The investment thesis

Skyworks Solutions (NASDAQ:SWKS) is a semiconductor company that develops and manufactures advanced analog, mixed-signal, and radio frequency (RF) semiconductors. SWKS products primarily focus on wireless communication applications, enabling connectivity across various devices and markets. Skyworks provides chip solutions for mobile devices, such as smartphones and tablets, automotive, aerospace, broadband, industrial, and Internet of Things (IoT) applications.

The long-term investment thesis for the company is relatively straightforward. Over the past ten years, SWKS revenues have grown at a compound annual growth rate of 13.2%. OI has done even better thanks to operating leverage, compounding at 18%. The wireless networking revolution is well underway, as these numbers demonstrate, but far from over. The demand for ubiquitous, “always-on” connectivity will expand beyond the mature smartphone market, fueling Skyworks products’ next growth phase and further empowering people’s lives and how they connect in new technological ways.

An example of such an increasing array of connecting devices hit the news recently with the announcement of Apple’s (AAPL) Vision Pro VR device. Wearable technologies have been a focus of tech giants for a while, and the Apple Watch has been on the market for eight years. Even if adoption has not been as rapid as other tech gadgets, the device has arguably carved out a niche amongst the younger generations. Regardless of whether the Vision Pro will immediately turn out to be a new major product lunch like the iPhone or just a solid niche contributor like the Apple watch, there will be opportunities for Skyworks’ technology to empower future wearables with RF technology.

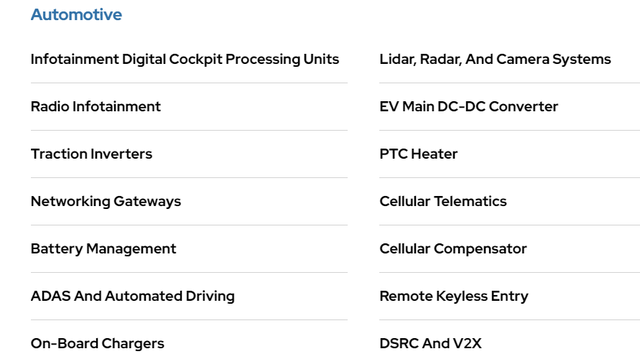

Besides wearables/IoT, automotive and infrastructure are the areas I am most bullish on for SWKS products. Regarding automotive, it is apparent how the industry is quietly evolving from supplying mechanical goods to hi-tech gadgets. As autonomous driving advances, it is only a matter of time before manufacturers must massively expand the use of RF chips in cars.

Skyworks’ website

Power supply, industrial and motor control, and WiFi6 are other high-growth areas for the firm. Boosted by its 2021 $2.75 billion acquisition of Silicon Labs, Skyworks has a complete line-up of products and seems ready to take on the challenge. Formidable competitors in the space include NXP Semiconductors (NXPI), Qualcomm (QCOM), Qorvo (QRVO), Broadcom (AVGO), and Murata Manufacturing (OTCPK:MRAAY).

However, Skyworks possesses decades of RF expertise, and the forecasts see the market keep growing at a CAGR of 15-20% throughout the rest of the decade (report 1), (report 2). Even if I do not expect SWKS to gain market share against its competitors, I believe the company will continue capturing an equal share of the market’s growth and expand at a double-digit rate in-line with its recent past.

Where Growth Meets Value

Considering such rosy growth forecasts, investors could expect SWKS to be a high-flyer stock trading at unreasonable earnings multiples. On the contrary, it trades at 13x forward earnings and 9x cash flow. These are obviously “value stock” multiples, so much so that famed value investor and “Margin of Safety” book author Seth Klarman started a new position in SWKS during the first quarter of 2023.

The reasons for the market’s assigning a low-multiples valuation to SWKS are, in no particular order:

1) Semiconductors are a capital-intensive, highly competitive industry. Even if SWKS produces an annual cash flow above $1 billion, most must go back into acquisitions and organic CapEx for the company to remain relevant. D&A increased rapidly in the last few years and now reaches $400 million, but the company’s new CapEx still exceeds such an amount, with an average of $500 million invested during the last three years. On the P&L side, over the previous ten years, SWKS R&D expenses averaged 11% of its turnover and grew more or less in line with sales at a CAGR of 12%.

