Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 7th, 2023.

Agree Realty (NYSE:ADC) has been getting hit with the rest of the real estate investment trust space. REITs have been performing quite weakly due to higher interest rates. The higher rates mean that financing new projects or acquisitions becomes more costly. Another factor of higher interest rates means that risk-free alternatives now exist. As investors primarily focus on the income-oriented nature of REITs, the rise in treasury rates has put pressure on REITs overall.

Still, for a longer-term investor, REITs can still offer attractive opportunities. I’m not sure where rates go from here or when they’ll be cut, but if you have a longer-term outlook than a year or two, we are getting some great valuations on quality REITs. I believe that Agree Realty is one such REIT that is looking quite appealing at this time. The 4.46% dividend yield currently might not be able to beat out a Treasury or CD, but it has other qualities it can offer.

ADC Fair Value Suggests Upside

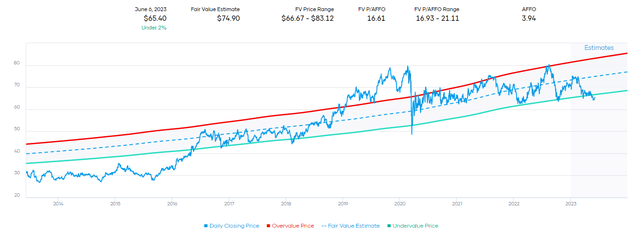

Historically, ADC had traded between a P/AFFO range of 17 to 21x. We are currently seeing the P/AFFO coming in at around 16.6x. That puts the current trading price at a value, and the fair value estimate based on the mid-range comes in at $74.90. Based on the last closing price, that could suggest nearly 15% of potential upside.

ADC Fair Value Estimate Range (Portfolio Insight)

While that range is likely to be lower now due to the higher interest rate environment, it still highlights the attractive valuation. At worst, the current price could be reflected as a fair value right now, in my opinion.

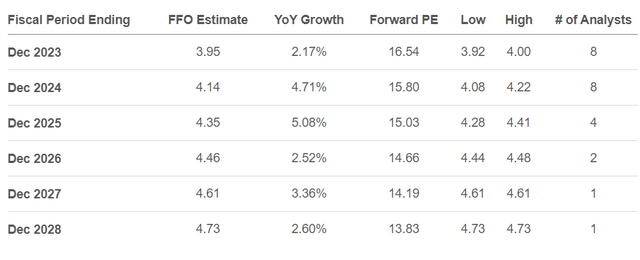

That’s where being a longer-term investor can come into play, as ADC is anticipated to grow its FFO going forward. Analysts are expecting fairly limited growth going forward, but any growth would support the current trading price.

ADC Earnings Estimates (Seeking Alpha)

Wall Street analysts currently have an upside average price target of $76.54. That would suggest around 17% of an upside move from the current level.

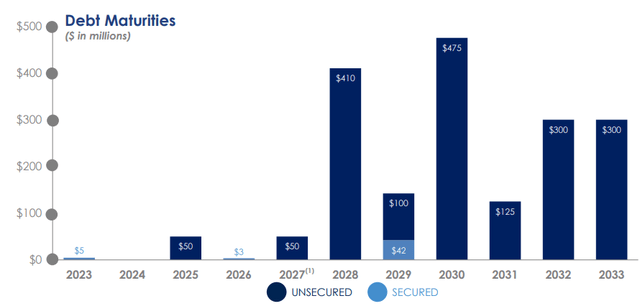

ADC Has No Debt Issues

One of the big problems with higher interest rates, besides making financing costs going forward more expensive if having to issue debt, is having to refinance debt at higher rates. Fortunately for ADC shareholders, the debt maturities are way out, with no significant near-term debt that they’ll have to refinance.

ADC Debt Maturities (Agree Realty)

Overall, they aren’t overly leveraged and have plenty of flexibility should things turn ugly. When other REITs might be drowning in debt, they can potentially take advantage of such a situation.

Peter Coughenour (the CFO) summed it up best in their prior earnings call, referring to their balance sheet as “fortress-like”:

Total debt to enterprise value at quarter end was approximately 24%, while our fixed charge coverage ratio which includes principal amortization in the preferred dividend remained at a very healthy level of 5.1x. We ended the quarter with total liquidity of $1.2 billion, including approximately $804 million of availability on the revolver, $362 million of outstanding forward equity and $13 million of cash-on-hand.

