Investment Thesis

Heineken (OTCQX:HEINY) is the world’s second-largest brewer (behind Anheuser-Busch InBev (BUD)), selling just over 250 million hectoliters of beer in 2022. Heineken, a truly international brand, maintains leading position in several European markets, and has a growing presence in emerging markets such as South Africa. Heineken, the enterprise’s flagship brand, is the world’s most popular premium lager that has spawned spinoffs including Heineken 0.0 and Heineken Silver. I find that the brand’s scope and strategy give it a prime position to capitalize on the industry’s premiumization trend, while its sound initiatives towards portfolio proliferation, non-alcoholic beer, and digitization are similarly promising. Down from its recent $58 highs, I recommend a BUY in HEINY for the following reasons.

Industry Trends

As I touched on in my article covering Anheuser-Busch, a diverse portfolio of products and premium beers is essential for a brewer in today’s market. Craft and import volumes are growing at a much faster rate than traditional beers in developed markets. According to the Brewers Association, overall beer volume in the US dropped 3.1 percent in 2022, though craft volume remained steady and import volume was up nearly 3 percent. At year-end, Import and Craft beers controlled more than 35% of the US beer market.

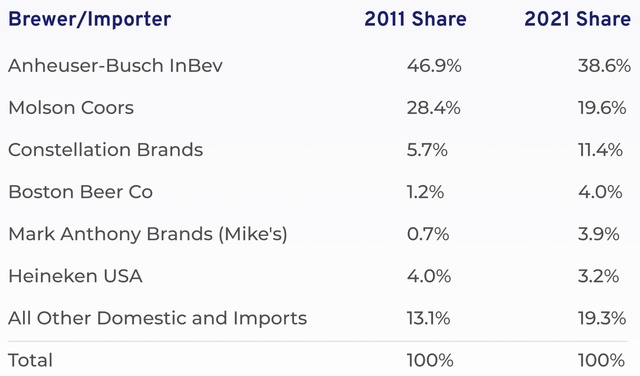

Looked at another way, from 2011 to 2021, let’s look at major brewers and their market share.

NBWA

The gradually decreasing relevance of traditional beer brands is quite clear: major brewers like Anheuser-Busch and Molson Coors lost 17.7% and 31% of their market share, respectively, while alternative options like Mike’s and Imports/Smaller Brewers grew 457% and 47.33%, respectively. Heineken, too, is a victim of this trend, losing 20% of its US market share in the 10-year period.

It is my belief that Heineken is on track to reverse this negative growth as its portfolio widens and becomes more appealing to the modern consumer. Heineken’s flagship Heineken brand, as well as the rest of its premium portfolio, has grown at a substantially faster rate than traditional beer. For example, in 2022, Heineken volume increased by 12.5%, premium beer by 11.4%, and other beer volume at a mere 6.9%. This effect is only compounded by the higher price point inherent to premium beer.

Heineken stands above other major players in the industry in this regard — in terms of beer and beer alternatives, Heineken’s portfolio is one of the most differentiated. Heineken’s major beers usually have flankers that are in higher-growth segments of the industry or are premium beers themselves. Look no further than the flagship Heineken brand: while Heineken itself is a premium beer, the firm also offers Heineken Silver, Heinken 0.0, and Heineken Light. Tecate offers Tecate ALTA and Tecate Light, with Tecate 0.0 on the way. Dos Equis has more products than I care to list. While this level of differentiation isn’t unique to Heineken, it is a more primary focus of Heineken than it is of brands that benefit from core competencies involving price/brand identity like the offerings of AB InBev or Molson Coors.

Lagunitas, Affligem, and Birra Moretti supplement Heineken within the premium portfolio, with Lagunitas in particular providing invaluable exposure to the craft space being the 5th largest name therein. It’s no secret that big brewers have struggled with increased competition from their craft counterparts, and the reinvigoration of the Lagunitas brand, detailed well in Forbes here, should enable that segment to become an increasing important piece of Heineken’s portfolio.

Furthermore, Heineken is an industry leader in cider, which, while not a huge segment of the broader market, is a segment that has recently grown at higher rates than traditional beers.

Of course, all of these qualitative factors are very hard to quantify, so I’ll try to keep the rest of this segment short.

