The electric vehicle space is one of the most competitive spaces in the market today. Numerous companies are trying to take advantage of the shift to greener transportation methods, but many are having trouble surviving. One such name is Faraday Future Intelligent Electric (NASDAQ:FFIE), which was one of the market’s biggest losers on Monday. Today, I’ll look at why the stock’s recent rally came to a sharp halt, and what it means for investors moving forward.

Last Friday, the company announced a triple whammy of bad news. The first item is that it due to supplier constraints and vehicle testing issues, the FF 91 2.0 Futurist Alliance Phase 2 delivery timeline has been updated from the end of the second quarter 2023 to August 2023. Faraday Future unveiled the FF91 back in 2017 with the intent to bring it to production in 2018, but the vehicle has seen numerous delays since then.

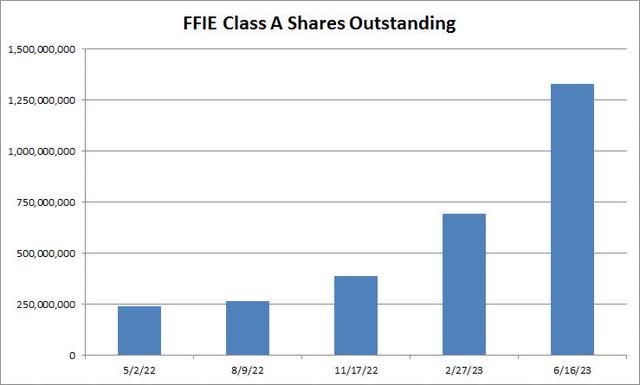

In addition to the latest delay for the FF 91, the company filed a mixed shelf to potentially raise up to $300 million. Launching a new vehicle in today’s market can be very expensive, and the company reported over half a billion dollars in cash burn last year. With numerous capital raises needed to get the FF 91 to market, the company’s outstanding share count has continued to surge as seen in the chart below. The market cap after Monday was around $373 million, so investors could be diluted quite significantly moving forward if the full amount of fresh capital detailed above is raised through equity.

FFIE Shares Outstanding (Company Filings)

In my previous article from April, I mentioned the possibility of a reverse split as shares continued to trade below one dollar. The third negative news item announced last week was that the company is seeking shareholder approval to do just that, with a ratio ranging from 1:2 to 1:90. To satisfy listing requirements, I’m guessing that a target number will certainly be in the double digits if a reverse split does come, so that the one dollar level doesn’t come into play again in the short term.

Faraday Future wouldn’t be the first EV maker to execute a reverse split in order to get back above a buck. We’ve seen names like Arcimoto (FUV) and Lordstown Motors (RIDE) do the same, with both stocks being hit hard after their splits went through. Both of those names are in a similar boat, having struggled to ramp production of their products and going through massive amounts of capital just to stay afloat.

One of the main issues with Faraday Future is that it is targeting a very small segment of the market. The top two trims of the FF 91 start at $249,000, so this is definitely not a mass market vehicle. While a lower priced variant is planned for the future, competition from the likes of Lucid (LCID), Tesla (TSLA), Mercedes (OTCPK:MBGAF), and others won’t exactly be going away anytime soon. Current analyst estimates have the company generating less than $44 million in revenues this year, and that number is down dramatically from the nearly $4 billion figure it stood at back in November 2021. Even if we start to see more than a token amount of revenue generated, the company is expected to remain deep in net loss territory for some time and that likely means a lot more cash burn.

Shares of Faraday Future were down more than 37% on Monday, trading at just 28 cents. That’s a penny above where I last covered it, but the situation here has only gotten worse. Current investors continue to be diluted dramatically by the quarter, and a reverse split could add significant further downside pressure to shares. With yet another delay to the FF 91 timeline being announced, the company is also looking at raising fresh capital. Until Faraday Future can significantly improve its execution, it wouldn’t surprise me to see the stock try to test its all-time lows near 15 cents a share.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here