Piper Sandler (NYSE:PIPR) is a full service corporate shop with trading and advisory businesses. For the most part its declines are matching up to the industry, and trends of supported equity brokerage while rate-exposed businesses fall are continuing into this latest quarter. However, we do notice that PIPR’s relationships in regional banking have paid off for corporate finance, which sees PIPR massively outperforming peers in that vertical. As for advisory, we think things might be troughing for PIPR especially as restructuring starts to pick up finally. While the business direction might not be too bad for PIPR with a lot of the major uncertainties at open of the year abating, we still note the PIPR PE as being too high and aren’t interested.

Q1 2023 Results

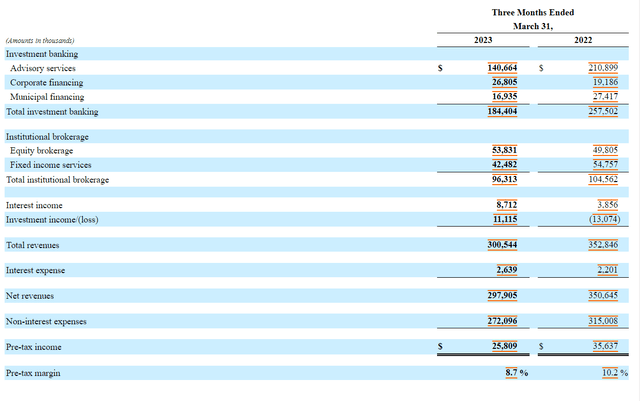

Let’s blaze through the important results from the 10-Q, where PIPR gives really thorough segment reporting.

IS (PIPR 10-Q)

Institutional brokerage is resilient because volatility in public markets has supported the equity brokerage business – pretty easy to understand. We should note that the volatility was focused in March, and has eased since. We don’t expect such a phenomenal result from equity brokerage next quarter. The fixed income business remains complex due to the rate situation which kept clients on the sidelines of the markets as they scoped things out. Things will remain complicated here as the meaning of a rate pause is parsed. Based on changes in rate expectations in the Yield Curve it looks like markets are actually revising the rate reversal upwards in terms of timeline despite the pause. Not a great sign for the fixed income business which is down around 20%. As a note, the Cornerstone acquisition hasn’t been lapped yet either for equity brokerage, so we are seeing some inorganic lift here. The segment is flattish, which is good in the current context.

Onto investment banking, advisory services are down since M&A markets are coming off peaks. Higher rates has sidelined financial sponsors who can’t hit return targets and access leverage through the LevFin markets, which remain very troubled and mostly dead on the interest rate volatility and uncertainty. This situation has persisted now for a year. But the mid-market positioning of PIPR has been helpful since it means less difficult comps since they didn’t serve megadeals in the opening of 2022, even though already then megadeals had mostly come to a stop. Moreover, mid-market positioning means smaller acquisitions for strategic sponsors that are more likely to write an equity check and are less dissuaded by the environment. Mid-market has definitely been a strong point in advisory across the sector, but of course all of it is down.

Corporate financing was a surprise. PIPR is a leader in serving regional banking. With the SVB collapse, which they actually worked on, but also liquidity concerns among a whole load of regional banks who are still very much in danger, DCM activity especially has picked up among those clients to shore up cash. This quarter was still affected by wait-and-see management in financial services around regulatory action. Now it seems we can trust regulators to keep things in check, therefore corporate financing for PIPR should see some more idiosyncratic lift as financial services clients make moves. PIPR is definitely one of the best exposed shops right now in terms of corporate financing, especially because this business at other shops will be mostly dormant as ECM and DCM markets remain broadly dead with no IPOs happening and little financing since no one knows where markets or rates are going to go. ECM and DCM are important signals for market direction, we are curious what will come in the next quarters.

Muni financing has likely not enjoyed the debt ceiling issue, but in general it suffers like DCM broadly has suffered due to interest rate volatility. The passing of the debt ceiling raise is going to offer somewhat of a hand here, but in general infrastructure spending is not elevated anymore as inflation remains a concern.

Bottom Line

We want to hearken back to another article we wrote on PIPR where we noted that they were adding restructuring headcount in a pretty meaningful way. They acquired some advisory shops and brought some restructuring-focused MDs onboard. We saw with Lazard (LAZ) that the promise of a restructuring boom may start coming true now. Credit conditions are definitely not great, corporations are dealing with a maturity wall and we also have demand-side pressures finally causing inflation to abate. Restructuring could have a nice melt up and PIPR will be a decent beneficiary, although there are larger restructuring franchises out there.

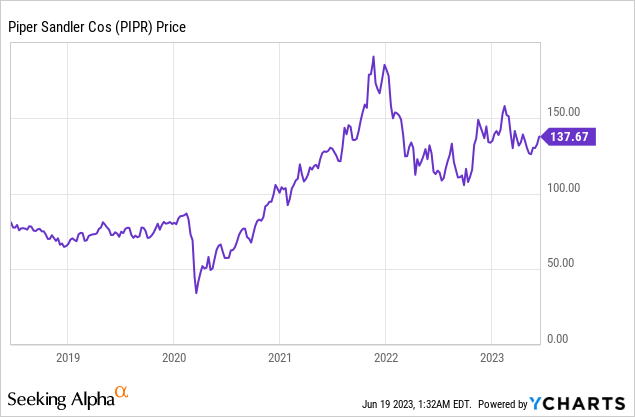

Still, we do not love the 14x non-GAAP PE. While we are okay with the non-GAAP figures, 14x doesn’t imply such a great earnings yield. We are probably nearing the bottom of the cycle, since something has to give for financial sponsor activity as their drypowder remains undeployed, and generally some incremental growth can eventually be expected especially as restructuring starts to pick up, but PIPR’s stock price is still relatively high compared to peaks, and it could take a while for pick-up in the other businesses even if we are nearing troughs. Further declines are possible, especially since we are lapping the hardest comps from 2021 now.

Overall, we’re not investing in advisory shops right now. Maybe if things were more pessimistic we’d want to play a market pick-up with them, but the price is pretty high and we just don’t see the market necessarily missing anything that we see in how they’ve been priced, in other words the value is probably fair, which means we’re not interested.

Read the full article here