Summary

On the heels of my recent ratings of MetLife (MET) and Prudential Financial (PRU), to round it off this month I am rating Aflac (NYSE:AFL), another stock in the larger financial sector, insurance subsector.

Today, Aflac gets a Hold /Neutral rating.

Its positives are having a healthy capital & liquidity position, revenue diversification, and benefiting from the macro environment of higher interest rates. Its negatives are it being modestly overvalued and overbought in terms of its current price.

Company Brief

Known for having a mascot of a cute duck, which some of us have got to know from watching all those Aflac TV commercials in the US with the talking duck, today we are deep diving into a somewhat less humorous topic, insurance!

Aflac, which is headquartered in Columbus Georgia and traces its roots to 1955, insures more than 50MM people worldwide, according to its Wikipedia page.

Their solutions span across several types of insurance including cancer insurance, short term disability, and life, among others.

For those that don’t know, the essential business model of an insurance company is taking in a lot more via insurance premiums from policyholders than have to be paid out in claims, and in the meantime “investing” the extra pile of cash into an asset portfolio that generates income from interest and dividends. It is one of the easiest business concepts to understand, in my opinion.

Rating Methodology

My approach to analysis is to find stocks trading cheaply but who otherwise have strong financial fundamentals.

To simplify things down to a straightforward methodology to rate a stock, for this one I will pose the following questions, and each yes answer is worth 20 points. A total score below 60 is a sell, a 60 is a hold, and above 60 is a buy.

- Is the stock suitable for dividend-income investors?

- Is there a value buying opportunity based on the price chart & valuations?

- Is revenue diversified across more than one source or business segment?

- Is the company in a healthy position in terms of capital & liquidity?

- Does the current macro environment with interest rates help this business?

There are Better Options for Dividend Yield

The first category I am rating is dividends.

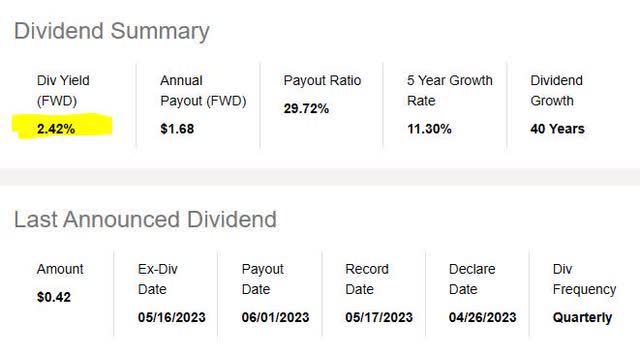

From dividend info on Seeking Alpha:

Aflac – dividend yield (Seeking Alpha)

I like their yield at 2.42% as of June 18th.

But is it competitive among peers? Let’s take a look.

MetLife‘s dividend yield is currently 3.75%, Prudential Financial‘s yield is at a whopping 5.75%, and Sun Life Financial (SLF) has a yield comes in currently at 4.22%. So among peers, Aflac’s yield is lower by a few percentage points.

In terms of growth, however, and stability, Aflac has proven that it can grow the dividend as well as make stable quarterly payments to return capital back to shareholders, something I value as an analyst.

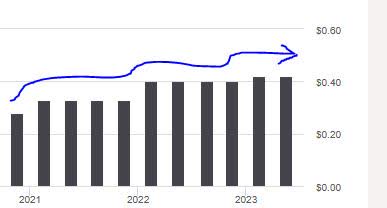

Aflac – dividend growth 5 years (Seeking Alpha)

Consider the above chart. Since 2021, Aflac has steadily grown its quarterly dividend, going from $0.33 per share in March 2021 to $0.42 per share as of June 2023. That’s a 27% increase in a few years.

Considering, however, that you can get a much higher yield by investing in any of Aflac’s peers mentioned, to get a more competitive yield I would go with those instead.

So the answer to this particular stock being suitable for dividend-income investors is No, not at this particular time, when you can get a better rate at its peers.

Not Great Opportunity for the Value Buyer Now

Let’s take a look at the price chart of this stock on Sunday June 18th, before Monday’s market open:

Aflac – June 18th price chart (StreetSmartEdge trading platform by Charles Schwab)

In the above price chart, we see the last Friday close was $69.43. I am tracking the 50-day simple moving average (blue solid line) vs the 200-day simple moving average (red solid line), and spotting lagging indicators of a bullish price trend (golden cross) or bearish price trend (death cross).

