Thesis

Effective household cash flow management entails having a positive cash flow, maintaining liquidity needs, decreasing risk, and optimizing returns through the strategic utilization of asset allocation. Integrating U.S. government securities, varying investment vehicles, and concepts taken from firms that allocate funds strategically can help optimize households financial stability. Through the exploration of the four investment modalities discussed, investors can gain access to the discussed securities utilizing them as a strategic tool for their broader finances.

1) Treasury Direct;

2) Money Market funds like the Vanguard Treasury Money Market Fund (VUSXX) & the Schwab Treasury Obligations Money Fund (SNOXX);

3) iShares iBonds Dec 2023 Term Treasury ETF (IBTD) and;

4) U.S. government security focused ETFs like the Vanguard Short-Term Treasury Index Fund (VGSH) & the US Treasury 3-Month Bill ETF (TBIL);

Having access to such a wide variety of products and combining them with financial management principals can help compound returns and enable household cash to work harder, safer, and smarter.

Introduction: Personal Cash Flow Management

There is a popular notion in personal money management practices vying for having adequate cash in a bank account at a multiple of 3-12x your monthly expenses depending on your personal situation. This is an uncertainty mitigating action and is a beneficial position to have for any household ensuring they have the liquidity to deal with short-term risks.

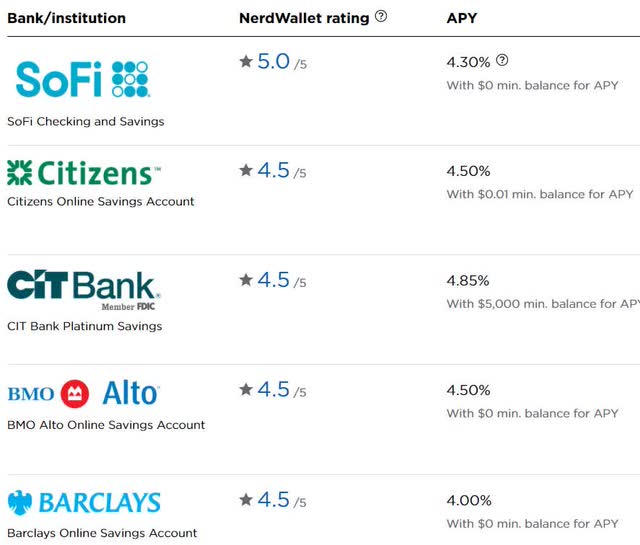

There are numerous techniques to maintain liquidity needs like accessing cash within a designated time-frame and utilizing varying security vehicles to increase yield and decrease risks. The options that are the focus of this article (note that these are not the only solution) are to utilize shorter duration treasury-backed securities through varying investment vehicles to increase those stagnant or lower bank returns AND maintain liquidity needs. Note: some of the most competitive bank returns are noted below, however, utilizing investment vehicles based on treasury securities can provide better rates and decrease bank specific risks and variance.

Competitive Popular Bank Interest Rates (Nerd Wallet)

Optimizing Cash-Like Investments For Households

To understand the utility of short-duration, low-risk government backed securities and related products, let’s explore how professionals maintain the liquidity needs of billion dollar firms while seeking positive returns and apply those fundamentals to your household. They utilize formulations such as the cash conversion cycle while investing much of their excess cash safely but in accordance with their projections. Companies like Berkshire Hathaway (BRK.A) and Johnson & Johnson (JNJ) utilize short-term government securities and money market funds as a relatively safe location for storing their cash until needed.

So the applicable question is how can a household maintain their cash liquidity needs, decrease risks, and increase returns moving towards an optimization? An example would be if a household desires to maintain a $100,000 emergency fund and the average bank interest rate is currently 0.39% resulting in $390 in interest. Assuming that the household has a high credit limit credit card with a 30 day payment, then they could buy a 28-day treasury security faster than they need to make a credit card payment. So they could theoretically take $78,000 of that savings and distribute it in 4x 4-week treasury securities (one that matures each week known as a ladder strategy) and create a greater than 5% APR or $3,900 which is 10x more with $22,000 less. This tactic makes it easy to withdraw money in case of emergency as a portion would be cyclically maturing every week. That is a great situation as the flow of cash into investments would have better returns that are safer than the current bank those funds reside which is one way of optimizing household finances.

