Investment Thesis

Waste Management (NYSE:WM) is, according to my calculation and also in historical comparison, at the moment slightly overvalued, but in the long term, an attractive buy. The company has been increasing revenues and EPS for decades, rewards the shareholder with buybacks and growing dividends, and is therefore also suitable for the upcoming years and possibly decades to be a stable anchor in a portfolio. In addition, there are further opportunities to increase efficiency through automation and an increased focus on the recycling business.

Trends & Comparison with peers

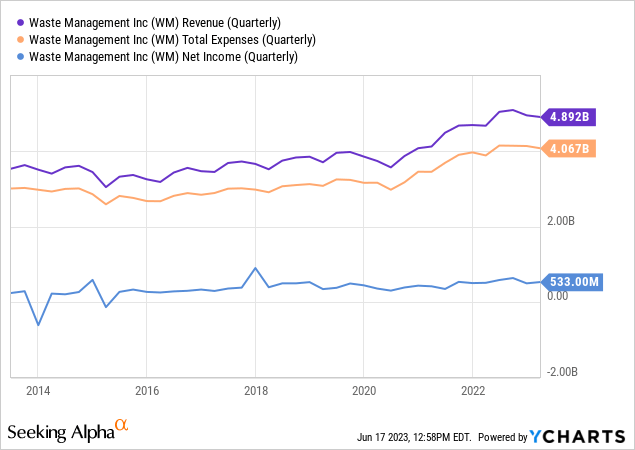

First, a short overview over a longer period for revenues, expenses, and net income.

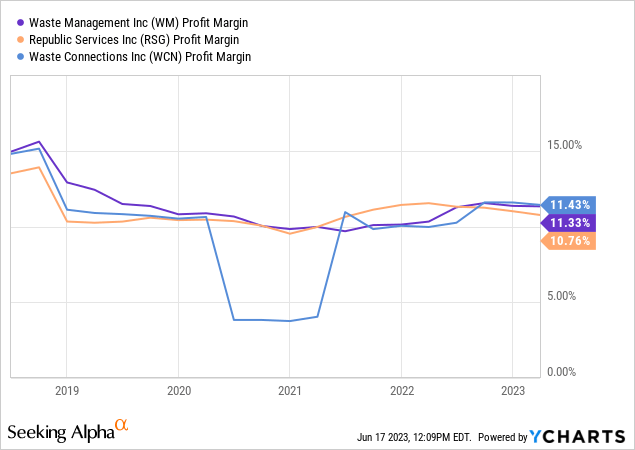

Please note that the figures below (except for the forward P/E ratio) are backward-looking, and past growth does not necessarily represent the next five years. It is noticeable that both RSG and WCN have a higher EBIT growth than revenue growth, but WM does not. This means that WM’s operating costs have increased more than its revenue, thus decreasing the EBIT margin.

| WM | RSG | WCN | |

| 5-year revenue growth rate | 6.4% | 5.7% | 9% |

| 5-year EBIT growth rate | 5.2% | 8% | 9.8% |

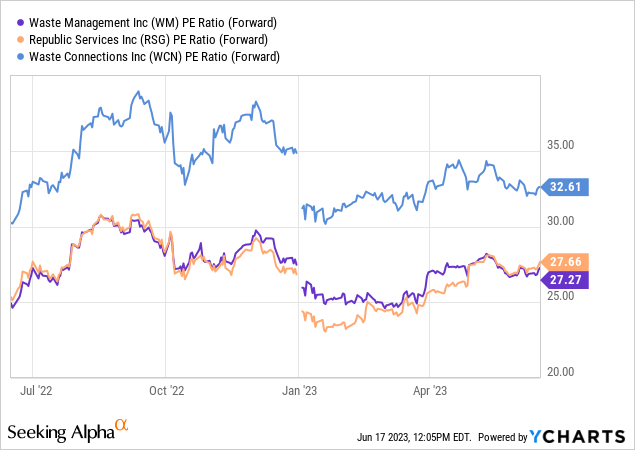

Given this moderate growth, none of the three companies can be described as cheaply valued.

