I’ve written a lot of articles on funds that do options plays such as QYLD, XYLD, JEPI, and SPYI and people always ask me if I make my own options plays. In this article I will show an example of one of my options plays in light of my forecast on a specific company. I will explain what I think of this company’s stock and how I plan on taking advantage of the trend I am seeing in it.

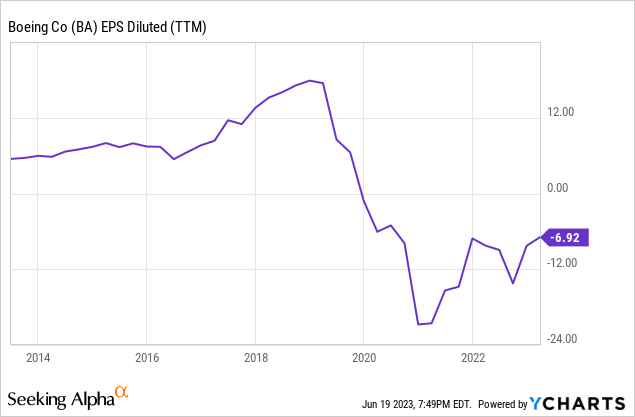

Up until 2020, Boeing (NYSE:BA) used to be known as a cash cow with its solid profitability, strong dividend history and duopoly status in the aircraft industry. Then all heck broke loose when company’s internal execution issues got coupled with the effects of COVID-19 on airlines and at one point we didn’t even know if the company would survive and its very existence was under threat. Since 2020, things have been improving for BA but not enough. The company still reports losses compared to earnings more than $10 per share annually prior to 2020.

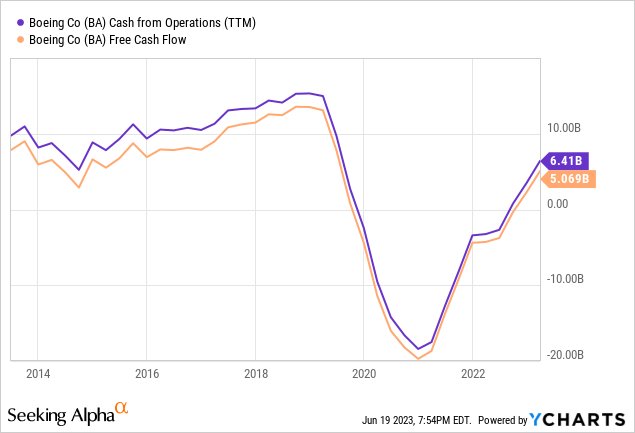

However, when dealing with Boeing, looking at profits doesn’t give us the full picture. You also have to look at other metrics such as cash flow from operations and free-cash-flow. The first metric tells us how much cash the company generates from its operations and less prone to accounting gimmicks and the second metric tells us how much of the cash it generates from operations that it keeps, in addition to any debt payments or new debt issuances. If a company’s free cash flow is larger than its operating cash flow, this could indicate that it issued new debt and if the opposite is true, it could mean that the company paid off some debt.

In Boeing’s case, we are seeing a nice $6.41 billion in operating cash flow and $5.06 billion in free cash flow. It’s much better than the negative $20 billion we saw in 2020 but still not as good as what we saw in 2019 which was about $15 billion for operating cash flow and $13 billion for free cash flow.

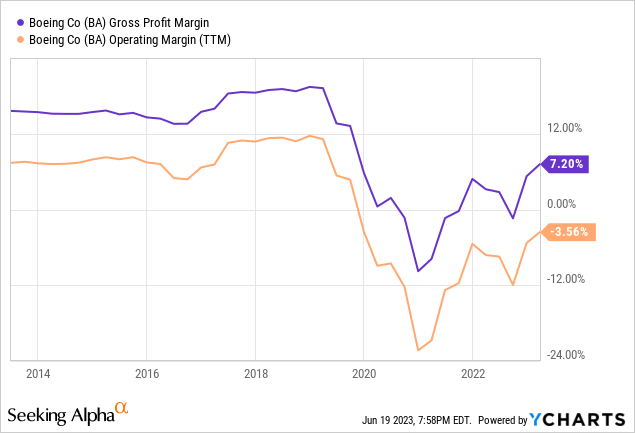

The company is making slowly but surely making progress but it will take time before its results improve to pre-COVID levels. For example, its gross margins are currently at 7.2%, up a few years ago but still down significantly from pre-COVID levels of 20%. Similarly its operating margin is a negative -3.56% which is an improvement from last year’s -12% but still far below the 12% level we saw in 2019. There is a long way to go before Boeing can be where it was before all this drama started.

