Introduction

Shares of BRC Inc. (NYSE:BRCC) have fallen 14.2% YTD. Despite the fact that quotes continue to be under pressure and valuation according to multiples is low relative to historical data, I believe that it is still not the best time to go long.

Investment thesis

Despite the fact that the stock is not expensive, and the management of the company announces plans to increase business volumes and achieve a positive operating margin, in my personal opinion, it is still not the best time to buy, because, I believe that in next quarters we may still see pressure on margins. First, the company is driving growth by expanding the Food, Drug and Mass segment, which is sensitive to higher operating costs due to inflation, as we saw in Q1 2022. Secondly, the launch of a 100-day promotion, in my opinion, will also put pressure on profitability in the 2nd quarter of 2022.

Company overview

BRC Inc. is engaged in serving premium coffee. The company’s revenue consists of three segments: wholesale, direct-to-consumer (DTC) and Outpost. The company was founded in 2014 and operates in the US market. In addition, the company actively supports non-profit organizations and military veterans.

1Q 2023 Earnings Review

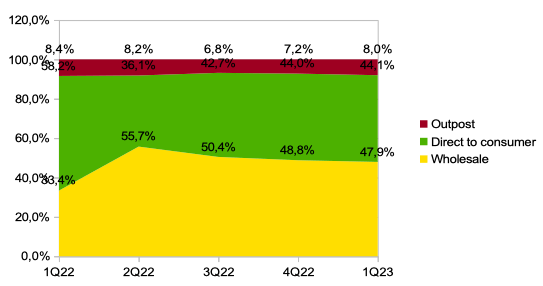

According to the results of the 1st quarter of 2023, the company reported better than investors expected. Revenue increased 26.8% YoY to $83.5 million. The biggest contributor to revenue growth was the wholesale segment, which posted an 82% YoY growth driven by expansion in the FDF (Food Drug & Mass) segment, while Direct-To-Consumer and Outpost revenue growth was -4% YoY and 21% YoY, respectively. The decline in the DTC segment was driven by lower marketing spend, while growth in the Outpost segment was driven by an increase in the number of stores from 9 in Q1 2022 to 16 in Q1 2023. You can see the change in the company’s revenue structure in the chart below.

Revenue mix (Company’s information)

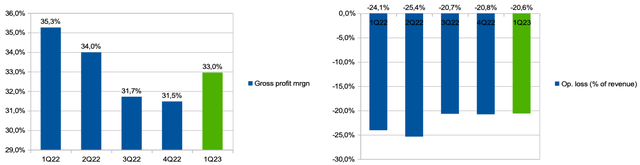

Gross profit margin decreased from 35.3% in Q1 2022 to 33% in Q1 2023 due to higher prices for coffee beans, transportation costs and raw materials. Operating expenses (% of revenue) decreased from 59.3% in 1Q 2022 to 53.6% in 1Q 2023, resulting in a reduction in operating loss (% of revenue) from 24.1% in 1Q 2022 to 20.6% in Q1 2023. You can see the details in the chart below.

Margin (Company’s information)

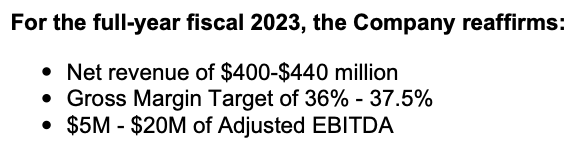

In addition, the company provided guidance for 2023. On the one hand, I like the company’s guidance and expectations for improving profitability, as investors, in my opinion, are particularly sensitive to improving economy, especially for those companies that are currently operating at a loss. On the other hand, I personally am not sure that the company is able to reach the declared gross margin level, since the main catalyst for revenue growth is, in accordance with the results for 1Q 2023 and management comments, the Wholesale segment.

Guidance (2023) (Company’s information)

My expectations

Based on management’s current comments during the Earnings Call following the Q1 financials, I can conclude that management sees the development of the Wholesale segment as the company’s top revenue driver. However, I expect that the outpacing growth of the wholesale segment could lead to pressure on operating margins in the coming quarters, as the focus on the FMD (Food, Drug and Mass) sales channel comes with an increased impact from rising raw materials costs.

In addition, according to the comments of one of the top managers, the company is launching a promotion for 100 days to increase customer loyalty and market share, but this will put pressure on the gross margin in the short term.

Risks

Margin: If revenue growth is slower than the company expects, this could result in later economies of scale and therefore breaking even, which I think is one of the main catalysts for stock growth.

Coffee beans price & raw materials: rising prices for coffee and raw materials could put additional pressure on margins, especially if the company cannot pass the price increase on to the end consumer.

Competition: the high level of competition in the coffee segment can lead to a decrease in brand awareness, revenue and market share. In addition, investments in prices and marketing campaigns by competitors can lead to pressure on sales margins. For example, in Q2 we will see pressure on sales from a 100-day promotion to increase customer loyalty.

Drivers

Margin: firstly, the company plans to increase product prices this year, which may help maintain the gross margin in the wholesale segment. Secondly, management plans to continue reducing and optimizing marketing expenses, which may allow the company to improve profitability. Thirdly, business growth can lead to a leverage effect, which will contribute to the achievement of the operating break-even point, which can be a serious growth catalyst for the company’s shares in my opinion.

Revenue growth: the company plans to open a new Food, Drug and Mass accounts in the 2nd half of 2023 and three company owned outposts, which could support the company’s revenue growth.

Brand: high customer loyalty, unique positioning, and active support of non-profit organizations have a positive impact on the perception of the company’s brand, which can contribute to both growth in business volumes and market share and the ability to increase prices. In addition, according to the results of the 1st quarter of 2023, the company’s product was placed in 4,400 Walmart stores, which also contributes to the growth of brand awareness.

Valuation

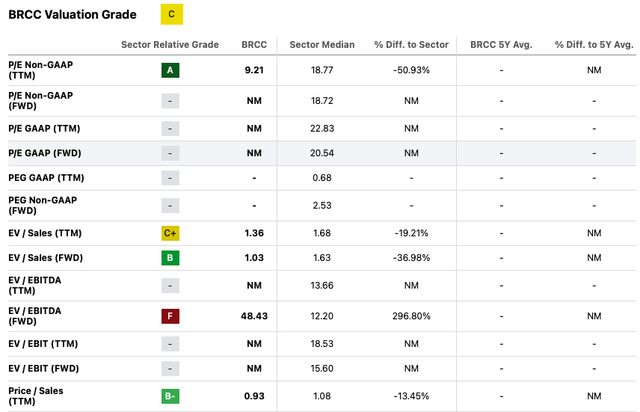

Despite the fact that the company is not valued dearly according to P/S and EV/Sales multiples, I think that the company is generally not valued cheaply. The company is currently generating losses at the level of operating income, so we cannot accurately calculate future P/E and EV/EBITDA multiples. Thus, I believe that the market is taking into account the risks that the company’s business may remain unprofitable for a longer period of time than management claims.

Valuation (SA)

Conclusion

At the moment, I like not only the company, its business model, management plans to achieve operating break-even, but also the active support of management for non-profit organizations, however, in my personal opinion, now is not the best time to buy shares. I believe investors will need to wait for Q2 2023 results to see if the company is able to deliver wholesale revenue growth and improve the operating margin of the business despite strong wholesale growth and active marketing campaigns. I think that management comments will be highly valued after the release of Q2 2023 results. I will gladly change my recommendation to buy if I see signs of profitability normalizing.

Read the full article here