Some Methods For Better Than Bank Account Yield Results

Accessing securities is one of the friction points for smaller investors so having multiple methods to obtain the target securities that align with the individual investment goals provides flexibility for resolving those friction points.

Method 1: TreasuryDirect.gov

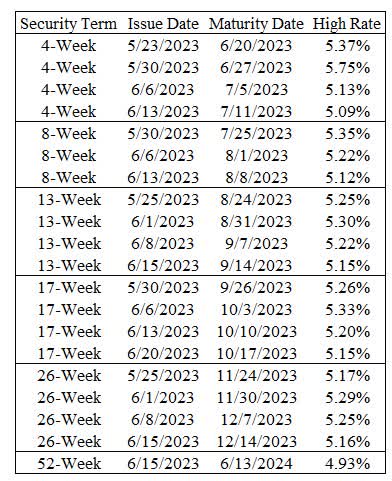

TreasuryDirect.gov is an excellent way to electronically buy treasury securities from your computer while maintaining direct transfers to/from your bank accounts. It provides users the flexibility to transact in accordance with their short-term needs maintaining liquidity and savings requirements. There are features that allow for automatic reinvestments and they provide competitive auction results. Observing the results table below shows a myriad of security maturities and the competitive rates that were auctioned recently. The market dynamics change these frequently, but the current short-term trend is competitive and well above many bank account rates.

Recent Treasury Auction Results (Author – Treasury Direct)

This method is accessible for U.S. individuals and entity managers (for businesses) who are above 18 years old, have a valid SSN/EIN, have a U.S. address, and have a U.S. depository financial institution.

Method 2: Money Market Funds

Utilizing Money Market Funds that are backed by stable government assets and repurchase agreements of varying combinations is another method for increasing yield and decreasing risk from singular bank accounts. Money Market funds offer high liquidity, can be FDIC insured, and generates income though avoiding capital appreciation.

Varying funds like the Vanguard Treasury Money Market Fund (VUSXX), Fidelity Treasury Money Market Fund (FDUXX), Schwab Treasury Obligations Money Fund (SNOXX), Invesco Government Money Market Fund (INAXX) are just some of the many options that can be utilized. These funds can help maintain liquidity requirements while maintaining principal invested and decrease risk through diversified holdings across target financial instruments.

Method 3: iShares iBonds Term Treasury ETF

Past articles (referenced below) have discussed a utilization case for iShares iBonds Term ETFs from BlackRock (BLK) due to the benefits of principal security, fixed income streams, liquidity, low costs, term based maturation, and diversification benefits.

Making A Case For iBonds High Yield Term Based ETFs (BATS:IBHE)

Why You Should Be Interested In iBonds Investment Grade Corporate Term ETFs

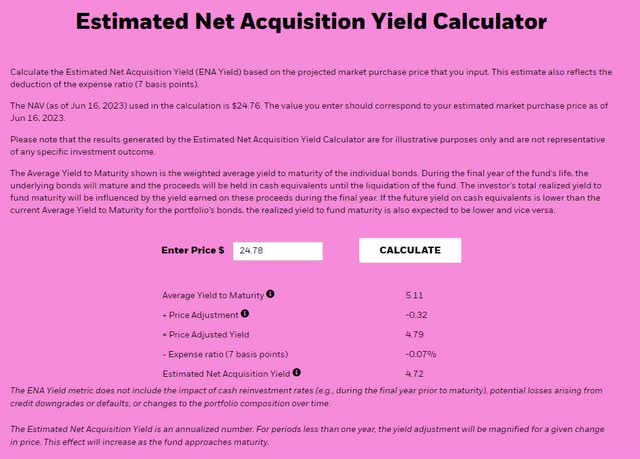

Utilizing iShares iBonds Dec 2023 Term Treasury ETF (IBTD) could be a way of investing in a principal safe treasury backed investment vehicle that matures annually while still maintaining liquidity though there is some market price volatility. With a purchase price of $24.78, the current estimated net acquisition yield is 4.72% including fees and excluding transaction costs. As you can see, adding layers to the transaction process create lesser returns but having access and knowledge of multiple products is advantageous for investors overall.