All three companies’ profit margins decreased during the pandemic and recently stabilized or increased slightly. This is probably due to the fact that less industrial activity has resulted in less waste and, therefore, lower capacity utilization.

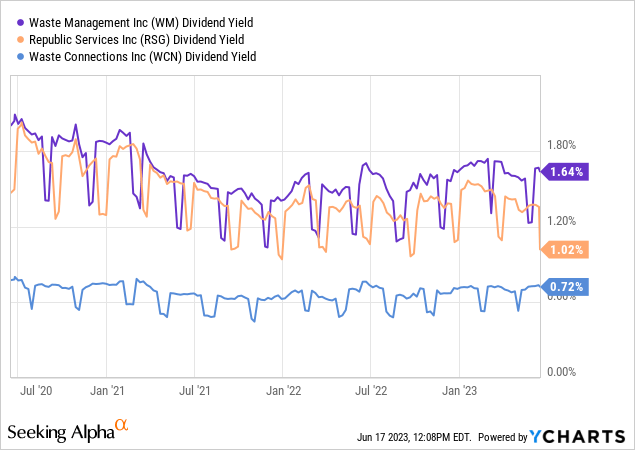

And one more comparison of the dividend.

Overall, it seems that the market is pricing the three companies quite accurately in relation to each other: WCN has grown the fastest in the last five years but also has the highest P/E ratio. In terms of margins, all three companies operate pretty similarly. WM has the highest dividend but also the highest payout ratio at 47%.

Growth opportunities

Even in the current political and social environment, with the transition to renewable energies and electric cars, much waste will continue to be produced. However, the focus and, thus, the opportunities for Waste Management may change. Some growth opportunities are:

- additional RNG facilities

- more focus on recycling

- Higher efficiency and margins through automation

Additional RNG facilities

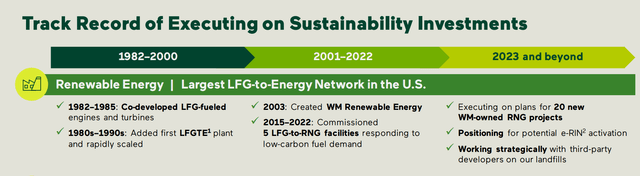

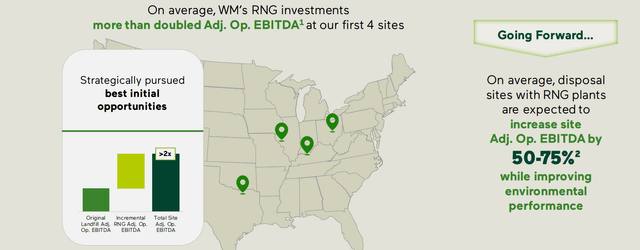

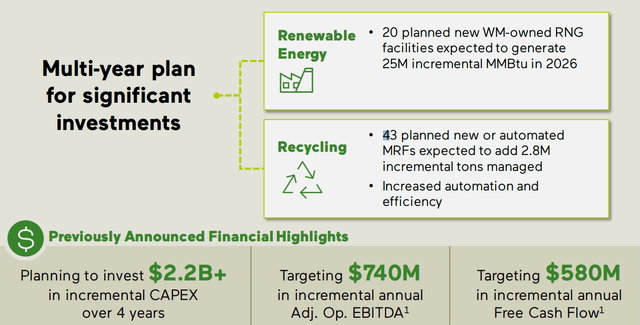

From 2001 to 2022, the company built 5 LFG-to-RNG plants (landfill gas to renewable natural gas). RNG is produced by anaerobic digestion, which decomposes organic matter in the absence of oxygen to produce methane gas. The methane gas can then be purified and used as a substitute for conventional natural gas. Twenty more such plants will be built starting in 2023.

