Microsoft Azure vs. AWS vs. Google Cloud

Cloud computing has become increasingly important to enterprise companies due to the massive wave of demand in generative AI, especially since the debut of ChatGPT in November 2022. I’ve seen many medias are craving to discuss the top three cloud vendors lately, namely Amazon.com, Inc. (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG), and Microsoft (NASDAQ:MSFT). Under this AI revolution, investors want to forecast the future market leader in cloud computing. We will analyze these three companies in terms of their market share history, revenue growth, and profitability in their respective cloud divisions.

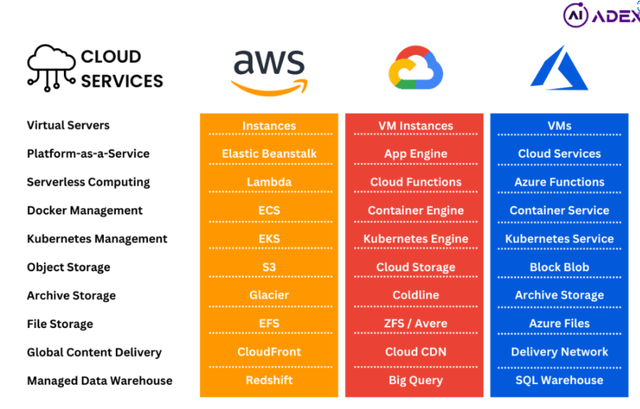

According to an article from CAST AI customers choose AMZN’s AWS because it offers a wide range of services and tools, making it a popular choice for many teams. However, MSFT’s Azure has slightly surpassed AWS in terms of usage among enterprises, thanks to MSFT’s strong relationship with this segment. Azure provides various services for enterprises, including Office 365 and Microsoft Teams, allowing organizations to combine enterprise software with cloud computing resources.

Both Azure and AWS have powerful machine learning capabilities. However, Google Cloud Platform (GCP) stands out due to its extensive internal research and expertise. GCP has played a significant role in developing open-source technologies, particularly in containers and technologies like Kubernetes and Istio service mesh, which have become industry standards. GCP’s culture of innovation makes it a preferred choice for startups and companies that value cutting-edge approaches and technologies. Now we will discuss their financial details to forecast who would be well-positioned to dominate the cloud vender market in the future.

Adex.Ltd

Who is the Current Market Leader

Companies Model

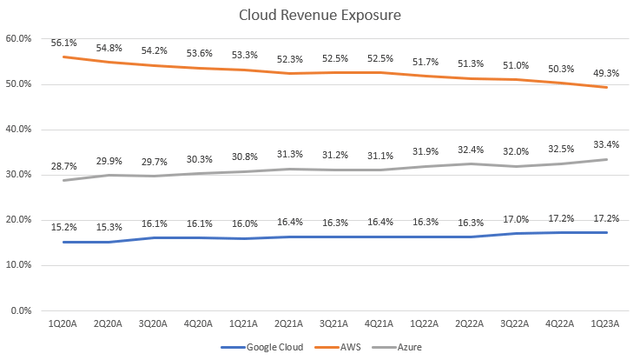

First of all, it’s insightful to analyze the market exposures of the three vendors. The chart above illustrates the percentage exposure of each vendor’s cloud revenue in relation to the total cloud revenue of all three vendors in each quarter. Among them, AMZN’s AWS stands out with the highest revenue amount compared to GOOGL and MSFT. AWS had been maintained more than 50% of revenue exposure until last quarter, which was equivalent to the combined revenue of GOOGL and MSFT. This clearly indicates that AWS has the largest customer base and generate more revenue if we assume their prices are relative stable.

Although AWS dominates the leading cloud vendor position, we clearly see its market share has been weakened in the last three years. The percentage has declined from 56.1% in 1Q CY2020 to 49.3% in 1Q CY2023. This decline implies that Azure and Google Cloud are making progress in terms of total revenue exposure as they have been gaining market share by attracting more customers.

Additionally, we can see the percentage of Azure’s revenue has been growing faster than Google Cloud, which implies that Azure has been more aggressive in expanding market share. I believe this is a growth tailwind for MSFT. Therefore, Although AWS currently is a market leader in the industry, it has been losing market shares to Google Cloud and Azure. Particularly, Azure has been gaining market share at a faster pace and may surpass AWS in the future.

