Introduction

It’s more than a year ago since I wrote my most recent article on uranium giant Cameco Corporation (NYSE:CCJ). Since then, the stock has rallied 34%, rising to a new 52-week high. While fossil fuel prices have moderated since last year, mainly as a result of weaker global growth (expectations), uranium remains in a fantastic position. Cameco isn’t just one of the safest sources of uranium for nations in the West, but it is also in a fantastic place to benefit from what is likely to become a multi-year upswing in uranium demand.

In this article, I’ll update my thesis and explain what the CCJ stock price breakout means for (long-term) investors.

So, let’s get to it!

Cameco Is More Than Just A Uranium Proxy

One of the trickiest things on the market is finding suitable trading/investment vehicles that fit a certain thesis. For example, let’s assume you’re bullish on agriculture commodities like wheat and corn. What do you buy? Do you start trading futures? Do you buy commodity ETFs with (often) high expense ratios? Do you pick companies in the agriculture supply chain? At what stage of the supply chain? Upstream? Midstream? Downstream?

The same applies to natural gas, oil, copper, lumber, and so many other commodities, including uranium.

While I have written dozens of bullish articles on fossil fuels, I’m not against renewables. While nuclear energy isn’t a renewable energy source, it’s my favorite way to produce electricity. It’s safe, highly efficient, and the best way to protect our energy-hungry economies against rising prices on a long-term basis.

Every successful economy (ever) had reliable and affordable energy. Without it, economic prosperity for the masses is simply not possible.

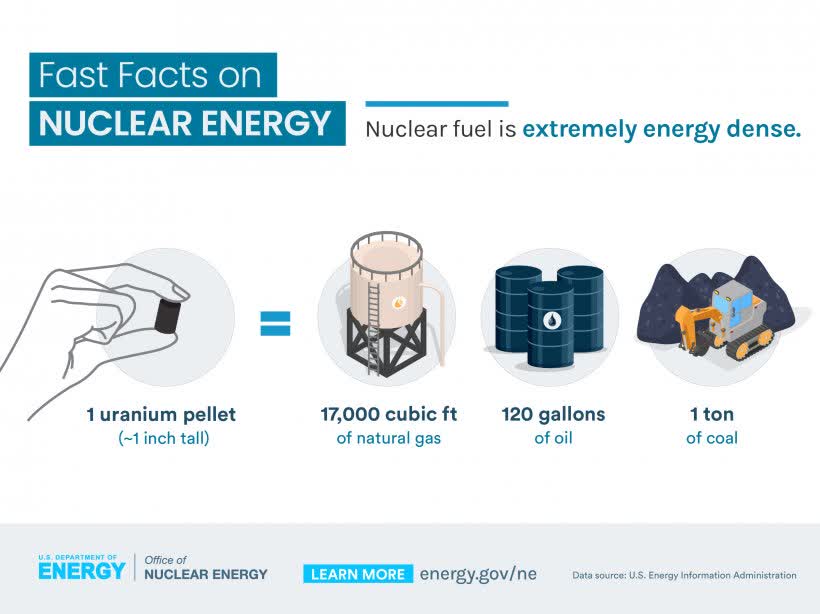

While building nuclear energy plants is extremely expensive, the benefits are tremendous. One tiny pallet of uranium has the energy density of one ton of coal, 120 gallons of oil, and 17 thousand cubic feet of natural gas.

Bloomberg

Especially at a time when global governments are looking to diversify away from coal, this is a fantastic alternative.

There’s just one major problem.

In an increasingly polarized world with increasing (trade) tensions between developed Western nations and emerging markets like China, Russia, and their allies, we cannot build supply chains that make us more dependent on non-allied nations.

This is an issue that has never been more important since the second world war. Supply chains are relocating, while the horrible war in Ukraine is further amplifying these differences.

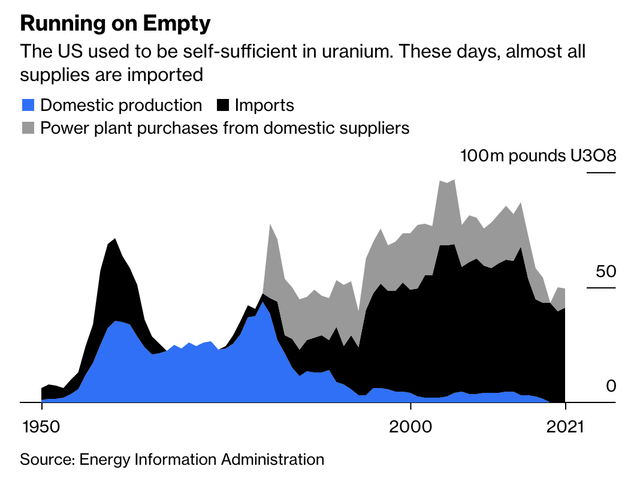

Looking at the chart I used last year (it’s still just as relevant), we see that the domestic production of uranium in the United States is essentially zero.

