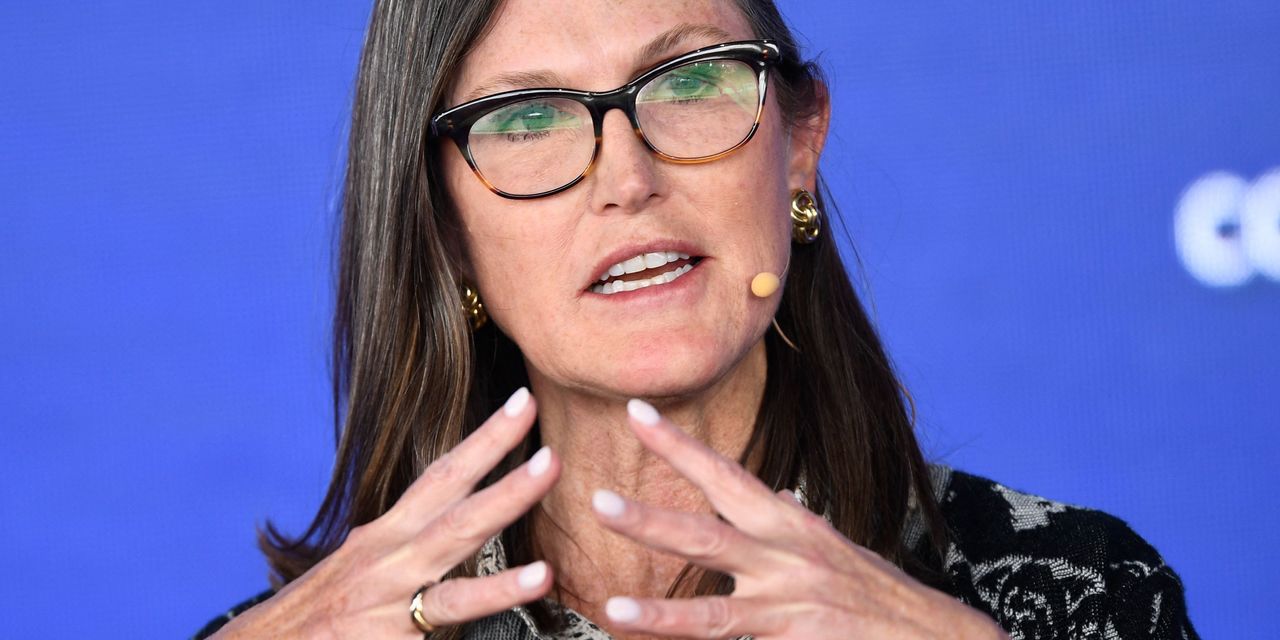

ARK Invest’s ARK Innovation exchange-traded fund sold another 62,415 shares of Tesla worth about $16 million, the asset management company founded by Cathie Wood disclosed on Friday evening.

The news of Friday’s stock sale comes after ARK Invest offloaded about 393,000 shares of Tesla (ticker: TSLA) worth almost $100 million from the Innovation ETF (ARKK) and two other funds on Monday.

ARK didn’t respond to a request for comment about Monday’s sales, and the company didn’t respond immediately to a request for comment over the holiday weekend about Friday’s sales.

But Wood might be selling because of Tesla’s recent success: Shares are up almost 50% over the past month, crushing the 10% and 6% comparable, respective gains of the

Nasdaq Composite

and

S&P 500.

Tesla stock’s run has helped push the Innovation ETF up about 15% over the past month, too.

It’s unlikely that Wood is taking profits or that she believes Tesla shares are fully valued. ARK’s published price target for Tesla stock is $2,000 by 2027, up almost eight-fold from Friday’s close—which works out to an average annual gain of about 66% between now and the middle of 2027.

The problem is more likely structural: Tesla stock comprises more than 11% of the Innovation ETF’s portfolio. Practically speaking,10% seems to be a rule of thumb for ARK: When things get above a certain percentage of the portfolio, the company trims. ARK may not be done selling, since Tesla’s stock price performance has pushed it beyond 11% of the innovation ETF.

While the Securities and Exchange Commission and the Internal Revenue Service have rules about how big one position should be in a diversified investment vehicle, those don’t seem to be at play here.

Diversification cuts volatility down and gives investors exposure to multiple stocks. ARK’s Innovation ETF, however, is relatively concentrated. The top 10 positions in the fund, which only holds 30 stocks, account for about 62% of the total portfolio.

Compare that to the

Vanguard Total Stock Market ETF

(VTI), which holds 3,883 stocks. Its top 10 holdings, including two classes of

Alphabet

(GOOGL) stock, account for about 28% of total assets.

Still, there can be limits to any fund’s concentration—which means that great performance from a stock can generate selling pressure on its position in a fund.

Write to Al Root at [email protected]

Read the full article here