Who Mainly Relies on Cloud Business

Companies Model

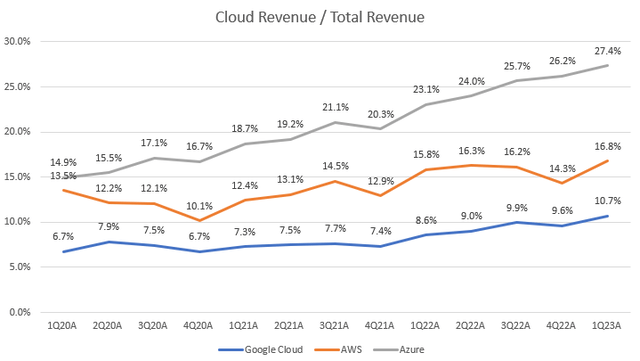

Regarding their revenue mix, we can see that the cloud segments of these companies have played increasingly important roles in driving their top-line growth, as all three segments have shown upward trends over the past three years. MSFT, being a pure-software company, relies heavily on its cloud segment to fuel its revenue growth, surpassing both GOOGL and AMZN. This is evident from the gray line consistently remaining above the orange and blue lines.

Specifically, in 1Q CY2023, Azure’s revenue accounted for 27.4% of MSFT’s total revenue, which was notably higher than AWS’s 16.8% and Google Cloud’s 10.7%. Furthermore, the slope of the gray line is the steepest, indicating that MSFT has prioritized the expansion of its Azure business within its revenue mix. In contrast, AWS’s revenue mix experienced only a slight improvement, growing from 13.5% in 1Q CY2020 to 16.8% in 1Q CY2023. This can be attributed to AWS already having a significant revenue exposure in the market, making substantial improvements more challenging to achieve.

Therefore, based on these observations, we can conclude that MSFT heavily relies on Azure to drive its top-line growth.

Who is Growing Faster

Companies Model

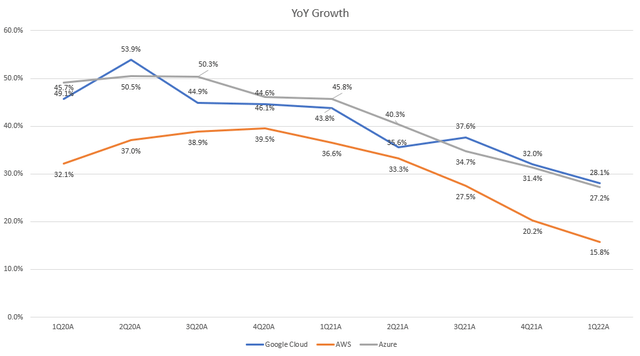

It’s not surprising to see a deceleration in YoY growth for these companies over the past years, considering the high competition and potential macroeconomic challenges. The COVID-19 pandemic prompted a surge in cloud demand as workplaces shifted from physical offices to remote setups, leading to increased reliance on cloud services. During this period, the yellow line representing AMZN’s AWS exhibited a positive slope in CY2020, indicating that AWS was the primary beneficiary, experiencing significant revenue growth due to higher demand compared to Azure and Google Cloud.

This growth acceleration was particularly impressive considering AWS’s already substantial revenue exposure. However, AWS’s growth has significantly slowed down since then. In 1Q CY2023, AWS’s YoY growth stood at 15.8%, which was notably lower than Azure’s 27.2% and Google Cloud’s 28.1%. Notably, despite Google Cloud’s lower revenue exposure (17.2% compared to MSFT’s 33.4% in 1Q CY2023), this suggests that the trend in Azure’s revenue growth has been more resilient compared to Google Cloud. In theory, Google Cloud should have maintained a higher growth rate due to its lower revenue exposure, which provides more room for scalability. Therefore, we can conclude that the growth trend of MSFT’s Azure is healthier compared to AWS and Google Cloud.

Who is Most Profitable

Companies Model

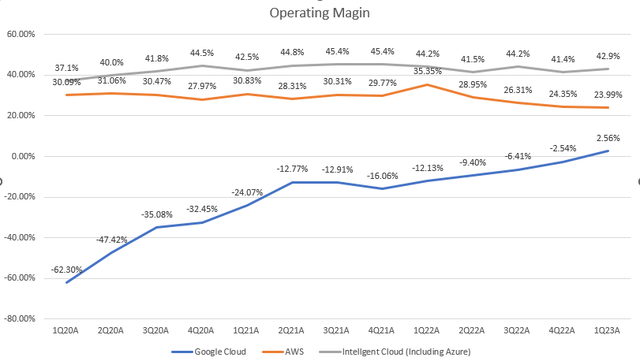

Before we get down to the details, I should clarify that MSFT doesn’t disclose the operating margin data for Azure. As a result, it’s not appropriate to directly compare the operating margin of its Intelligent Cloud segment (which includes 66% of Azure revenue) with AWS and Google Cloud. Instead, investors should focus on the overall trend of MSFT’s cloud segment.

Regarding profitability, both AWS and MSFT’s Intelligent Cloud segment have maintained positive operating margins over the past three years. On the other hand, Google Cloud has had a negative operating margin. However, we can see that Google Cloud has shown the strongest margin expansion and reached the breakeven point in the last quarter, which is a positive sign for its cloud segment. This indicates that Google Cloud is making faster progress in terms of profitability.

