Investment thesis

Although it was founded in 1849 and long-term prospects are good, prospects for Ducommun (NYSE:DCO) in the short and medium term are weakening due to increased interest expenses caused by higher interest rates at a time when the global economy could face a more or less severe recession as a consequence of the recent interest rate hikes carried out to contain the high inflation rates. The company has grown through acquisitions, and the long-term debt is currently at relatively high levels as a consequence, which is diminishing the company’s ability to continue investing in growth in the short and medium term as interest rates are eating up a big portion of cash from operations.

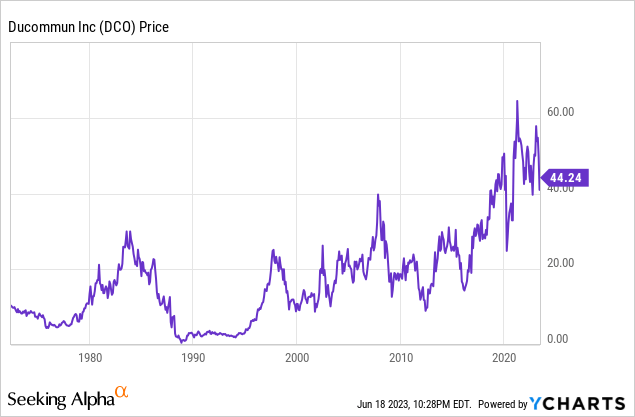

In this regard, stagnant sales, rising interest expenses, and fear of a potential recession are leaving investors on the sidelines, which has caused a recent share price decline of 32.35% from all-time highs reached in 2021. But despite this, the temporary nature of headwinds (and even a potential recession) makes me remain bullish on the company’s long-term as investors with enough patience could enjoy relatively high capital gains as the company has enough resources to face current and potential headwinds. But despite this, I would like to clarify that averaging down is the strategy that I highly recommend due to the current complex macroeconomic landscape.

A brief overview of the company

Ducommun is a leading provider of engineering and manufacturing services for high-performance products and high-cost-of failure applications used primarily in the aerospace and defense, industrial, medical, and other industries. The company was founded in 1849 and its market cap currently stands at $643 million, employing over 2,000 workers worldwide.

Ducommun Incorporated logo (Ducommun.com)

The company operates under two main segments: Electronic Systems and Structural Systems. Under the Electronic Systems segment, which generated 62% of the company’s total net sales in 2022, the company designs, engineers, and manufactures high-reliability electronic and electromechanical products used in technology-driven markets including aerospace and defense and industrial end-use markets. And under the Structural Systems segment, which provided 38% of the company’s net sales in 2022, the company designs, engineers, and manufactures various sizes of complex contoured aerostructure components and assemblies and supplies composite and metal bonded structures and assemblies for commercial aircraft, military fixed-wing aircraft, and military and commercial rotary-wing aircraft.

Currently, shares are trading at $44.24, which represents a 32.35% decline from all-time highs of $65.40 on April 14, 2021. This represents a significant decline in the share price as there are growing concerns about a potential recession at a time when the company finds itself with a considerable amount of debt while rising interest rates are causing increased interest expenses. But to understand where this debt comes from, it is very important to review the acquisitions carried out in recent years.

Recent acquisitions

In June 2011, the company acquired LaBarge, a widely recognized supplier of electronics manufacturing services operating across many high-growth industries with annual revenues of $324 million at the time of the purchase, for $338 million. This represented a major acquisition as Ducommun’s revenues nearly doubled after the acquisition, and the company took over $360 million of long-term debt to fund it.

After some years of deleveraging its balance sheet, in January 2016, the company divested its Pittsburgh, PA. business, for $38.5 million, and two months later, the company also divested its Miltec Corporation subsidiary for $14.6 million. Later, in September 2017, the company acquired LS Holdings Company, a world leader in lightning protection systems using its proprietary technology for various applications serving the aerospace and defense industries, for $60 million.

The acquisition spree continued in April 2018 as the company acquired Certified Thermoplastics, a leader in precision profile extrusions and extruded assemblies of engineered thermoplastic resins, compounds, and alloys for a wide range of commercial aerospace, defense, medical, and industrial applications, and later, in October 2019, the company also acquired Nobles Worldwide, the global leader in the design and manufacture of high-performance ammunition handling systems for military aircraft, helicopters, ground vehicles, and shipboard systems, for $77 million.

As the debt was increasingly manageable due to lower long-term debt, in December 2021, the company acquired Magnetic Seal LLC, a leading provider of high-impact, military-proven magnetic seals for critical systems in aerospace and defense applications for $69.5 million, and during the same month, the company completed a sale-leaseback transaction for its industrial property located on Gardena Blvd., in Carson, California, for an after-tax cash proceeds of $110 million.

