Strategy

Launched and managed by First Trust Advisors L.P. in 2009, the First Trust NASDAQ ABA Community Bank Index Fund ETF (NASDAQ:QABA) invests in the stocks of companies operating across the financial sector, primarily NASDAQ-listed community banks. The QABA fund excludes banks with international specialization, defined as those having an AUM greater than $10 billion and more than 25% of total AUM in non-US offices. The fund employs a market-cap-weighted strategy, is rebalanced quarterly, and invests in growth and value stocks of companies across diverse market capitalizations. QABA also aims to track and replicate the performance of the NASDAQ OMX ABA Community Bank Index.

Holding Analysis

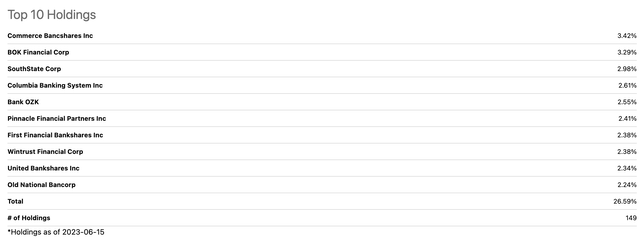

As mentioned earlier, this ETF primarily targets community banks that steer clear of mega-money centers dominating the sector. The fund invests 100% in the United States and, despite utilizing a market-cap weighting strategy, many of its portfolio holdings tend to be equally distributed, especially in the top 10 holdings. These holdings only constitute 27% of the entire portfolio, with weights ranging from 2% to 3% each. The fund, comprising a total of 149 holdings, has relatively low concentration risk. The fund also has substantial exposure to the following states: Texas, California, Montana, Indiana, and Ohio. A detailed distribution of the fund’s top 10 holdings and top state exposure is illustrated below.

Seeking Alpha First Trust Portfolios

Strengths

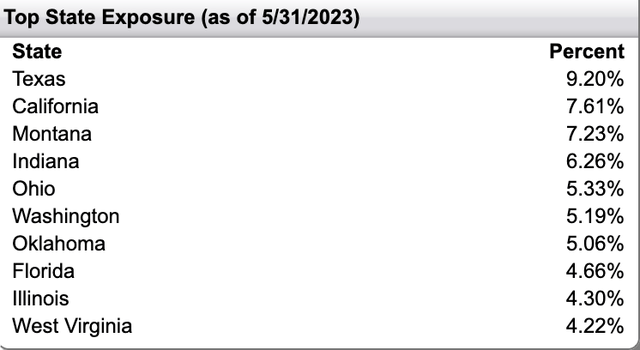

One of QABA’s key strengths is its attractive, steady-growth dividend yield. The fund currently has a dividend yield of 2.83%, slightly higher than the median for all ETFs at 2.22%. Although this figure isn’t extraordinarily high, QABA compensates by maintaining a steady dividend growth rate for TTM, 3 years, 5 years, and 10 years. Although the growth rate for 3 years and 5 years is below the median for all ETFs, its growth rate for 5 years and 10 years exceeds the median. It’s noteworthy that QABA has consistently paid dividends for 12 years, significantly longer than the median for all ETFs (2 years). Furthermore, the fund has sustained an average 4-year yield of 2.28%, slightly below its current yield. This reflects the fund’s dividend stability amid the market downturn in 2022 and throughout 2023.

Seeking Alpha

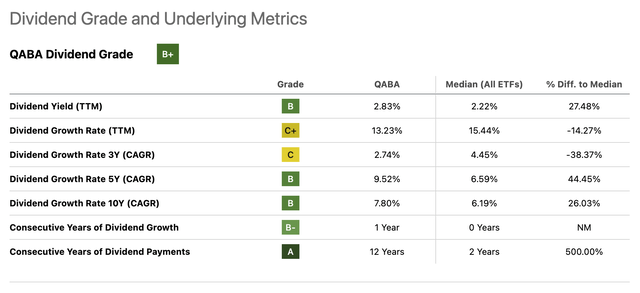

The fund is also inherently less risky than many peer competitors. QABA’s top 10 holdings constitute only 27% of its entire portfolio, significantly less than that of its peers. Its turnover rate is also relatively low at 18%. Community banks inherently pose less risk than larger banks as they hold less volatile assets and have less direct exposure to the corporate debt market, ultimately mitigating concentration risk.

