Shares of Rocket Lab USA, Inc. (NASDAQ:RKLB) have fallen alongside the broader space sector over the last few quarters. However, this decline appears to be an excellent buying opportunity. Rocket Lab seems poised for rapid growth in the upcoming quarters, in part due to an expected increase in Electron launch cadence. In this article, I discuss this improving launch cadence and its implications for Rocket Lab’s growth.

Background

In 2022, Rocket Lab reported annual revenue of $211 million, with about $60 million of this stemming from their Electron launch business.

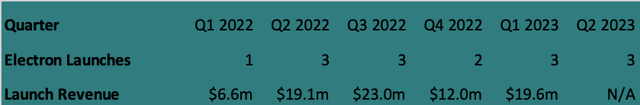

The figure below shows the Electron launch cadence and revenues by quarter since Q1 2022. Please note that the launch number for this quarter is an estimate. Rocket Lab’s CFO, Adam Spice, confirmed at the “Stifel 2023 Cross Sector Insight Conference” on June 6 that the company has completed two launches, with a third scheduled for later in June.

Electron launch cadence (Rocket Lab investor presentations Q1 2022-Q1 2023 and CFO comments at the Stifel 2023 Cross Sector Insight Conference.)

As readers can see, over the past six quarters Rocket Lab has conducted 15 launches, with a current cadence of three launches per quarter. On average, each Electron launch generated about $6.7 million. However, per the CFO, the average selling price currently stands slightly higher around $7.5 million per launch.

Rocket Lab has also benefited from recent turbulence in the small launch industry, with for instance Virgin Orbit going bankrupt and Astra experiencing launch failures. These setbacks have resulted in some orders being redirected to Rocket Lab, as noted in their most recent earnings call.

And, of course, secular growth in the space industry continues.

Upcoming Launch Cadence

Launch cadence for the Electron is set to increase presently. During the earnings call for the last quarter, the company guided nine launches for the H2 2023. This projection was reiterated by CFO Adam Spice at the Stifel conference on June 6.

Given this guidance, the most likely outcome should be 4 launches in Q3 and 5 in Q4. Assuming each launch generates $7 million in revenue, we can start to forecast the potential impact on Rocket Lab’s financials.

In Q1, Rocket Lab reported revenue of $54 million, with Q2 guidance of $60-63 million. Let’s use $61 million for our Q2 calculations. Then, if we set aside ongoing growth in Rocket Lab’s space systems division and assume it remains constant after Q2 (an unrealistic assumption, of course), we can project Q3 revenue of $68 million and Q4 revenue of $75 million.

This means that from Q4 2022 to Q4 2023, Rocket Lab’s quarterly revenue can very reasonably be expected to grow from $51 million to $75 million – representing an excellent 47% increase. And this estimate does not account for any potential growth in the space systems segment in Q3 and Q4. Hence, Rocket Lab should soon be growing its top line at a rapid clip.

Moreover, as noted by Spice, increased Electron launch cadence should also tend to improve margins as the high fixed costs of research and development and maintaining launch facilities are spread out over more launches.

The New HASTE Program

Rocket Lab initiated its HASTE (Hypersonic Accelerator Suborbital Test Electron) program in April this year. This program involves a modified version of the Electron rocket for hypersonic suborbital testing and payloads. This represents a distinct new business from Rocket Lab’s usual (orbital) launch business. This new program is entirely geared toward defense applications.

According to CFO Adam Spice at the Stifel conference, the HASTE program could also significantly increase launch cadence. As Spice noted, “We’ve got several programs that we are engaged on for this type of, for this HASTE opportunity… ultimately we see, you know, dozens and dozens of launch opportunities for this kind of program in the not too distant future right. So this is not a one-sie two-sie [i.e., one-time, two-time] thing, we believe this has the opportunity to scale meaningfully and be a real meaningful contributor to our launch cadence growth.”

Per the CFO, HASTE launches generate more revenue than regular Electron launches, albeit with higher associated expenses.

Investors should therefore keep a close eye on this recently launched Electron variant by Rocket Lab.

Rocket Lab Has The Capacity For Sustained Higher Cadence

Per the CFO, Rocket Lab is currently producing one Electron rocket every eighteen days, which equates to exactly five per quarter. The company also has ample launch site capacity, with one launch facility in New Zealand and another in Virginia. Rocket Lab’s ability to handle a higher cadence was demonstrated in Q1 when they executed two launches separated by only seven days.

It, therefore, seems reasonable to expect that Rocket Lab could reach a cadence where it launches every rocket it currently produces – i.e., five per quarter. And if demand continues to grow, Rocket Lab could invest to further expand its Electron production. The CFO noted this potential, stating: “I mentioned we are building… a rocket every 18 days. Well, we have the ability to build… a rocket per week… if the demand was to kind of present itself.”

