Introduction

Valeura Energy (TSX:VLE:CA) (OTCPK:VLERF) is a Canadian upstream oil and gas company that operates in the Gulf of Thailand and has a natural gas discovery under appraisal in Turkey. The company’s management team has demonstrated a successful track record in making value-enhancing acquisitions. Their strategic focus is on achieving intermediate production growth through a combination of organic and inorganic means, primarily funded by internally generated cash. I find this strategy highly compelling, as it has the potential to create significant value for shareholders.

With major oil and gas companies reducing their capital investments in traditional fossil fuels, smaller exploration and production companies like Valeura have an opportunity to step in and acquire assets at attractive valuations. Valeura’s story reflects this trend, having secured operated interests in several licenses in the Gulf of Thailand. The company’s current ambition is to optimize efficiency, reduce costs, extend the lifespan of acquired assets, and invest in new production opportunities. This dual nature of Valeura, encompassing both growth prospects and strong cash flow generation, makes it an extremely attractive investment proposition.

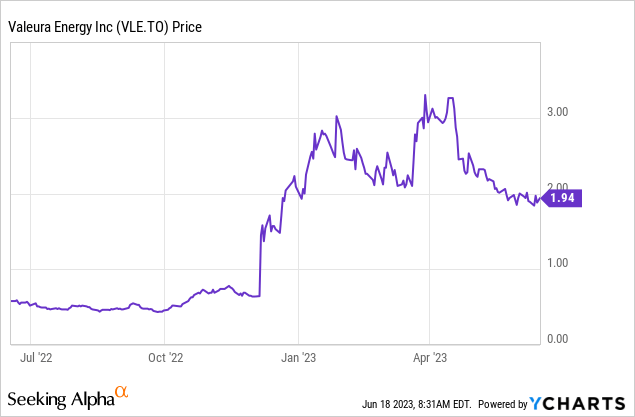

Following a rally triggered by the announcement of their latest acquisition, the stock has experienced a subsequent decline of over 40% due to factors such as a decline in oil prices and profit-taking by early investors. Considering the company’s favorable fundamentals and the discounted valuation, I perceive the current stock price as an attractive entry point.

Overview of company’s assets

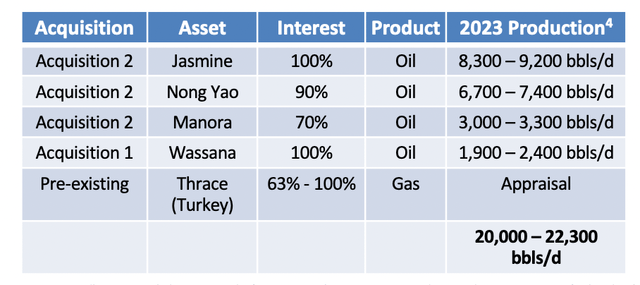

Valeura primarily holds assets in the Gulf of Thailand and has a promising long-term potential in a sizable tight gas play in Turkey. The company’s presence in the Gulf of Thailand is a result of two significant acquisitions:

- The first acquisition involved the G10/48 license in the shallow waters of the Gulf of Thailand. This license provided an opportunity to reactivate production in the Wassana oil field, which was acquired from the bankrupt KrisEnergy in June 2022 for a headline price of $14.3 million. The price of this acquisition has been criticized by industry sources as being unfavorable to KrisEnergy shareholders. Notably, this asset also brings along substantial tax losses that can be utilized as credits to offset future taxable income.

- The second acquisition, completed in March 2023, was from Mubadala Energy. It included operated interests in several producing assets in the Gulf of Thailand, such as the Jasmine, Nong Yao, and Manora oil fields. This transaction was truly transformative for Valeura. For a headline price of $10.4 million, the company gained access to a production capacity of 21 thousand barrels of oil per day. Additionally, Valeura benefited from the cash and working capital position of the acquired entity, resulting in a significant bargain purchase gain of over $200 million. The deal initially announced in December 2022 certainly appeared too good to be true at the time.

Valeura’s transformative acquisitions (Company’s Presentation)

Regarding the Mubadala acquisition, it is important to consider some additional factors that may help explain the price tag. One aspect is that there are contingent considerations tied to oil prices. This information can be found in the Interim Consolidated Financial Statements, dated May 12, which are publicly available on Sedar.

