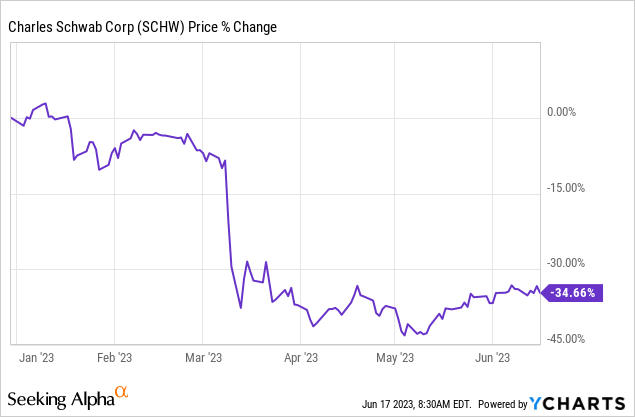

Markets have a short memory. Seems it was just yesterday that we were all collectively fretting over bank runs. Today, we would only be interested in the news if the story had “AI” mentioned as the cause. The Charles Schwab Corporation (NYSE:SCHW) was also part of this herd behavior. The stock fell sharply in the early part of the year as everyone suddenly realized the extent of their duration mismatch.

Since then we have traded water and the stock is near where it was in mid-March. But things are not getting better. We tell you why you should be very careful with the thinking that the stock is a buy just because it is cheaper.

Earnings Downgrade

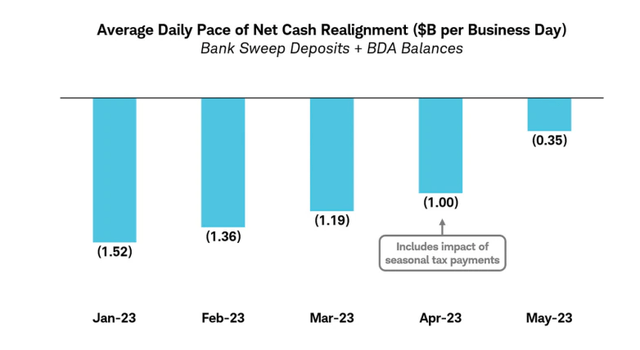

Charles Schwab provided an earnings outlook update and it had some interesting data points. The good news came first in that update and we can see that there has been a notable slowdown in movements of funds out of the company. What they are showing below is the daily pace of cash realignment.

Company Update June 14

This is in essence the amount that is no longer willing to give money to Charles Schwab for free. The CFO extrapolated the trend to suggest that we should be good by year end.

This trend carried into early June, with the month-to-date pace across bank sweep, BDA balances, and broker-dealer cash balances tracking similar to May. The trajectory in client cash realignment further supports our belief that this activity will abate during the second half of 2023.

Source: Company Update June 14

Interestingly even this massive slowdown in deposits moving out, did not stop the company from downgrading their numbers for the year.

We estimate that the impact from these transitory borrowings and time deposits will more than offset the benefits of higher asset yields in this environment, resulting in our second quarter NIM contracting by approximately 35 basis points sequentially. The combination of a temporarily compressed NIM and a smaller interest-earning asset base, along with softer trading activity, is expected to drive a year-over-year decline in second quarter revenue of 10%–11%. That being said, the measurable deceleration in the pace of client cash realignment activity is helping limit the incremental utilization of the supplemental funding sources.

Source: Company Update June 14

Our Outlook

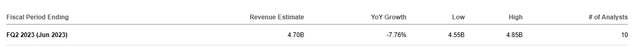

Analysts must have taken the week off as we don’t see them even following the company guidance. The estimates for the next quarter are for a decline of just 7.76% in revenues.

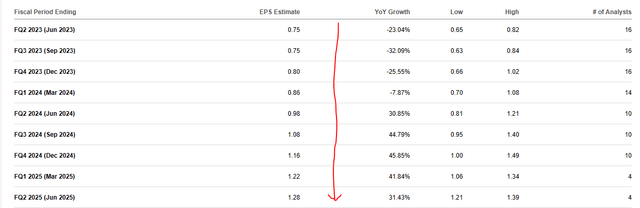

Seeking Alpha

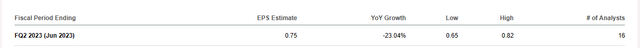

The company itself guided for a 10-11% drop and that was in the middle of June. It is not like things will suddenly reverse by the end of the quarter. Similarly, earnings remain offside and it is actually reasonable to expect 67 cents at this point and not the 75 cents where the consensus is trending.