In summary, we continue to maintain a fortress-like balance sheet that affords us tremendous flexibility to take advantage of the lack of competition in the market and execute on high-quality opportunities.

This has afforded them an investment-grade credit rating of BBB with a stable outlook.

Worth noting as an aside, their preferred can also be an excellent choice and is publicly traded for easy access to all investors (NYSE:ADC.PA). It comes with a 4.25% coupon and is perpetual with a callable date after September 2026. Due to the low dividend rate on this issue, it likely isn’t going to be called anytime soon. That saw the price drop to currently around $17.70, or what translates into a 6% yield that is currently paid at $0.0885 per month.

Appealing Dividend With Growth Potential

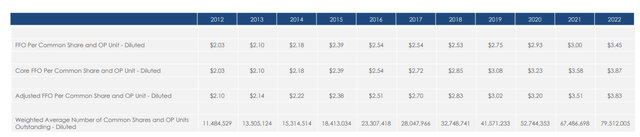

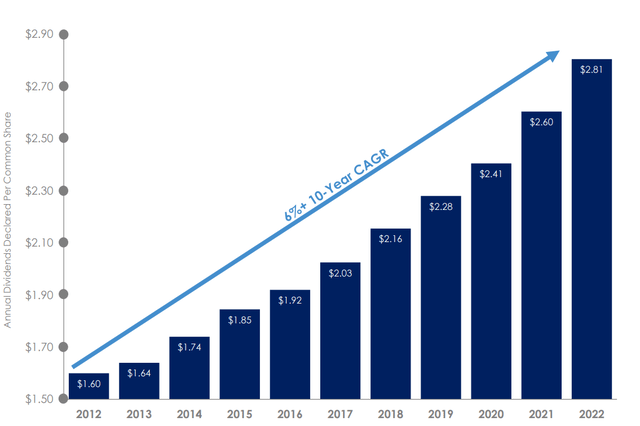

They have a strong history of growing their dividend, and the growth in earnings of ADC has supported that dividend.

ADC Earnings Record (Agree Realty)

Besides potential appreciation in the share price going forward, dividend growth is a primary benefit of investing outside of the risk-free areas that the current environment is offering.

ADC Dividend History (Agree Realty)

Starting in 2021, they switched to a monthly dividend schedule. For income investors, that can be seen as beneficial as providing more regular payouts can help retirees pay bills or even investors that reinvest at a slightly faster compounding rate over quarterly payouts.

The latest growth in the dividend could be seen as slower, with the last raise at 1.2%. Given the current uncertain environment, being more cautious could be seen as prudent. They generally raise twice a year as well, so the 1.2% bump is likely to see another bump later this year – at least if history repeats itself. Looking back over a year-over-year period, the dividend increase was closer to 3.85%.

They target an AFFO payout ratio of 75-85%. At a quarterly payout based on the current monthly rate, we’d see it come to $0.729. They posted AFFO at $0.98 for the first quarter, providing an AFFO payout ratio of 74.4%. The current dividend based on last year’s AFFO would work out to 76.14%. This puts the current payout ratio on the lower end of their range, even using old numbers. Even if we expected no growth going forward, they could still increase and be within their own target range.

ADC’s Portfolio

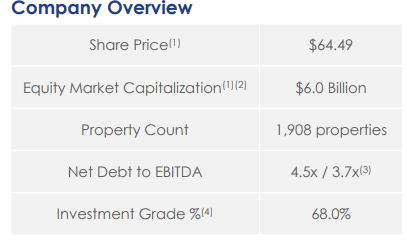

Retail can often conjure up negative sentiment amongst investors as we head into a weaker economy. However, most of ADC’s tenants are of higher quality. 68% of the tenants are considered investment grade, and the overall diversification of ADC with 1908 properties should certainly help too. They listed occupancy as standing at 99.7% in the last quarter.

