Author’s Note: This article was published on iREIT on Alpha back in late May of 2023.

Dear subscribers,

KION AG (OTCPK:KNNGF) is a company that has already been paying off quite a bit as an investment for the past few months. My last major buy was made during later periods of 2022 – and my stance in September has produced a TSR of around 12.38% including the dividend, compared to the 3.82% of the S&P500 as of the time of writing this article.

Still, KION’s recovery is likely to remain somewhat muted in the near term. The company has plenty of hurdles to overcome – that’s why it’s so cheap. However, I believe the company will overcome these and significantly outperform – which is where I take my conviction from.

In this article, I’ll update my thesis, and show you why I expect a non-trivial upside of 250% for KION – at least in the end, once things really normalize.

KION – Upside in materials handling and automation

KION is the market leader in several crucial technologies not only important for the current development in industrial technologies and materials as well as logistics, but crucial.

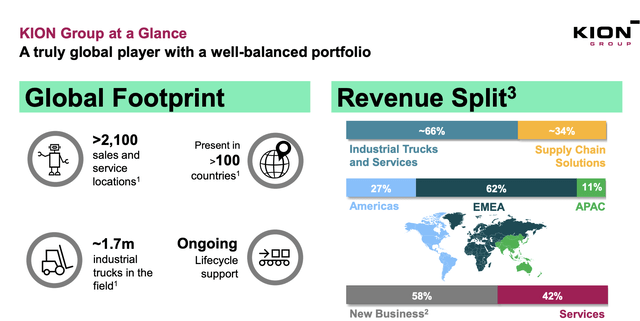

KION is the world leader in industrial truck solutions in EMEA, and the global #2 in the same segment. It’s #1 in global supply chain solutions and can report an annual order intake climbing toward the €13B on an annual basis. This has seen some pressure over the past year or so, but the problem with KION and what has caused it to fall is not top-line growth or lack thereof. The company in fact has a well-filled orderbook and excellent demand trends. Still, it’s down to around €11.1B in 2022, with a new intake of slightly above that.

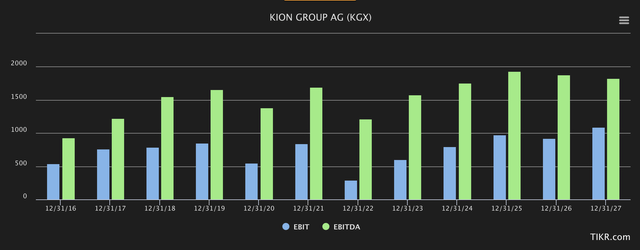

The issue is really found in the company’s margins. On a pre-tax, or EBIT basis, the company made only 2.6% for FY22, and that’s really quite terrible for a market leader in supply chain solutions and 1-2nd place in industrial trucks.

The company’s revenue split and footprint remain appealing…

KION IR (KION IR)

…and it’s the first company to offer the sort of fully-automated large-scale warehousing and logistics solutions to automated warehouses with a full life cycle product offering, including services. Toyota may currently be the leader in Industrial Trucks, but KION leads the charge, by far, in Automation and logistics.

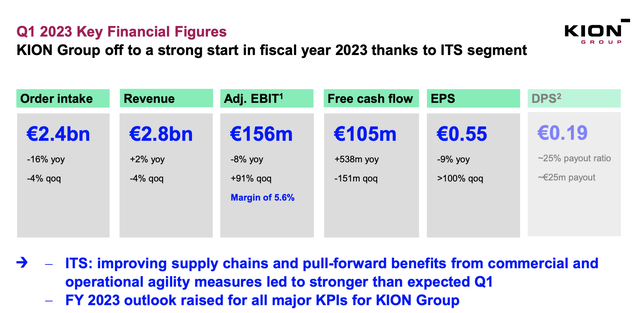

The troubles that KION faces are broad-based and not unique to KION as a company. We saw many of those issues reappear, or clarify during 1Q23. The company had a strong start to the year, with a good-sized order intake and a 2% revenue increase, but margins are anything but solved. With a -8% YoY adjusted EBIT, we’re not seeing 2.6% EBIT, but we’re seeing 5.6% compared to the usual double digits. Still, results were up significantly quarterly, so the recovery has at the very least begun.

KION IR (KION IR)

Also, the company has delivered significant upside for its customers during 1Q, including new Li-ion partnerships, its own fuel cell system, and a new multi-brand global strategy, with significant focus on new export products from China. The company’s ITS segment result were better than expected, with supply chain recovery driving revenue and margin recovery.

