Lemonade, Inc. (NYSE:LMND) is a forward-thinking insurance company that combines Artificial Intelligence and behavioral economics to provide fast and convenient insurance services to customers in the United States and Europe. Founded in 2015, Lemonade has made significant strides in the insurance industry, leveraging cutting-edge technology to streamline processes and improve customer experiences. One of Lemonade’s key selling points is its use of AI and machine learning algorithms, which enable customers to obtain insurance coverage in as little as 90 seconds and receive claims payouts within three minutes. This emphasis on speed and efficiency sets Lemonade apart from traditional insurance providers. Furthermore, Lemonade’s AI-powered platform allows for a chat-based experience, offering customers a human-like interaction 24/7.

Considering how the company has positioned itself as a leading AI enabler in the insurance industry, it does not come as a surprise that LMND stock has gained 43% this year helped by the momentum behind companies that facilitate a future powered by AI technology. With the company continuing to make steady progress on the financial performance front and its efforts being rewarded with positive earnings revisions, Lemonade stock is well-positioned to climb higher.

The Improving Profitability Profile

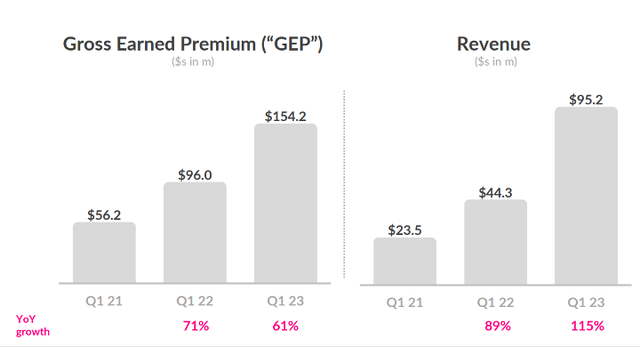

In terms of financial performance, Lemonade has demonstrated impressive growth. In the first quarter of 2023, both gross earned premium and gross profit increased by over 60% YoY, while operating expenses only grew by 4%. This indicates that Lemonade is not only expanding in size but also improving its profitability in line with expectations. The company’s positive trajectory is further supported by a declining loss ratio, which dropped to 87% in the most recent quarter from 89% in the previous quarter and 94% six months ago. Lemonade attributes this decline to advancements in AI and machine learning capabilities, as well as the increased predictive power of their data sets. The company’s revenue in Q1 also grew by 115% YoY to $95 million, mainly due to increased gross earned premium and a reduced proportion of premium ceded to reinsurers.

Exhibit 1: Revenue and gross earned premium growth

Q1 shareholder letter

The company’s commitment to innovation is evident in its continuous development of AI models. Lemonade’s AI framework, including models like LTV6 and LTV7, allows the company to predict churn, cross-sells, and claims with remarkable precision. These models have refined loss predictions and enabled a more accurate assessment of catastrophe exposures at a granular level. With further advancement in AI models, the company aims to achieve true precision pricing and underwriting, continuously improving its risk assessment capabilities.

Lemonade’s integration of AI extends beyond customer-facing interactions. Lemonade has built an insurance operating system that optimizes internal operations using dozens of AI models for pricing, underwriting, customer service, payments, and more. By automating and introducing self-service capabilities, Lemonade reduces reliance on traditional headcount per policy sold, leading to cost savings and operational efficiency.

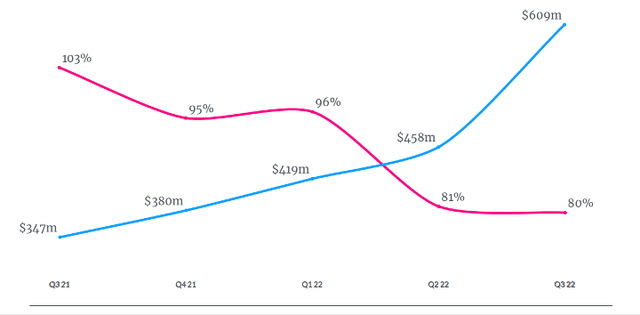

Lemonade’s extensive use of customer interactions and textured data, amounting to 160TB, has enabled the training of approximately 50 machine-learning models. These models have revolutionized various aspects of Lemonade’s operations. CX.ai, handling around one-third of all customer requests, showcases an impressive CSAT score of 4.5, indicating high customer satisfaction. AI Jim plays a crucial role in the first notice of loss (FNOL) for 98% of claims and successfully handles 45% of claims end-to-end, surpassing human accuracy levels. The implementation of fraud algorithms has been highly effective, flagging over $100 million in fraudulent claims and detecting doctored documents worth $12 million in claims. Lemonade’s Watchtower system tracks wildfires and weather conditions, automatically adjusting marketing strategies and implementing delayed start dates for affected areas. The integration of telematics, utilized by over 90% of customers, has resulted in reduced loss adjustment expenses, mitigated adverse selection, and allowed for precise pricing that was previously unattainable with legacy systems. Furthermore, computer vision and Natural Language Processing technology have demonstrated an impressive hit rate of approximately 80% in detecting risky homes for underwriting review. Consequently, between Q3 2021 and Q3 2022, the adjusted expense ratio dropped 24% as IFP grew 76%.

