Investment Summary

ProFrac Holding Corp. (NASDAQ:ACDC) is a renowned player in the oil and gas sector, focusing on hydraulic fracturing services. Their expertise lies in utilizing advanced technologies and techniques to optimize well productivity and maximize the recovery of hydrocarbons.

The first quarter of the year did highlight the company’s ability to grow revenues at a strong rate, but the profitability of the business sharply declined, blamed on the long-term strategy the company is setting in place which will cause some inconsistencies in profitability in the beginning. But with strong tailwinds for the industry, as demand for LNG increasing and the strong portfolio ACDC has makes they are able to tap into many areas of the industry to grow their revenues. With a very low p/e right now and the company expecting profitability to get back on track, I am confident in rating them a buy right now.

Materials Pull-Through Creates A Tailwind

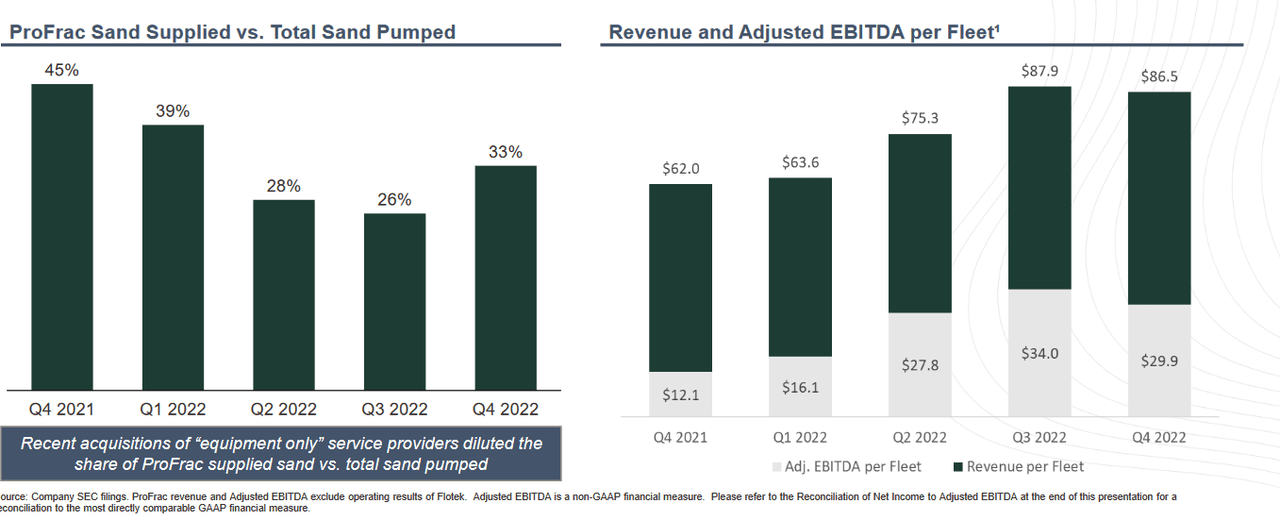

In 2022 ACDC supplied only 30% of the sand pumped by its fleet but in the first quarter of 2023 that number jumped up to 38% instead, which highlights the potential for further profitability by the company and that they run a robust business that can leverage and outperform the market.

Company Volumes (Investor Presentation)

ACDC has also over the last years been able to steadily increase the revenue per fleet much thanks to ACDC maintaining a minimum amount of long-term contracts which makes them more flexible to pick and choose the most profitable places where they can operate. With the growth of its revenues per fleet, ACDC is making large moves to help facilitate this growth as they add more and more acquisitions to its portfolio. The completed acquisition of REV Energy Holdings helped add an additional 6 frac fleets which ACDC paid $140 million for. As mentioned, the coming quarters should bring better profitability for the business so it will be key to watch the impact these acquisitions are having on the earnings.