Seeking Alpha

The analyst vacation or perhaps unbridled optimism, had other consequences as well. Not only are they ignoring the glaring negative update from the company but there is a vertical climb in the earnings per share.

Seeking Alpha

What exactly is this based on?

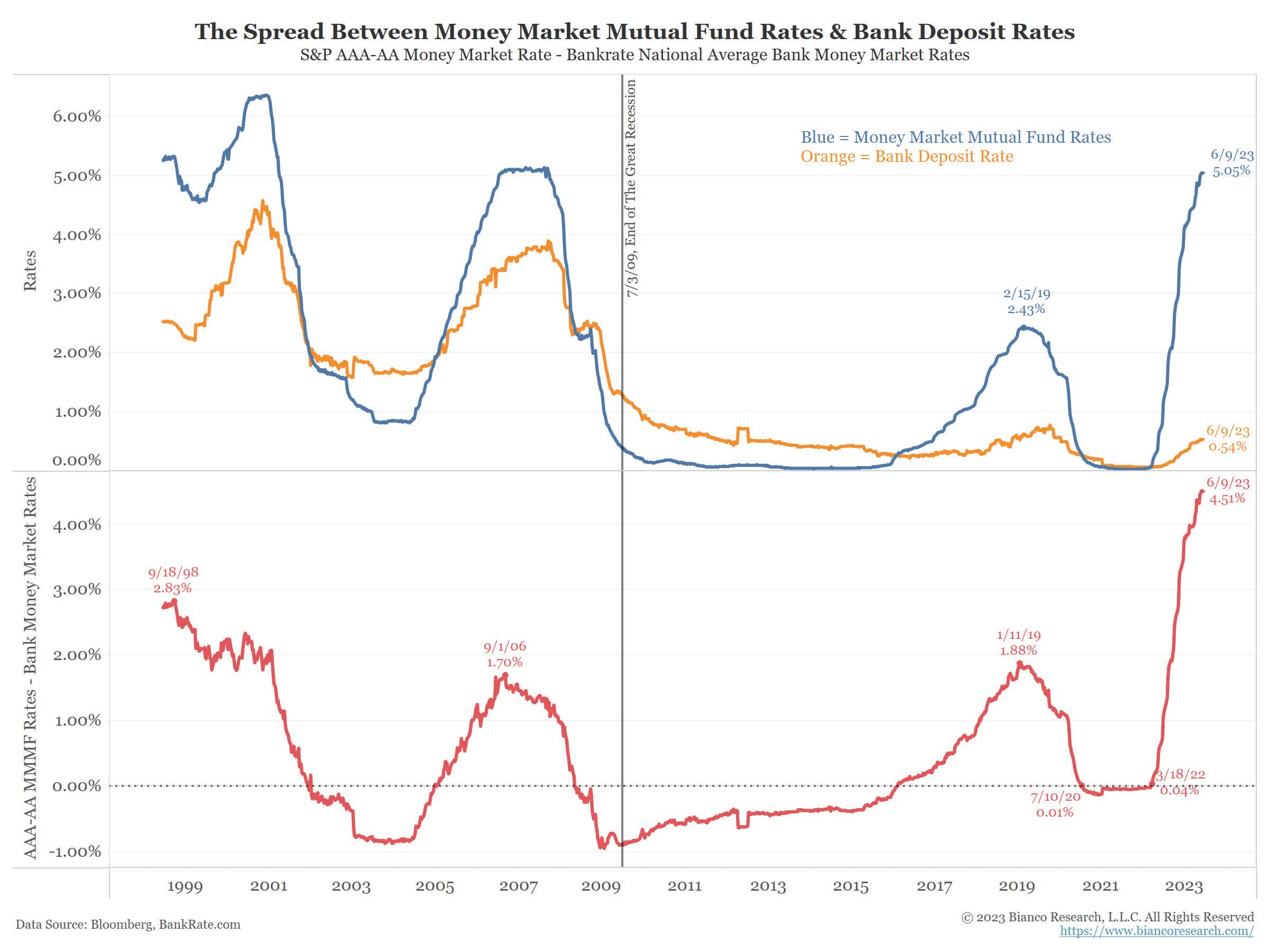

Every indicator shows that banks are now facing increasing amounts of outflows. Deposits fell by $79 billion in the week ended June 7. Take an objective look at the chart below showing how much an investor can earn risk-free at the average bank and the average money market account and ask yourself whether you believe the estimates above.

Jim Bianco-Twitter

What we are seeing from Charles Schwab is a pause in the trend. Perhaps some of this is driven by the euphoria in the market. When you are making 100% on your Invesco QQQ Trust ETF (QQQ) calls you really don’t care about 5% annual interest rates. When that story ends in tears, and we get ready for the next recession, expect some major outflows once again. Of course Charles Schwab can blunt this by offering 4% to 5% on their deposits. Similarly, it is paying 5% on s FHL Bank loans. And of course you should keep in mind that the company’s (predominantly) locked-in long term assets are earning under 3.25%. The math won’t be pretty and this will be made worse if the Federal Reserve does indeed hike twice more as the “dot-plots” showed.

Verdict

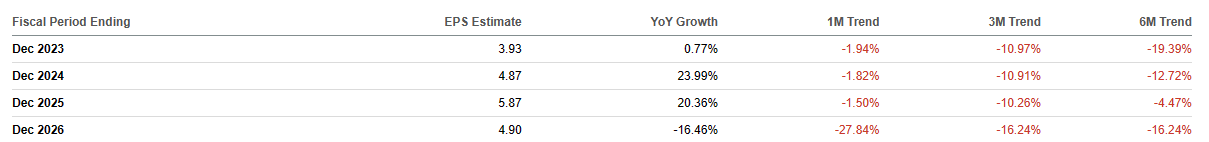

We told you the first time we wrote on Charles Schwab that it was not cheap. Back in April when everyone thought the company was a bargain because it had fallen, the estimates were for $3.93 a share.

Seeking Alpha April 6 Estimates For SCHW

Note that this is from April 6, 2023. We said,

