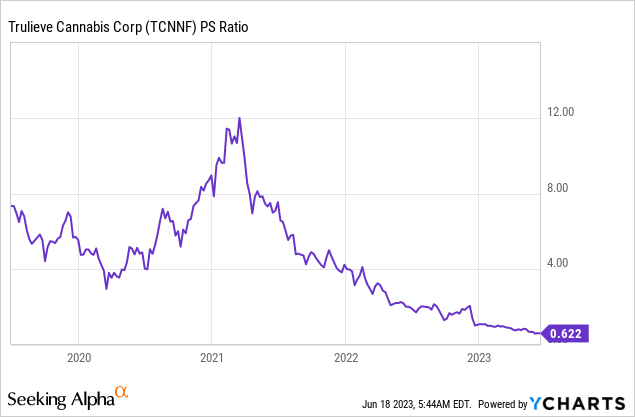

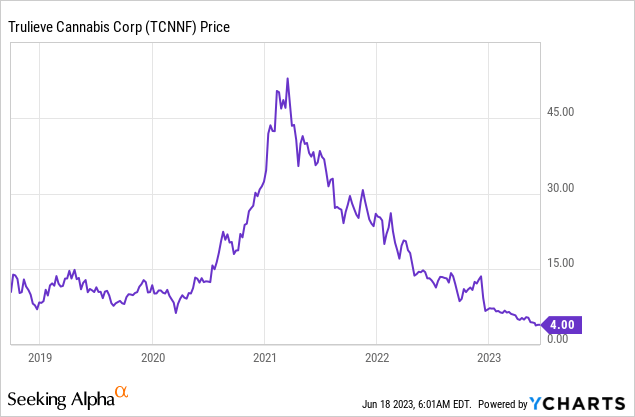

Trulieve (OTCQX:TCNNF) is down 40% since I last covered the company earlier this year. The catalysts for the decline are still pertinent but the bearishness has likely gone too far. Trulieve’s current market at $743 million now masks its status as the second largest US multi-state operator in a market that is forecast to grow to $71 billion in sales by 2030. This forecast, put out by cannabis analytics firm New Frontier Data, is without any legalization at the federal level. Trulieve is now swapping hands at a 0.62x trailing 12-month revenue multiple. This key measure of market sentiment has been inverted on the back of a Fed funds rate hiked and then paused at its highest level since 2008. Critically, it captures just 6.2% of Trulieve’s 5-year average market sentiment when the company swapped hands at a 6.41x trailing 12-month revenue multiple.

Trulieve went public a month before Canada’s October 17, 2018 legalization date and has since meandered through periods of extreme euphoria and fear. The current stretch has become the deepest and most extended in the company’s history as a public company with the common shares down 70% over the last year. To be clear, Trulieve has never traded as low as it’s currently swapping hands for against a cannabis market forecasted to grow markedly through to the end of the decade.

Trulieve Attempts To Reduce Its Cost Base

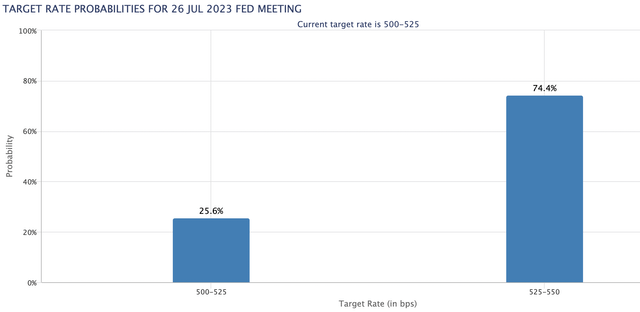

The extent of the decline is even more staggering against what was a positive operating cash flow of $400,000 generated during the company’s fiscal 2023 first quarter. This comes as the broader market appetite for risk is likely set to increase on the back of the Fed’s June interest rate pause. We’ve already seen greater positive volatility for a number of tickers in previously out-of-favor sectors like green energy. The thesis here is that there is a lagging effect for this and higher quality tickers in cannabis are likely to see greater positive volatility if the Fed was to follow up with another pause at its July 26th FOMC meeting. However, the market is currently pricing a 74.4% chance that the Fed actually hikes rates by 25 basis points. This would form a key risk to the risk appetite expansion thesis and would mean a continuation of current valuation headwinds.