If we notice the orange line, we can see a significant margin contraction for AWS, starting from 35.35% in 1Q CY2022 and declining to 23.99% in 1Q CY2023. This contraction will impact AMZN’s operating margin and bottom-line growth. Although we don’t have operating margin data for Azure, we can see a relatively flat margin trend for its Intelligent Cloud segment over the past four quarters.

Moreover, although GOOGL has been prioritizing profitability and maintaining a resilient revenue growth over the past years, Google Cloud has the smallest market share in terms of total revenue exposure, which can’t directly compete with Azure and AWS. Therefore, I believe MSFT’s Azure is well positioned to compete with AMZN’s AWS in the coming years and has the potential to achieve market leadership in the cloud computing industry.

Earnings Revisions

Seeking Alpha

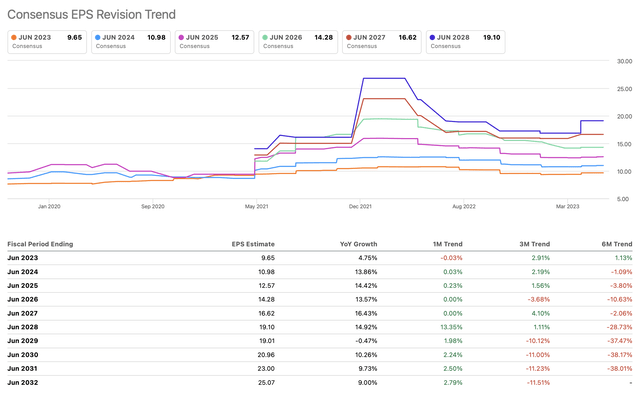

This chart shows the street’s earnings revisions on MSFT. When looking at future years beyond the current or next fiscal year, specific numbers may not be very informative. This is because near-term consensus heavily rely on companies’ forward outlooks. Instead, investors should pay closer attention to the overall growth trend.

While there have been significant downward revisions in the 6M trend, indicating a more cautious outlook, we can see upward revisions from FY2028. This suggests that the market may be starting to factor in the potential positive impact of generative AI and cloud development in the long run. However, we haven’t seen significant revisions yet. I believe the market may require a few positive quarters to confirm the anticipated AI inflection point.

On a shorter-term basis, the 1M trend has been stable, indicating that the downward revisions in the near term may have reached a bottom. It’s important for investors to consider that price movements in the market can react earlier and more quickly than earnings revisions. This can help explain the significant the stock’s 45% rally YTD, as investors may be pricing in future expectations ahead of earnings revisions.

Valuation

Seeking Alpha

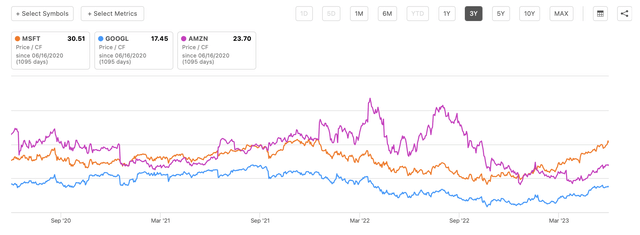

MSFT is currently trading at 35.5x P/E fwd, which is higher than GOOGL’s 23x and AMZN’s 82x. However, comparing P/E may not provide a complete picture. For example, AMZN’s profitability issue, including margin deterioration and weak retail growth, make it less suitable for direct comparison.

Instead, we can focus on the mega caps’ FCF profile. Looking at the chart, we can see that MSFT is trading at a P/FCF TTM of 30.5x, the highest among the group. This suggests that investors have a more optimistic outlook for MSFT’s ability to generate FCF compared to GOOGL and AMZN. Being a pure software company, MSFT is expected to benefit significantly from the generative AI tailwind and cloud growth potential, resulting in higher FCF growth.

However, we can’t ignore the downside risk for MSFT. If the company’s results fall short of market expectations, the potential selloff could be more severe. Therefore, while MSFT’s higher valuation reflects positive investor sentiment, it also carries more risk of disappointed market reaction.

Conclusion

In sum, although AWS maintains a leading market share, but Azure and Google Cloud are catching up. Azure has shown stronger revenue growth and market share expansion compared to Google Cloud. MSFT heavily relies on Azure for revenue growth. I admit that AWS has a larger revenue exposure but has experienced a significant growth slowdown. Moreover, Google Cloud is focused on profitability and has reached breakeven in 1Q CY2023, but its market share still remains small. Therefore, I believe that MSFT’s Azure is well positioned to compete with AWS and has the growth potential for market leadership in the cloud vendor industry in the future.

Read the full article here