Our long-term outlook embraces a flexible, long-term approach to seize opportunities in debt and equity investments across the real estate landscape.

The foundations of the global commercial real estate market are shifting. Since 2020, a confluence of factors – a dramatic shift in how buildings are used, the fastest surge in interest rates in more than 40 years, bank failures in the U.S. and Europe, and now a looming recession – could prompt price declines not seen since the global financial crisis 15 years ago.

This upheaval will challenge rules of thumb and require a fresh approach to real estate underwriting. Over the cyclical horizon, commercial real estate dynamics are likely to get worse before they brighten.

For investors, this may seem daunting. But it also could be one of the best periods to deploy capital in decades.

In the near term, we see unprecedented potential in real estate debt. This includes new senior origination opportunities as lenders retreat, as well as distressed public and private debt. We foresee a tsunami of real estate loans maturing through 2025 – including at least $1.5 trillion in the U.S., about 650 billion euros in Europe and $177 billion in Asia-Pacific.1 In addition to the target-rich opportunity set in debt, we believe in positioning portfolios for select equity investments in sectors with strong secular tailwinds, such as residential real estate, logistics, and data centers.

This complex landscape demands a differentiated approach, a long-term view of global economies and markets, and a granular understanding of local market dynamics. But we are also cognizant of downside risks to the global economy. Overall, we see better prospects in more senior credit and are more cautious on equity (see our June 2023 Secular Outlook, “The Aftershock Economy”).

There’s no doubt, however, that the pandemic has transformed rental housing, offices, retail, and other sectors, and that market trends will play out differently across countries and regions. For example, office buildings in central business districts in cities such as San Francisco are challenged by remote work trends. However, enthusiasm for working from home has been less pronounced in markets such as London, as well as Singapore and other Asian capitals, particularly for individuals going to high-end, sustainable offices in alluring locations. Likewise, there is a discrepancy in the U.S. between real estate investment trusts (REITs), which lost about a quarter of their value in 2022, and prices in private markets.

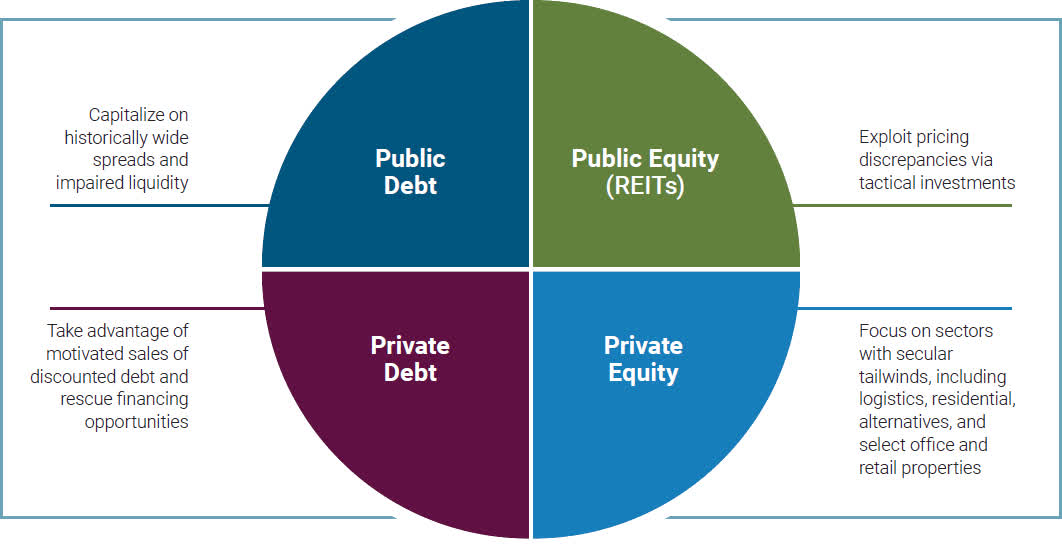

We believe these crosscurrents will create volatility and opportunities for relative value investing across the four quadrants of public and private debt, and public and private equity.

Patience also will be important, as supply and demand will ultimately determine the long-term value of real estate. Land use restrictions and high construction costs will reduce supply more than in any previous cycle, underpinning real estate values over the long term, in our view.

