Investment thesis

Our current investment thesis is:

- IDEXX growth and margins are highly attractive, with no real financial downsides.

- Commercially, IDEXX has transitioned toward higher growth/margin areas while creating greater certainty by improving its recurring revenue.

- The industry as a whole is attractive because it is defensive in nature on the downside while showing the characteristics of long-term growth.

- The long issue is the share price, which prices in perfection. As much as we like the business, no company is perfect.

Company description

IDEXX Laboratories (NASDAQ:IDXX) is a global company that develops, manufactures, and distributes products for veterinary, livestock, poultry, dairy, and water testing markets.

The company operates through three segments:

- Companion Animal Group

- Water Quality Products, and Livestock

- Poultry and Dairy

Its products include point-of-care veterinary diagnostic products, veterinary reference laboratory diagnostic and consulting services, health monitoring and laboratory animal diagnostic instruments, and services for the biomedical research community, among others.

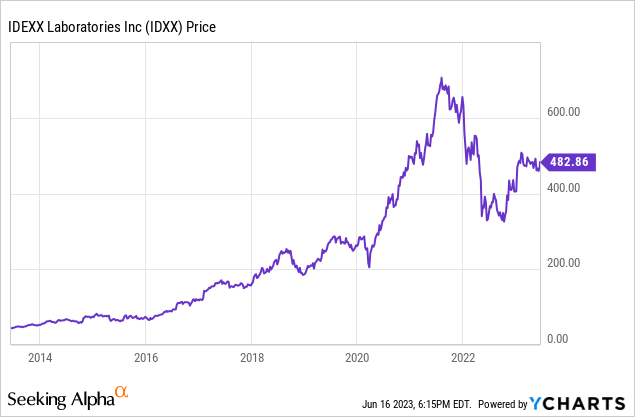

Share price

IDEXX has been one of the top-performing stocks of the decade, returning over 900% to shareholders. The company has grown rapidly, building a leading market offering.

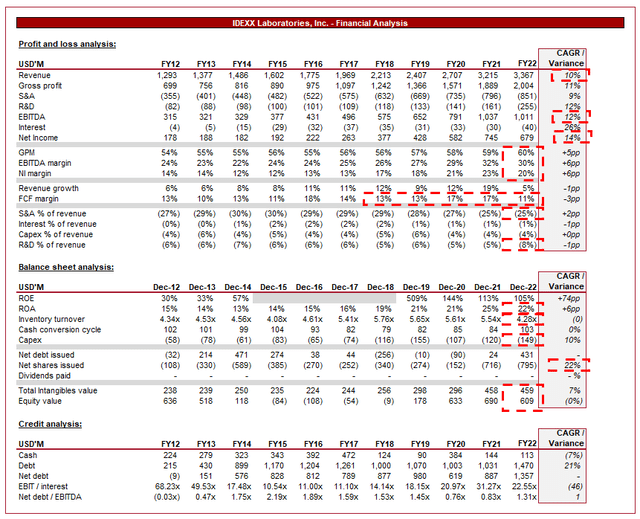

Financial analysis

IDEXX financials (Tikr Terminal)

Presented above is IDEXX’s financial performance for the last 10 years. The financial performance of the business has been fantastic, with little in the way of a downside.

Revenue

Revenue has grown at a CAGR of 10%, with not a single period of growth below 5%. This level of consistency is fantastic for a business that is not a traditional growth business.

The key for IDEXX which underpins the revenue analysis we will conduct is the increasing use of technology in veterinary medicine. IDEXX has been at the forefront of this trend, with the development of its diagnostic tests and software solutions that are designed to provide accurate diagnosis at clinical visits. Similar to the rest of society, this technological trend will only continue.

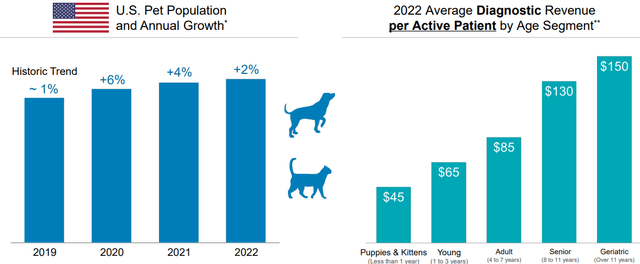

One of the obvious revenue drivers has been an increase in the number of household pets. The growth in pets has remained consistent, with an increasing number during the lockdown period, as consumers were spending a greater amount of time indoors. As pet ownership continues to rise, more pet owners are seeking high-quality healthcare services for their pets. The value for IDEXX is accretive over time, as the older the pet gets, the greater amount of support is required. This is illustrated in the second graph below, with revenue almost double for a geriatric pet compared to puppies/kittens.