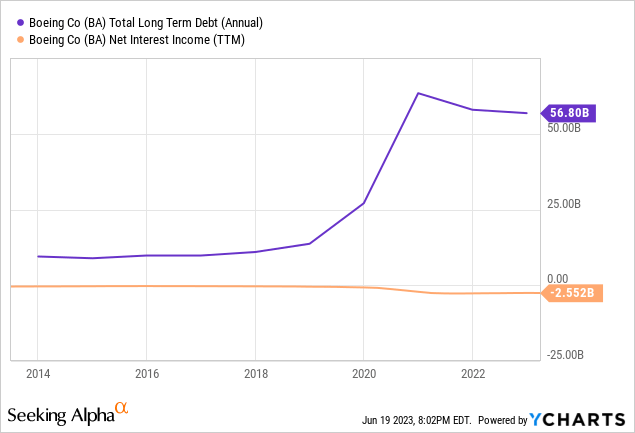

The company took on massive amounts of debt in 2020 in order to survive and this resulted in a major hit on the company’s balance sheet. Since then it’s been paying off its debt slowly but its current annual interest payments total $2.55 billion which is about 40% of the company’s total operating cash flow for the year. Unless the company pays off significant portion of its debt or increases its operating cash flow significantly very quickly, these interest payments will continue to hit its sustainability and its ability to return cash to investors.

Make no mistake, Boeing has a lot going on for it. The company still enjoys duopoly status in its industry, still has a massive backlog of orders, still has many profitable government and defense contracts, still making the correct moves to improve its balance sheet and profitability but it has a lot of work to get there. This is why I can see the stock stuck in a range for the next year or so.

Then how do we take advantage of this? There are ways we can take advantage of this move through some options plays. Some people are immediately turned off when they hear “options” because people always say that options are too risky. Many people say options are like lottery tickets where you spend some money to get lucky and make lots of money if you indeed get lucky but in most cases you will lose everything because you will rarely get lucky. This is true for naked options plays but if you are doing a risk-defined options play, this can have the opposite effect where you are managing risk rather than amplifying it.

There are several options plays to take advantage of a flat or range-bound trend namely iron condors, short straddles, short strangles, iron butterflies among others. Which one you use will depend on your risk tolerance, goals, comfort level and how much you want to actively manage the position. For example iron condors tend to be relatively low risk and low pay plays (especially if you set them significantly out of money) but they can go badly if a stock has a sudden unexpected move like how Nvidia (NVDA) jumped 30% overnight recently. Short strangles and short straddles can be very risky and very difficult to manage also because you tend to sell naked options in both sides.

The play I am doing on Boeing is a version of butterfly (not iron butterfly). This involves selling 2 call options near (or at the money) and buying 1 call option deep out of money and 1 call option deep in the money. Let me explain it with a concrete example. First, I am selling 2 calls with a strike price of $210 ($10 below current price) expiring a year from now (June 2024). Second, I am buying 1 call option with a strike price of $160 for the same date. Third, I am buying 1 call option with a strike price of $260 for the same date. Notice that both options I bought are the same distance away (exactly $50) from the 2 call options I sold.

Please bear with me, as multi-legged options plays can be complicated to grasp for some people but I will explain it as simply as possible. So now I have the following position:

LONG > 1x $160 call expiring June 2024 (Price: $74.50)

SHORT > 2x $210 call2 expiring June 2024 (Price: $39.20 x 2)

LONG > 1x $260 call expiring June 2024 (Price: $16.45)

In order to set up this position, I am paying $12.55 per position and since each options position represents 100 shares, we are looking at $1,255. This is the cost of the position as well as the maximum amount I can lose no matter what happens. If Boeing went bankrupt and stock suddenly dropped to $0, I can’t lose more than $1,255. Similarly if the stock pulled an Nvidia and doubled in a few months, I can’t lose more than $1,255. As a matter of fact, you can buy a call option around $320 for a cheap price to further protect your position from a possibility of a blow off top.