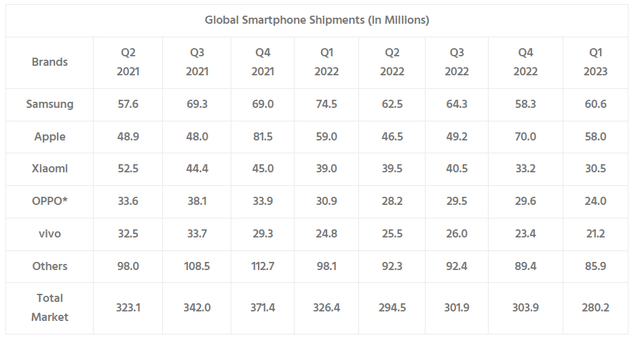

2) Semis are a cyclical business. If the global economy slows, so will the demand for SWKS products. Cyclical companies may often appear cheap if the earnings power is not adjusted to reflect cycle normalization. SWKS trades at not only 13x fwd EPS but also 10x (non-GAAP) FY22 EPS, so the multiple is expanding because of an ongoing earnings drop. Determining whether SWKS is approaching or not a trough and estimating the recovery timeline is crucial in valuing its business. Skyworks’ 2Q23 revenues declined approximately 14% on both a YoY and QoQ basis. The drop shouldn’t surprise, considering the trend closely matches the 14% YoY decline in global smartphone shipments.

counterpointresearch.com

3) Short-term guidance fears. Even if analysts have already cut their consensus significantly for the second quarter, expecting SWKS to earn $2.03 (-22.8% vs. 2Q22 Act @$2.63 per share), SWKS still managed to miss it by $0.01, reporting $2.02 and guiding for an even worse 3Q23 @$1.67, well below analysts’ expectations of $2.10 (-20.4%) and 3Q22 Act @$2.44 (-31.6%). As a result, analysts are rushing to downgrade the stock, worrying that the worst is yet to come.

Beware customer concentration

While the above uncertainties tend to be industry-wide, one additional, company-specific issue places Skyworks in a more concentrated club of “optically cheap” semis stocks. Other notable club members include, for example, Qualcomm on Chinese-customers concentration fears (63.6% of QCOM’s 2022 revenue originates from China) and Cirrus Logic (CRUS) on heavy single-customer dependency, the same as Skyworks’s: Apple.

SWKS’s heavy reliance on Apple as a customer is a big overhang for the stock and a risk that is not easy to dismiss. Even if, on a positive note, Skyworks’ position as a leading supplier of future iPhone iterations seems secure for now, the Cupertino giant exerts significant influence on SWKS. 59% of fiscal 2022 revenues came from Apple, and if Skyworks were to lose AAPL as a customer even only for one design win, the impact on earnings would be dramatic. While the Silicon Labs acquisition has expanded SKWS’s revenues, it has yet to diminish its reliance on AAPL.

To make things worse, Apple reportedly started the development of its own RF chips in 2021. Fast forward to January 2023, and the news was out that AAPL is still trying to introduce its 5G modem chips by 2025, although nothing is certain yet. The development would displace Qualcomm and Broadcom, leaving SWKS’s supply of power amplifiers and front-end RF chips untouched by the change. The problem could be, however, indirect: QCOM also produces RF chips and power amplifiers. If QCOM tries to win over the business from SWKS and service AAPL with these products to replace the lost 5G modem revenues, competition could intensify. Yet, I am not certain Qualcomm would be willing to increase dependency on Apple again on this, at the risk of being ditched twice within a short time.

I understand why Apple is pushing to successfully test and roll out a competing 5G modem technology first. The business is worth much more than the one with SWKS, and Qualcomm’s business with Apple alone is worth approximately $9 billion (~20% of QCOM’s total), almost three times SWKS’s revenues from AAPL. Apple is also Broadcom’s biggest customer (~20% of AVGO revenue), and the business is worth approximately $7 billion. A move to in-house chip supply could be worth up to $16 billion for AAPL, even without accounting for SWKS products. However, early attempts by AAPL to produce the chips failed, with reports of overheating problems that forced Apple back into the hands of QCOM. For SWKS products, the technical challenges seem to be even higher.

My takeaway is that, more than a question of if, SWKS executives and investors should ask themselves when such a change will happen. My best guess is that Apple will avoid releasing a botched product into the market at all costs because of its reputation, favoring a slow roll-out. AAPL’s caution will presumably give at least 18 months to 2 years’ notice to SWKS when a rumor similar to the one now affecting QCOM and AVGO starts to circulate. Also, in my opinion, the front-end RF chip final development will not even happen until the first in-house 5G modem is out in the market.

Eventually, SWKS may lose Apple. But even if a change happens, it will come with a very slow roll-out. It is tough to believe that AAPL might have something to displace SWKS before 2027-2028 at the soonest. Skyworks has at least another five years to figure out how to reduce its dependency to a (still challenging but) more survivable ~20-30% total, like for AVGO or QCOM now. At the same time, it is almost impossible to expect Apple to drop much lower than that threshold. The sheer size of AAPL’s business will always make it a huge customer, and it would be foolish to disengage from further interaction for the sake of diversification.