The recent initiation of the HASTE program further illustrates Rocket Lab’s willingness to invest in growing its Electron business (even if the upcoming Neutron rocket may be a bigger priority).

Finally, Rocket Lab has a strong balance sheet. Rocket Lab has almost $400m in “cash” and a book value of $640m. The cash alone is more than all of Rocket Lab’s liabilities (both short- and long-term), and Rocket Lab has negligible interest expense. The cash is, of course, being burned through while Rocket Lab progresses on the runway to profitability, although much of the burn is going towards R&D for the upcoming Neutron rocket slated to debut late 2024 – Rocket Lab is investing a total of about $250 million into Neutron, a sizable portion of which will accrue between now and 2024 or 2025 (some has already accrued). But at the current burn rate (rocket lab posted a net loss of $46m in Q1), and even adjusted for further spending on Neutron, Rocket Lab should comfortably make it through Neutron’s debut, at least financially.

Improved total gross profits from an improved Electron launch cadence should further improve the financial outlook.

Therefore, for 2024 and beyond, Rocket Lab’s launch revenues from Electron launch can reasonably be expected to grow at a solid pace.

The Bigger Picture

Of course, Electron launch is only a small part of the picture for Rocket Lab. Its space systems division is already about twice as large, and Neutron – which is slated to be priced at around $50m per launch – could increase launch revenues by several multiples. I intend to write in detail about each of these parts of Rocket Lab’s business on other occasions, since there is quite a lot that can be unpacked here (and, admittedly, they are a bigger part of the strong buy rating than the Electron launch business).

Still, a few brief notes on Neutron are warranted since we are discussing the future of Rocket Lab’s launch business.

Neutron is, of course, the most important part of the Rocket Lab upside story. Rocket Lab is currently valued at $2.7 billion and has a P/S ratio of about 12 (ttm). If Rocket Lab is at $75m/quarter or $300/year exiting 2023, as we have discussed, then at that run-rate the P/S ratio would further fall to about 9. And then if Neutron is successful, that could result in billions of dollars of revenue within a couple of years. 20 launches would be a billion dollars in revenue, and the Neutron is designed to land at launch site and easily launch again and again – for 10 to 20 uses per rocket. This could easily bring Rocket Lab’s P/S ratio (if it remained at its current market cap of $2.7 billion) down to 2 or even 1 within the next few years.

Management also expects Neutron to eventually have gross margins of around 50%, so profitability should also improve if it is successful.

If this scenario plays out and Rocket Lab becomes profitable, then it is easy to see a much higher valuation for Rocket Lab. Rocket Lab has been in a slump along with other space stocks and is down from a peak valuation of around $10 billion. While that valuation may have been a bit premature, if Rocket Lab’s revenues grew to $1-2 billion in a couple of years and were making good progress toward profitability (or had achieved it), then a valuation of $10-20 billion would be fairly reasonable given the strong multiples that advanced technology stocks tend to command. It would also be reasonable given SpaceX’s much higher valuation, which has been fueled to a significant extent by its lucrative Falcon 9 business (which is the same business that the Neutron will vie for).

Whether Rocket Lab is successful with Neutron remains to be seen, of course. This is rocket science after all. Investors should therefore make no mistake: Rocket Lab is a high risk investment with real potential downside. But this risk comes with a great deal of upside, and in that context Rocket Lab is an attractive investment. If Rocket Lab’s market cap would, say, 5x or 10x upon Neutron’s success, then, say, a 50% chance of success would give the bet on Rocket Lab a strongly positive expected value even if the downside is potential bankruptcy. And so the investment seems to make good sense for investors who are looking for high growth and the potential of a multi-bagger. Not everyone looks for this in their investments, of course, and that is fine too.

At any rate, while we wait for the Neutron story to develop, investors can take solace that Electron is doing well and that this part of Rocket Lab’s business seems to have a healthy future. It is not the biggest part of Rocket Lab’s financial outlook, but it could still be a solid positive in coming years.

Conclusion

While Rocket Lab investors eagerly await the debut of the upcoming Neutron rocket, the growth of the Electron business should not be overlooked. Although the financial impact of the Neutron could be far larger, the Electron could potentially be a good, profitable business for Rocket Lab for many years if launch cadence can be further increased. The upcoming increase in Electron launch cadence should therefore count as a solid win for Rocket Lab.

Improved cadence could also significantly bolster Rocket Lab’s stock price in the coming months as its top line grows significantly through the rest of the year.

Read the full article here