Strategy

Launched and managed by Invesco Capital Management LLC, the Invesco KBW Regional Banking ETF (NASDAQ:KBWR) invests in stocks of companies operating across the United States’ financial sector, primarily in regional bank sectors. KBWR invests in growth and value stocks across diverse market capitalizations and aims to track and replicate the performance of the KBW Nasdaq Regional Banking Index. Formed on November 1, 2011, the fund has accumulated an AUM of nearly $64 million. The index is rebalanced and reconstituted quarterly. The fund employs a market-cap weighting strategy that does not provide broad exposure to the entire US banking industry.

Holding Analysis

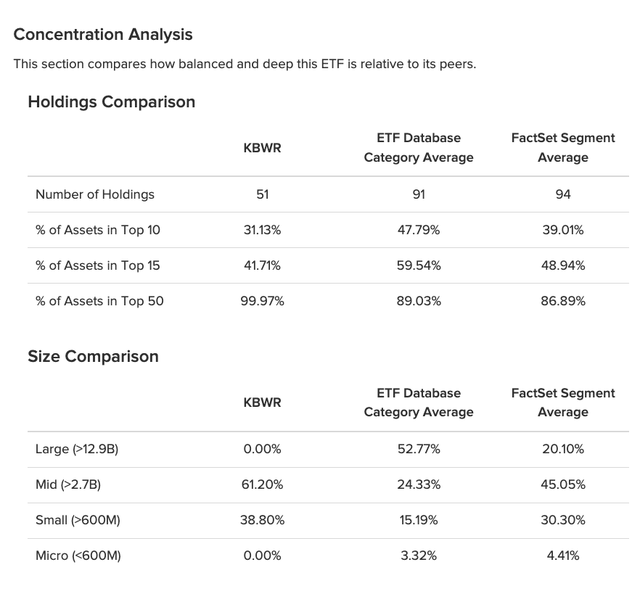

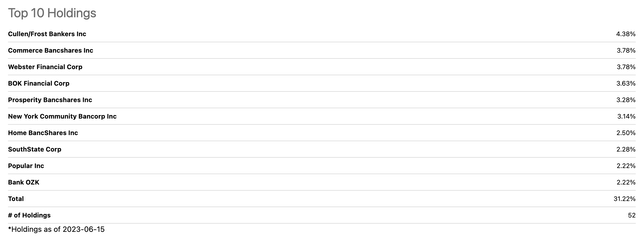

KBWR focuses exclusively on small-cap regional banking firms within the US. The fund invests 100% in the US, and despite utilizing a market-cap weighting strategy, many of its portfolio holdings tend to be equally distributed, especially in the top 10 holdings. These holdings only constitute 31% of the entire portfolio, with weights ranging from 2% to 4% each. The fund, comprising a total of 52 stocks, has relatively low concentration risk as 69% of the portfolio is allocated to the remaining 42 stocks in the portfolio. Moreover, the fund allocates 39% to small-cap banks and 61% to mid-cap banks.

etfdb.com

Seeking Alpha

Strengths

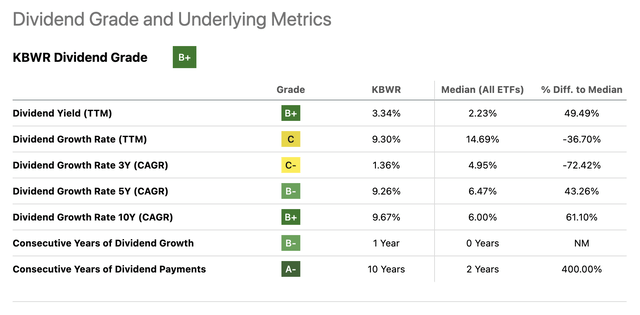

With an AUM of under $64 million, KBWR is among the smallest regional banking ETFs among its peers. Nevertheless, the fund has still been able to sustain stable dividends. The fund currently has a dividend yield of 3.30% with a 4-year average of 2.75%, all of which compare favorably to its peers. Surprisingly, the fund’s actual dividend rate, at $1.51, is higher than all of its peers except KBWB at $1.57. The fund has consistently paid out dividends for the past 10 years, whereas the median for all ETFs is 2 years. While the fund’s dividend growth rate for 3 and 5 years may trail its peers, its growth rate is still substantially above the median for all ETFs. Moreover, KBWR has been given a rating of D- for its risk grade, and many of its underlying metrics are also in the D range. Its annualized volatility and tracking error for the last 5 years have been significantly higher than the median. Especially in a time when the regional banking sector carries higher risk, investors are particularly drawn to funds that generate substantial income and consistently pay out dividends. This can add a layer of stability to a fund that generally has shown very little capital appreciation.