Exhibit 2: The adjusted expense ratio and IFP

Investor presentation 2022

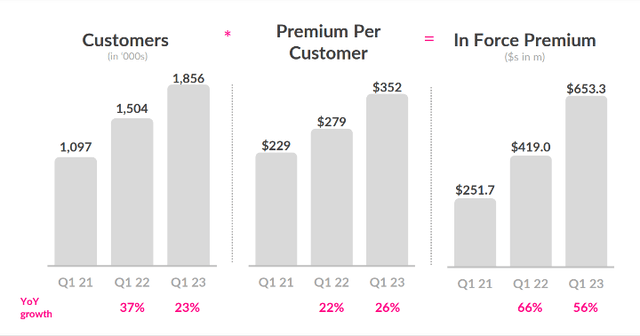

In the first quarter of 2023, the company’s in-force premium grew by 56% compared to the previous year, reaching $653 million. Additionally, the customer count increased by 23% to 1.9 million, and the premium per customer rose by 26% to $352. These results were driven by organic growth, policy value appreciation over time, and a shift towards higher-value homeowner, car, and pet policies.

Exhibit 3: IFP growth

Q1 shareholder letter

Lemonade’s expansion into different market segments has yielded notable results and positioned the company for continued growth. In Q3 2022, Lemonade acquired 1.4 million customers in the renters’ market with a promising conversion rate of 50%. However, the loss ratio for the same period was 65%, indicating room for improvement in managing risks associated with renters’ insurance.

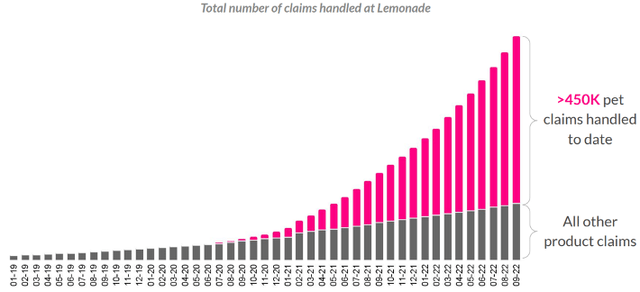

Turning to the pet market, Lemonade operates in a growing industry with the U.S. market valued at $2.6 billion and is projected to grow at a compounded annual growth rate of approximately 25% in the next 5 years. With over 80 million households owning pets, the penetration of pet insurance in 2021 stood at 2.5%. In Q3 2022, Lemonade efficiently handled 47% of pet insurance claims using AI technology, reflecting its commitment to streamlined operations. The number of claims reached an impressive 450,000 during that period.

Exhibit 4: Total number of claims handled by Lemonade as of Q3 2022

Investor presentation 2022

The Lemonade Family product line, which offers bundled insurance products, has shown promising results. Approximately 35% of customers opt for bundled policies, and the churn rate for Lemonade Family policies is half that of single-line renters’ policies, indicating the value and customer loyalty associated with multi-line offerings.

Further, the company’s entry into the home insurance market presents significant opportunities, with a total addressable market exceeding $120 billion. In the car insurance segment, Lemonade has generated substantial interest, evidenced by a car waitlist exceeding 300,000 potential customers. Existing customers have displayed a strong conversion rate of 25%, underscoring their trust in Lemonade’s offerings. The TAM for the car insurance market stands at an impressive $320 billion.

Looking ahead, Lemonade has set ambitious targets for the next five years. The company expects a CAGR of 20% in its in-force premium through 2027. Additionally, Lemonade aims to achieve a gross loss ratio of approximately 70% and a multi-line customer rate of around 25% by the same year. These projections highlight Lemonade’s commitment to sustained growth and its confidence in capturing a significant market share across its key target markets.

In June 2023, Lemonade simplified its security stack by deploying the Talon Enterprise Browser. Chosen for its advanced protection capabilities, granular control features, and excellent user experiences, Talon provides Lemonade with vital visibility and control over third-party partners working on unmanaged devices. This strategic implementation reinforces Lemonade’s commitment to robust security practices, ensuring the protection of sensitive data and mitigating potential risks as the company grows.

The company remains focused on improving its profitability by prioritizing the reduction of both the loss ratio and expense ratio. Lemonade has been actively increasing its rate filing approvals to ensure more precise pricing, resulting in a steady improvement in the loss ratio quarter over quarter. Efforts to optimize operations and consolidate systems have contributed to cost savings, with further efficiencies expected once Metromile customers transition to Lemonade systems.

