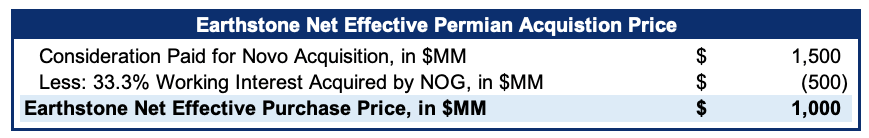

The oil and gas M&A boom is in full swing, with Earthstone Energy (NYSE:ESTE) recently having announced it was acquiring Novo Oil & Gas Holdings LLC, a Delaware operator backed by private equity firm Encap, for $1.5B. Northern Oil and Gas (NOG) is acquiring a 33% working interest in the asset for $500MM, resulting in a net effective purchase price of $1B for Earthstone, as can be seen below:

Bison Analysis

This transaction was relatively straightforward compared to other recent oil and gas transactions we’ve covered. For instance, Callon Petroleum’s (CPE) purchase of Percussion Petroleum assets included the assumption of contingent payments and liabilities, while Ovintiv’s (OVV) acquisition of Encap Permian assets involved the simultaneous sale of Bakken assets at a significantly below-market price. Both these transactions implied much higher purchase prices than were initially disclosed, and material upside for nearby Vital Energy (NYSE:VTLE).

Earthstone Acquisition and Implications

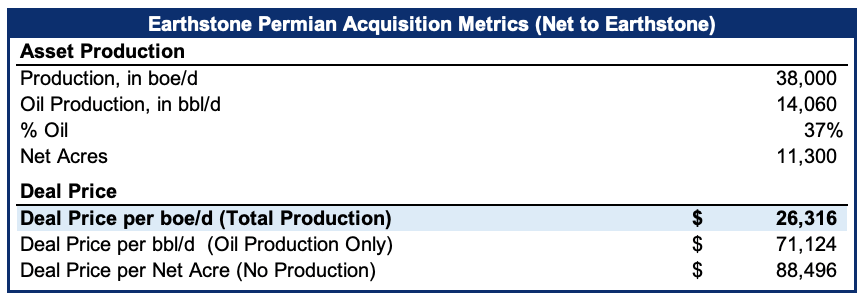

Earthstone disclosed having bought 38,000 boe/d of production with 37% oil, net of the production attributable to Northern Oil & Gas. It is also assuming significant inventory, including 11,300 net acres, 21 drilled uncompleted wells, and 200 gross drilling locations. These production metrics imply a deal price of $26,316/boe/d:

Bison Analysis

Earthstone undeniably got a good deal for these assets, with this deal price coming in on the low end of recent transactions in the Permian. For instance, we estimate the deal prices for the Ovintiv and Callon transactions were closer to $65,000 and $43,000 per boe/d, respectively. Earthstone is also claiming they are getting significant high-return inventory with an average break-even price of $40/bbl, with significant undeveloped acreage, significantly improving the overall production profile of its assets.

Implications for Vital Energy

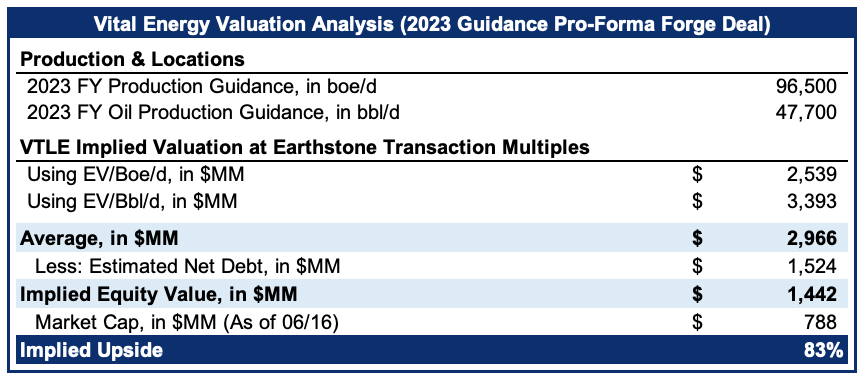

Remarkably, even this modestly-priced transaction price implies a significant upside for Vital Energy. It is worth noting that Vital recently acquired Delaware assets from Forge Energy for $378MM, expanding its footprint into the Delaware basin and significantly increasing its production profile for 2023:

Bison Analysis

As can be seen above, we estimate that this most recent transaction implies 83% upside for Vital’s assets in a similar deal, despite this lower deal price. In our view, this is reflective of an extremely steep valuation discount for Vital that continues to be priced in by public markets. As U.S E&Ps in the Permian and elsewhere continue to consolidate to take advantage of persistent market valuation dislocations, Vital may benefit significantly.

Read the full article here