Pet data (IDEXX)

For this reason, the increase as a result of Covid could provide a material bump to the business in the coming decade.

In conjunction with this point, the change in demographics could be a tailwind for the business. As the current population ages, there is growing demand for healthcare services for older pets. IDEXX is well positioned to benefit from this trend (beyond the increased revenue potential as the above illustrates), as its diagnostic services become increasingly important.

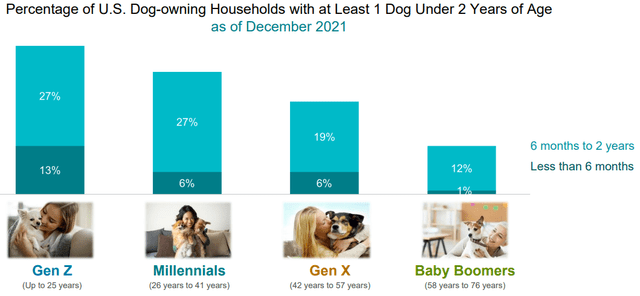

Further, there is scope for this growth rate to improve as the younger generation has the largest proportion of dog ownership. A portion of this is likely situational, as the older generation is less likely to have the ability to support a pet, but nevertheless, we are seeing a bottom-heavy distribution which is the key.

Dog ownership (Latest data) (IDEXX)

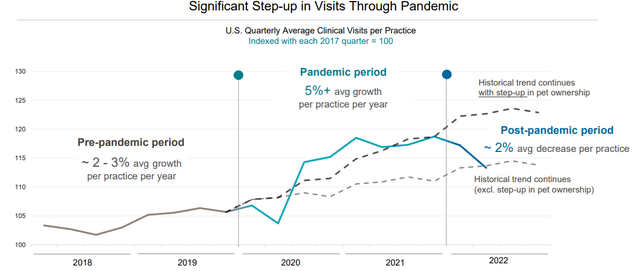

Another key revenue contributor is the use of clinical visits and veterinary services. Consumers are increasingly treating their pet’s health similarly to humans, becoming more aware of the importance of regular check-ups and preventative care for their pets. This comes with a greater understanding of animal anatomy, allowing for the improvement in the ability to provide health services. As the following graph shows, the growth rate of additional services has continually grown, with Covid-19 distorting the trend. We expect that this will continue to increase.

Clinical visit growth (IDEXX)

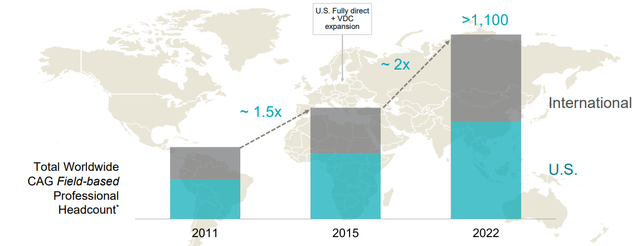

IDEXX has supported this growth by expanding its global footprint, both in personnel and instrument installations. This is key as demand will only increase if the infrastructure is in place to support it. With this in mind, the investment in the expansion will always race ahead of the revenue growth rate.

As the following illustrates, we have seen headcount more than double, with a significant investment in international operations.

Headcount in CAG (IDEXX)

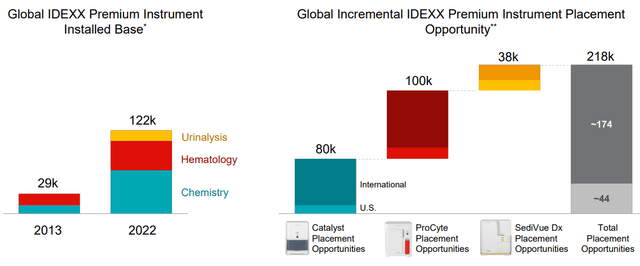

Further, installed instruments have grown at an 17% CAGR, with no material slowdown in sight. Similar to headcount, the scope is largely due to the ability to expand overseas.

