There has been increasing talk of a bullish breadth expansion across markets in recent weeks. While mega-cap tech dominated through May, year-to-date returns are looking a bit better across the small-cap space and even among some of the highly speculative niches of late. The ARK Innovation ETF (ARKK) is now near its best levels since August last year while a new ETF is garnering attention for its very high yield.

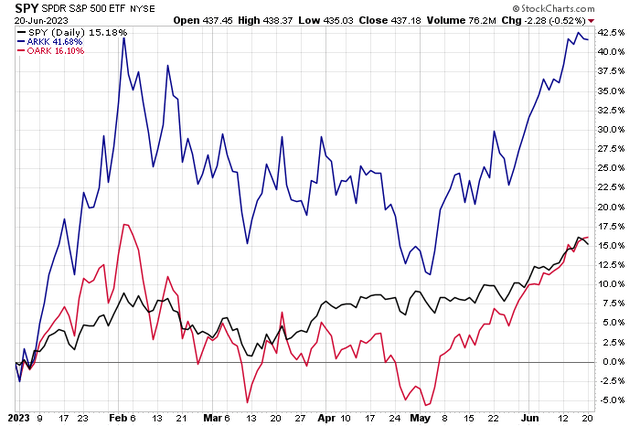

The YieldMax ARKK Option Income Strategy ETF (NYSEARCA:OARK) sells option premium on the highly volatile ARKK ETF. You can see in the total-return chart below how the return profiles of the two ETFs are somewhat similar, but OARK allows holders to take advantage of ARKK’s high implied volatility. The downside is that when ARKK rallies sharply (as we have seen this year), the call options sold appreciate, resulting in negative alpha for OARK compared to ARKK.

I expect ARKK to continue to perform well, so I have a hold on the yield-enhanced OARK product with the expectation that it will underperform ARKK in the months ahead.

Total Return Analysis: OARK Trails As ARKK Has Surged In 2023

Stockcharts.com

According to the issuer, OARK is an actively managed fund that seeks to generate monthly income by selling/writing call options on ARKK. OARK pursues a strategy that aims to harvest compelling yields, while retaining capped participation in the price gains of ARKK. The fund’s distribution rate is very high at 36.5% as of June 20, 2023, and dividends are paid monthly. You can view the distribution schedule here.

The ETF’s primary investment objective is to seek current income. Its secondary investment objective is to seek exposure to the share price of the ARK Innovation ETF, subject to a limit on potential investment gains, so analyzing ARKK is crucial to forming a view on OARK.

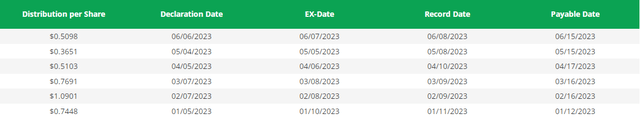

OARK: Distributions In 2023

YieldMax

OARK began trading in November last year and it features a high gross annual expense ratio of 0.99%. Net assets are still modest at just $25.2 million and its 30-day median bid/ask spread is elevated at 0.32%, so using limit orders during periods of weak liquidity in the trading day is prudent.

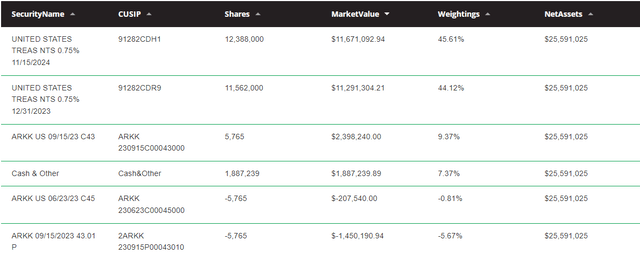

OARK currently holds September $43 strike call options on ARKK along with short positions in both June and September 2023 expiring calls and puts, respectively. This portfolio along with a long Treasury securities position and cash help to generate a high yield along with a synthetic long position in ARKK. OARK must constantly roll out to new options positions, so that leads to its lofty cost.

OARK: Portfolio of Short Options, Long Treasurys & Cash

YieldMax

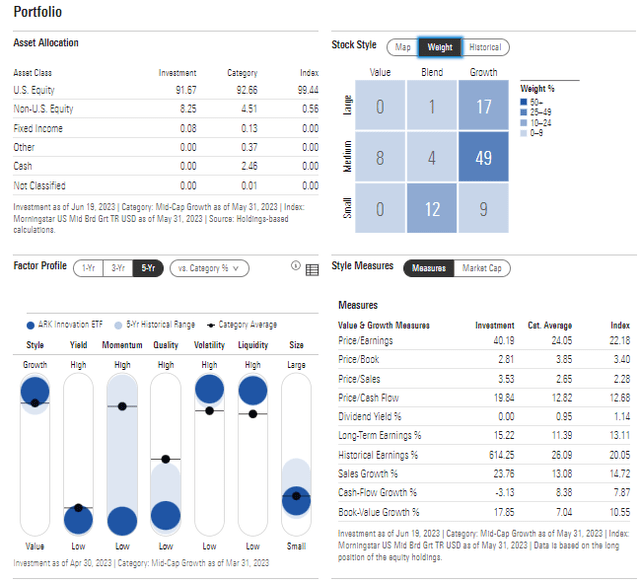

ARKK itself trades at a high 40.2 price-to-earnings multiple, according to Morningstar, but the portfolio’s earnings growth rate is robust. Moreover, paying 3.5x sales is reasonable today compared to some of the sky-high P/S ratios seen in early 2021. The valuation reset in the space was much needed and even this year’s AI euphoria has not resulted in an extreme valuation rebound. So I am encouraged by that.

