Dear readers/followers,

I published a bold article on Prologis (NYSE:PLD) back in February, concluding that there was no alpha in buying the stock at the time as according to my calculations investors could reasonably expect to earn just 8% annual returns. The call, which was entirely based on valuation, has been right so far, as the stock has traded completely sideways while the S&P 500 has climbed almost 10% higher.

After some thinking I came to the conclusion that although PLD won’t make you rich and it may not beat a broader market index, it can still make sense to include it in a portfolio for some strategies, which is why I want to give the company another look today. After-all Warren Buffett says that it’s better to invest in great companies at a good (fair) price than good companies at a great price and although I love buying deeply discounted turn-around plays, those should never account for 100% of the portfolio. We need some stability, which is where companies like PLD come in.

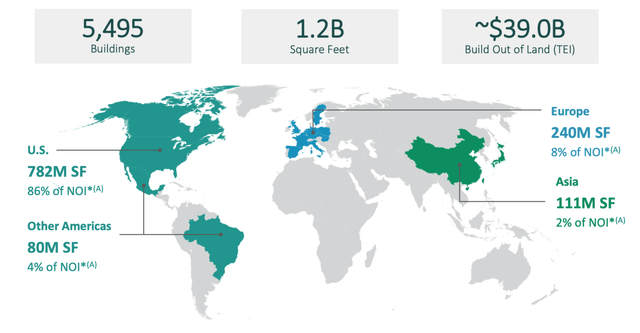

Prologis is by far the world’s largest logistics REIT with over 5,000 properties located across the world and a market cap of $113 Billion which is triple that of its next ten largest competitors. This puts the company is a league of its own and what it really means is that its growth will be primarily driven by the growth of the industry as whole, rather than by increasing their market share.

Prologis Presentation

Double-digit growth prospects

And since demand for logistics space is expected to grow by a CAGR of 11% for the rest of the decade, the growth prospects are quite good. This growth will be driven primarily by (1) increasing e-commerce penetration as a % of sales and (2) higher inventories in proportion to sales as supply constraints ease and as retailers target larger inventory buffers post-Covid.

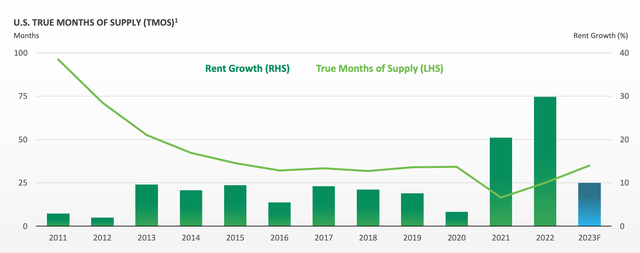

On the supply side, new construction starts are down 30% globally from the 2022 peak, primarily due to a higher cost of capital. In the US, “true months of supply” which is calculated by adding up vacant space and unleased space under construction and dividing by the trailing 12-month average net absorption per month, stands at 30 months. That’s right in line with the historical average and since anything below 50 months has historically been consistent with real rent growth, the company expects to be able to increase their rents quite significantly (10% per year or so) going forward.

Prologis Presentation

I also want to point out that tenants should be able to absorb these higher rents without any problems as rent accounts for a very small portion (3-6%) of total supply chain costs which are dominated by transportation costs (45-70%) and labor costs (15-25%). This means that a 1% saving on transportation and labor can offset a 15% increase in rent.

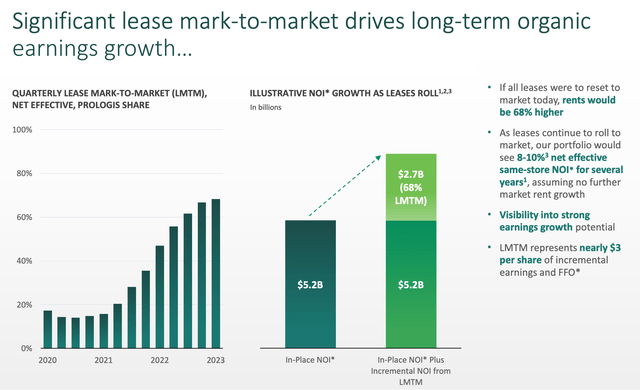

One of the largest and most predictable growth drivers going forward will be the roll-over of rents as they expire. Prologis estimates that their properties are currently leased at rates deeply below market. In particular, if all leases were reset today to market rents, NOI would increase by a staggering 68%. New leases during the most recent quarter were indeed 68.8% higher (42% on a cash basis) and same-store cash NOI increased by 11% YoY.

Prologis Presentation

This means that every year as about 12-15% of leases expire, the company is able to re-lease the space at a 68% higher rent, which drives portfolio wide growth of 8-10% per year. This growth is highly visible and essentially locked in. Moreover, it’s on top of market rent growth which is also expected to grow as illustrated by the true months of supply chart above. Combined these two factors should result in internal growth of 10-12% per year, without even accounting for new acquisitions or developments.

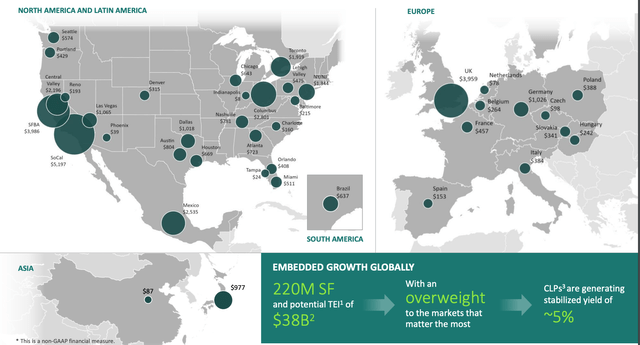

And the thing is that Prologis has a really good track record of developing properties with $40 Billion invested over the past 20 years at an average value-creation margin of nearly 30%. Currently, they have about $38 Billion worth of projects in the pipeline ready to be deployed which can generate an additional 220 Million sft of space (+18% of existing portfolio).

Prologis Presentation

Premium valuation

There’s little doubt that Prologis will manage to grow their earnings, but that’s also why it’s not particularly cheap. With an annual NOI of just under $5.2 Billion the stock trades at an implied cap rate of 3.7%, which is the lowest I’ve seen for any REIT and frankly doesn’t leave much space for a re-rating higher which means that all growth will probably have to come from FFO growth.

Management guides towards a full year 2023 FFO of $5.42 to $5.50 per share. Beyond this year, with a very conservative A- rated balance sheet, FFO should grow in line with NOI at high single to low double digits as rents roll-over. Assuming 10% annual growth on midpoint of guidance FFO estimates, FFO per share could reach $6.60 by 2025.

Continuing to value the REIT at 23x FFO (explained in the original article) yields a price target of $151 per share (upside of 23%). I personally view this price target as realistic, because it assumes no further growth from acquisitions and/or development projects which where the company has generated a lot of returns for shareholders, but at the same it uses a relatively aggressive multiple which I don’t see going much higher, unless we enter a true bull market.

A 23% upside on top of a 2.5% dividend over two and a half years isn’t super exciting, but we started this article knowing that PLD is a stable company that will produce return more or less in line with the market and that’s exactly what we get. Personally, I will not be adding the stock to my portfolio, despite it being a very high quality business. PLD can certainly add stability to any portfolio, but for me there’s not enough “meat on the bone” which is why I will continue to rate the stock at a HOLD at the current price and will continue to prioritize REITs that trades at a discount to NAV.

Read the full article here