Instrument installs and runway (IDEXX)

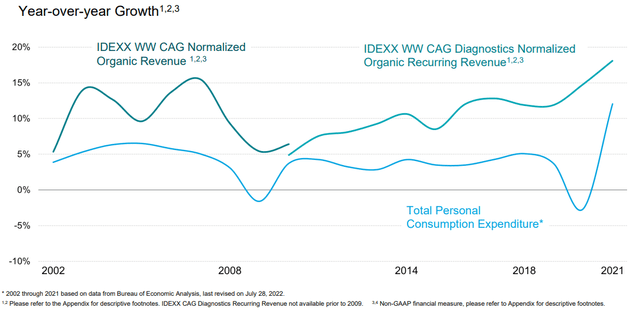

Moreover, with growth understood, it is worth exploring the resilience of revenue. Spending on pets has shown little negative volatility, despite two serious economic events in the last 20 years. Consumers are seemingly able to find the finances to support spending regardless of conditions. IDEXX’s organic growth supports this, with not a single period of negative growth.

CAG growth (IDEXX)

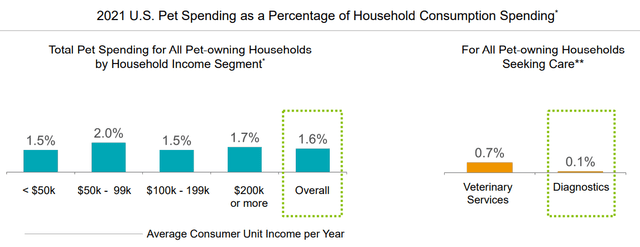

One of the reasons for this is the relatively small portion of income that is allocated to pet spending. Regardless of their income segment, consumers are spending a similar amount on their pets, showing the ability to cost-effectively own a pet. For this reason, a decline in a consumer’s financial standing should not materially impact their ability to support pets.

Pet Spend (IDEXX)

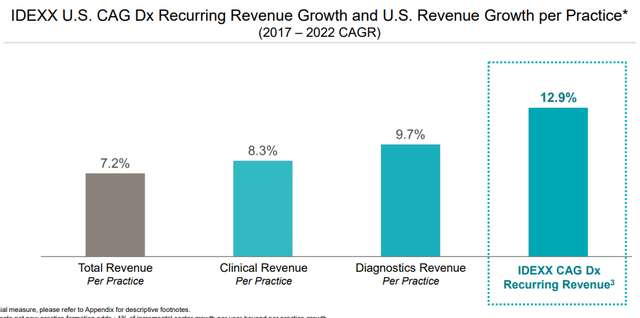

Survey data supports this, with consumers willing to forego any discretionary spending in order to cover spending needs.

Household spending (IDEXX)

Therefore, the current economic conditions do not concern us in the slightest. IDEXX’s financials reflect its commercial standing, that being incredible resilience.

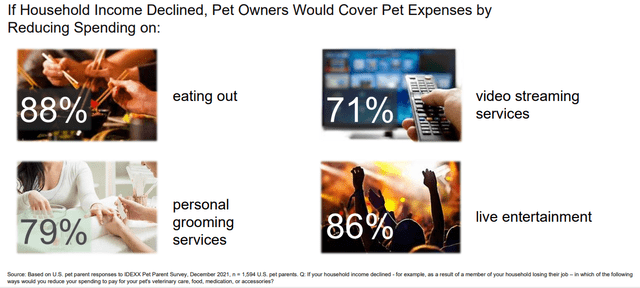

As if IDEXX is not already showing the hallmarks of a tech-adjacent business, the company has expanded its offering to include software services. This is one of the fastest-growing parts of the business and is contributing to margin improvement.

Vet software (IDEXX)

This has the potential to push revenue growth above the past trajectory, revolutionizing how the business makes money.

