CarMax Stock Analysis

Thesis

CarMax (NYSE:KMX) operates in an industry that is likely to struggle in the coming months as economic conditions are not favorable. The Fed Funds rate is above 5% for the first time since 2007, and one or two more rate hikes are likely, which combined with more difficult lending will most likely impact spending on used car purchases.

In addition, I do not believe CarMax is attractive to long-term investors as I do not see clear competitive advantages or the ability to allocate capital efficiently based on historical industry ROIC and WACC figures.

Analysis

CarMax 10-K

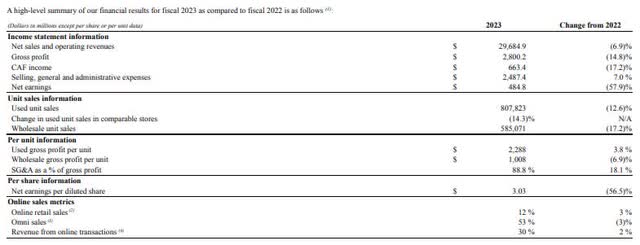

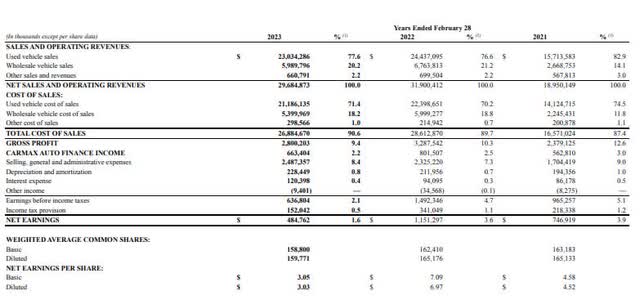

If we look at the most recent 10-K to make a CarMax stock analysis, we can clearly see that the latest results were rather disappointing based on the development of revenues and earnings. It should be noted, however, that the results for 2021 and 2022 are rather unusual, as supply chain problems led to a shortage of new cars, causing used car prices to soar. As a result, earnings and sales in previous years were elevated and are therefore not the best point of comparison.

However, as CarMax operates mainly in the 0-10 year old vehicle market, I can see them having some problems in the future as many people will be unable to finance the more expensive cars and therefore many will try to buy cheaper and older cars. Financing a car at over 5% interest is going to be quite different in terms of monthly payments than getting close to 0% interest.

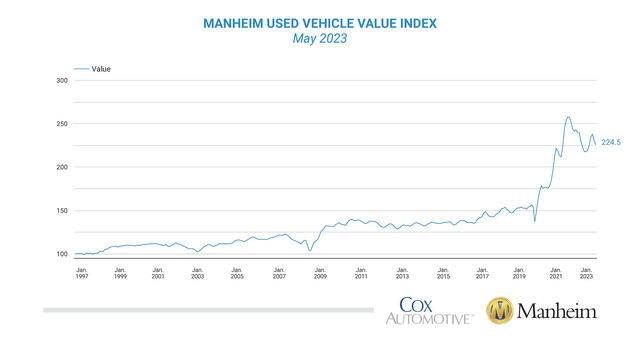

Manheim Used Vehicle Index

And the Manheim Used Car Index shows that, despite falling prices, they are still much higher than they were pre-pandemic and pre-inflation. So I think a lot of people will try to buy cars that are older, like in the 8+ year range, when they need a new car because that is more manageable for most people when they are trying to buy a car within a financially reasonable framework.

CarMax 10-K

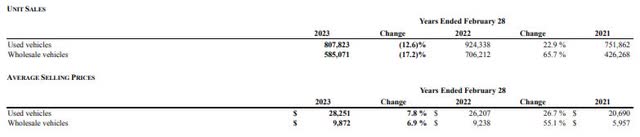

These higher prices are also clearly reflected in the average sales prices of used cars over the period shown. They rose from ~20k to ~28k within two years. However, despite the higher prices, CarMax also sold more cars in fiscal 2023 than in fiscal 2021, which should normally be reflected in earnings and revenues. 807k used cars sold vs. 751k used cars sold in FY2021.

CarMax 10-K

Unfortunately, despite much higher sales in 2023, CarMax’s net profit was much lower than in 2021. So, despite the increase in sales and average selling price, costs were higher and therefore destroyed the margin. This does not suggest an efficient allocation of capital. In particular, the cost of sales for used cars has risen sharply. Over this period, the gross profit margin fell from ~12% to 9%. And the net earnings margin was only 1.6% in FY2023. It will be very interesting to see if the results improve or even fall further.