ADC Overview (Agree Realty)

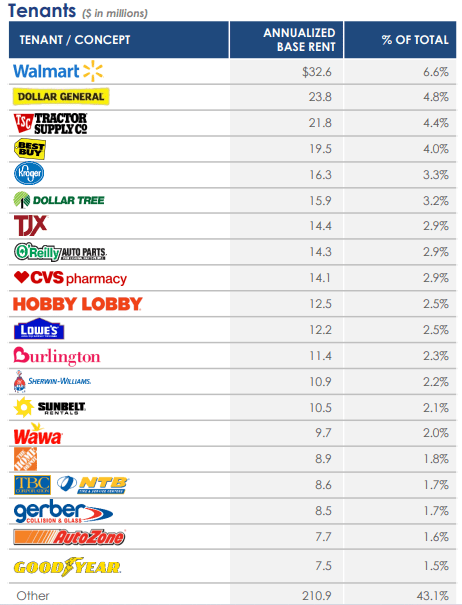

The top tenants include Walmart (WMT) and Dollar General (DG). The types of tenants that may see slowdowns in their business can also be an area that consumers trade down to. Additionally, whatever the underlying business conditions are in the short-term, they are likely to continue to be able to pay their rent to ADC – and that’s the more important factor.

ADC Top Tenants (Agree Realty)

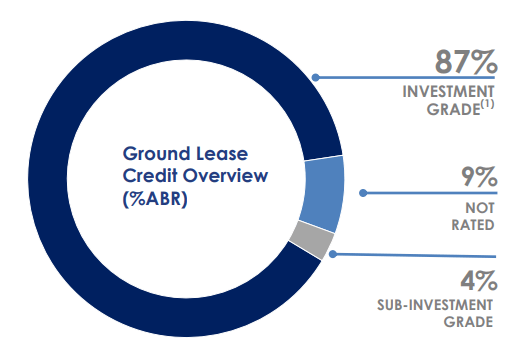

As we noted in previous updates, one area they’ve been working towards is incorporating more ground leases. As of the end of March, this was 12.1% of their annualized base rents. Those are connected to 208 leases with an 11.1 years weighted average lease term. Looking specifically at the ground lease portfolio, we see an even higher percentage of these belonging to the investment-grade category.

ADC Ground Lease Overview (Agree Realty)

While this continues to remain a focus for them, they noted in their call that more attention has been going to ground leases and their advantages. This has caused a bit of a slowdown in the acquisition, with only two being acquired in the prior quarter. They even noted that they might be a bit to blame for more awareness around the opportunities there.

I think if anything, people have been more cognizant of ground leases, I’ve talked on previous calls, probably due to some of our fault and then safe recognition. And then the sell-side recognition, there’s more attention paid to them. We acquired two during the quarter. There’s a number of them in our pipeline. But I think people are becoming generally speaking, more aware of the embedded value in the ground lease space. We were very fortunate to take advantage of it for a while, but we continue to find those select opportunities, whether they be blended extends, but a really interesting one in California this quarter with a former seller, but we’ll continue to source those opportunities. But I do think there is more recognition of the embedded value in that space now.

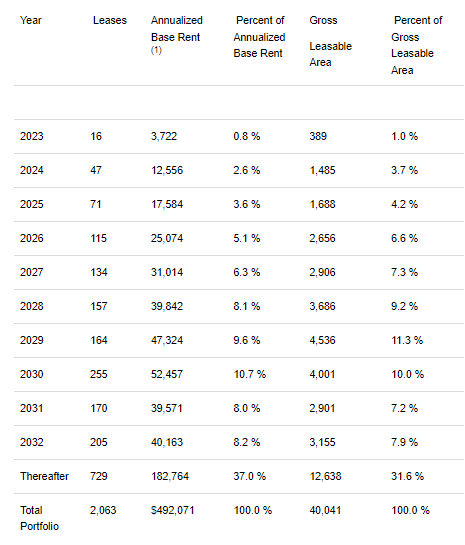

Similar to a strong debt maturity, their lease maturity schedule is just as envious. It puts them in a strong position relative to some other REITs that are facing debt maturities that are coming not only due but also relatively higher lease expirations in a tougher economic period.

ADC Lease Schedule (Agree Realty)

Conclusion

ADC is a retail REIT that has a lot of things going for it. They are in a strong position with no material debt maturities coming soon. Additionally, they have lease maturities that are also spread out over the coming decade, with fairly limited lease maturities in the short term. The majority of their tenants are investment-grade tenants, which puts them in a strong position to collect most of the rents that are due even during a tough economic period. Currently, their occupancy rate is incredibly high, at nearly 100%.

The dividend yield might not seem competitive if compared to risk-free yields currently. However, with growth potential and the strong financial position they are in, there is room for growth. They are currently paying on the low end of their AFFO payout range. At the same time, there is capital appreciation potential as they are trading below their fair value range.

Read the full article here