Investment Summary

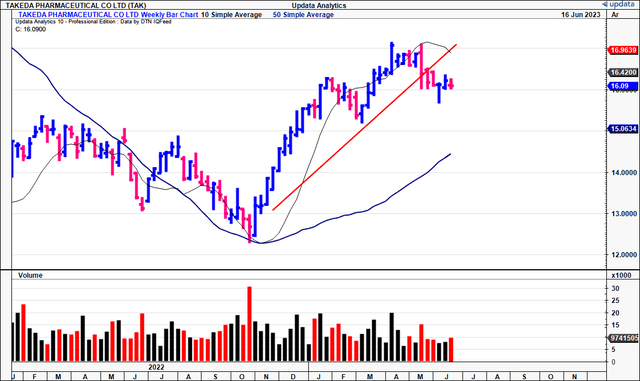

Six months on from the reinstated buy thesis, the equity stock of Takeda Pharmaceutical Company Limited (NYSE:TAK) has appreciated 10% at the time of writing. I was bullish on the company in December, and it has been a pleasure to see the investment thesis, although slowly, somewhat vindicated.

Underlining the medium-term gains are a number of important updates to the critical facts in TAK’s investment debate. The company has faced a set of growth challenges in the last 2-3 quarters, which may have potentially hurt the valuation. Nevertheless, a detailed inspection of the numbers reveals TAK comes to us with desirable economic and fundamental characteristics These position the company to attract a higher market valuation. Net-net, rigorous scrutiny of the company reveals there ample evidence supporting a buy rating. Rate buy $42/share valuation.

Figure 1

Data: Updata

Catalysts for further price change

As mentioned, the drivers of TAK’s intrinsic valuation, and market valuation, are fundamentally and economically derived. To put things into perspective, TAK was founded in 1781, in Japan. It has been operating that long, growing the business every decade or so. You have here a Japanese bastion of a firm that has deep customer networks, cost-relationship advantages and literally centuries of business growth.

1. Economic catalysts

The numbers are still up to scratch in the modern setting, as noted in the example below:

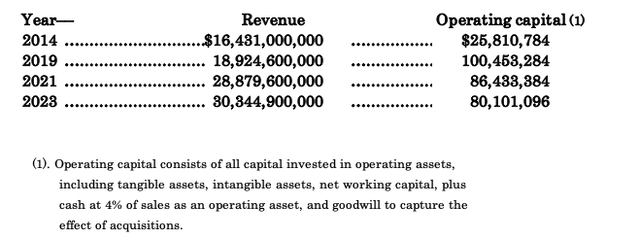

Table 1. TAK 10-year revenue, operating capital

Data: Author, TAK SEC Filings

Revenues have compounded 7% per year on average from 2014-2023. Whereas the annual compound rate of growth in operating capital, defined via (1) in Table 1, is 13%, coupled with the 12.3% compounding rate of growth in pre-tax income. That’s a doubling in revenue and more than 210% increase in investments made.

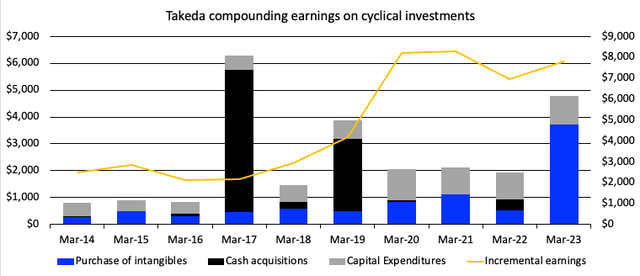

Such respective compounding growth in income is telling. For one, it tells of TAK’s ability to reinvest its earnings back into additional growth programs, producing growth in free cash flow at high rates of return. You can see in Figure 2 the sources of TAK’s capital charge on a rolling TTM basis. There has been a blend in the usage of capital (blue bars for intangibles, black bars ranging from cash acquisitions, great for CapEx). The line of post-tax earnings underwent tremendous growth from ’14-’20. Since then, the company has generated post-tax earnings in the range of $7.5-$8.5Bn.

Figure 2

Data: Author, TAK SEC Filings

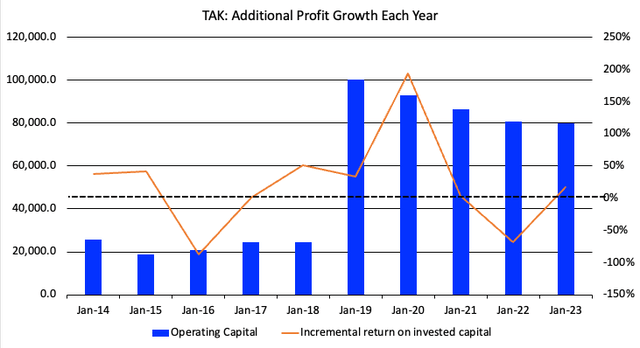

Breaking this down on an incremental basis, the following points are relevant:

- Over the 2019-2023 period, the company invested an additional $55.4Bn in operating capital. This is quite the capital charge in that period.

- At the same time, TAK generated ~$4.8mm in additional post-tax earnings growth from this $55.4Bn investment.

- That equates to an 8.6% return on incremental capital employed.

Two down years have brought down the overall average ROIC for the company, but the data shows these trends have every right to continue in my estimation. Especially with the growth characteristics discussed below.