Investor presentation

These RNG plants expand existing landfill sites and increase their environmental and economic benefits. RNG production is expected to grow from 3M to 28M MMBtu (2021-2026).

Investor presentation

More focus on recycling

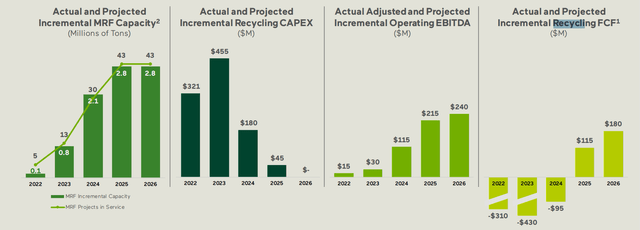

Whether plastic, paper, glass, or metals. Recycling is enormously important, and in the past decades, mankind has probably done too little for it. In a perfect world, all waste would be recycled. That would be better for people, animals, groundwater, and raw material use. That is why the company is planning significant expansions and new facilities in this area. MRFs stand for Material Recovery Facilities.

Investor presentation

The recycling business is currently being expanded and massively ramped up. Including the necessary CAPEX means the business will only generate free cash flow from 2025. Although the company does not provide any information beyond 2026, it is fair to say that these plants will be in operation for years and decades.

Investor presentation

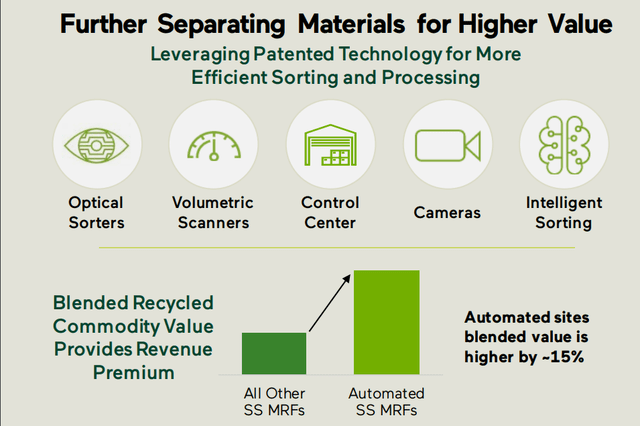

Higher efficiency and margins through automation

Better margins through fewer personnel due to automation is an ongoing process that will not have a fixed start and end date. At this point, the company should benefit from advances in the seemingly far-away tech industry: machine learning, artificial intelligence, and robotics. Efficiency improvement methods could be used in various areas, from waste sorting to autonomous driving. The possibilities are numerous; check out this TrashBot smart trash can or this beach cleanup method. Even if WM does not use such niche products, the collected waste could end up on their sites.

Investor presentation

Automated equipment has ability to process material at faster rates than ever before, processing 30-40% more tons than non-automated MRFs utilizing similar footprint. Our Chicago MRF, one of the largest facilities in North America, can process 66 tons per hour, more than double the average throughput of non-automated MRFs.

Investor Day (page 45)

Valuation

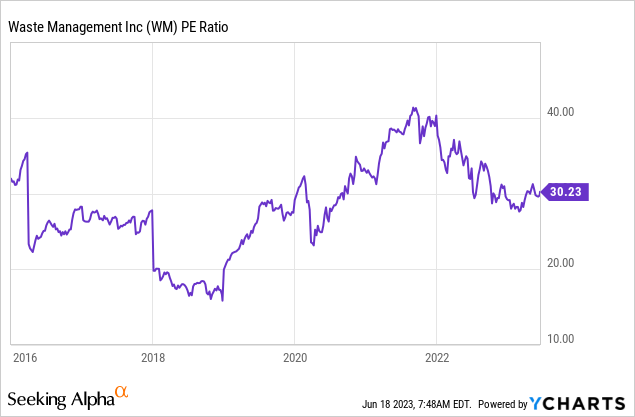

This all sounds very good. But what about the valuation, and what can investors expect for the next years? This question is not easy to answer as it depends very much on what future P/E valuation the company will get attributed by the market. Let us look at the history.