The Contingent Consideration of up to an additional US$50 million is contingent on certain upside benchmark oil price scenarios in 2022, 2023 and 2024. […]

The contingent consideration is payable if the arithmetical average of the daily “close” of all quotations in US dollars for Dubai crude oil in the Platts Crude Oil Marketwire on a $/bbl basis (the “Benchmark”) averages over $100 dollars for 2022, 2023 or 2024. […]

For each of 2023 and 2024, the contingent consideration is calculated as $1.15 million per $1/bbl increase in the Benchmark over $100.

No consideration was due in 2022, and it seems unlikely any will be due in 2023.

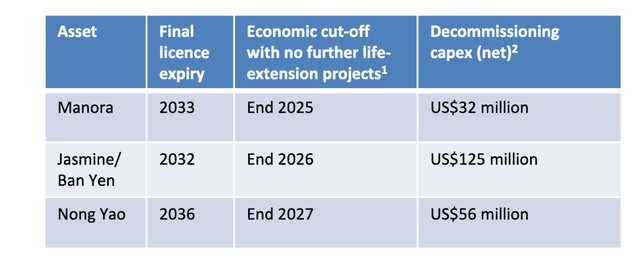

Second, with the acquisition Valeura is also assuming long-term liabilities to cover decommissioning costs.

Total decommissioning costs have been currently estimated by the operator, using internal and/or external engineering estimates, to be an aggregate net outlay of approximately US$210 million on an undiscounted basis.

Estimated decomissioning capex by asset (Company’s Presentation)

According to Thailand’s regulations, a decommissioning plan must be implemented when either at least 60% of the reserves have been produced or the license is set to expire within the next five years. Among the three fields involved in the acquisition, only the Manora field has an existing decommissioning plan, and approximately half of the associated costs have been already provisioned.

It’s important to note that the decommissioning cost estimates are based on a pre-2021 outlook. Valeura intends to explore and adopt best practices to enhance the decommissioning process through the use of innovative technologies. The goal is to improve efficiency, effectiveness, and safety, thereby minimizing costs. Management is confident that decommissioning costs can be reduced, potentially by a significant margin, from the initial estimates.

Third, all the acquired assets are categorized as mid- to late-life fields, with a combined total of approximately 23 million barrels of 2P (proved plus probable) reserves. At the current production rates, these reserves would last for approximately three years. However, it is worth noting that these assets have a track record of consistent reserve replacement through exploration and infill drilling. Management has expressed confidence in extending the economic lives of these assets well into the current decade.

| Asset | 2P oil reserves (million bbls) | 2P oil reserves (net after royalty, million bbls) |

| Jasmine | 10.0 | 8.8 |

| Nong Yao | 11.2 | 10.4 |

| Manora | 1.8 | 1.7 |

A highly value-creating strategy

Valeura is pursuing a parallel strategy of cashflow generation from current assets, organic growth, and inorganic growth.

To drive down costs, the company plans to optimize tax efficiency and leverage synergies among its acquired assets. It also aims to stabilize production and extend the economic lives of its producing fields through an aggressive infill drilling campaign. Management has set a target of drilling a total of 21 new or recompleted wellbores in 2023, with seven already completed or in progress as of Q1 2023.

In addition, Valeura intends to invest in new production. The Wassana oil field, acquired from KrisEnergy, resumed operations on April 28, 2023, and is performing as expected. Furthermore, the company plans to allocate approximately $75 million over 2023 and 2024 for the development of the Nong Yao C field. The drilling of the first four wells, out of a total of nine planned, is scheduled for completion in Q4 2023. First oil production is anticipated in Q1 2024, contributing to a targeted net increase of approximately 11,000 bbls/d by 2024.

Valeura is also pursuing a longer-term opportunity in Turkey’s deep, tight gas play, which provides potential future growth avenues. Additionally, the company remains open to exploring new acquisition opportunities.

Some investors may be dissatisfied by the absence of buyback and lack of focus on shareholder’s returns. In addition, new acquisitions may require Valeura to increase its debt burden or be dilutive for shareholders. However, the management’s track record in decision-making in this regard is encouraging. In addition, if we are, as I believe, in an O&G cyclical bear market within a secular bull market, the company’s growth strategy is going to generate significant shareholder returns. It is irrelevant whether these returns come from dividends, buybacks or share appreciation.