Bloomberg

Meanwhile, demand has risen, causing imports to soar.

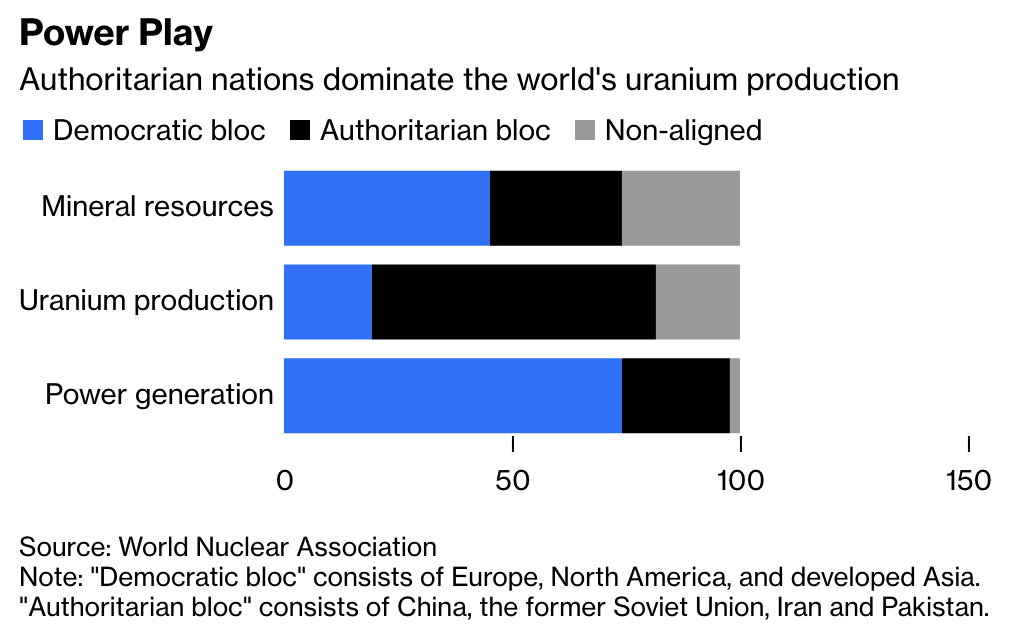

The chart below shows that democratic nations produce the biggest part of nuclear-powered electricity. However, authoritarian nations and non-aligned nations produce the biggest share of global uranium.

Bloomberg

That’s a huge geopolitical risk.

It’s also where Cameco comes in.

With a market cap of $13.8 billion in New York, this Canadian-based miner is one of the largest sources of uranium in the West. The company just reached a new 52-week high without the support from coal, oil, and gas, which are the commodities that are currently the backbone of global energy security.

TradingView (CCJ)

Furthermore, Cameco currently has approximately 215 million pounds of uranium and over 70,000 tons of UF6 conversion capacity under long-term contracts, with delivery commitments extending beyond a decade. The company’s average annual delivery volume for uranium over the next five years is expected to be 26 million pounds.

This brings me to the main question of this article.

How’s Cameco Doing?

Last month, Cameco presented at the Bank of America Securities (BAC) Global Metals, Mining & Steel Conference.

During the conference, the company emphasized that as the outlook for nuclear power improves, the confidence of fuel buyers increases, leading to more term contracts and price effects.

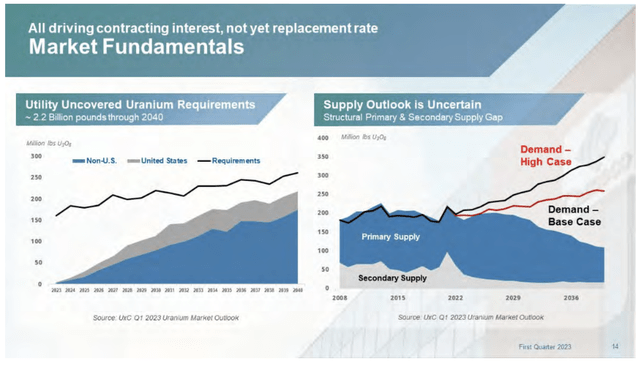

The demand for uranium is significant, with 2.2 billion pounds of uranium needing to be procured for the known reactor fleet by 2040.