Seeking Alpha

Weaknesses

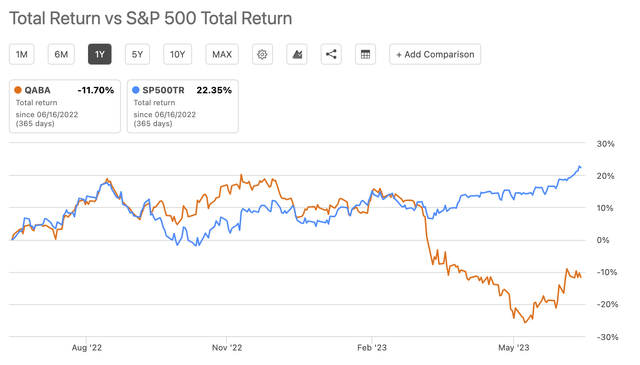

The fund has underperformed since the beginning of 2023. While QABA performed similarly to and even outpaced the S&P 500 in the past year, its performance in recent months has been alarming. The fund experienced a steep drop in February 2023 and has declined to a nearly -30% total return rate. In the past month or so, the fund has slightly rebounded to a -10% total return rate. Over the past year, QABA is down nearly 12%, while the S&P 500 is up 22%. The fund’s recent performance contradicts my expectation that the Federal Reserve’s interest rate hikes should benefit banks and spur growth.

Seeking Alpha

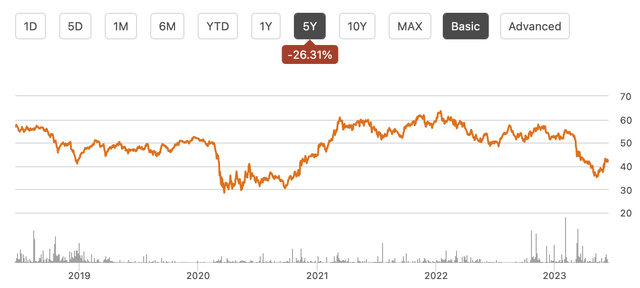

Examining QABA’s price performance over the past 5 years, the fund is currently down -26%. While this negative growth can largely be attributed to the sharp decline in 2023, the fund has demonstrated relatively little growth. Even at its peak at the beginning of 2022, the fund was just slightly above $60, not much higher than its price 5 years ago, which was just under $60.

Seeking Alpha

Opportunities

Although QABA hasn’t benefited much from an increasing interest rate over the past year, community banks should generally benefit from recent interest rate hikes. Community banks focus more on loans that provide higher yields and reprice faster than deposit rates when interest rates rise. In contrast, large banks tend to concentrate on tradable assets, including securities that are less sensitive to interest rate changes.

Furthermore, community banks are gaining more confidence in their ability to generate new revenue streams. Most notably, these banks are leaning more toward wealth management as a new growth strategy. This is a growing service that many community banks are now adding to their platforms, with over 63% of banks reporting that they currently offer it. Along with this new offering, smaller banks are starting to engage consumers on the digital front, aiming to capitalize on the digital transformation resulting from developments in FinTech. While Big Brand Banks have resources to invest billions of dollars into this sector, they often utilize complex and expensive technologies that hinder progress. Alternatively, smaller community banks typically employ outside companies to assist with their technical needs. Ultimately, smaller banks can add new features at a faster and more affordable rate than large banks and most tech-focused financial companies.

Threats

While community banks may lag in their technological development compared to larger banks, cybersecurity and credit risks are significant factors slowing growth. 85% of community banks have listed cybersecurity as a top risk priority, with credit risk also at 84%. Although larger banks are also targets of cyberattacks, community banks typically have fewer resources to invest in advanced cybersecurity infrastructure. Moreover, they may lack the specialized IT and cybersecurity professionals necessary to address these types of threats. This issue will only become a more significant problem as community banks continue to grow and develop technologically.

Conclusion

QABA’s main strength is its decent dividend yield and its relatively stable dividend yield growth. The fund also has a comparatively low-risk profile, with smaller and more equally distributed investments in less volatile community banks. This approach ultimately results in a more diversified portfolio that mitigates concentration risk. However, this comes with very slow growth. The fund’s price is down 26% over the past 5 years, largely attributable to its sharp decline in 2023. Surprisingly, the fund has performed worse in an environment that should promote growth as interest rates continue to increase. Ultimately, I rate QABA a Hold.

Read the full article here