Introduction

It’s been just over a year since our previous coverage of DermTech (NASDAQ:DMTK), wherein the prior article it was noted that DMTK was facing “An All or Nothing Moment”. Although the company offers transformative technology with much promise, management guidance on sales was incredibly soft, reversing a trend of prior optimism. As a result, we warned that if DMTK could not commercialize its proprietary SmartSticker solution, the company could be on a path toward a slow fade to oblivion. With the company recently announcing a CEO change, it’s a great time to take another look at DMTK’s outlook.

Company Overview

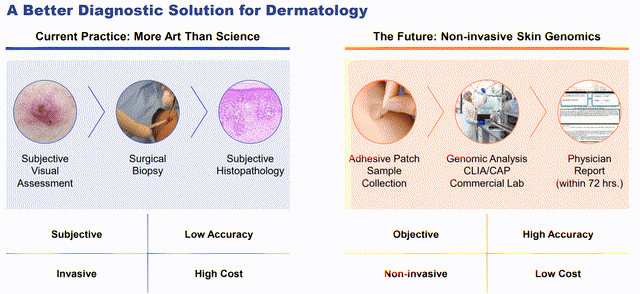

DermTech, Inc. (DMTK) is a molecular diagnostic company that develops and markets non-invasive tests to diagnose skin conditions and ailments including skin cancer, inflammatory diseases and other conditions. DMTK’s solutions provide an alternative to the surgical biopsy and minimize patient discomfort, scarring and risk of infection. Its primary product is the Pigmented Lesion Assay (PLA) test – a non-invasive, proprietary, adhesive patch (or SmartSticker) that evaluates a tissue sample for melanoma. The slide below highlights the key benefits of DermTech’s PLA approach vs. traditional biopsies.

Source: Earlier article linked above.

Investor Presentation

Key Developments & Updated Investment Case

The most significant development since our prior coverage on DMTK occurred on May 9th, 2023, when the company announced that Bret Christensen would take over as president and CEO. Mr. Christensen comes to DMTK from Insulet (PODD), where he was the chief commercial officer. If Mr. Christensen can help replicate even a fraction of the success of Insulet, this would be a huge win for DMTK investors.

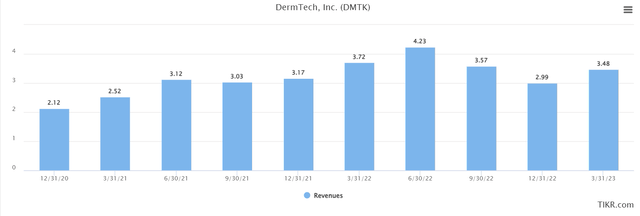

The first challenge for DMTK’s new CEO will be to commercialize its product offerings. At this point, little else matters if DMTK cannot achieve sales momentum. Mr. Christensen has been on the job just over a month, so he’ll certainly need some additional time to develop a full-scale strategic plan, but he also must act quickly. As shown in the chart below, DMTK’s revenue has completely stagnated since June of 2021, outside of a 1-time “pop” to $4 million in June of 2022. It’s hard to even call this a true pop given DMTK’s low starting baseline.

TIKR

Over the last year, DMTK has continued to land coverage with smaller insurance carriers, but the company still hasn’t really landed the complete backing of some of the major national carriers. This is clearly becoming a sticking point in the broader adoption of the company’s products.

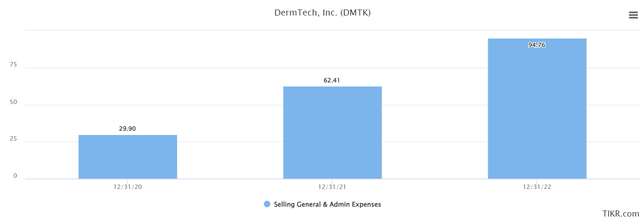

The next major issue for new management to quickly resolve is to stop throwing mass amounts of cash toward SG&A. In 2022, the company spent $95M on SG&A vs. just $15M of revenue. Clearly, this level is not sustainable at current sales run rates. DMTK needs to get its core sales infrastructure in place and then reduce some of its current SG&A investments.