The company also mentioned the importance of considering the rate at which utilities are satisfying demand, as it affects price formation. Currently, utilities are consuming about 180 million pounds per year, below replacement rate contracting, indicating potential price formation and a strong demand outlook.

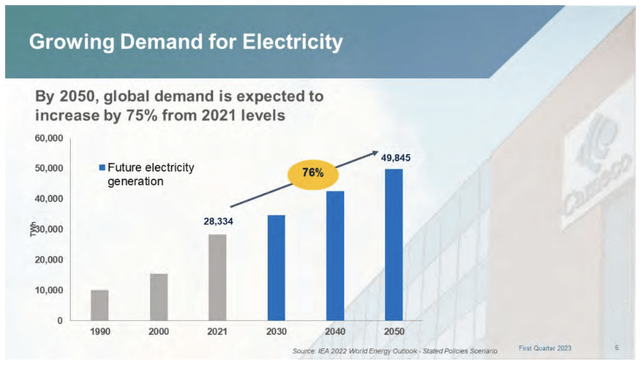

On top of that, electricity demand is expected to rise by 76% until 2050 (from 2021 levels).

Cameco Corp.

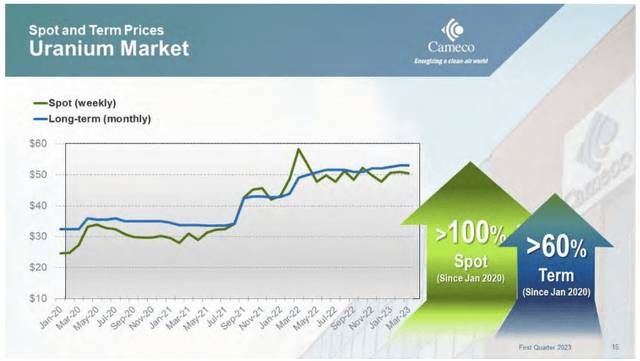

With that said, the supply side is an issue, which explains why Uranium stocks are doing well, despite declines in fossil fuel commodities. Both spot and long-term uranium prices have done well this year.

Cameco Corp.

The company pointed out that primary supply is not poised to respond to the improving demand outlook unless prices increase. Secondary supply, which typically fills the gap, has been exhausted due to low uranium prices. The lack of secondary supplies means that more primary supply is needed. Hence, the company emphasized the importance of bringing new supplies under certain conditions.

Cameco Corp.

However, the company cautions against bringing on new projects without considering volume and timing. Timing is crucial, as previous price cycles have resulted in supply arriving after demand has already been met, leading to value destruction. This applies to a wide range of industries.

Cameco Corp.

The company suggests that the supply side needs to respond responsibly by building homes for their production rather than relying on the spot market. Cameco also acknowledged the uncertainty on the supply side but remains optimistic about its position, as the company is fully invested across the fuel cycle and remains disciplined when it comes to capital spending.

Furthermore, on top of long-term pricing and volume tailwinds, the company expanded its business by buying 49% of Westinghouse in 2022.

Westinghouse services about half the nuclear power generation sector and is the original equipment manufacturer to more than half the global nuclear reactor fleet. The company has industry-leading intellectual property and a specialized workforce of roughly 9,000 employees capable of operating in highly regulated markets around the world.

During the BofA conference, Cameco emphasized that Westinghouse’s position as the original equipment manufacturer (“OEM)” and fabricator for about half of the global lightwater reactor fleet complements Cameco’s position in heavy water reactors. Note that Cameco was vertically integrated prior to the deal.

The acquisition enhances Cameco’s vertical integration on the lightwater reactor side, which accounts for 90% of the global fleet. Westinghouse also brings a conversion facility in the UK, which is valuable in the current bottlenecked conversion market.

Additionally, Westinghouse has new build opportunities with the AP 1000 and AP 300, offering growth potential.

Cameco mentioned the brownfield leverage opportunity within Westinghouse’s fabrication plants, similar to Cameco’s tier-one assets.