Cash flow generation is significant

Oil production in Q1 2023 averaged 20,475 bbls/d and is forecast to average between 20,000 and 22,300 bbls/d according to guidance. Valeura, however, seems to track well in advance of its target, with average production of 23,700 bbls/d in June. This is the result of its recent successful drilling campaign at the Nong Yao and Jasmine fields.

Valeura benefits from Brent pricing and relatively low costs. Operating expenses are expected to be around $220 – 240 million, or around $30 per barrel. With Brent prices around $80 per barrel, netbacks are around $29 per barrel. Looking forward, the company aims to bring production to a target level of around 25,000 bbls/d and beyond.

While short-term capital expenditures may impact free cash flow, the potential for significant cash flow generation is undeniable. Management has provided guidance of $30 million per month in free cash flow from the Mubadala assets alone.

Gulf of Thailand location is strategic

The Gulf of Thailand has a history of successful oil and gas discoveries. According to estimates, it has produced more than 10 billion boe since the 1970s. The reason is that the region offers a favorable geology that allows for the accumulation of oil and gas reserves in sedimentary basins, especially offshore.

Offshore operating conditions are relatively benign and in shallow water. They benefit from existing infrastructure and support services, including well-developed offshore platforms, pipelines, and processing facilities that facilitate the production and transportation of hydrocarbons.

The region is strategically located, providing access to markets in Southeast Asia. The proximity to countries like Thailand, Malaysia, and Vietnam offers a significant consumer base for oil and gas products. About one half of the global population lives in Southeast Asia, one of the fastest growing and most energy starved regions in the world.

Secular trend of O&G major divesting offers opportunity via acquisitions

Valeura is excellently positioned to take advantage of the shifting focus of oil majors towards renewables, which creates opportunities for small upstream exploration and development companies. Valeura’s management has the trackrecord, the experience, the knowledge of the local industry, and the necessary connections to acquire valuable assets at low prices. As proven by the recent acquisitions, these assets are often matured fields that small companies can leverage their agility and flexibility to operate more efficiently and cost-effectively.

Management team has delivered

While in the past the management team has been perceived by some to be overly enthusiastic regarding their Turkey discovery, it appears that their communication strategy has now become more conservative and restrained. The handling of the recent Mubadala acquisitions demonstrates a high level of professionalism. The management team has fulfilled their commitments as stated in the initial announcement made in December, in particular concluding the acquisition within the specified timeline. Moreover, all acquired assets have been performing as expected, solidifying the management’s credibility.

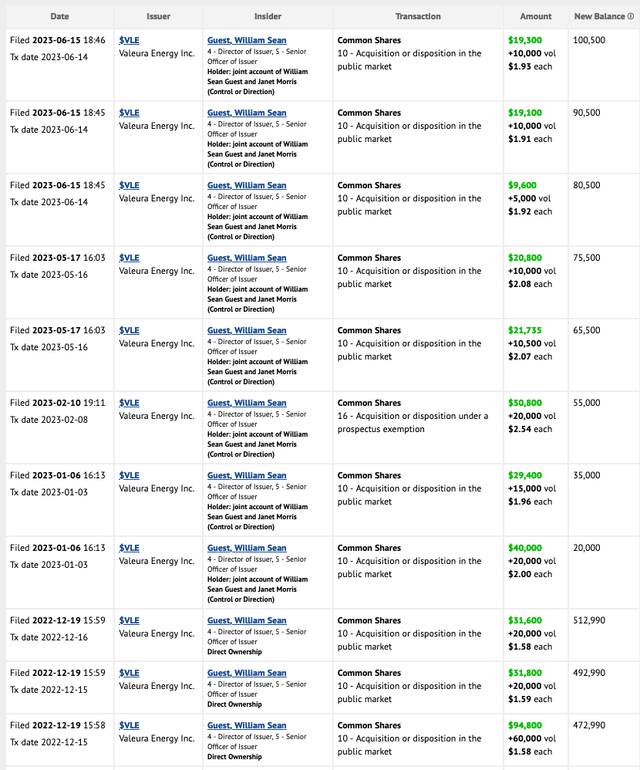

Another important point when investing in O&G is whether management’s interests are aligned with those of shareholders. Personally, I especially like to see key management figures buy in the open market when there is a potential undervaluation. CEO William Sean Guest, for instance, has consistently increased his holdings during market downturns since the Mubadala acquisition was announced in 2022. This further enhances my confidence in the management team.

