Permian basin operators continue to consolidate at an astounding pace. Only a few days after Earthstone Energy (ESTE) announced its acquisition of Novo Oil & Gas Holdings LLC, Civitas Resources (NYSE:CIVI) announced today that it will be simultaneously acquiring Midland Basin assets from Hibernia Energy III, LLC and Delaware Basin assets from Tap Rock Resources. Both are owned by private equity firm NGP Energy Capital Management, LLC.

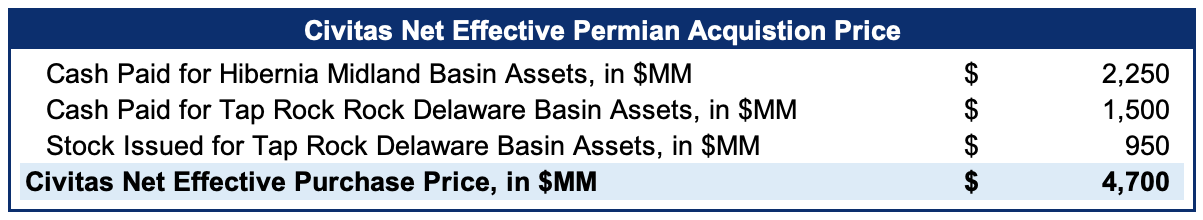

The total consideration to be paid to NGP, as per Civitas, will be $4.7B including both cash and stock. A breakdown of the purchase price can be seen below:

Bison Interests

Civitas Acquisition and Implications

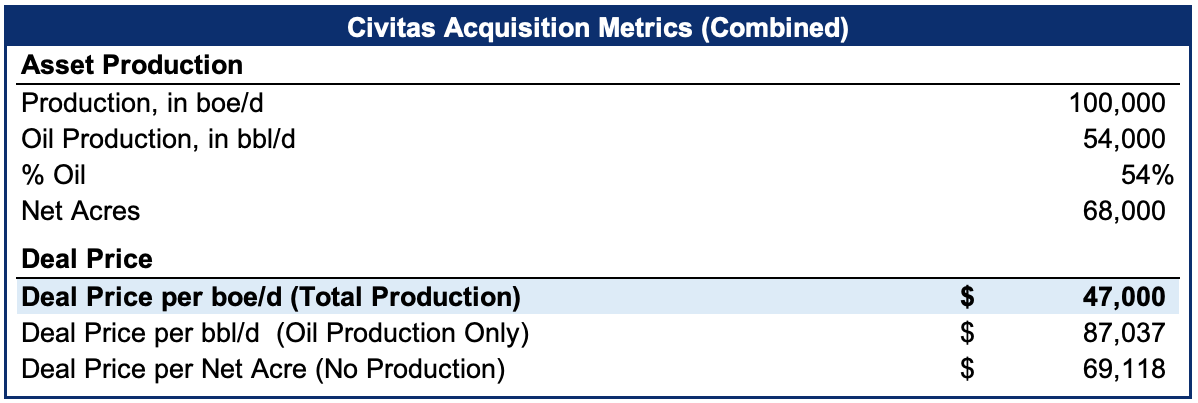

Civitas discloses it is buying 100,000 boe/d of existing production (54% oil) from NGP. Civitas also claims it will be getting significant combined inventory from these assets, including 68,000 net acres, 800 gross drilling locations, and 335MM Boe of proved reserves. These metrics imply a deal price of $47,000/boe/d:

Bison Analysis

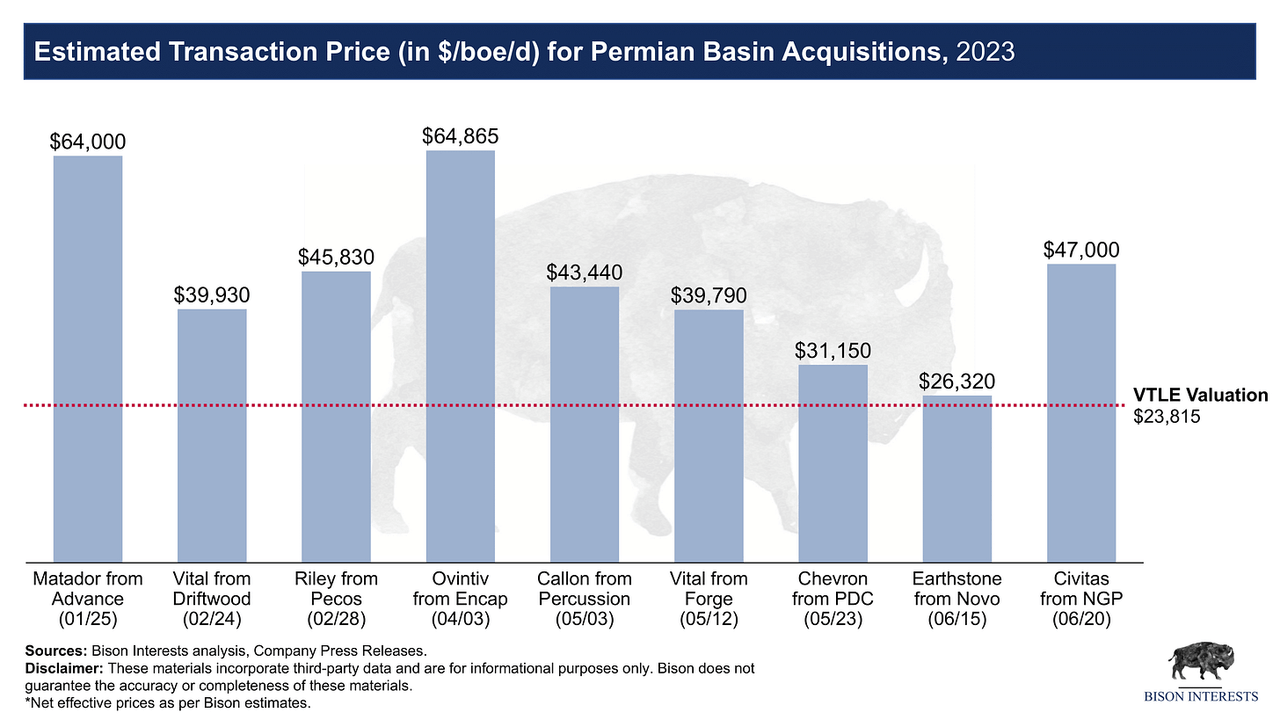

This is a healthy valuation compared to recent deals in the Permian, particularly the recent Earthstone deal which transacted at nearly half the price ($26,316/boe/d). We estimated that Earthstone’s modestly priced acquisition still implied more than 80% upside to Vital shares via its Forge acquisition, and therefore, it will come as no surprise that this higher valuation implies a significant upside for Vital Energy (NYSE:VTLE). More on this below.

Implications for Vital Energy

Civitas claims to be buying these assets for 3.0x EV/EBITDA, which is on the higher end of transaction multiples we’ve seen in the Permian recently and continues the trend of rising valuations for oil and gas acquisitions. Importantly, this transaction multiple is significantly above the 2x EV/EBITDA we estimate Vital is trading at today. It is remarkable to see buyers disclosing transaction multiples for private assets above that of publicly traded comparables, which may galvanize further consolidation in the space as valuations rise.

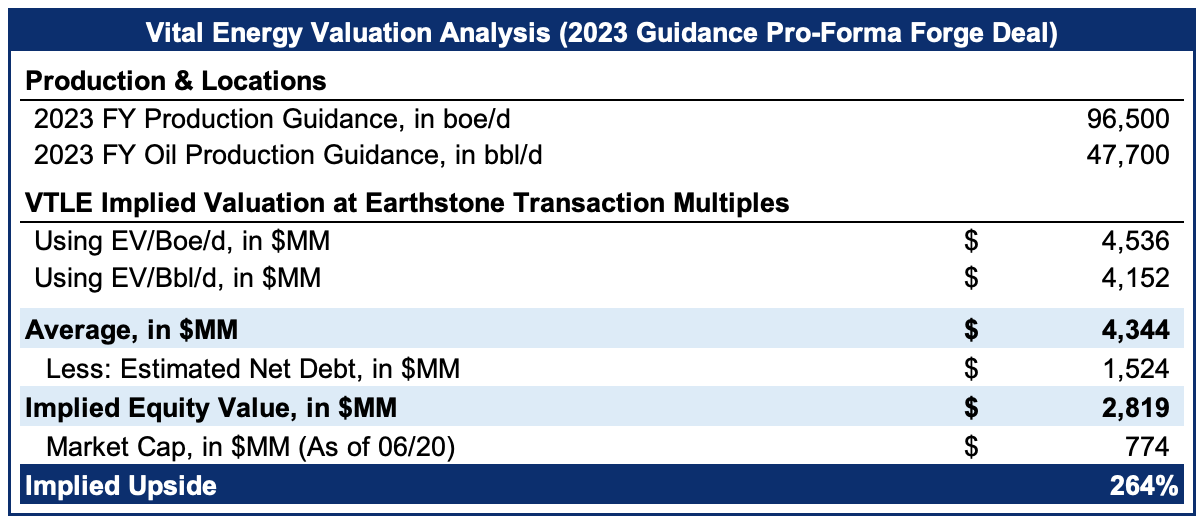

We estimate that this transaction’s valuation implies more than 260% upside for Vital Energy, as can be seen below:

Bison Analysis

While these Permian assets transacted at a healthy multiple, it is worth noting that this is not the highest deal price we’ve seen recently. For instance, Ovintiv disclosed having bought EnCap’s Permian assets for a price of $57,000/boe/d, which we estimate was closer to $65,000/boe/d after making certain transaction adjustments. Transaction valuations for recent Permian acquisitions can be seen below:

Bison Analysis

It is worth considering what other, more richly priced transactions imply for Vital – particularly as oil prices rise. And importantly, the upside to Vital’s shares in a similarly priced transaction is extremely compelling and suggests that this opportunity to buy a heavily discounted, nearby producer with similar assets may not be around for long.

Read the full article here