020 as earnings were more than cut in half. It is now over two years later and earnings have not recovered so another recession could push growth years into the future.

Additionally, Coda is a relatively illiquid stock with about $300 thousand in daily volume traded per day. This illiquidity will be magnified if the no growth risk plays out and the stock drops from here. This means that if an investor needs to sell shares quickly and suddenly, they may bring the stock price down while they do. The best way to deal with this risk is by using position size controls and by only investing in Coda with a long term time horizon. If there is any chance an investor may need the money they invested on short notice, it is best not to invest in the stock at all.

Final Thoughts

Addressable market comments from the Q1 2023 earnings call led investors that don’t know the Coda’s products very well to get a bit too excited about Coda’s growth prospects. The Q2 call extinguished this excitement a bit, although the DAVD growth story hasn’t changed.

It’s difficult, however, to reconcile this growth potential with Coda’s past financial results. Revenue and earnings have bounced around from year to year but from end to end, earnings have been flat. Because of this I am attempting to be a bit more cautious on the growth outlook even though the story is intriguing; Coda seems to have the best product in a niche but growing market. This type of story has played out well with other companies such as XPEL, Inc. (XPEL). But even with a conservative forecast, I think an investment in Coda could provide 20%+ return per year through 2027.

I don’t think this is a coffee can type of investment where investors can buy and forget. It will be important to keep a close eye on the growth story and make sure it is staying on track. If not, I see downside for the stock if future financial performance mirrors that of the past.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here