Postponements are really the main issue and reason as to why the company isn’t recovering faster. The current economic uncertainty, with people expecting a recession to begin and perhaps last for some time, decisions on new orders for logistics systems and industrial trucks are being postponed, leading to order uncertainty for KION. There is good visibility in the near-term order book, but most of the reason why KION saw a good 1Q23 is due to the specific ITS segment.

Simply put, the company’s margin development and recovery will be aided by recoveries and trends in the overall macro, which is currently uncertain. One of the primary drivers of the company currently being down is investors and customers being uncertain of when this will be.

However, it’s obviously important to not mistake this for it never recovering. And that is a common mistake I see investors making, value-oriented or not. When a company is trading down as KION once did, it is as though investors do not expect the company to ever recover. While this may be true for some businesses, which then do end up going bankrupt, a market leader like KION is incredibly unlikely to go to zero in as short a time as that.

For that reason, I view the current trends as very favorable in terms of valuation, which we’ll look closer at in a little while.

For now, I want to highlight the following:

- KION is in a recovery sort of mode – the company’s margins are as low as they’ve been for several years. The last time it was this bad was in similar, recession-type environments. Do not expect a quick turnaround.

- At the same time, the company is showing early signs of fundamental recovery. In 1Q23, we saw the EBIT margin recover to above 5% as singular company segments went back toward normalization.

- Because the company’s fundamentals remain extremely solid, this is the perfect time for value-conscious long-term investors that can accept a 2-5 year time period to recover. If you’re willing to do this, you might see those 250%+ returns that I am talking about here.

- I view recovery as extremely likely over time. The company has a history of being volatile. Even before the pandemic, it went up to almost €80/share before tumbling to €38 in the COVID-19 mania. This means that the company is now cheaper than during COVID-19.

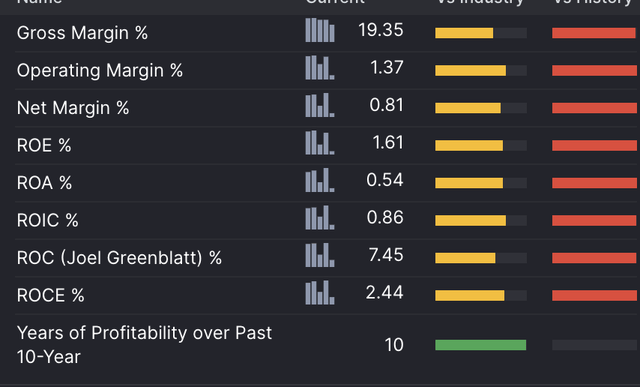

The company’s margins have declined to sector average, or below the sector average, depending on your comps. However, this is due to the massive decline in the last 2 years, which is likely to be non-permanent, as I see it.

KION Profitability (GuruFocus)

And, as you can see, company profitability is still excellent over a 10-year period of time. I also want to point out that despite a net margin of less than a percent currently on a 2022 basis, the company still isn’t even close to “worst” in its segment.

This is not an excuse – but a highlighting of how badly the pandemic and the latest year impacted company margins sector-wide. KION is not alone, and it is certainly not unique.

The company’s dividend is cut to the bone. Don’t buy KION for the 2022-2023 dividend – it’s currently less than 0.6%. However, the company has less than 35% LT debt/cap, it’s BBB-rated and investment-safe (on a rating basis), and despite all the negatives, remains profitable.

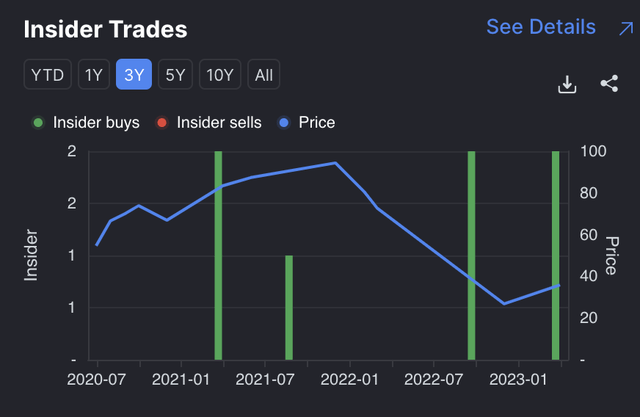

I also want to highlight that KION has seen a fair amount of recent insider buying, which is generally a good piece of news in an environment like this or for a stock like this. And those insider buys have actually been increasing, about during the same time that I have been buying as well. In fact, not a single insider has been selling stock despite the rollercoaster the company has been doing.

