Elevator Pitch

My investment rating for Palantir Technologies Inc. (NYSE:PLTR) stock is a Buy. I previously touched on the factors that could affect PLTR’s 2023 prospects in my December 13, 2022 write-up.

With this latest update, my attention turns to Palantir’s outlook for the long run. In 5 years’ time, the worldwide AI software platform market is projected to expand strongly as per estimates provided by market research firm International Data Corporation or IDC. Based on a review of the key metrics revealed at PLTR’s recent AIPCon customer conference, I see Palantir growing its market share in the AI software platform space in the years ahead. In consideration of Palantir’s favorable outlook with the rise of AI, I raise my rating for PLTR from a Hold earlier to a Buy now.

Where Will Palantir Stock Be In 5 Years?

I am of the view that PLTR will extend its lead in the growing global AI software platform market in the next five years.

In September last year, Palantir issued a press release citing research from IDC that recognized PLTR as “the No. 1 Artificial Intelligence software platform both in 2021 market share and revenue.”

A recent June 12, 2023 research report (not publicly available) published by BofA Securities titled “The Train Is Rolling Along” also referred to IDC research which highlighted that Palantir boasted a 10% share of the global AI software platform market in 2021. The same BofA (BAC) Securities report mentions that IDC’s forecasts point to the worldwide generative AI platforms and generative AI applications markets expanding by CAGRs of +126% and +110% to $15.9 billion and $20.8 billion, respectively for the 2022-2026 period.

In a nutshell, key AI-related markets are expected to grow rapidly in the future, and this should be a tailwind for Palantir, which is the market leader in the worldwide AI software platform market. The takeaways from PLTR’s recent client event at the beginning of this month offer support for my bullish view of the company’s growth potential, as detailed in the subsequent section.

PLTR Stock Key Metrics

In its May 26, 2023 media release, Palantir noted that the June 1, 2023 AIPCon customer conference will be primarily focused on “the rapid adoption of Palantir AIP (Artificial Intelligence Platform)”, which “enables customers to activate large language models and other AI on their private network.”

PLTR shared a couple of key metrics at the company’s recent AIPCon customer conference (event transcript taken from S&P Capital IQ).

The first key metric is that there was “more inbound (interest) for Palantir in the last couple of weeks (leading up to the June 1, 2023 customer conference) than we had all last year (2022)” as per CEO Alex Karp’s comments at AIPCon. This coincided with the soft launch of Palantir AIP with some of its clients beginning in late-April. It is clear that a number of companies are keen to adopt Palantir AIP to leverage on growth opportunities in AI.

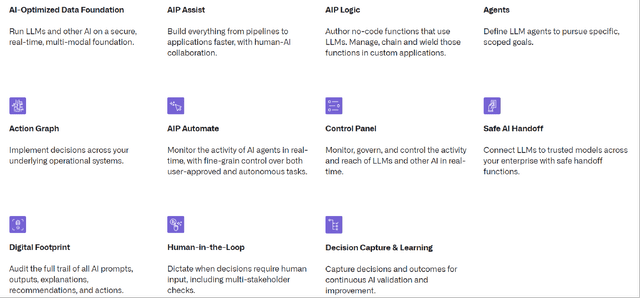

Key Features Of Palantir AIP

PLTR’s Corporate Website

The second key metric is that PLTR could potentially generate revenue equivalent to around 20% of the costs savings or value created from its AI offerings. A June 5, 2023 Goldman Sachs (GS) research report (not publicly available) titled “Customer Conference Showcases AI Platform” made reference to a Q&A between GS’ analysts and Palantir management. In that exchange, PLTR noted that if “their AI Applications are clearly helping a Fortune 500 company save $100M”, Palantir might charge “$20M or a similar proportion” of the savings. In other words, PLTR does have a strategy in mind to monetize the Palantir AIP in the future.

The third key metric relates to a successful case study with one of Palantir’s customers. Cleveland Clinic witnessed “a 33% increase in patient acceptance rate” and “a 75% reduction in time spent calculating bid activity” after engaging PLTR as a technology/AI partner, as revealed by Cleveland’s Chief Digital Officer, Rohit Chandra.

In summary, Palantir is in a good position to maintain and grow its market share in the global AI software platform market, considering meaningful customer interest in its Artificial Intelligence Platform or AIP. PLTR has managed to deliver results with its AI offerings in the past as seen with the Cleveland Clinic case study. More importantly, Palantir already has plans in place to make money from AIP by potentially charging clients based on a percentage of economic value created or expense savings.

What Is The Short-Term Prediction For 2023?

Palantir’s updated FY 2023 financial guidance released in tandem with its Q1 2023 results in early May shows a mixed picture.

On the negative side of things, the mid-point of PLTR’s FY 2023 top line guidance was only increased marginally by +0.2% from $2.205 billion previously to $2.21 billion now, even though its Q1 revenue beat market expectations by +3.8%. This suggests that Palantir’s management remains cautious about the company’s revenue growth outlook in view of macroeconomic pressures and the potential funding gap for government-related projects.

On the positive side of things, Palantir revised its operating profit margin guidance for full-year FY 2023 upwards from 23% earlier to 24% currently based on the mid-point of its guidance. PLTR also guided for positive earnings on a GAAP basis for every single quarter in the current fiscal year. At its Q1 2023 earnings briefing, Palantir specifically mentioned about “continued disciplined spend management” which is expected to be a key factor supporting the company’s expectations of improved profitability.

Nevertheless, investors are looking beyond PLTR’s 2023 financial performance and focusing on the company’s long-term AI growth potential. In the next section, I identify potential short-term catalysts for Palantir.

What Are Catalysts To Watch For?

News flow regarding more clients adopting Palantir’s AI offerings is likely to be the major catalyst for PLTR in the near term.

One example is PLTR’s May 23, 2023 press release revealing that Jacobs Solutions Inc. (J) is “leveraging Palantir’s AI capabilities to commercialize new AI solutions” in areas such as “critical infrastructure, advanced facilities, supply chain management.” Specifically, Jacobs noted at PLTR’s AIPCon customer conference on June 1 that it had relied on Palantir AIP to optimize capacity usage at the company’s waste water management plants and storage tanks based on decade-long forecasts.

Another example is Palantir’s June 7, 2023 announcement of the creation of a “smart factory” in North America for Panasonic Energy. Earlier, Panasonic Energy highlighted that the time taken for a key work processes at its “electrode control towers” was substantially cut from four hours to 15 minutes utilizing PLTR’s AI offerings as disclosed at the June 1 AIPCon.

Looking forward, investors should watch for catalysts relating to positive news regarding Palantir AIP and other AI-related offerings gaining further traction with more enterprises.

Is Palantir Stock Good To Hold Long Term?

I rate Palantir as a Buy, as I see PLTR as a good long-term holding.

An increasing number of companies will be looking to hire external partners to enhance their AI capabilities. I expect a significant proportion of corporates to choose the market leader in AI software platforms, Palantir, considering the “nobody got fired for hiring IBM (IBM)” mentality of engaging the most established player in any specific market.

As such, I see Palantir gaining market share in the growing global AI software platform market in five years’ time, which I view as the key investment merit for the stock. PLTR’s consensus forward FY 2025 Enterprise Value-to-Revenue of below 10 times or 9.7 times (source: S&P Capital IQ) to be exact seems reasonable for an AI software platform market leader boasting a consensus forward FY 2024-2027 revenue CAGR of +24% (implied EV/sales-to-growth ratio of 0.4 times).

Read the full article here