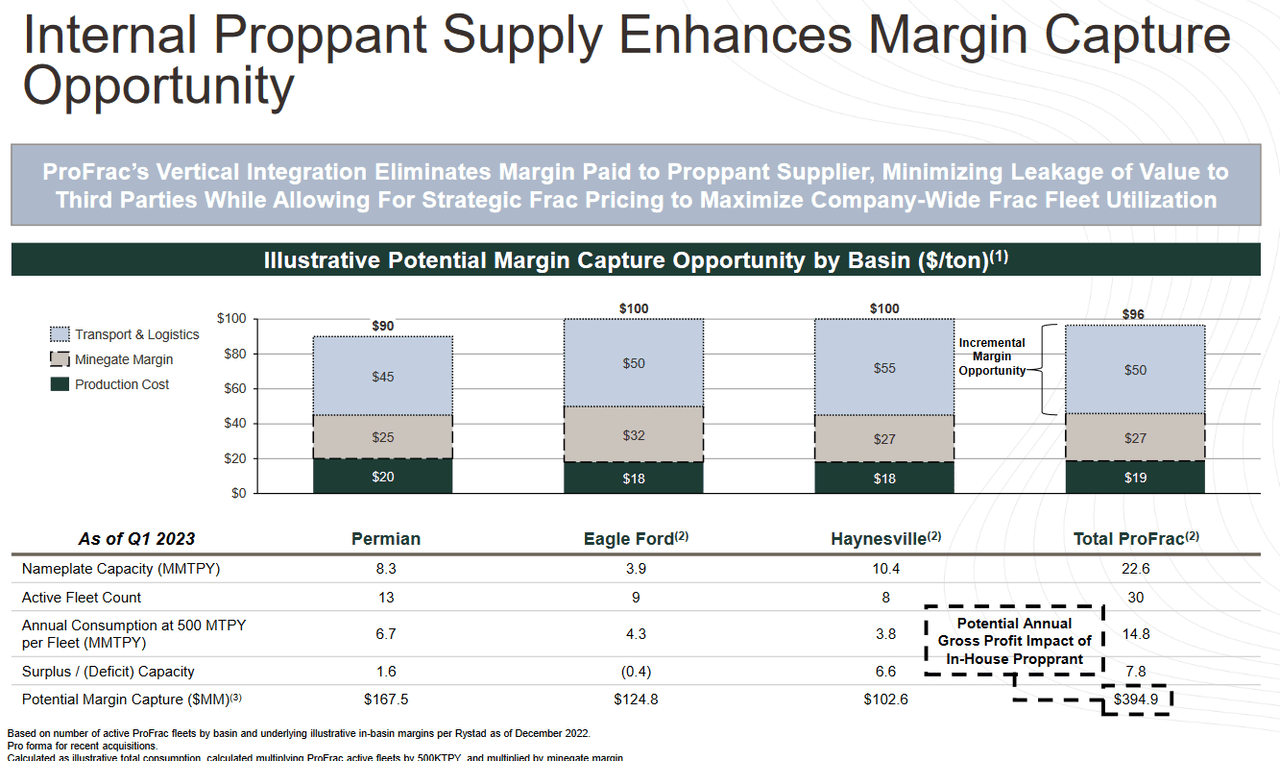

Market Opportunity (Investor Presentation)

One major move that could impact the margins in a positive way would be if ACDC is able to properly implement its vertical integration plan in its proppant segment. This would help eliminate some of the margins the company is paying suppliers which in the long-term will bring a stronger margin expansion and stability to their business. The reduced capital spend by ACDC will help bring down costs and if there is a clear improvement in the margins as a result I think a higher valuation of the company will follow too.

Since its IPO ACDC has created a lot of value for shareholders and built its portfolio through M&A, which amounts to $1.4 billion. The strategy of acquiring older fleets and then retiring them to then replacing them with new ones is proving to be a solid long-term plan it has helped ACDC generate solid levered FCF in the last 12 months. A good indication of the potential for the company will be a solid increase in the avg. active fleets the company has. This should help provide a clearer image as to where the company is heading, a steady upwards climb should translate into growing revenues and earnings if demand persists.

Risks

The primary risks I see facing investors right now interested in ACDC would be that shares have at quite an alarming rate been diluted. Sitting at 54 million outstanding currently, up from 44 million in 2022. I think this amount of dilution helps contribute to the lower multiple that ACDC currently is receiving. With the solid margins the business has and the sheer capital they are spending on acquisitions you’d think that ACDC be more optimistically valued at around 10 – 12x forward earnings.

Unfortunately, I don’t think there will be a major shift upward in the valuation until there are clear signs that ACDC is stopping its dilution of shares soon. What could further contribute to the lower multiple is if ACDC isn’t able to grow its margins efficiently. Looking at the last earnings report by the company, the cost of revenues grew twice as fast as the actual revenues at 14%. These increased expenses ensured that Q1 2023 had a yearly decline in operating income. But I think the measures ACDC is taking to cutting down on costs will prove efficient in the coming reports for the year.