This outlook emerged from PIMCO’s inaugural Global Real Estate Investment Forum last month in Newport Beach, California. As with PIMCO’s Cyclical and Secular Forums, hundreds of investment professionals from across the globe gathered to debate the worldwide outlook for commercial real estate over both cyclical and secular horizons (see our video on the forum process, “Reading the Road Ahead: Behind the Scenes at PIMCO’s Economic Forums”). Following the 2020 merger with the real estate operations of Allianz, PIMCO’s parent company, the PIMCO real estate platform ranks among the largest in the world, with about $195 billion in assets under management, 300 professionals, and a robust presence across the risk spectrum in global real estate debt and equity markets, both public and private (see Figure 1).2

Figure 1: Seeking relative value across four quadrants of global commercial real estate investing

PIMCO as of June 2023

Secular themes and investment implications

Let’s look at how cyclical and secular trends may play out across key commercial real estate sectors across regions, from those enjoying tailwinds to the most stressed.

Residential

Residential housing will likely benefit from long-term trends such as urbanization, increasing household formations, and rising costs of home ownership. Student housing may benefit as more learners go abroad to schools in the U.S., U.K., Australia, and other countries. Supply remains below historical levels and we anticipate limited price declines and healthy rental growth.

With banks sidelined, we see attractive opportunities to lend to development and value-add projects. On the equity side, we see potential in newer properties in select urban gateway markets at less expensive entry points.

Investors may benefit from diversification into areas such as core and core-plus properties and developments near leading universities. As with other sectors, multi-family and student housing will likely benefit as investments flow from office and retail markets.

Logistics

Few areas have benefited more from the coronavirus pandemic than logistics. E-commerce should continue to drive demand for industrial storage and distribution assets over the secular horizon. Consumer desire for quick deliveries is driving demand in urban areas. Tenants increasingly want new, more modern facilities with smaller carbon footprints, especially in Europe.3 Nearshoring is catalyzing demand in new regions and near ports, while regulatory restrictions limit the supply of land.

Prices for logistics facilities have already declined across mature markets, dropping 10% in the U.S. and 20% in Europe. Limited supply and outsize rental growth suggest the sector may be among the first to see compression of capitalization rates. Where pricing has neared a cyclical trough, investors may even consider accepting negative leverage (when debt decreases an investor’s net operating income) given the sector’s growth prospects.

Data Centers

Growing demand for data center capacity is among the most powerful secular trends in the global economy. Capacity in Europe significantly lags the U.S., and latency and digital sovereignty requirements necessitate local facilities.

However, few platforms can credibly combine continent-wide real estate development know-how with the technical expertise and experience needed to develop, lease, and operate data centers. This material barrier to entry creates an exceptional opportunity to meet demand in the highest-growth markets for facilities that can store and process vast amounts of data.

Lodging

The hotel sector has recovered from the pandemic-induced downturn and remains resilient despite a deteriorating economic backdrop and rising operating costs. While business travel may slow, we believe tourism will continue to spur demand, including from Japanese and Chinese travelers. Sustainability concerns should also boost energy-efficient and eco-friendly operations.

Lodging has traditionally relied more heavily on commercial mortgage-backed securities (CMBS) and regional banks for financing. But the contraction in these sources of finance could create attractive opportunities for lenders capable of underwriting these operationally complex real estate assets.

Retail

In recent years, the growth of e-commerce has pushed down retail rents and valuations. As we expect recession to tamp down spending in the U.S., businesses providing nonessential products appear most vulnerable to further declines. In contrast, we don’t expect significant further correction in prices of Class A assets.

We believe investors should focus on multi-tenant properties in prime locations. These have proven resilient, and investors have been gradually returning, even though rental growth is likely to be muted. Equity investments in shopping centers anchored by grocery stores and retail properties in traditional, prime locations appear attractive in the U.S., while debt investments for assets such as these may be preferable in Europe.

Offices

No property sector has been hit harder than office buildings. The pandemic normalized remote working, which we expect will continue in the U.S. In Europe, by contrast, workers have generally returned to the office, particularly those going to modern offices with desirable working environments. As a result, our research suggests that clearing prices for U.S. office assets today are down by 25% to more than 40% from 2021 levels versus declines of 15% to 20% for office properties in Europe and Asia-Pacific, which have higher occupancy levels. With this backdrop, we expect to see increasing distressed sales in the U.S., versus selective and limited sales in European and Asian markets.