Valuation

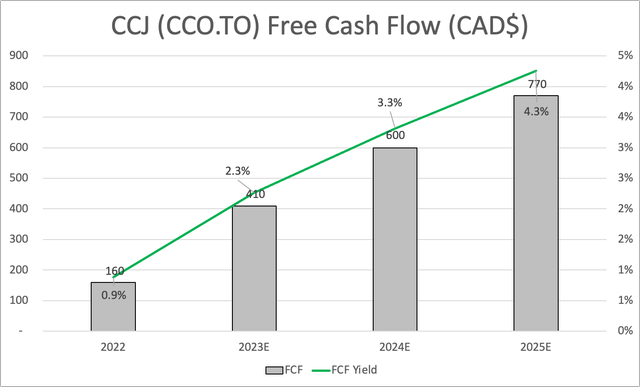

What’s interesting is that despite an expected CapEx increase of more than 100% between 2025 and 2021, the company is expected to boost free cash flow to almost C$800 in 2025. In this case, I’m using Canadian dollars.

Leo Nelissen

What we’re dealing with here is a company that is not only in a perfect position to benefit from a long-term uranium bull case but also has the ability to generate strong free cash flow despite new investments in its business.

The company plans to ramp up production at McArthur River and Key Lake to produce 15 million pounds in 2023 and 18 million pounds in 2024. At Cigar Lake, production is expected to remain at 18 million pounds for both 2023 and 2024.

Cameco also has the potential to expand and extend production from existing Tier 1 assets as uncovered requirements translate into additional contract commitments.

If all opportunities are pursued, their annual share of Tier 1 uranium supply could reach approximately 32 million pounds. Tier 2 assets will be kept on care and maintenance unless long-term contracts with similar returns can be secured.

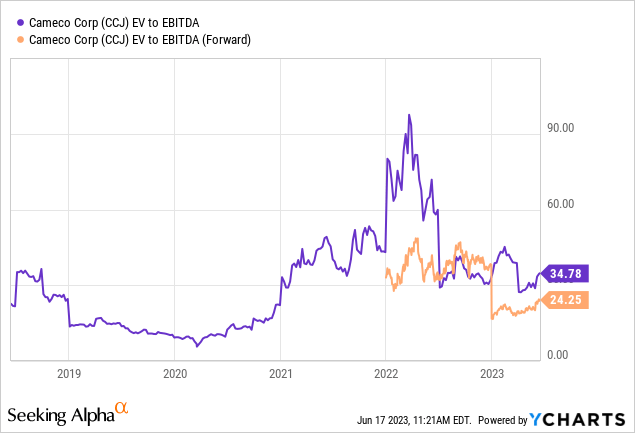

With that in mind, CCJ is trading at 35x LTM EBITDA and 24x NTM EBITDA.

Although it may appear to be a substantial multiple (and indeed, it is), it’s crucial to consider the context: the company is projected to generate a mere C$720 million in EBITDA this year. However, there are optimistic forecasts indicating that the company will elevate this figure to C$1.4 billion by 2025, with further growth anticipated beyond that.

Hence, I agree with the consensus that CCJ should not trade lower than $37 (in New York). The current price is $32, implying a 15% mid-term upside.

On a long-term basis, I expect CCJ shares to remain strong (but volatile). We are not even close to a situation where major Western nations are shifting their focus to nuclear energy. In Europe, it’s mainly France. The US has no major projects planned.

I think CCJ’s future is bright. Very bright.

The only reason why I do not own CCJ shares is that I have a significant position in energy and related commodities. I’ll have to make some room and see how CCJ best fits with my existing holdings.

Takeaway

In conclusion, Cameco Corporation stands out as more than just a uranium proxy in the market. As nations around the world seek to diversify away from coal, nuclear energy emerges as a fantastic alternative.

With a strong market position, Cameco is well-positioned to meet the increasing demand for uranium. The company’s long-term contracts and extensive reserves provide stability and security in a volatile market.

The recent acquisition of Westinghouse further enhances Cameco’s position, expanding its reach in the nuclear power generation sector.

Despite the expected increase in capital expenditures, Cameco is projected to generate strong free cash flow, making it an attractive investment opportunity.

While the stock’s current valuation may seem high, the growth potential and optimistic forecasts suggest that CCJ shares have room for further upside.

With the global shift towards nuclear energy still in its early stages, Cameco’s future looks promising.

Personally, I see CCJ as a bright investment prospect and consider making room in my portfolio to accommodate it.

Read the full article here