But in April 2023, the company carried out another major acquisition as it acquired BLR Aerospace, a leading provider of aerodynamic systems that enhance the productivity, performance, and safety of rotary- and fixed-wing aircraft on commercial and military platforms, for $117 million.

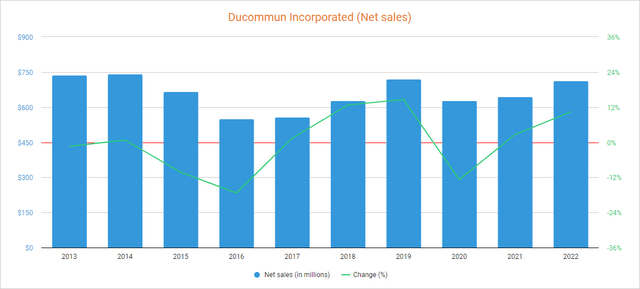

Certainly, all these acquisitions helped the company increase sales through 2019, but despite a significant recovery in 2021 and 2022, sales remain stagnant as the coronavirus pandemic crisis, along with the current macroeconomic context marked by strong inflationary pressures, supply chain issues, and the war between Russia and Ukraine have caused strong headwinds in the commercial aerospace markets since 2020.

Net sales are stabilizing after coronavirus-related headwinds

After the acquisition of LaBarge in 2011, sales have remained stagnant as the company has dedicated much of its resources to deleveraging the balance sheet. After some improvements in 2018 and 2019, the coronavirus pandemic crisis caused a 12.78% decline due to worldwide self-imposed restrictions to stop the spread of the coronavirus. Nevertheless, sales have recently recovered as they increased by 2.62% in 2021 and by 10.40% in 2022.

Ducommun Incorporated net sales (Seeking Alpha)

The positive trend has continued during the first quarter of 2023 as net sales increased by 10.83% year over year as the commercial aerospace industry keeps recovering after coronavirus-related headwinds. In this regard, net sales are expected to grow by 7.34% in 2023 and by a further 7.48% in 2024 as backlog in commercial aerospace increased by 74% year over year during the first quarter of 2023 to $464 million.

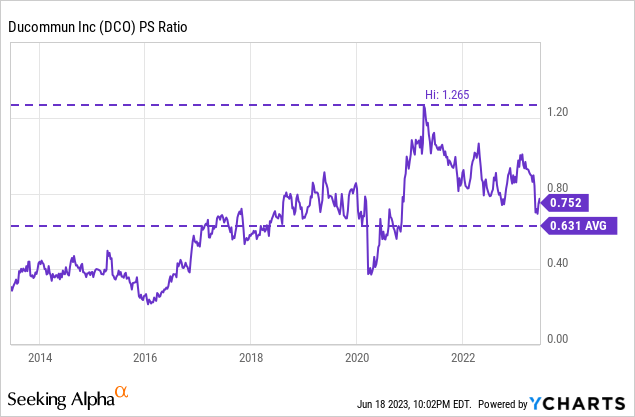

The recent recovery in net sales coupled with the decline in the share price has caused a drop in the P/S ratio to 0.631, which means the company currently generates $1.58 in net sales for each dollar held in shares by investors, annually.

This ratio is 16.09% lower than the average of the past 10 years and represents a 50.12% decline from decade-highs of 1.265, which reflects the growing pessimism among investors, but despite fears of a recession and the impact that interest expenses may have in the short and medium term for the company, margins have remained relatively stable despite ongoing headwinds, so the company should be able to cover interest expenses and continue to reduce its debt levels to healthier levels.

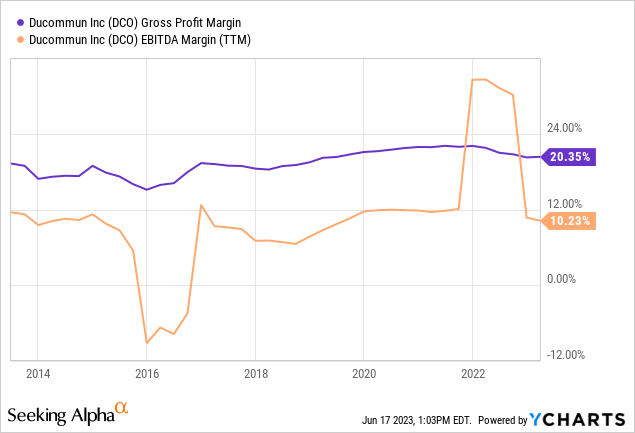

Margins are stable and the company is profitable

The company has managed to maintain relatively healthy margins over the years, with gross profit margins dancing around 20% and EBITDA margins dancing around 10%, which means the company is systematically profitable. In this regard, the trailing twelve months’ gross profit margin currently stands at 20.35%, and the EBITDA margin is at 10.23%.