Valuation

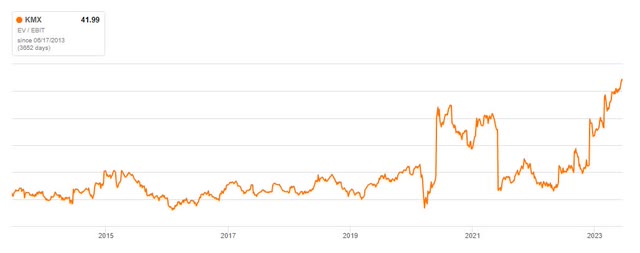

Seeking Alpha

Due to the sharp decline in earnings, the EV / EBIT valuation looks very expensive. Normally, an EV / EBIT of more than 40 is a sign of high-quality, high-growth companies. However, with Manheim writing on their website that used retail sales were down 11% year-on-year in May, I can see CarMax’s next earnings report showing lower earnings, which would lead to an even more expensive valuation.

But even the historical average of 20x was very expensive for the growth they achieved. So I think that even if the economy normalizes in the next few years, there is still a long way to go before they are attractively valued, which for me would be in the range of 13x to 15x EV/EBIT.

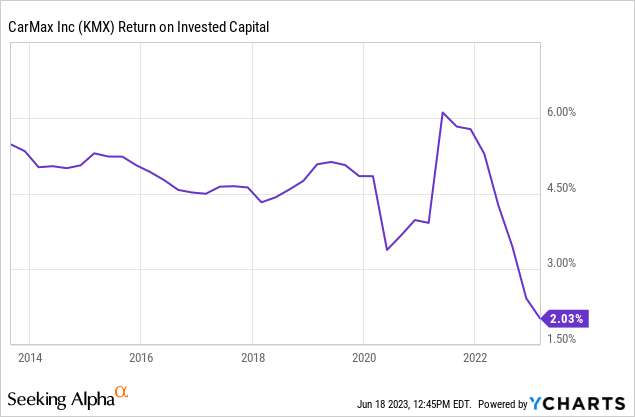

ROIC CarMax

One problem that will arise from higher interest rates is that the cost of capital will rise. And if we look at CarMax’s 10-year ROIC, we can see that the WACC is likely to be higher than the ROIC and therefore it will be difficult to grow. In general, the industry in which CarMax operates is capital intensive, with an average cost of capital of 9.7%, and achieving only a low single-digit ROIC could lead to problems in the long term. For me, this is the main reason why I would not invest in CarMax, as I like companies with a wide ROIC-WACC spread, as I think this is one of the best ways to achieve excellent long-term results.

I also think that high ROIC figures show that companies have a competitive advantage and pricing power. But I don’t think CarMax has either of them. They have a recognizable brand, but most of the time people will buy from the dealer who gives them the best price combined with the best service. CarMax is the largest used car retailer in the US, but their market share is only 4%. So I don’t think they have the market power of companies in other industries that have over 30% market share. They may have the market leadership title, but I don’t think they can benefit very much from that.

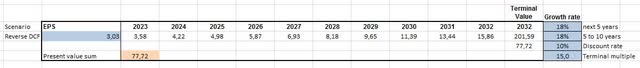

Reverse DCF

Author + Seeking Alpha Data

Basic diluted EPS: $3.03 To justify the current share price, EPS must grow by 18% per year over the next 10 years. A rather difficult task, if you ask me. Share buybacks are also on hold at the moment, so growth has to come from earnings growth, and that could be difficult as the industry is relatively sensitive to economic conditions.

This also reinforces my observation from the EV/EBIT multiple that CarMax is currently overvalued.

Growth Opportunities for CarMax

CarMax plans to have revenues between $33 billion and $45 billion by fiscal year 2026, which I think is a very wide range. And they hope to increase their market share from the current 4% to 5%. To achieve this goal, they plan to open 5 new stores in FY24. However, their stores already cover 85% of the US population and the remaining 15% may be relatively little for future growth.

But I like the opportunities they have in the data they process that they can leverage, and I also think their omni-channel platform is a good idea. However, for me personally, the industry as a whole is not that attractive for the next few years and I would wait to see how the economic situation develops. And CarMax’s growth targets are relatively ambitious. So we will have to see how this plays out.

Conclusion

Right now, CarMax is a bit of a turnaround play as they have to improve their margins and manage their business in an environment where interest rates are the highest they have been in 16 years. I think this is going to change the industry a lot and it will be interesting to see how the players react to this new environment that many of the CarMax employees, who are in their 30s and 40s, have probably never seen before. They have grown up with lower rates and now it will be their time to show how they can adapt to this new reality.

So I think there are more attractive ways to invest capital right now, but that in no way means that CarMax is a bad company, it just means that this is a tricky situation with many possible outcomes and I like the easy ones better.

Read the full article here