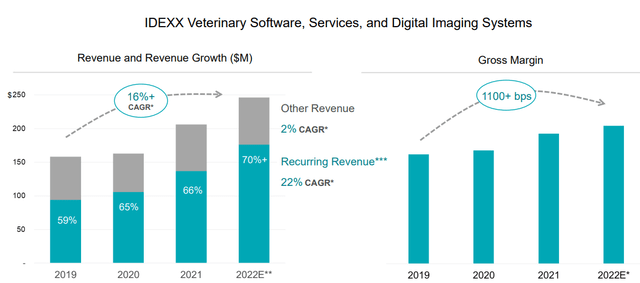

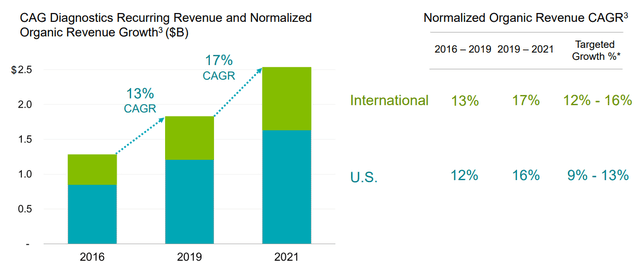

IDEXX’s revenue is of the highest quality. The company’s recurring revenue growth has exceeded all other segments, increasing its proportion of total revenue. This is highly regarded as it creates a degree of certainty over revenue, while also giving the business the ability to maintain and improve margins through periodic inflationary price increases.

Recurring revenue (IDEXX)

The ability to maintain growth long term is highly likely in our view due to the ability to replicate its success in the US overseas. The business has already seen its international growth exceed the US but will only accelerate as more geographies are added.

Growth by region (IDEXX)

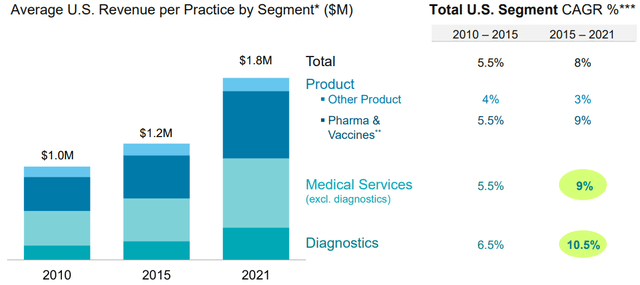

Further, although the diagnostics/MS are the crown jewels, growth is strong across all its segments. The business is not reliant on any one revenue stream.

Growth by segment (IDEXX)

Management currently estimates that it serves c.15% of its total addressable market, reflecting the growth potential available. Even within its core NA market, the business still has room to grow. The lion’s share of this should come IDEXX’s way in our view given its market dominance.

Margins

IDEXX’s margins reflect the quality of its revenue. The company currently has an EBITDA margin of 30% and a NIM of 20%. Not only is the level impressive but IDEXX has seen consistent improvement, with EBITDA-M up 6ppts. in 10 years.

The primary reason for this is a change in revenue mix toward Medical services and diagnostics, as well as software. Further, the nature of these revenue streams greatly allows positive pricing action, with recurring revenue driving much of the recent improvement.

Inflationary pressures and weakening demand has impacted the near-term performance, with margins slipping Y/Y. Management is expecting this to continue in FY23, although margin expansion should occur from there as the revenue mix shift continues.

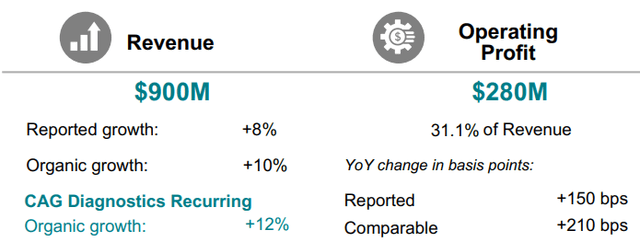

Q1 results

Q1 (IDEXX)

IDEXX continues to flex its resilience, reporting organic growth of 10%, with CAG generating 12%. Management note its install base growth continues to be strong, allowing revenue to expand as it has despite economic weakness.

Balance sheet

IDEXX’s balance sheet is fairly clean, reflected in its fantastic efficiency metrics.

The c.1x decline in inventory turnover is likely a reflection of slowing conditions but should not be a concern for now, as the ratio remains at a good level. This should be monitored quarterly as Management operationally adapts to changing conditions.

Management’s investment in future growth is reflected in its capex investment, which has grown at a CAGR of 10%. When considered alongside P&L costs, the total spending is c.18% of revenue.

This has all been achieved with minimal use of debt, with the company’s current ND/EBITDA ratio a mild 1.3x. This leaves scope for expansion if required.