During the first quarter of 2023, the company reported gross profit and EBITDA margins of 20.29% and 10.07%, respectively, which means the company remains as profitable as usual despite inflationary pressures, supply chain issues, and labor shortages. Furthermore, the management expects stronger margins by 2024 boosted by restructuring efforts as the company is shutting down its Monrovia, California, and Berryville, Arkansas manufacturing facilities and transferring most of the manufacturing processes to its low-cost operations located in Guaymas, Mexico, with which the management expects $11 million to $13 million in annual savings.

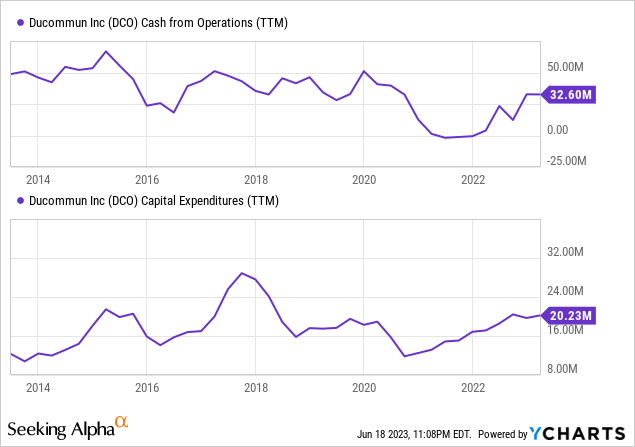

In this regard, trailing twelve months’ cash from operations currently stands at $32.60 million and capital expenditures at $20.23 million, so operations are apparently sustainable. If we add $11 million to $13 million of expected annual savings by 2024, the company should have significant excess cash with which to continue dealing with the current debt levels.

The deleveraging process continues

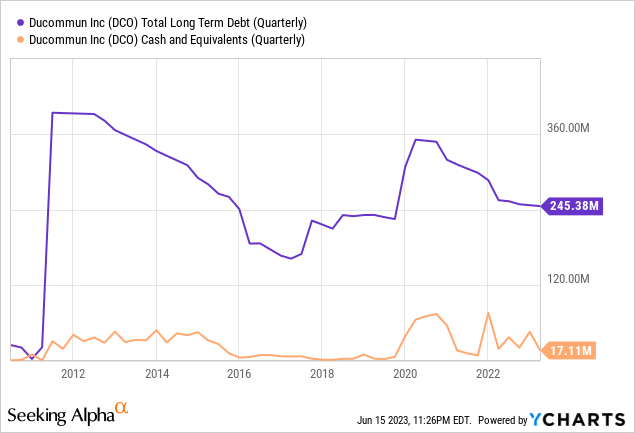

The management decided to suspend the dividend in May 2011 as deleveraging the balance sheet became a top priority after the major acquisition of LaBarge in June of the same year as long-term debt surpassed the $360 million mark. In this regard, long-term debt has successfully declined to $245 million as the pace of acquisitions has slowed since the LaBarge acquisition, but cash and equivalents are currently very low at $17.11 million.

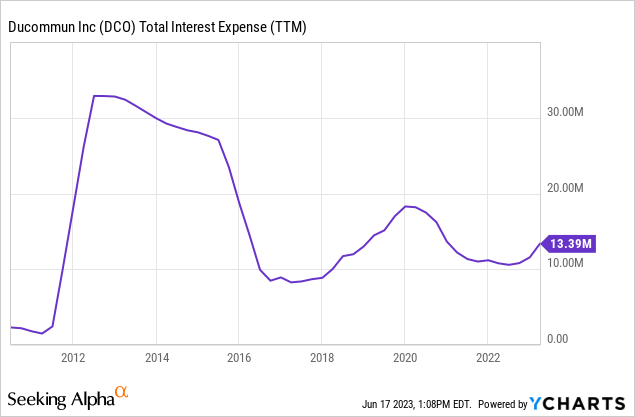

Thanks to the deleveraging carried out in the past 10 years, annual interest expenses declined from over $30 million to $13.39 million, which has freed up resources as the company now needs to meet lower interest expenses. Still, interest expenses increased to $4.22 million during the first quarter of 2023 due to increased interest rates, which means annual interest expenses actually stand at around $17 million as of currently.

But considering the company generates excess cash of over $10 million and expects to achieve annual savings of $11 million to $13 million thanks to ongoing restructuring efforts, the company should generate enough cash to cover interest expenses and keep deleveraging the balance sheet.