Seeking Alpha

Seeking Alpha

Weaknesses

Although indirectly related, the regional banking sector may face potential repercussions from the recent collapse of several regional banks, including Silicon Valley Bank and Signature Bank. Alongside this, there was also difficulty and turmoil surrounding the acquisitions of both Credit Suisse and First Republic Bank. These factors can leave many investors concerned for the health of the banking sector and the entire economy as a whole. As of late, regional bank stocks have become increasingly cheap and risky. Much of the risk is tied to investor confidence in the industry. The primary driver for regional banks’ recent poor performance is fear among consumers. Depositors who hear about the failure of other banks can lose confidence in their own respective bank and pull money out. This then creates financial stress for the bank, resulting in major stock losses even when the bank is fundamentally sound.

Opportunities

Due to this fear among consumers, the Federal Deposit Insurance Corporation (FDIC) has recently advocated boosting deposit insurance above $250,000 for some accounts. The FDIC hopes that by increasing insurance after the three recent bank failures, it can reduce the risk of further bank failures. This will also provide temporary unlimited deposit insurance to bank accounts that do not earn interest, a policy similar to one implemented during the Great Recession. It’s also worth noting that more than 99% of accounts fell under the $250,000 cap as of December 2022, but the growth of these uninsured accounts has made banks riskier. Uninsured deposits accounted for 47% of deposited funds in 2021.

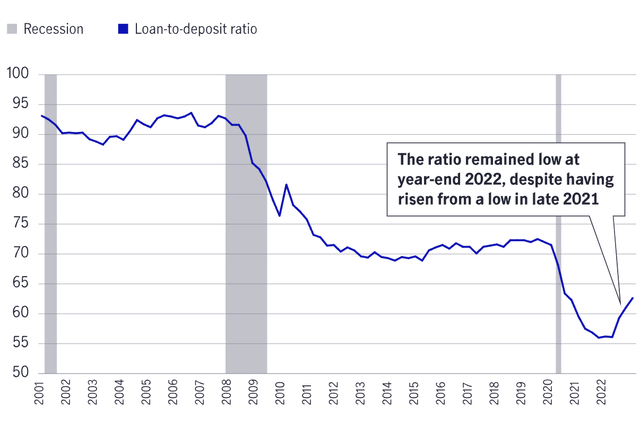

Furthermore, if we examine the median loan-to-deposit ratio for banks across the country, we see that the ratio remained low at the end of 2022 despite having risen from a low point in late 2021. This low loan-to-deposit ratio is a good indicator of a healthy banking sector. The ratio is a commonly used metric to assess a bank’s liquidity as it shows a bank’s ability to cover loan losses, as well as how reliant a bank is on deposits for its lending. In the graph below, the ratio has continuously been decreasing throughout the past two decades, with its sharpest drops during recessionary periods.

John Hancock Investment Management

Threats

Alongside a pessimistic consumer outlook among banks, stress in the commercial real estate sector could potentially pose a significant risk for regional banks, as losses from higher interest rates can manifest over the coming months. A Citigroup analysis found that banks represent 54% of the overall $5.7 trillion commercial real estate market. Furthermore, compared to big banks, small banks hold 4.4 times more exposure to US CRE loans, and a large percentage of those loans will require refinancing in the near future. This can further reduce borrowing among consumers already in a rising interest rate environment. This could then lead to a vicious cycle where there could be an increase in loan defaults and a decrease in overall credit quality for regional banks.

Conclusion

While KBWR is among the smaller regional banking ETFs among its peer group, the fund has been able to sustain dividends relatively similar to those of its much larger peers. It has consistently issued dividends for 10 years and has maintained stable yield growth over the long term. Currently, investors are primarily focusing on dividends, as the potential for capital appreciation has diminished due to recent bank failures in the United States. The sector is extremely dependent on consumer sentiments, and the FDIC has even recommended increasing deposit insurance to restore consumer confidence in the sector. As long as dividends remain stable and the sector does not experience a recession, I will rate KBWR a Hold.

Read the full article here