TIKR

Total losses also need to be quickly addressed. On average, DMTK is losing $30M per quarter, including a loss of $31M in Q1 2023. This has become a huge problem as the company has almost burned thru its entire cash stockpile over the past 2 years. In June of 2021, DMTK had $230M of cash on hand. As of Q1 2023, the company is down to $48M. It’s likely that new management is looking to raise additional cash and unfortunately this will probably come from a dilutive equity offering or debt with some heavily restrictive covenants.

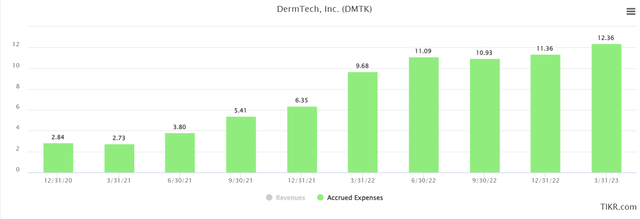

DMTK’s accrued expense balance is also trending upward. Given that the company is facing a cash crunch, this is another ominous sign that potential investors need to keep close tabs on.

TIKR

With DMTK still in the very early phases of commercializing its technology, a deep dive into free cash flow, ROIC and other metrics is not really relevant to this article. All such indicators are currently upside down.

At this point, potential investors are probably wondering whether there is an investment case for DTMK at all. Although the last 12-months certainly have been challenging, there are some positive tailwinds to consider. First, since the end of last year, the company has added 35 million covered lives. This brings total covered lives across the US to 126 million. Roughly 68 million are covered thru Medicare and another 58 million thru regional and governmental payers. Over the past year, the company has increased total coverage by more than 40%. This is a significant step in the right direction. Additionally, management estimates that their market penetration has reached 48% of total dermatologists across the US. Having this level of product awareness is another important step. Usage must increase in order for DMTK to achieve long-term success, but the company does have its “foot-in-the-door” with a large portion of the US dermatologist base. As discussed in prior coverage, the US market for skin cancer treatment is estimated to be in excess of $10 billion annually. If DMTK is able to tap into a fraction of this market, shareholders could benefit significantly. In our view, however, the biggest potential driver of the investment case is the switch to a new CEO. Although there is no guarantee that DMTK turns things around, the board took a definite step in the right direction by bringing in someone with significant commercialization experience. Additionally, the new CEO has experience operating a growth company in the healthcare / medical arena, another plus given the regulatory complexities tied to the space.

Bull, Bear & Base Outlooks

With the switch to new leadership and the fact that DMTK is still looking to launch sales, it’s challenging to determine a clear view of how the company’s financials could evolve over the next few years. In this case, it’s best to take a scenario approach when considering the future.

The base case scenario is fairly straightforward. In this case, new management comes in, is able to raise some additional capital to fund operations for the next 18-24 months and DMTK begins to further commercialize its offerings. Wall Street Analysts currently project 2024 sales of $23M. In this scenario, we think it’s possible 2024 sales could hit $35M. Historically, DMTK’s P/S multiple has varied greatly from 5.0-90.0x. Given the company’s struggles, further expansion beyond 6.0x is unlikely at this time. If DMTK hits $35M of sales, its market cap could double from current levels and hit $170M. However, there is still a fair amount of execution risk in this scenario for investors to consider.

The bear case is also pretty straightforward. In this scenario, despite new management’s best efforts, the company runs out of cash to fund operations within the next 12-18 months. Here, the stock price either goes to zero or a strategic acquirer comes in to swoop up DMTK at a bargain price (likely a valuation of $100M or less).

Lastly, the bull case would have to assume that new management makes strong progress in commercializing DMTK’s products and services. Here, sales could expand to over $50M by end-of-year 2024. Using the same 6.0x multiple, DMTK’s market cap expands to $300M+ in the bullish scenario. Admittedly, new management would have to make a lot of progress quickly for the bull thesis to play out. Technically, this progress is possible since DMTK’s SmartSticker product already has all of the regulatory approvals needed to proceed. What DMTK needs is a huge pickup in adoption. If that occurs, longer-term, DMTK could experience a run similar to Shockwave Medical or Exact Sciences.

Unfortunately, in both the base and bull scenarios, there is a large amount of uncertainty, making it hard to suggest with any degree of confidence right now that DMTK could hit these targets. That’s not to suggest that the bear scenario is more likely, but more that potential investors need to approach this opportunity with caution. DMTK offers a high degree of risk but also high potential rewards. Factoring in the current risks, DMTK stock is assigned a hold rating.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here