Currently, the stock is in a golden cross trend, trading well above both moving averages.

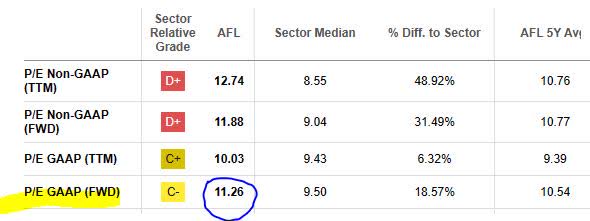

Next, let’s look at valuations such as forward P/E Ratio and forward P/B Ratio, taken from Seeking Alpha valuation data.

Aflac – forward P/E ratio (Seeking Alpha)

The current P/E I am tracking is 11.26. Although it is over 18% higher than the median for its sector, it remains below the S&P500 average of 14.93 for May 2023.

Aflac – P/B ratio (Seeking Alpha)

In terms of P/B, it is currently at 2.05. The benchmark I use is a P/B of 1.0, with anything over that heading into overvalued territory, below it being undervalued. In this case, the P/B shows overvaluation, and 108% higher than the median for its sector.

So although the P/E is modest, from the P/B and price chart itself I would say the answer to whether this stock currently presents a value buying opportunity is a No.

I would wait for its next dip and death cross formation before scooping it up somewhere in the $62 to $64 range, to add to an existing portfolio of diversified financial sector equities, and a lower price could present a more competitive dividend yield.

Revenue is Diversified

As an analyst, I look for companies that are not dependent on one revenue stream, geographic location, or single great idea.

Instead, consider the quarterly revenue of Aflac below, which shows diversification:

Aflac – quarterly revenue by category (Seeking Alpha)

It is a business model built on three income streams: collecting regular premiums and annuity payments from its thousands of policyholders, investing the extra cash into assets that generate interest and dividend income for Aflac, and also generating gains from selling some of those assets at market value.

This is true for most of its peers, as far as how an insurance company makes money.

As a component of the Fortune 500, and being on Fortune’s list of world’s most admired companies, I believe the “brand” strength should also be considered by investors and that brand’s ability to bring in new policyholders each year and the continuing premiums that it brings in.

To answer whether the company has diversified revenue, it is Yes.

Capital and Liquidity in Stable Position

Let’s talk about capital and liquidity and their importance to an insurance company staying afloat.

Setting a positive outlook for the year in his Q1 earnings comments, company CEO Daniel Amos stated:

As always, we are committed to prudent liquidity and capital management. We continue to generate strong investment results while remaining in a defensive position as we monitor evolving economic conditions. In addition, we have taken proactive steps in recent years to defend cash flow and deployable capital against a weakening yen. We treasure our track record of dividend growth, highlighted by 2022 marking the 40th consecutive year of dividend increases.

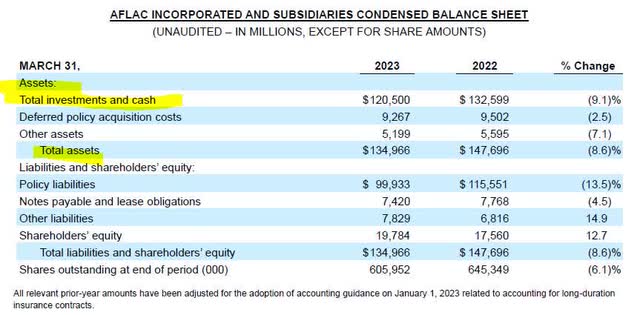

Consider the company’s balance sheet from Q1 results. The firm is literally sitting on $120.5B in total investments and cash, on the asset side, with just over $115B in total liabilities:

Aflac – balance sheet (Aflac)

Also logically speaking, because its biggest liability is having to pay out policyholder claims, and that only happens once a valid insurance claim is processed, this type of business is not subject to something like a “bank run” because depositors at a bank can ask for their money any time and have to be paid. Insurance policyholders only get paid under very specific conditions. One type of product insurance companies offer is an annuity.

Supporting my sentiment is a May 30th article in the Wall Street Journal highlighting how the run on banks did not apply to insurers:

Annuities are full of penalties for cashing out, deterring investors from seeking higher rates.

Marc Rowan, chief executive of Apollo Global Management, said that bank-run risk doesn’t impact the annuities industry because people use these investments to save for retirement.

