EDX Markets, a new crypto exchange backed by a consortium of traditional Wall Street firms including

Charles Schwab

and Citadel Securities, said Tuesday it had begun processing trades. Trading platforms like

Coinbase

should be wary.

The exchange is in part an answer to last year’s blowup of FTX.com, a Bahamas-based platform that like most of its counterparts in crypto trading, played the roles of exchange, custodian, and broker for its customers, functions that in the stock market are separated. Billions of dollars worth of FTX customers’ crypto were misappropriated, and founder Sam Bankman-Fried is facing fraud charges, which he denies.

What makes EDX’s structure unique—at least for crypto—is that it says it only plans to play the role of exchange, much like the New York Stock Exchange does for equities. It won’t take on the roles of broker or custodian. Other institutions will use it to agree on prices for crypto trades without EDX itself taking custody of the assets.

That separation in roles is exactly what Securities and Exchange Commission Chair Gary Gensler has been calling for in recent months.

“Separation of these core functions helps mitigate the conflicts that can arise with the commingling of such services,” Gensler said in remarks at a conference this month. “If one of your earlier speakers said they were combining these functions or that they were surreptitiously trading against their customers without complying with our rules, no one in this room would stand for it.”

An SEC spokesperson declined to comment on EDX.

The agency earlier this month sued Coinbase (ticker: COIN), alleging that the firm operated as an unregistered securities exchange, broker, and clearing agency. Coinbase has denied that it allows the trading of securities on its platform. Its executives have said that the SEC hasn’t provided a clear path to register with the agency.

Coinbase didn’t respond to a request for comment on the EDX launch.

EDX has a number of prominent Wall Street backers. In addition to Charles Schwab (SCHW) and Citadel, the firm’s investors include Fidelity and

Virtu Financial

(VIRT).

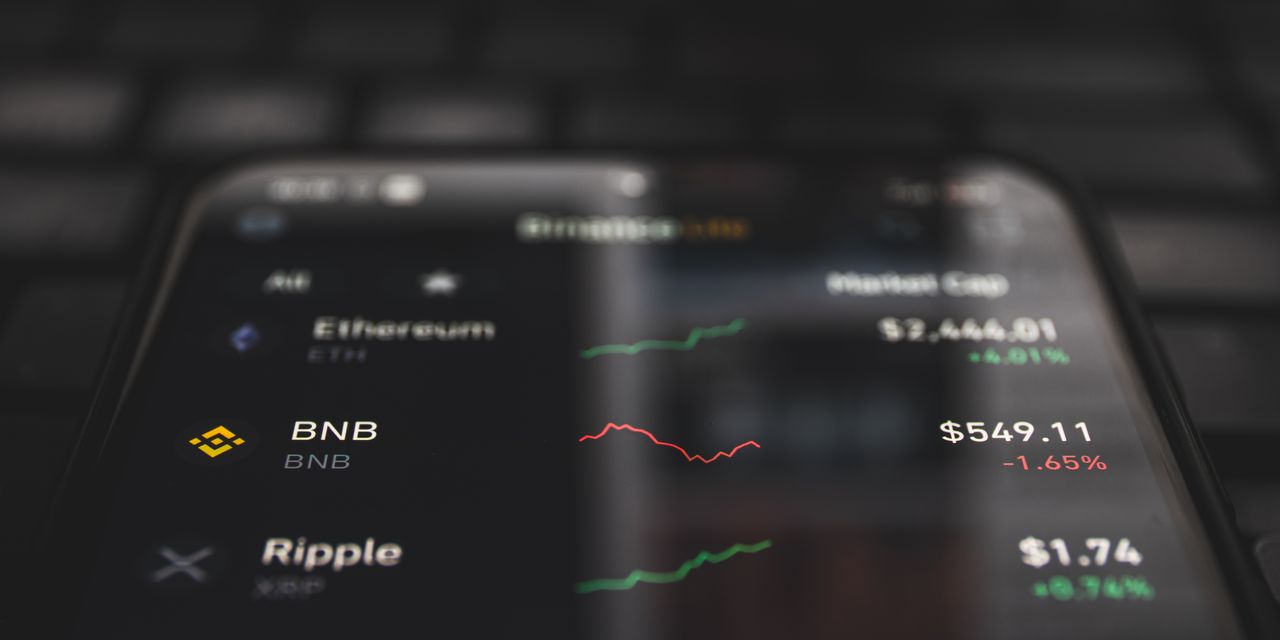

For now, EDX’s scope is limited. The exchange only trades

Bitcoin,

Ethereum, Litecoin, and Bitcoin Cash, rather than the hundreds of tokens that change hands on Coinbase and its competitor Binance. The firm plans later this year to launch a clearinghouse to help settle trades.

Its entry into the market is a strong sign that the crypto market’s old way of doing business, where trading platforms profit from providing all those functions at once, is on the way out the door. Even as the SEC’s lawsuit against Coinbase could take years to play out, traditional firms are starting to bring the old rules to bear on the token market.

Write to Joe Light at [email protected]

Read the full article here