Green Diamond and Evergreen

Heineken’s value-creation strategies are well-founded, if a little vague (what does “shape the future of beer and beyond” really mean, anyway?), and I believe that Heineken’s future is bright as a result. Heineken’s avenues for organic growth are numerous, if modest, and promise similarly modest growth. For those interested, Forbes has a pretty interesting article on this here.

This is not something that I’m going to dive into in this article, as it would double in length, but Heineken’s initiatives promise sustainability, digitization, operational efficiency, and more, with concrete, albeit limited, progress being made towards each goal. I would recommend skimming through Heineken’s reports to learn more about this.

Markets in 2022

Africa and APAC

Heineken’s Distell and Namibia Breweries acquisitions will enable the brand to capture a significant share of industry growth in south and east Africa. Select Heineken brands, like Amstel, Strongbow, or Desperados, grew between 10%-30% volume in the region and Heineken revenue grew 20%. Soft 2022 volume in EMEA was more than offset by price and currency fluctuations, netting an enormous 26.7% increase in revenue across EMEA. I anticipate that volume growth in South Africa and other early-stage markets will be lucrative in the long-term.

APAC was the region of highest growth for Heineken due to a continued rebound from the COVID-19 pandemic — the region now makes up nearly 25% of Heineken’s revenues, up from its previous high of 16.5% in 2018. Premiumization is again key, as Heineken, Heineken Silver, and Tiger Crystal were key contributors to an enormous 63.3% volume growth, 68.31% BEIA revenue growth, and 64% BEIA operating profit growth. It’s difficult to tell exactly what proportion of this was due to pandemic recovery, but given the region’s rapid population growth and increasingly relevant middle class, Heineken’s ever-increasing relevance in the region speaks well of its future prospects.

Later-Stage Markets

Look no further than the Americas to find the positive effects of premiumization at scale — while consolidated beer volume increased only 3.6%, BEIA revenue increased a staggering 30.37% and BEIA operating profit by a respectable 14.5%. Premium beer grew double digits in volume, spearheaded by Heineken and Amstel ULTRA.

Results in Europe were similar — moderate volume increase (4.8%) supplemented by a sizeable increase in BEIA revenue (19.7%) and operating profit (5.3%).

While margins did slim a little, that can be largely attributed to rising operational costs, mostly due to commodity headwinds (presumably transitory) and increases in personnel expenses. Therefore, I find the long-term benefits of premiumization to be very concrete.

Financials

I won’t harp on about the entire financial history of the business, but I will at least point out the most relevant pieces of recent performance.

Recent revenue growth has been solid, finally jumping from 26.6 billion Euros to 34.7 billion from 2021 to 2022 which appears to have finally completed the company’s COVID recovery. Heineken is most likely set up to continue its usual mid-single-digit top-line growth for the foreseeable future.

At first glance, the small compression of Heineken’s gross margin seems more worrying than it probably should be — inflating commodity costs likely account for a majority of this difference and I would anticipate a relative return to form in the next year or two provided that market conditions stabilize. If I’m being especially optimistic, perhaps the gross margin may even improve given recent price levels and Heineken’s focus on premiumization. Digitization will also help with this — it isn’t something that I talked about in this article, but Heineken’s steps towards digitizing at scale are nothing to scoff at, and should improve operational efficiencies substantially in coming times.

Cash flows have been net negative the past couple of years, largely a result of debt repayments, dividends, and PP&E purchases, but given that cash flow from operations remains healthy and Heineken’s payoff windows are mostly relatively long-term, the most obvious consequence of this leveraged position would be a dividend cut — though, the dividend isn’t exactly breaking any records as is, so investors seeking a stable cash flow should look elsewhere.

This is a minor cause for concern, as cash will probably be tight in the near future, though Heineken has traditionally been a business that runs with leverage and has not had any major issues historically.

