Introduction

Shares of Shift Technologies (NASDAQ:SFT) have risen 31% YTD. Despite the fact that the company’s shares are trading extremely low by multiples, I believe that now is not the best time to go long.

Investment thesis

Shift is a classic example of a growth company, where investors first of all pay attention not to current financial results, but to possible financial results in the future. At the moment, I would like to focus on the specific drivers and risks that are associated directly with the company, and not on the general market sentiment regarding growth companies. In my personal opinion, it is still not worth making a purchase decision based on a low valuation of the company, as the used car market is still under pressure, based on the operating results of the company, we see both a decrease in sales volumes and a decrease in selling prices, then how business scale growth is one of the key factors of the business model to achieve economies of scale. In addition, there is no clarity on the company’s strategic changes that management announced during the Earnings Call following the Q1 2023 reporting. In addition, the change of the CEO of the company does not add clarity either regarding the future prospects and strategy.

Company overview

Shift is a retailer of used cars. The company uses its own online business platform, where users can not only choose a car, but also receive additional services such as financing from Shift partners. The company was founded in 2013 and operates in the US market.

1Q 2023 Earnings Review

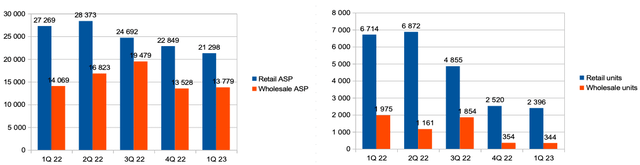

The company reported better than investors expected, however, in my opinion, the overall results still look weak. The company’s revenue decreased by 73.7% YoY and reached $58 million. The main reason for the decrease in revenue is the decrease in the volume of cars sold, which decreased by 68.5% YoY, while the average price decreased by 22% YoY in the retail segment and by 2.1% in the wholesale segment.

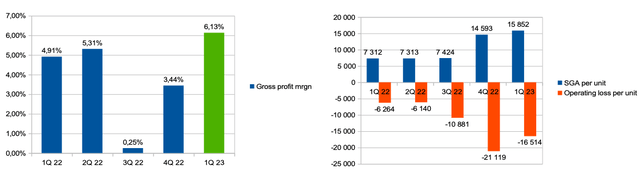

Despite the fact that the company managed to demonstrate an improvement in the gross margin, which increased from 4.9% in Q1 2022 to 6.1% in Q1 2023, operating loss (% of revenue) increased from 25% in Q1 2022 to 78% in Q1 2023 due to an increase in SGA expenses (% of revenue) from 29% in Q1 2022 to 75% in Q1 2023 due to a significant decrease in business volumes and reduced economies of scale , since part of the operating expenses for marketing, personnel and rent are fixed.

Volume & ASP (Company’s information)

We see a positive change in the gross margin in 1Q 2023 in line with the company’s previously announced plans, however, the decline in business volumes continues to have a negative impact on the unit economy. We see continued growth in SGA costs per car due to the extreme decline in the volume of cars sold, and we also see significant losses at the level of operating loss per car sold.

Gross margin & Unit economy (Company’s information)

I would like to specifically note that during the Earning Call after the publication of the 1Q 2023 financials, management decided not to hold a Q&A session, due to the fact that the company is currently in the process of adjusting the strategy. On the one hand, a change in strategy and the search for new points of growth can be a positive factor, however, on the other hand, I am concerned that the unwillingness of management to disclose details may indicate the adoption of some unpopular decision, for example, dilution of shares, or lack of clear plans. At the moment, I consider the change in strategy as an additional risk, and not as a potential driver of quotes. I may change my mind when the company releases details.

My expectations

At the moment, it is very difficult to make assumptions about the company’s future operating and financial results, as management has explicitly announced plans to change the strategy, and there is also uncertainty regarding debt restructuring. In my personal opinion, there is a high risk that the company may not be able to achieve operating profitability levels, or management may push the deadline for achieving positive operating income from 2024 to a later date. I am biased on the fact of plans to change the strategy and the current results of the economy unit.

We see that a significant improvement in the unit economy is possible only with the growth of business scale, when the company has the opportunity to reduce fixed operating costs as a result of the leverage effect. However, current market trends indicate that both used car market volumes and average selling prices are under pressure.

Risks

Market trends: pressures on consumer spending are driving both the decline in used car sales and the average car price, putting pressure on both business growth and commissions.

Strategy: announcing plans to adjust strategy but not providing clear plans and details on the Earning Call after Q1 2022 results is, in my personal opinion, an additional risk at the moment because it could be a decision to dilute current shareholders or changing plans to achieve operating break-even

Competition: the company operates in a market where there are both already larger players and a high level of competition, I believe that the active actions and marketing activity of other players can have a negative impact on the growth of the company’s revenue and, therefore, on the ability to reach the break-even point in the future.

Others: I would also like to add the lack of clarity on debt restructuring and the possible risk of diluting existing shareholders. At the moment, the company’s balance sheet is about $59 million, however, we cannot know how the details of the strategy may change and in what year the company will be able to achieve operating break-even.

Drivers

Margin: increasing market share and increasing economies of scale can help improve the unit economy and speed up the process of achieving operating break-even, because growth in business volumes will have a favorable effect on the leverage of marketing and personnel costs. In addition, the company demonstrated a willingness to optimize costs when it cut staff by around 30%.

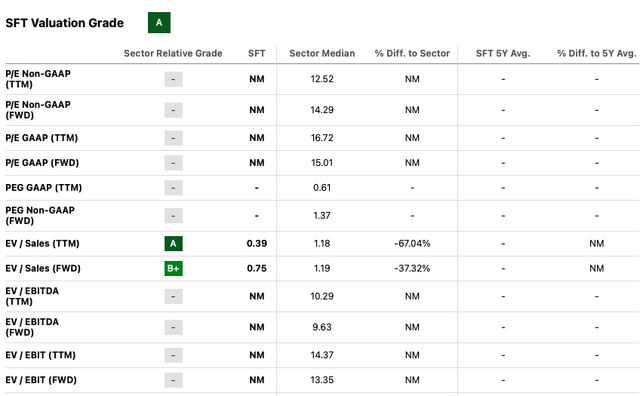

Valuation

At the moment, the company’s shares are valued extremely low in accordance with the multiples, but this is not enough to make an investment decision. I believe that investors are imposing high risks of potential business failure or significant dilution of current shareholders’ stakes in order to raise additional capital. In addition, the vast majority of multiples simply cannot be calculated due to negative earnings, even at the EBITDA level.

Valuation (SA)

Conclusion

At the moment I am holding a HOLD recommendation for the company’s shares based solely on the extremely low valuation, if the valuation were higher I would recommend selling the company’s shares. I believe that the risk of bankruptcy over the next few quarters is low, as the company still has about $59 million on its balance sheet, and the current cash burn allows the company to operate in the near future. However, at the moment, I don’t see a clear strategy for management to grow the business and reduce operating costs to break even. Earlier, management said that it plans to achieve a breakeven in 2024, however, according to the results of the 1st quarter of 2023, plans were announced to adjust the strategy, but no clear details were announced.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here