Figure 3

Note: Incremental return is the change in NOPAT on incremental capital. (Data: Author, TAK SEC Filings)

2. Fundamental catalysts

Note: As a reminder from earlier, TAK reports in JPY, and thus all figures will be presented here in JPY in order to avoid confusion.

In FY’22, TAK clipped revenue of ~JPY4 trillion, representing core growth of 3.5%. This growth can be primarily attributed to the substantial increase in product sales, mainly from recent launches, which were up 19% YoY. Notably, new launches are ~40% of TAK’s total revenue. It pulled this to core operating profit of c.JPY8.4Bn, a growth rate of 9.1% YoY. This pulled down to operating margin, which increased by 1.6 percentage points on the previous year.

Looking at the divisional breakdown, there are many highlights. To name a few:

- TAK’s pipeline is stacked and the company is pushing on numerous conversions. Phase III readouts for TAK-755, Phase II readouts for Waziristan, and proof-of-concept data for its Orexin franchise have all yielded positive study outcomes.

- In my view, these advancements provide support for the program stage-ups of these innovative therapies. For instance, TAK-755 holds potential as a treatment for congenital TTP, with plans to file for approval in the U.S. and other regions. Similarly, Waziristan, an RNA interference therapy, shows promise in mitigating liver-related complications caused by harmful protein aggregates. Both are key updates, however, and could be meaningful if converted.

- Leverage

- Management is focused on bringing the debt load back to longer-term levels. Long-term debt is at $30.44mm in FY’23, down from heights of $43mm in 2019.

- By the end of the period, the company successfully brought down its leverage ratio to 2.6x.

- I’d note this is a good sign for TAK on a couple of fronts. One, it is a prudent move given the current macro regime and interest rates situation. In terms of capital budgeting, it tells me the firm has its investors in mind.

- Two, this achievement is even more noteworthy considering the impact of a significant JPY3Bn payment made to acquire TAK-279 from Nimbus.

- Hence, there is ample liquidity to drive business growth, earnings growth and focus on reducing business obligations.

- Geographic diversification

- TAKHZYRO’s recent listing on the NRDL in China is a good example of the company’s seamless entry into new markets.

- TAK’s achievements in the U.S., such as the growth of ENTYVIO as the leading prescribed biologic for IBD, solidify the company’s market leadership. These accomplishments underscore TAK’s ability to penetrate diverse markets and position itself as a global healthcare leader in my view.

When talking in first principles, the capacity to enter new markets with ease, and start growing profits as a result is a fairly attractive set of investment criteria.

- Dividend increase could attract investment:

- TAK’s planned dividend increase from JPY180 to JPY188 per share in the fiscal year 2023 is a fairly strong indicator of management’s confidence in the company’s prospects in my opinion.

- On the other hand, it could also suggest a lack of opportunities to invest internally.

- Nevertheless, the 4.4% gain isn’t unwelcome and adds to the capital appreciation one can generate.

These fundamental catalysts are integral to the buy thesis formed on TAK going forward.

Valuation

TAK is priced at an absolute steal in my view at 9.7x forward EBITDA. Further, investors are selling at 21x forward earnings, and you’d get 0.55x trailing PEG ratio as illustration of the growth. Elsewhere, the company is more than fairly rated in my opinion.

Investors are paying just 7.8x forward cash flow, ~1.1x book value and there’s the c.2% dividend yield to consider as well- these are each value factors. On first check, this doesn’t appear correct to me, not in the slightest. It appears too much of a discount.

At the current market value of $50.1Bn, and assuming a 12% discount rate, investors are expecting $6Bn in future owner earnings from TAK (6,000/0.12 = 50,100). At the TTM free cash flow of $4.32Bn, the market expects 6.8% annual compounding growth from TAK into FY’28, not an unreasonable view in my eyes (4,328*(1+6.8%)^5)/(0.12) = $50,100).

At FY’23, that would call for $4.662Bn in post-tax earnings this year. I’m looking to ~15x forward owner earnings for TAK, the sector multiple, getting me to $64.9Bn in market cap or $41.8mm per share. This is supportive of a buy rating, with 160% upside potential at the time of writing.

In short

There are multiple supportive points to warrant a revised buy thesis on TAK in my view. Chief to these are fundamental, economic and valuation factors. The company’s sales and growth route continues on a normal trajectory. Meanwhile, it is recycling capital well into additional profits, and as of the last 12 months, additional market valuation.

Looking forward, it wouldn’t be unreasonable to expect a market valuation of $64.9Bn or $41.8 per share in my opinion, based on the evidence shown here today. Net-net, I am reiterating TAK as a hold based on the culmination of these factors. $41.8/share is a considerable upside on the current market value, and plenty of margin of safety in case the estimates are tweaked up a bit without notice. Reiterate buy.

Risks to investment thesis

In addition to the constructive features discussed here today, investors must also understand these key risks that could either change or nullify the investment thesis:

I would note potential foreign exchange risks with the JPY’s performance against other currencies, especially the USD. There has been notable relief from the famous JPY “carry trade” however there is still risk to TAK’s revenues on this in my view.

We shouldn’t ignore the obvious macroeconomic risks hovering above global financial markets either. These consist of inflationary, rates-driven, and geopolitical risks that could each have an impact on the broad market.

Whilst TAK’s debt levels have come down somewhat, there is still interest rate risk on the balance sheet and if rates were to continue pricing higher, this may have an impact on the company’s bottom-line fundamentals.

Investors must recognize these risks in full before any investment decision.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here