The wise use of capital

What I really like about Skyworks is that the company has been a great capital allocator and a shareholders-friendly company. I agree with Morningstar’s analyst Brian Colello, who assigns an “Exemplary” rating to SWKS.

Skyworks is a well-run company with a solid leadership team and a sound balance sheet. The company has minimal debt, with net debt currently just above $1 billion. SWKS used to have a net cash position until its $2.75 billion acquisition of Silicon Labs. The deal was possibly pricey when looking at multiples, but the company has been steadily growing design wins. SLAB will need some time to translate these design wins into higher revenues for SWKS, as the technology has a long lead time to reach the product stage and grow in the market.

Skyworks has repurchased shares in an orderly fashion during the last few years, and its diluted weighted average outstanding shares decreased steadily over time. From the 192.2 million shares as of Sep 2013 to the current 159.2 million shares, that’s a 17.2% decrease over the last ten years, which is sizable for a technology company.

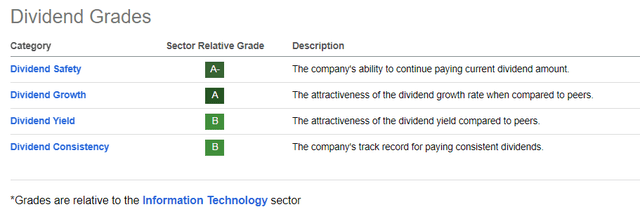

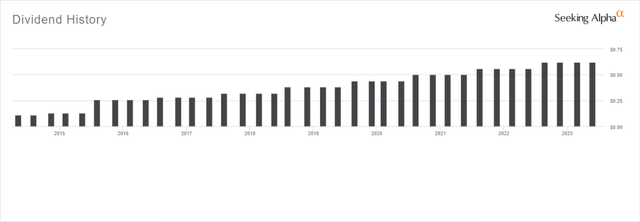

At the same time, Skyworks has started to pay a dividend in 2014. The dividend has grown for seven years, placing SWKS in the Dividend Challengers list. The company fares very well when checking Seeking Alpha’s proprietary dividend rating system:

Seeking Alpha

The current yield is not exceptionally high at 2.3%, but I expect the company to announce the usual $0.06 annual raise soon, bringing the forward 12-month payment to $2.72 per share or about 2.5% based on the recent share price. Also, a 2.5% yield in the technology sector is by any means “low.”

The payout ratio remains manageable even after the constant raises. While temporarily elevated because of SWKS’s earnings decrease vs. last year, the ratio rounds off at 32% based on the $8.39 forward EPS consensus. With earnings expected to re-accelerate faster than dividend growth from 2024 or 2025, the ratio should return closer to its historical mean of ~25% adjusted earnings. SKWS seems suitable for DGI investors, and I currently own some shares as part of my dividend growth bucket allocation.

Seeking Alpha

Valuation and verdict

Despite the ongoing revenue slowdown, I expect such a trend to reverse within the next 12 to 18 months, and SWKS should return to rapid growth afterward. Analysts’ consensus sees the trough in 2023, with 2024 revenues bouncing back to 2022 levels in fiscal year 2024 and then growing towards the $6 billion mark in 2025. While there could be some minor discrepancies, I concur with the forecast’s overall trend.

Based on a 37% EBITDA margin, I see SWKS’s 2025 EBITDA climbing back to the $2.2 billion region. Attaching a 12x EV/EBITDA multiple, in line with SWKS’s long-term average, the company could be worth about $26.6 billion EV.

By subtracting the $1.1 billion net debt (stable without further M&A), Skyworks’ fair market cap could be approximately $25.5 billion, representing a 49% upside vs. the current capitalization. The three years upside should be even higher since SWKS will likely continue to buy back shares and distribute dividends. Despite the earnings hiccup, I expect SWKS to be able to continue to retire ~2% of outstanding shares per year, all while distributing an ever-increasing dividend that could approach $3.2 in the third year.

Based on an exit price of $166 per share ($25.5 billion / 153.7 million shares outstanding in 2025), I expect an annualized total return, including dividends, of about 18%. Despite customer concentration risks, I see investors targeting a profitable investment exit at this level before any structural change in the revenue mix happens.

I have run a longer-term cash flow simulation to cover the worst-case scenario of a sudden loss of Apple. I am confident that investors could see a profitable long-term return of 10%-12% on SWKS shares even under such a bearish scenario. I plan to publish such a review in a follow-up analysis to be released sometime next quarter. In the meantime, I am starting coverage with a BUY rating on SWKS.

Read the full article here