CME FedWatch Tool

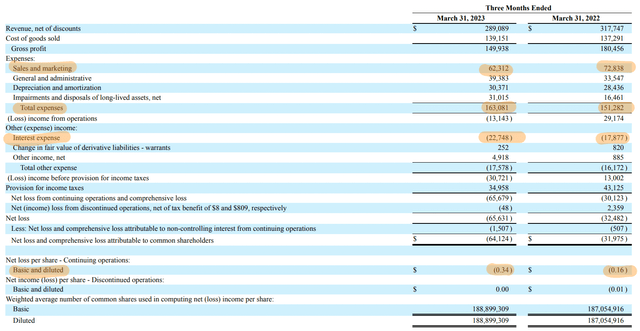

Trulieve generated revenue of $289 million during its first quarter, a 9.2% decline over its year-ago comp and a miss by $4.44 million on consensus estimates. However, whilst it was disappointing that the company underperformed on consensus, the core takeaway from the earnings report was what progress was made to reduce operating expenses and enhance core profitability.

Trulieve Cannabis Fiscal 2023 First Quarter Form 10-Q

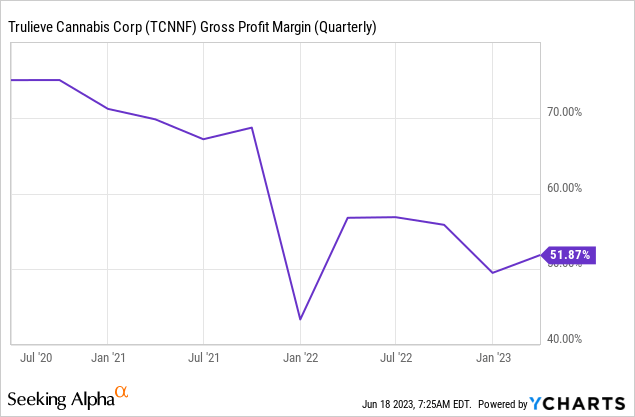

Trulieve’s gross profit margins increased 200 basis points sequentially to 51.87% during the first quarter. However, it was still far below the company’s year-ago gross profit margins. The Tallahassee, Florida-based company managed to reduce its sales and marketing spend by $10.5 million year-over-year to $62.3 million. Total operating expenses for the quarter actually rose to $163.1 million from $151.28 million in the year-ago period.

The company’s total debt pile of $1.03 billion as of the end of the first quarter drove a near-record quarterly interest expense of $22.7 million. This large debt position will continue to form a material headwind to any plans to enhance end profitability but offset by cash and equivalents, including restricted cash, of $195.3 million. Net loss per share of $0.34 increased by 18 cents over the year-ago comp.

Have We Hit The Floor?

But in many ways the earnings were retrospective. Getting excess costs out of business operations is a gradual process and Trulieve just got started on this process. The company shutting its dispensary in Grover Beach, California, and is exiting Massachusetts entirely with the closure of three dispensaries. CEO Kim Rivers was upbeat during the earnings call stating that Trulieve was able to deliver a $24 million reduction in SG&A expense over the fourth quarter to help the company record adjusted EBITDA of $78 million, a roughly 27% margin.

The whole point of investing is to own a stake in a company able to grow its worth over the period of your investment and Trulieve whilst maintaining its more than 180 retail store footprint and 4 million square feet of cultivation and processing capacity is still expanding even as it consolidates certain sites. The company started selling medical cannabis in Georgia with the opening of two dispensaries and also become the first MSO to launch an advertising campaign on Twitter. Crucially, Trulieve expects to generate positive free cash flow in 2023, a position that would place its balance sheet on better footing and possibly aggregate with an improvement of market appetite for risk to boost its share price. The bears may have been right so far, but I think the pendulum might be about to swing toward the bulls.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here