Going forward, we see a trifurcation of the office sector. Best-in-class assets – buildings with low carbon footprints, appealing amenities, alluring locations, and high occupancy – will likely weather the storm. We also see opportunity in “brown-to-green” investments that target Class B+ and A- properties, especially in prime locations in Europe and Asia-Pacific. However, we expect mid-quality structures will require upgrades in order to survive, while the lowest-quality assets will become obsolete, leaving owners facing big losses.

Investment takeaways

- We anticipate that reduced liquidity, pressure on fundamentals, and geopolitical tensions will cause short- to medium-term distress. Rapid interest rate increases in the U.S. have led to defaults, regional banking crises, and stricter lending standards. Europe faces an energy crisis and uncertainty from the war in Ukraine, while Asia-Pacific experiences geopolitical tensions. Real estate loans totaling some $2.4 trillion globally1 will mature over the next few years, forcing a day of reckoning.

- We favor new loan origination and purchases of existing loans – including transitional lending. We believe investors should take a broad approach to debt, but go narrow and deep on equity investments. Investors should focus on high-conviction, tactical deployment into stressed and deeply discounted assets facing immediate liquidity pressures, in our view. Overall, we prefer a mix of cyclically distressed assets and properties benefiting from secular themes.

- Private credit and special situations will gain prominence. Distressed banking sectors present opportunities to seize market share from nonbank lenders. We see potential in commercial real estate lending, loan portfolio sales, nonperforming loans, and rescue capital. Investors may benefit from high quality assets with lower loan-to-value ratios and attractive spreads, while negatively perceived commercial mortgage-backed securities may offer high yields at potentially significant discounts.

- Market volatility will provide relative value investment opportunities across debt and equity markets, both public and private. Global platforms are well-positioned to make tactical trades and exploit pricing discrepancies between public and private markets.

- We see the greatest opportunities in the residential, logistics, and data center sectors in the U.S., Europe, and the Asia-Pacific region. However, these sectors will evolve in diverse ways in different regions.

Conclusion

We’re in a challenging macroeconomic environment that requires versatility, patience, and a long-term perspective. We believe investors should lean into the target-rich opportunity set in real-estate-related credit over the near term, while remaining strategic and patient in equity. For long-term investors, we believe that equity strategies focused on assets that will benefit from secular trends – including demographics, digitalization, and decarbonization – will drive value creation.

1 JLL, Morgan Stanley, CBRE

2 PIMCO as of 31 March 2023

3 Green Street, April and May 2023

Disclosures

All investments contain risk and may lose value. Investments in residential/commercial mortgage loans and commercial real estate debt are subject to risks that include prepayment, delinquency, foreclosure, risks of loss, servicing risks and adverse regulatory developments, which risks may be heightened in the case of non-performing loans. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, interest rates, property tax rates, regulatory limitations on rents, zoning laws, and operating expenses. Investments in mortgage and asset-backed securities are highly complex instruments that may be sensitive to changes in interest rates and subject to early repayment risk. Structured products such as collateralized debt obligations are also highly complex instruments, typically involving a high degree of risk; use of these instruments may involve derivative instruments that could lose more than the principal amount invested. Private credit involves an investment in non-publicly traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss.

Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2023-0607-2942623

Disclaimer

Copyright PIMCO 2023. All Rights Reserved. Investment Products: NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED.

PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023 PIMCO

Pacific Investment Management Company LLC (“PIMCO”) is an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). PIMCO Investments LLC (“PIMCO Investments”) is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). PIMCO and PIMCO Investments is solely responsible for its content. PIMCO Investments is the distributor of PIMCO investment products, and any PIMCO Content relating to those investment products is the sole responsibility of PIMCO Investments.

The information provided herein is not directed at any investor or category of investors and is provided solely as general information about our products and services and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of PIMCO nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act of 1974, as amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein. If you are an individual retirement investor, contact your financial advisor or other fiduciary unrelated to PIMCO about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

Check the background of this firm on FINRA’s BrokerCheck.

Original Post

Read the full article here