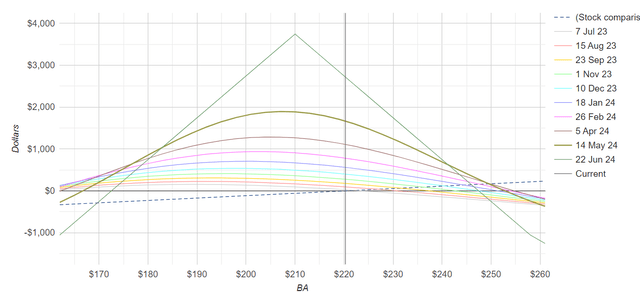

Now let us check how our position’s profit-loss profile looks like. As I said before, our maximum loss potential is $1,255 no matter what happens. Our maximum gain potential is $3,745 which is almost 300% of our maximum loss potential. Why? Because as I mentioned above, our strikes are each $50 wide which means the maximum you can gain from this position is $5000 minus $1,255 that we paid to open this position.

But we are not looking to gain the maximum gain of 300%, neither are we looking to hold this position for the whole year. Because our position assumes that Boeing will be range-bound between $160 and $260, as long as the stock stays within this range, we can close our position early for a quick profit. For example, if the stock is trading at $210 a month from today, we can close our position for a profit of $120 vs our cost of $1,255 which is an almost 10% profit. Come Christmas and stock is flat at $220. We can pocket $430 and close our position for a profit of 30%. As long as the stock remains in a range and some time passes, we can make some nice profits.

optionsprofitcalculator.com

If the stock suddenly collapses below $160 or has a massive rally above $260 in a quick fashion, our position will lose money but we still won’t see the maximum loss until all options expire. For example if the stock suddenly dropped to $160 tomorrow, we’d only be down about $200 because there would be still lots of time value in all options especially out $160 calls which we had bought for a hedge. If the stock were to drop to $160 in a slow fashion and ended up there in June 2024, we’d suffer the max loss of $1,255 but even that’s highly unlikely because if the stock were to drop slowly we’d have plenty of opportunity to adjust our play or roll it for another 3-6 months.

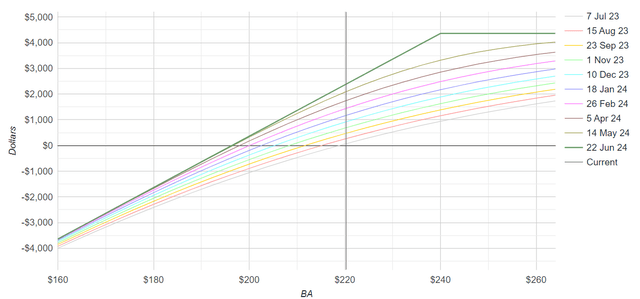

Of course if we believe the stock is going to be in a range for the next 12 months, and we don’t want to deal with multi-leg option plays, we could simply buy 100 shares of BA and write covered calls against it. For example, if we wrote $240 calls for a price of $23.90, we can make a nice profit if the stock stays flat or rises slightly. The problem is that this position would require you to put down $19,638 and your max loss would be this amount versus $1,255 if the stock were to drop to 0 (extremely unlikely but still). If the stock were to drop to $160, your loss would be about $4,000 instead of $1,255.

optionsprofitcalculator.com

My method allows you to take advantage of a range-bound stock by using 1/12th of buying power of doing a covered call strategy but it requires you to be comfortable with a multi-leg options play and be ready to close your position earlier for a partial profit if needed.

You can also build other versions of this play as well. For example instead of making it a $50-wide play you can make it a $60-wide play (which would be $150-$210-$270). Both your potential profits and maximum loss would increase. Similarly you can be more conservative and make it a $40 wide play (which would be $170-$210-$250) and reduce both your risk and profit potential. In a $60 wide play, your maximum profit rises to $4,225 but your maximum risk also rises to $1,745. In a $40 wide play, your maximum profit drops to $3,176 but your maximum risk also drops dramatically to $824.

When I do these types of plays, I also buy a call option way out of money (strike price of $320 or so) in case the stock suddenly has a blow off top. I don’t buy additional protection for the downside because if the stock suddenly crashes I can just use it as a buying opportunity and buy shares at cheap price. Besides, in theory a stock can have unlimited rises but only limited downside since it can’t drop below $0 so we usually don’t need as much protection for downside.

Read the full article here