We think they are all still wrong. Not about the direction, but about the magnitude. When all is said and done, SCHW will be lucky to generate $3.00 of earnings this year. So it is trading at 16-17X our estimates, after a 40% stock price drop.

Source: Charles Schwab Not In Charge

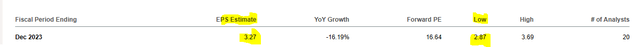

Where are we today?

Seeking Alpha

Oh yes. $3.27. Fantastic. As we showed above the numbers even for the quarter ahead are so awfully wrong that the only analyst that might get 2023 right is that genius who is predicting $2.87. The actual final numbers are rather irrelevant though. What is relevant is the trend. What is relevant is where it will trough and what will that quarter be on an annualized basis. We think it will be below 50 cents at some point in the next 3 quarters and that is our best case scenario. So $2.00 in annualized earnings is where we are headed. $54 stock. You do the math. We had neutral ratings the last two times. We are now downgrading this to a sell.

The Preferred Shares

While the common shares have never been an income play thanks to the small dividend, the preferred shares offer much more. There are two issues here that we looked at.

1) The Charles Schwab Corporation DEP SHS 1/40 PFD (SCHW.PD)

2) The Charles Schwab Corporation 4.450% DEP SHS REP 1/40TH N-CUM PFD SERJ (SCHW.PJ)

Both offer decent yields with the SCHW.PD offering near 6%. While they beat the common shares, they really don’t offer much at a time where one can get quality 7% plus yields in short term investment grade bonds. Even if we wanted preferred shares from the banking side, we would lean on Bank of America Corporation 7.25%CNV PFD L (BAC.PL). We don’t see any upside for the Charles Schwab preferred shares. We also don’t see existential risks for the company and hence rate them at hold/neutral.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here