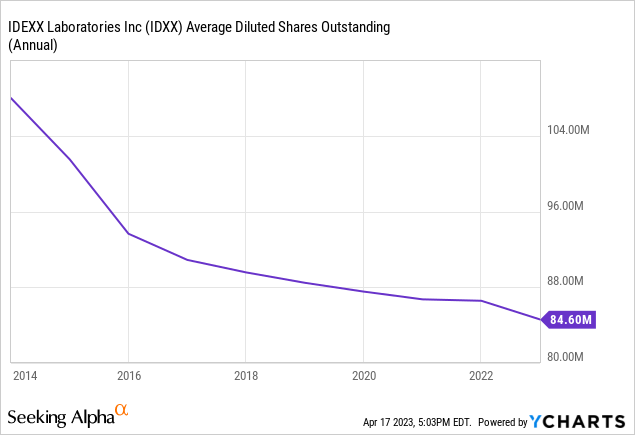

Management’s distribution channel of choice is buybacks, with payments rapidly increasing in the last 2 years. This will likely fall in the coming years as much of the company’s excess cash has been expended.

Outlook

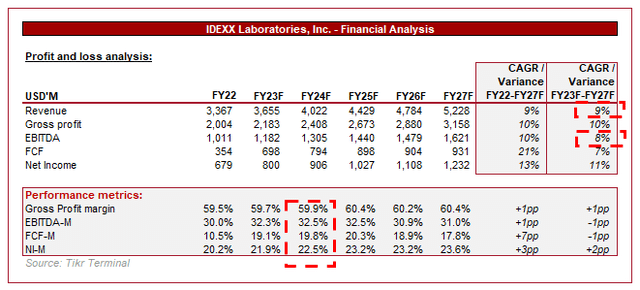

Wall St. outlook (Tikr Terminal)

Presented above is Wall Street’s outlook for the coming 5 years.

Revenue growth is expected to be slightly lower than historically achieved but still at a strong level of 9%. This looks like a conservative view from analysts but looks reasonable. Our view is that the commercial profile suggests an amount closer to 15% is possible.

Further, margin improvement is also expected, with its EBITDA margin improving to 32.5%. We concur with this view as a greater proportion of cloud and diagnostics services are provided.

Valuation

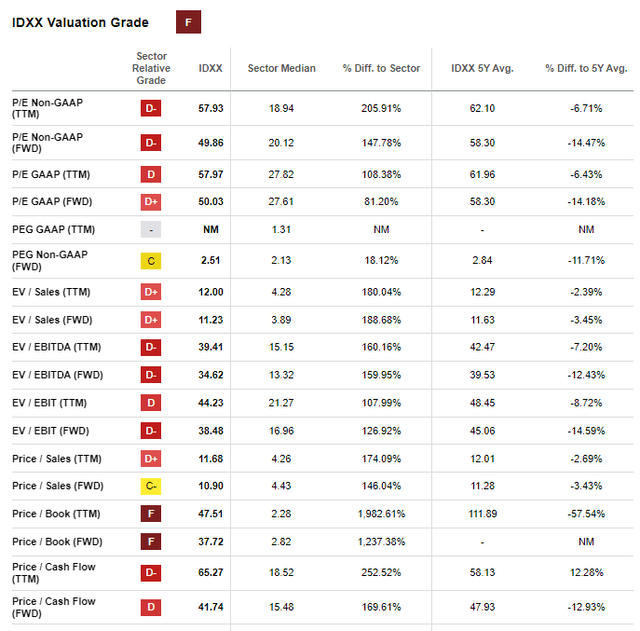

IDEXX valuation (Seeking Alpha)

Readers likely expect IDEXX to be trading at a premium but the degree to which is quite staggering. The business is valued in line with growth businesses, boasting an EBITDA multiple of 35-39x.

This is a sizeable level which makes investing in the business difficult. If growth was to slow, not that we expect it to, a rapid multiple contraction will be required as investors rerate the future cash flows. For this reason, the risk of investing at this price is extremely high.

Our view is highly positive and we expect further good things to come. Based on this we believe the business is trading around its fair value, potentially with some upside. We see the company’s fair value at its 2020 multiple plus a slight premium to reflect the revenue mix change in the last 2 years. The reason for this is that the valuation exploded post-lockdown and muddies the fundamentals. Regardless, we do not see enough upside to justify the risk.

Final thoughts

IDEXX is a fantastic business with a 20-year track record of growth. Rarely is a business this good without a problem of some sort. The company is highly defensive, growth and margins are great, the outlook is positive, and the balance sheet is strong. The key risk with IDEXX is the same for any company of its grandiose nature, execution. If growth slows, if Management missteps, markets will react aggressively due to a perfect future priced in.

The market has taken all the gains to be made, at least based on the current iteration of the business. Investors who currently own the stock are very lucky but for those considering a new position, any upside is lacking we feel.

Read the full article here