Estimated Net Acquisition Yield Calculator (BlackRock)

Method 4: Treasury Focused ETFs

There are multiple ETFs that trade with holdings focused on government backed shorter duration securities. These ETFs have more volatile price action than some of the other instruments mentioned in prior methods but could be a good place to maintain liquidity while gaining return for excess cash while mitigating risk. Examples include Vanguard Short-Term Treasury Index Fund (VGSH), US Treasury 3-Month Bill ETF (TBIL), SPDR Bloomberg 1-3 Month T-Bill ETF (BIL), and iShares U.S. Treasury Bond ETF (GOVT) to name a few. It’s important to compare the expense ratios and historical volatility of these products as it will affect the returns. It’s also important to understand how interest rate changes will affect the price of these funds since interest rate hikes will decrease the principal and interest rate cuts will increase the value.

Risks

There are risks associated with all investing and it’s important to understand them prior to purchasing securities.

Credit Risk

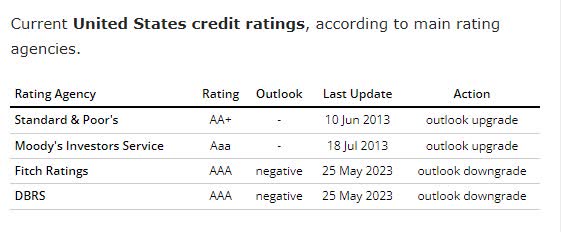

Credit risk is a risk referring to the inability for the issuer to fulfill their payment obligation to investors. Fortunately, the products listed above take heavy positions or are backed exclusively by the United States Government which theoretically provides the most “risk-free” and risk reduced assets in the world.

United States Credit Ratings (Worldgovernmentbonds.com)

Liquidity Risk

Liquidity risk from an investor perspective is the risk that immediate cash is needed and the investors can’t recover the full value of their holding within a short-term time period. This is a common issue for holding debt instruments in the sense that debt holders may need to sell at a discount to liquidate their holdings. Fortunately, ETFs allow for more liquidity though the price action may not be favorable for the investor at the time they need to sell. Other products listed above are either maturity based which means lesser liquidity but the maturity duration can be selected and laddered to fit investor needs. One way to mitigate this risk is to ensure that liquidity requirements are met elsewhere as discussed above and that the security can be held to maturity.

Interest Rate Risk

Interest rate risk is the risk that an increase in interest rates have on debt instruments due to an inverse relationship ultimately decreasing the value at that time. This risk can also be mitigated by holding the debt instrument to maturity. However, it is important to note that the inverse is true as well, if interest rates decrease then the value of the debt instrument will increase and an investor could sell their holdings earlier at a premium to their cost basis. Thus, the management of interest rate risk now has three exit opportunities which are 1) price declines, sell at loss 2) price increases, sell at gain 3) do nothing, bonds mature and investors collects principal at that time. Having multiple options provides flexibility to investors.

Fees/Costs/Taxation

Trading costs and commissions from brokerage firms and exchanges can severely deteriorate the yield to maturity of many investments holdings. Many firms offer no-commission ETF transactions, which should be a consideration as to the investment vehicle utilized. Treasury Direct offers fee-less transactions and many of the ETF/Mutual Fund products do have an expense ratio. U.S. treasury securities are also state tax exempt which is obviously a positive aspect depending on state residency.

Conclusion

Effective personal cash flow management entails maintaining liquidity needs, decreasing risk, and optimizing returns through the strategic utilization of asset allocation. Integrating U.S. government securities and cash management principals can help optimize households financial stability. The four methods listed above for accessing more stable securities offer reward and risks but ultimately can help households achieve improved financial outcomes enabling their hard earned money to compound more effectively for them.

Read the full article here