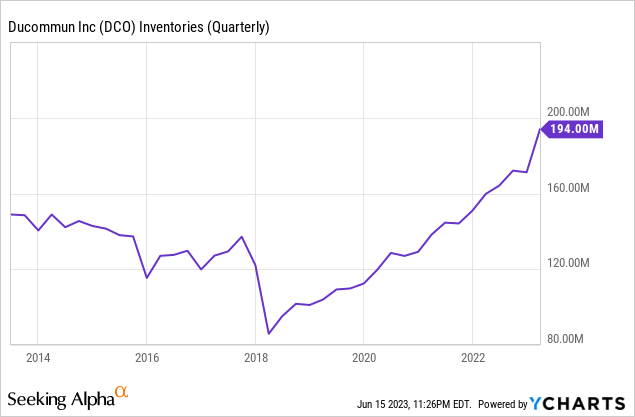

Continuing with the debt issue, since 2018, inventories have increased to $194 million as the company has manufactured more products than it has sold, reflecting the recent difficulty the company has experienced in increasing sales. Despite this, increased inventories open up the opportunity to temporarily reduce production capacity to convert said inventories into actual cash, although this could present a series of challenges as decreased production capacity could lead to lower margins due to unabsorbed labor if not done wisely. In this sense, the closure of two factories to move a large part of the production to Mexico makes it possible for said transfer to be done at a pace slow enough to allow some emptying of inventories, with which I would expect (temporary) higher than usual cash from operations in the medium term as inventories are partially emptied.

In this regard, it will depend on management’s ability to profitably reduce production capacity (or, failing that, increase the company’s sales) so that inventories can be converted into actual cash with which to continue paying down long-term debt.

Risks worth mentioning

Although I consider Ducommun’s risk profile to be quite low in the long term thanks to fairly constant cash from operations, increasingly manageable debt (despite current interest expense increases), and restructuring efforts, there are certain risks that I would like to highlight, especially for the short and medium term.

- The company’s operations are subject to a strong cyclical component, so averaging down is highly recommended especially in the current macroeconomic landscape marked by inflationary pressures and recessionary risks.

- The company’s operations depend to a great extent on US government defense spending, and therefore, a reduction could have a direct impact on sales.

- A potential recession as a consequence of the recent interest rate hikes carried out to contain high inflation rates could cause a reduction in volumes, which would not only have a direct impact on sales but also on profit margins due to unabsorbed labor. Furthermore, the company could find it difficult to deplete part of its inventories in such a scenario, which could lead to issues covering interest expenses and generating enough excess cash to reduce current debt levels.

- In 2022, 21.6% of the company’s sales came from Raytheon (RTX), with which a reduction in the demand from said company could have a direct impact on Ducommun’s sales. Furthermore, 61% of sales in 2022 were provided by the company’s top 10 customers, which adds a considerable risk of suffering volatility in sales.

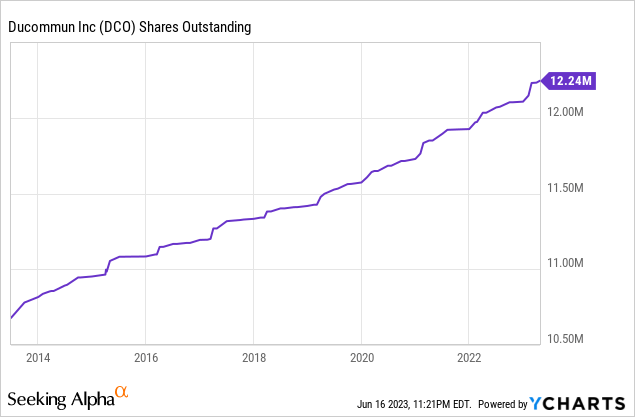

- Another risk I think investors should be aware of is share dilution. The total number of Ducommun’s shares outstanding has increased by 14.66% in the past 10 years, which means each share represents a smaller size of the company as time passes.

Conclusion

The recent decline in Ducommun’s share price responds to growing concerns about a potential recession and a recent increase in interest expenses due to higher interest rates, and in this regard, I consider that said decline is actually justified. Still, the strength of the company’s operations, as well as ongoing restructuring efforts (and high expected annual savings), make me believe that investors with a long-term vision and enough patience will be rewarded in the long run as they could reap relatively high capital gains once the current macroeconomic landscape improves and the company manages to reduce its debt a little more as the P/S ratio 16% lower than the average of the past 10 years.

The company’s margins are expected to improve in the short to medium term as it is currently shutting down two manufacturing facilities and moving all the manufacturing capacity to its low-cost manufacturing factory in Mexico. Furthermore, the company expects to sell the associated land and building at both locations, which should provide cash to keep paying down the long-term debt pile. In addition, the current restructuring is opening the door to the opportunity to reduce inventories in order to convert them into cash and continue with the deleveraging process as inventories are unusually high at $194 million while long-term debt stands at $245 million.

For these reasons, I consider that growing investors’ pessimism represents a good opportunity for more patient investors, but despite this, I strongly recommend using dollar-cost averaging as a strategy as the current macroeconomic context is very volatile and the company has a strong cyclical nature.

Read the full article here