Financials

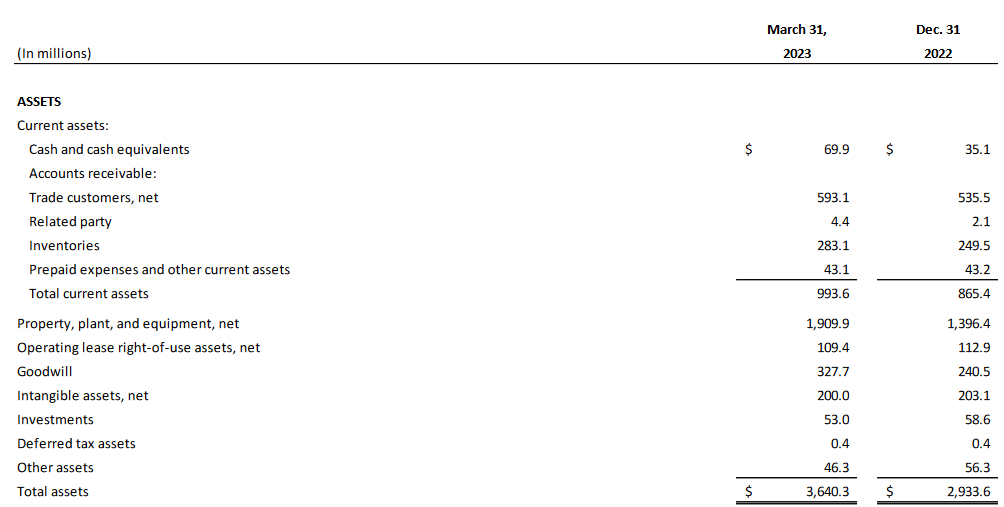

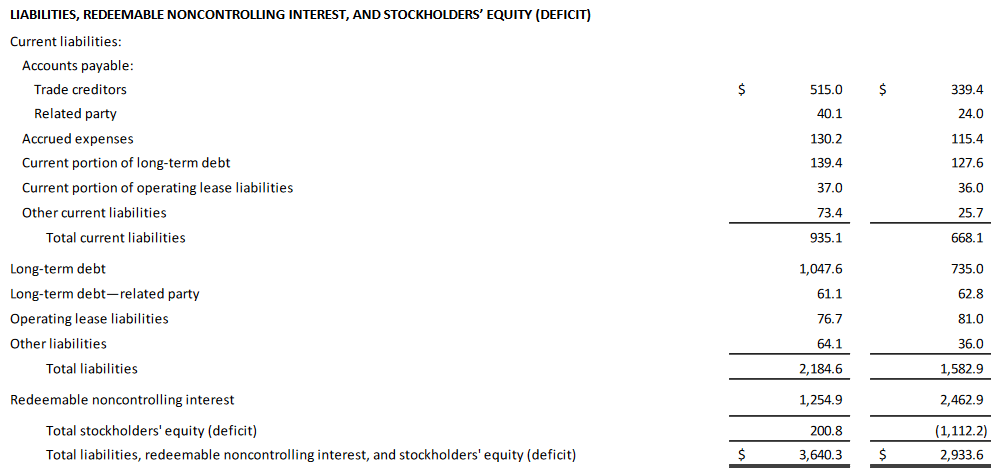

Just quickly looking at the balance sheet for ACDC it’s clear they have been able to quickly grow their assets on just a QoQ basis. It went from just under $3 billion to $3.6 billion, many thanks to the acquisitions the company is doing, which right now I think are quickly paying off and making the company a steadily more intriguing investment. The acquisitions helped increase the property, plant, and equipment part of the balance sheet, which is where the majority of the asset growth was had. But the cash position also saw a slight increase, now sitting at $69 million.

Assets (Q1 Report) Liabilities (Q1 Report)

Unfortunately, the increase in cash does little to make the debt/cash ratio decrease, it’s still sitting very high at around 14 right now. I would prefer the company to have a stronger cash position to make for a less leveraged balance sheet and solidify its financial state further. Thankfully the net debt/EBITDA sits quite low at 1.45, and with the margin expansion, the management sees this metric should go down further.

With that said, I think looking at the cash flow improvements for the business will be key in the coming quarters. This will help them build up a strong cash position which they can continuously tap into to make acquisitions just like they have since its IPO.

Valuation & Wrap Up

Right now I think that ACDC stock sits at a very low risk/reward multiple of just under 5. The market they are in is continually growing and I don’t see them being out of business because of renewables being on the rise. The oil and gas industry will remain robust as they represent the majority of our energy generation.

Stock Chart (Seeking Alpha)

With ACDC able to make significant acquisitions since its IPO they have grown their assets at a fast rate and solidified their position in several regions. They prioritize a flexible business model where they are selective with their contracts and keep a minimal amount of long-term ones to enable them to move with the industry and trends more efficiently. With expectations by the management of margin expansion, I am confident that ACDC will over the long term bring a lot of value to shareholders. The current price is fair to pay and I am rating ACDC stock a buy as a result of it.

Read the full article here