ARKK Portfolio & Factor Profiles

Morningstar

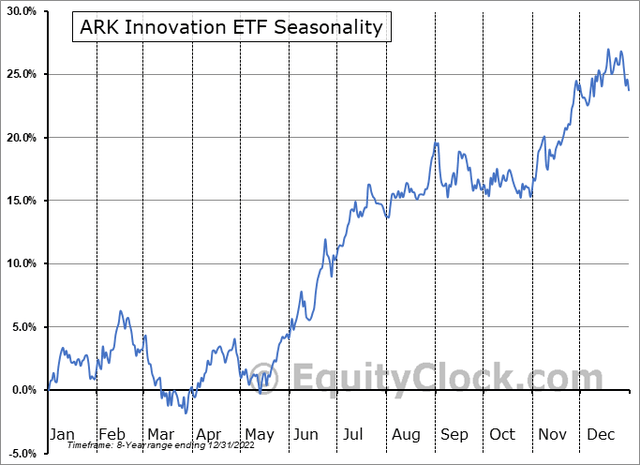

Seasonally, ARKK tends to rally now through the end of Q3, so the summer stretch tends to be an ideal period to have long exposure to innovation stocks, according to data provided by Equity Clock.

ARKK: Bullish Seasonal Trends Through August

Equity Clock

The Technical Take

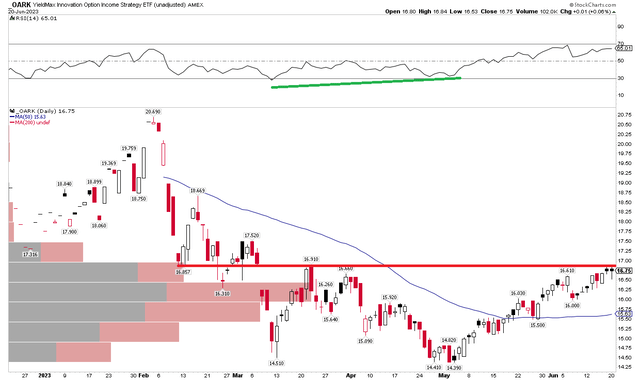

OARK does not have a long price history after its debut late last year, so chart analysis is not as useful. Still, I see resistance at the $17 mark, but the broader pattern is a bearish to bullish reversal which I will detail in the following price-only graph. Also notice the positive RSI divergence in the momentum reading at the top of the chart – that is a positive signature. But let’s take a look at ARKK itself to get a sense of where the trend is and where price may go. That will help for a technical view of OARK.

OARK: Bucking Up Against Resistance

Stockcharts.com

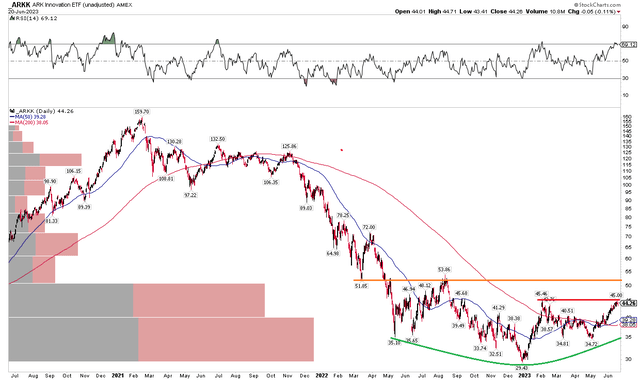

As for ARKK itself, I see positive signs. There is a bullish rounded bottom pattern working here – the green line in the below chart indicates that the ball is being handed off from the bears to the bulls. With ARKK’s long-term 200-day moving average turning flat and potentially inflecting positive, a new upswing may be taking shape after a massive drawdown off the early 2021 all-time high.

I see resistance at $45 with another layer of possible selling pressure in the low to mid-$50s. That mid-$40s spot aligns with the $16 to $17 range on OARK. Overall, I am encouraged by the reversals potentially shaping up with both OARK and ARKK. But that means ARKK would outperform OARK should the bullish thesis play out.

ARKK: Bullish Rounded Bottom Reversal Taking Shape, Improving RSI Trend

Stockcharts.com

The Bottom Line

I like the valuation, technical, and momentum situations with ARKK right now, so I would rather own that fund rather than OARK since the yield-focused ETF will likely underperform should ARKK’s performance continue to shine. Thus, I have a hold on OARK.

Read the full article here