Slow Growth In Europe

Lemonade’s expansion into the European market has faced challenges, resulting in slower progress compared to its home U.S. market. Despite significant growth in 2022, with gross written premiums increasing by 78% to €4.3 million, the volume is still relatively small compared to its US operations. Other European insurance companies have made more substantial strides during similar timeframes, benefiting from first-mover advantage and a better understanding of local pain points.

One factor contributing to Lemonade’s slow growth in Europe is the limited use of AI compared to its AI-powered operations in the domestic market. AI plays a crucial role in differentiating Lemonade in the U.S. market, particularly in customer experience and claims handling. However, its use of AI is not yet significant in Europe, according to regulatory filings.

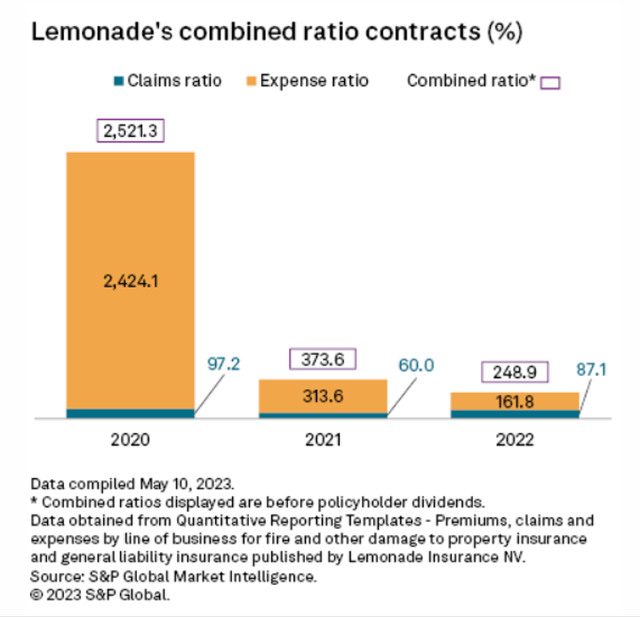

The low premium volume in Europe poses challenges for underwriting profitability, especially since Lemonade cedes a majority of its premium to reinsurers and incurs high costs. The expense ratio, in particular, contributes to the company’s underwriting losses, with a combined ratio of 248.9% in 2022. In comparison, the U.S. segment achieved a more favorable combined ratio of 121.5% in its third full year of underwriting.

Exhibit 5: Combined ratio

S&P Global

Although Lemonade’s underwriting performance in Europe is yet to reach profitability, there are signs of improvement as the company continues to grow. As the book matures and scales further, the insurer expects the loss ratio to follow a similar improvement trajectory as observed in its U.S. portfolio.

While Lemonade has gained traction in certain European markets, such as Germany, France, and the Netherlands, the company’s European ambitions may be reevaluated in light of its overall performance. Lemonade’s primary focus remains on its larger U.S. operations, and Europe currently plays a secondary role. However, given the investments made in obtaining licenses and the long-term opportunities available, a complete withdrawal from Europe is considered unlikely.

Lemonade may explore offering higher premium insurance products, including motor, homeowners, and pet insurance, in Europe to attract customers beyond cheap renters and contents cover. By tapping into these additional lines of business, the company may be able to unlock greater value and potentially improve its performance in the European market.

Analysts Are Making Note Of Lemonade’s Profitability Push

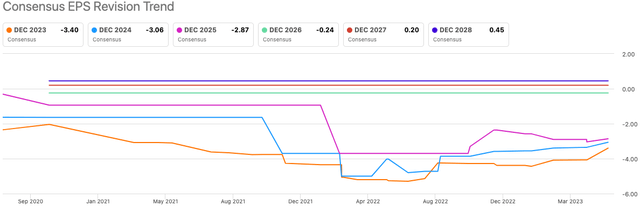

Since the start of this year, Wall Street expectations for Lemonade’s earnings have trended higher with the company’s renewed focus on improving profitability.

Exhibit 6: EPS revisions

Seeking Alpha

Positive earnings revisions often act as catalysts driving stock prices higher, and I believe Lemonade will continue to have momentum on this front with the company’s AI models beginning to deliver promising results, delivering efficiency gains.

Takeaway

Lemonade has established itself as a disruptive force in the insurance industry, harnessing the power of AI to enhance customer experience and streamline operations. While its European expansion has been slow compared to the American market, the company is making progress and gaining market share. By addressing underwriting challenges and exploring opportunities in higher-premium insurance segments, Lemonade remains a formidable player in the insurtech space, poised to capitalize on its strengths and expand its market presence.

Read the full article here