Valuation

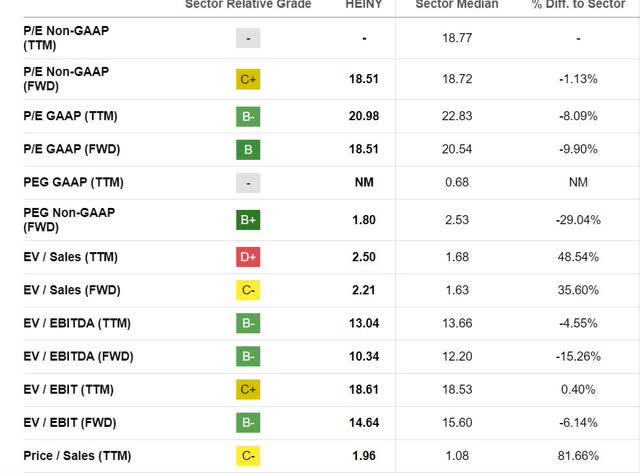

Seeking Alpha

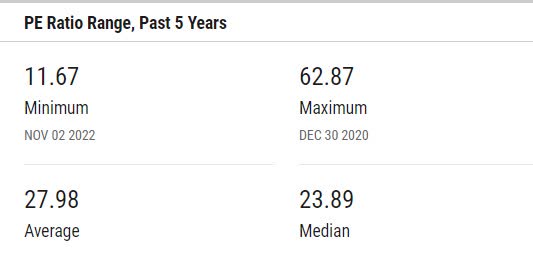

Currently, Heineken is trading at a GAAP P/E ratio of just under 21, which is historically undervalued according to the YCharts measurements of Heineken’s P/E over the last 5 years, using both mean and median. Of course, these measurements are likely to be somewhat skewed due to the pandemic, but Heineken’s P/E trails that of Carlsberg and Constellation Brands and is only marginally higher than Molson Coors. It would have been comparable to AB InBev’s before the Bud Light fiasco, as BUD’s P/E peaked close to 22.

YCharts

I see no major red flags in other multiples, especially since many forward-looking or non-GAAP measurements place Heineken as an industry frontrunner when compared to its direct competitors.

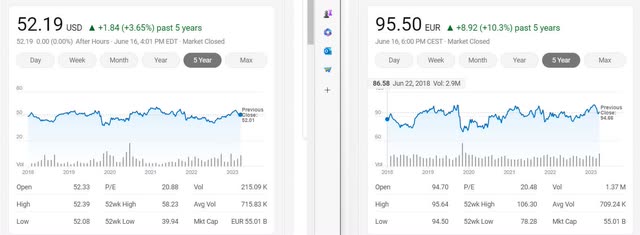

Furthermore, FactSet analyst target prices for HEIA (who tracks proportionally to HEINY in most cases, as shown below), give upside of about 15%. It can be assumed that, if attained, HEINY would capture about 1/3rd of this given historical trends. I find these estimates conservative, as some more optimistic (perhaps overly so) estimates put a one-year price target at close to $70 for HEINY. While it is probably most likely that Heineken will sit somewhere comfortably in the middle of these estimates, Heineken’s commitment to products that are increasing in relevance — especially in underrepresented regions — as well as to staying sustainable and socially responsible, make Heineken a high-quality company worth a long position in my view.

HEINY (Left) vs. HEIA (Right) (MSN)

Risks

As with all investments, I’d like to take a moment to point out the most relevant risks to a HEINY investment.

- While Heineken does have a presence in the craft beer segment, this is not exclusive. Failure to continue to grow the Lagunitas brand in particular will severely hinder Heineken’s relevance in this high-growth segment.

- Compared to its competitors, Heineken is somewhat underrepresented in the APAC market, though recent improvements have been made to change this.

- Pricing pressures in Western Europe somewhat limit growth in the region.

- Dividend may be cut if cash flow needs to be bolstered.

- The acquisitive nature of the company often requires a degree of leverage that can sap cash away from the company

Bottom Line

I’m reminded of the overused Buffet quote about good companies and fair prices, and I feel that Heineken is a prime example of this principle.

Given the quality of Heineken’s business and its advantaged market position afforded by its high levels of premiumization and portfolio breadth (including presence in non-alcoholic beer, craft beers, and beer alternatives), accented by the recent struggles of AB InBev, I find that purchasing Heineken at its current price — which appears to be fair or better — is a good idea. Despite the risks, I find Heineken NV to be a BUY at its current price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here