So the current valuation is relatively high, but the stock rarely traded below a P/E ratio of 20. Analysts assume about 10% annual EPS growth for the next few years. This is not only due to revenue growth but also due to buybacks. So the number could be realistic, especially if the company improves its margins.

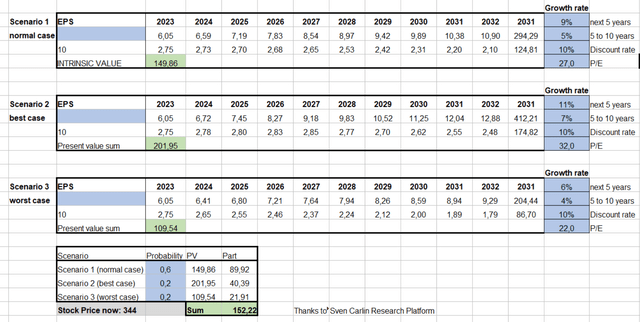

However, it is possible to weigh different scenarios against each other in a discounted cash flow table. This scenario is divided into a normal case, a best case, and a worst case. For this company’s business model, all 3 cases are not too far apart; the biggest difference is the attributed P/E. The normal case is weighted with 60% probability, and the other two cases with 20% each. The result is a fair value of $152. This would mean the company is currently just about 9% overvalued.

author

Risks

WM also faces several potential challenges. First, the company operates in a regulated environment, which means that the government could enact new laws at any time that would directly or indirectly affect the company’s business. An indirect impact on the consumer (additional taxes on plastic, for example) could reduce the general volume of waste generated by the population. However, we know that waste reduction is the goal anyway. Nothing happens overnight, but rather in the time frame of decades.

The company could face other challenges, such as not finding enough qualified workers and drivers. Overall, the risks here are not too great from my point of view, as the company’s services are essential for the functioning of society.

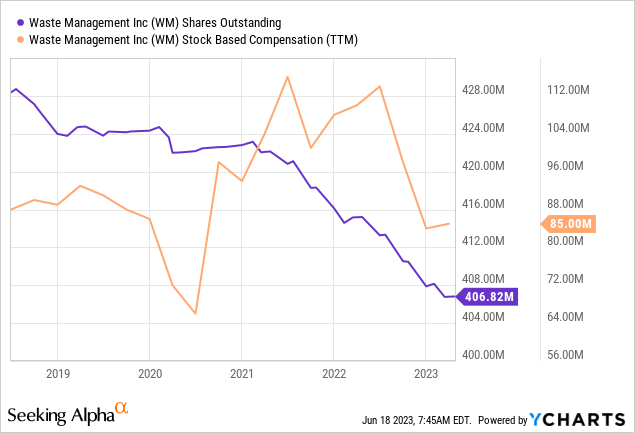

Share dilution, insider trades & SBCs

For me, these three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can put us, shareholders, at a disadvantage. In addition, insider trades sometimes contain valuable info about the confidence of management itself.

All in all, this area looks good: outstanding shares are falling, SBCs are not that high, and there has been insider selling but rather low as well.

Conclusion

I like a balanced portfolio with some safe havens and some growth stocks with higher risk. For the former, WM is an ideal candidate for all the reasons mentioned. A long-term buy and hold from my current perspective.

| Investor’s Checklist | Check | Description |

|---|---|---|

| Rising revenues? | Yes | Increasing over longer time periods |

| Improving margins? | Yes | Possible competitive edge |

| PEG ratio below one? | No | PEG ratio below one may suggest undervaluation |

| Sufficient cash reserves? | Yes | Vital for the survival & growth especially of unprofitable companies |

| Rewards shareholders? | Yes | Returning capital to shareholders |

| Shareholder negatives? | No | Actions that disadvantage shareholders |

| Stock in uptrend? | Yes | Trading above its 200-day moving average? |

Read the full article here