So the answer to whether it is in a healthy capital & liquidity position, I think is Yes.

Favorable Macro Environment – Interest Rates

Two business models that usually benefit more than others from rising interest rates are banks and insurance, since a major component of their revenue comes from earning interest on assets. At the same time, when rates go up higher it makes the cost of borrowing higher for all other types of businesses that are not banks or insurance, as well as higher costs of borrowing for consumers too.

This category is subject to change, based on Fed decisions on rates going forward.

In their Q1 earnings comments in late April, they stated “adjusted net investment income increased 7.1% to $197MM, largely due to higher floating rate income.”

If their asset portfolio holds a floating rate bond, for instance, is linked to an interest rate index.

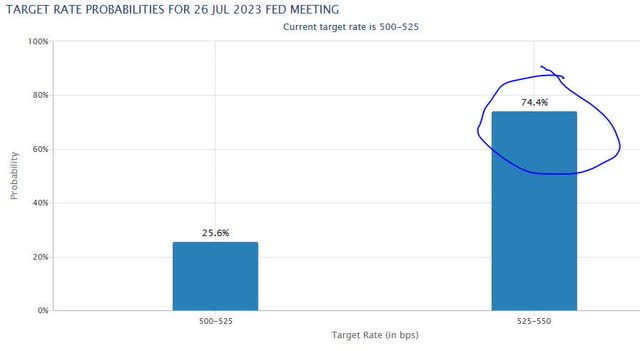

Since the Fed at its most recent meeting kept rates the same, and from a forward looking view the CME Fedwatch survey of rate traders shows a high probability of a rate increase at the July Fed meeting, I think this could continue to benefit Aflac, particularly the part of its asset portfolio benefiting from short term or variable rates.

CME Fedwatch – probability of another rate increase (CME Fedwatch)

Consider also that my argument is supported by the following from a July 2022 blog article by the Office of Financial Research, part of the US Treasury Department:

Modestly rising interest rates are generally positive for the insurance industry. When rates rise at a reasonable pace, portfolio yields also rise. With these new, higher-yielding corporate and other bond purchases, insurers’ investment earnings also increase. Life insurers, in particular, benefit from a rising interest rate environment as they’re likely to earn improved spreads over the cost of funding liabilities.

Therefore, yes the current macro environment for rates is in its favor, as with banks, another component of the larger financial sector.

Risks to my Outlook

My lukewarm and neutral sentiment about this stock could be impacted by a key risk facing insurers: the exposure of their investment portfolio to commercial real estate, and particularly the subcategory of office properties.

This has actually come up often in comments from my readers so it is vital to address here, specifically regarding Aflac, as it could have a negative impact going forward for this company, and therefore would make my current rating overly positive.

The following from the Q1 earnings commentary by Brad Dyslin, the company’s global chief investment officer, gives us some insight into the situation at the firm:

Like the rest of the industry, we are seeing pressure in the commercial real estate markets. Office properties are the current area of focus given the difficult market for office leasing. Office represents approximately 30% of our total $8.1 billion commercial mortgage loan portfolio with most of our exposure in our transitional real estate book. We currently expect approximately $500 million of loans to enter into some form of foreclosure, approximately 6% of our total mortgage holdings.

However, this is an existing risk already known at the end of Q1 results released a few months ago, so I believe the market has already priced in this risk and adapted to it, since it is a known one and no surprise by now, particularly since the dip after the earnings release… as shown in the price chart.. was followed by a rebound rather quickly and now the stock is trading above its 200 day SMA.

This risk, hence, could only be a “moderate” one at this time for a company of this scale, until we get further guidance in the next quarterly release coming up around the corner.

Conclusion

I reiterate my neutral/hold rating on this stock as Aflac is a reputable, established insurance brand with healthy capital & liquidity, diversified revenue, and a macro environment benefiting it due to higher interest rates.

At the same time, its valuation and current price are higher than I would like in order to give it a buy rating, and a much higher dividend yield can be gotten at several of its peers in the insurance segment.

The ongoing risk to insurers of asset exposure to commercial real estate has been addressed, and although it is a pertinent risk I think the market has already factored this in. It will require more analysis, particularly of management commentary in the next few quarterly results.

For now, I will keep an eye on the Aflac duck as it swims around in the insurance pond a little longer, before considering buying the duck!

Read the full article here