KION insider buying (GuruFocus)

Based on this, and everything I’ve said above, I’m positive about the prospects of KION, and give you my valuation assumption for the company at this time.

KION’s valuation – Remains positive, and I see a massive upside

As usual, I like considering the most realistic possible outcomes, or at least a range of them, when investing in a company. There are many possible outcomes for investing in KION, but the common thread I see in each of them comes down to the net results being pretty positive overall.

The reason for that is simple. I don’t forecast – and any analyst I follow or have listened to, nor subscribe to does either – the company’s margin-related troubles to stay around for that long. In fact, we expect normalization to occur to some extent this year.

What I mean by normalization is this.

KION forecasts (S&P Global/TIKR.com)

That 2022 was a bad year, no doubt. However, that things are going to recover seems like a foregone conclusion at this point. With 1Q23 in the bag, the worry that remains is not “if” the company will recover as the order books start filling up again and customers move “back on track” with their investments, it’s “when”.

And because I invest within a 2-5 year timeframe, and I believe it will happen during that timeframe, the exact “when” of it does not really matter. What I believe is that when it does occur, this company will advance significantly. We’ve already seen double-digit market outperformance since September – but that will seem pale in comparison to what a normalized fair value for the company once it goes back to growth will be.

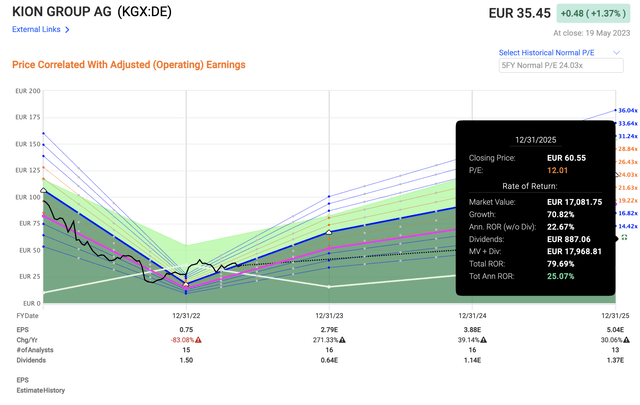

If you wanted to, you could forecast KION at a 12.01x P/E on a forward basis. That’s conservative – and well below where the company usually is. It’s the lowest I would go for – and what does that give you?

F.A.S.T graphs KION Upside (F.A.S.T graphs)

Market-beating RoR of 25% per year.

That’s the bearish case, to be perfectly transparent with you. As you start adjusting upward, your upside only grows. A fair-value 15x is closer to 35% per year, or 114% until 2025E, and a 20-24x P/E which is a historical 5-year average for this particular company comes in at 61% annually, or 250.51% TSR until 2025E.

Now, mind you that this is predicated on the company actually hitting its targets. I do believe it will do exactly this though, even if the analyst accuracy is only about 75% on a 2-year basis with a 20% margin of error. There might also be that the margin recovery doesn’t go as quickly or as “deeply” as analysts expect. Still, even based on this I see that massive 12-24x P/E upside as enough to be market-beating in any potentially realistic scenario at this time.

That makes KION, together with investments like Teleperformance (OTCPK:TLPFY), one of the highest, safest total-return plays that I currently engage in. Both of these companies share many similarities, though KION is the more volatile of the two and is in the industrial, rather than the communications segment.

However, both businesses are massively underappreciated for what they are, and I believe this will bring about massive returns and recovery for those investors willing to invest, and for the company to recover.

As this is my M.O., I do not have an issue with this.

The current S&P Global targets, as a fun exercise, come to a range of €20 on the low side and €63 on the high side to an average of €44. About a year ago, this was €64 on the low side and €140 on the high side, with an average of almost €100/share.

Do you believe that the company has lost more than 50% of its fundamental value in less than a year?

I do not – and that is what I invest in here.

Thesis

My thesis on KION is as follows:

- KION Group is an attractive capital goods play with an emphasis on intralogistics solutions, automation, and warehouse technologies – things like forklifts, to put it simply.

- The company is undervalued and forecasts imply a significant upside over the coming 5 years, with an upside of over 100%.

- KION is a “BUY” with a price target of €78/share, but I am not shifting it further.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansion/reversion.

That means that the company still fulfills all of my criteria for attractive valuation-oriented investing. I’m still at a “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here