Insider buyings from Valeura’s CEO (ceo.ca)

Cheap valuation

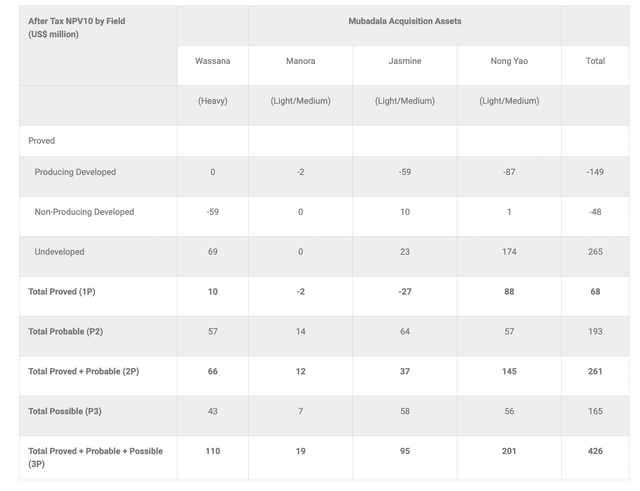

Reserves and resources have been recently assessed by a third party in the NSAI report dated April 17, 2023. The relevant benchmark for Valeura is Brent price. Estimates of NPV below have been based on Brent prices of $84.67, $82.34, $80.68 and 81.04 per bbl for 2023, 2024, 2025 and 2026, respectively, with 2% escalation thereafter. Values are reported on an after tax basis. They include the tax credit that the company has inherited as a result of its acquisition from KrisEnergy, resulting in no taxes payable for the Wassana field. Operating costs are based on the most recent 2023 guidance.

Estimates of NPV10 based on the NSAI report (Company’s Website)

Valeura has a market capitalization of around $150 million. This means that it is currently trading at a 65% discount to NPV. Given the short remaining lives of the assets, and the overhanging decommissioning liabilities, I believe reinvesting is crucial to unlock the value of the Gulf of Thailand assets.

It should be noted that estimates of NPV only take into account the oil revenues from current operating assets. They do not include any potential upside from the Thrace Basin gas play, as well as from potential future acquisitions. They also do not take into account the fact that the company had $268.5 million on its balance sheet at the end of Q1 2023 and $103.8 million in working capital, as a results of its Mubadala acquisition.

The valuation certainly seem cheap also when comparing with peers. Valeura is currently valued at around $6,800 per flowing barrel versus an average of $14,800 for a peer group made up of Jadestone Energy, Pharos Energy, EnQuest, and International Petroleum, and I would argue that none of them are richly priced at the moment.

Risks

In the short term, the primary risk to the investment thesis is a recession in the Western world and a further decline in oil prices. However, Valeura trades at a significant discount to its net present value, providing a meaningful margin of safety. Notably, the company’s Mubadala acquisition has resulted in Valeura holding cash and working capital that exceeds its entire market capitalization. This unique aspect adds an additional layer of security for investors.

Nonetheless, as a small O&G company, Valeura is an intrinsically risky play and position sizing should be appropriate. Its producing assets are all located in the Gulf of Thailand. This lack of geographical diversification exposes them to geopolitical risks, changes in government policies, and local economic conditions. The concentrated asset portfolio means that any adverse events or underperformance in these assets can significantly impact the company’s financial health. The main risk lies in the company’s ability to extend the economic life of its mature fields: there is no certainty that the management will be able to replace reserves at the same rate as before.

Conclusions

Valeura offers growth via both organic initiatives and potential future acquisitions. While its operating assets have a relatively short economic life and come with decommissioning liabilities, they generate substantial cash flow. Moreover, the assets have a track record of replacing reserves, which suggests that the management team will likely succeed in extending their economic life. Overall, considering the potential for extended economic life, attractive cash flow generation, and the favorable valuation compared to NPV, Valeura looks like a mispriced opportunity for O&G investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here