Investors in office properties have seen the worst selloff in recent memory. Alexandria Real Estate Equities, Inc. (NYSE:ARE) holders have also been hammered, even though management assured investors that their biopharma and life sciences focus remains the REIT’s most significant differentiator.

Alexandria’s Q1 earnings release in April showed robustness in its operating metrics. However, a further selloff in May demonstrated that investors are likely betting things could get worse in Q2 and possibly the second half.

Berkshire Hathaway’s (BRK.A) (BRK.B) Warren Buffett and Charlie Munger cautioned investors about the malaise engulfing commercial properties in the company’s annual meeting in May. However, Munger highlighted that the “current situation is not as severe as the 2008 financial crisis.”

I gleaned that the current valuation in ARE likely reflects that positioning, as it trades a forward dividend yield of 4.2%. ARE Bulls could argue that its dividend yield is much higher than its 10Y average of 3.2%.

However, with the 10Y Treasury yield still printing at 3.77%, investors are likely demanding an even wider margin of safety before they decide to return in droves to support ARE’s bottoming process.

Does it make sense? In the global financial crisis of 2008, the 10Y printed a high of over 4% before falling. As the global economy went into a recession, investors correctly anticipated that the Fed could slash rates to deal with the full-blown crisis.

However, we aren’t expected to fall into a recession yet, and the Fed’s revised summary of economic projections or SEP also upgraded its economic growth forecasts.

With inflation rates still well above the Fed’s 2% long-term target, I believe it’s unlikely that Alexandria investors could get significant rate cuts booster from the Fed in the near term. Moreover, ARE’s forward dividend yield is nowhere close to the highs seen in 2008, as it topped out at nearly 10%.

Therefore, I assessed that the market had gotten it right that the risk/reward likely isn’t attractive enough for long-term buyers to return aggressively.

In addition, I gleaned that management’s commentary at its April earnings conference also didn’t convince me that the company could avoid competition from increased supply in its target market moving ahead.

CEO Peter Moglia articulated that Alexandria’s focus on “high barrier-to-entry markets” helps to “mitigate the impact of generic supply.” Management also highlighted concerns about “people are still trying to put new products into the queue in a market that has a lot of vacancies [in San Francisco].”

Therefore, I believe investors need to monitor the developments moving ahead, as the fallout could get worse if Alexandria faces competition from the generic supply that could affect its ability to keep its 2023 guidance of a 6.4% FFO per share increase.

Fellow contributor Trapping Value aptly highlighted that the threat from conversion supply in Boston should not be ignored, as “there is a trend of office conversions to life science use.”

Management also alluded to “speculative building in Boston,” even though Alexandria stressed that they are “not directly competitive with those vacant buildings.” Therefore, I assessed that while the company’s Q1 metrics seemed robust, with guidance kept, investors need to anticipate further headwinds.

Coupled with a relatively unattractive yield against the current 10Y yield, the margin of safety might not be sufficient to attract long-term buyers to return aggressively.

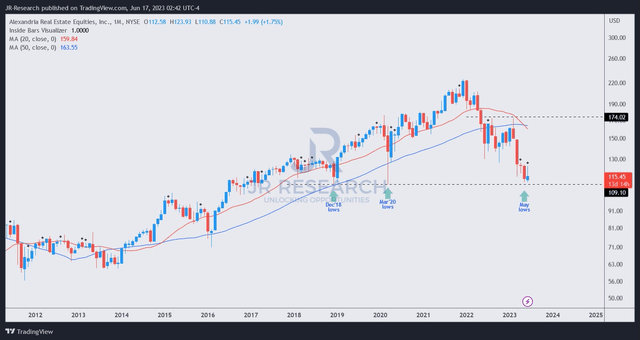

ARE price chart (monthly) (TradingView)

To be fair to ARE, its price action suggests reasons to be cautiously optimistic, despite its relatively unattractive valuation.

Dip buyers returned to defend the May selloff, and ARE could potentially consolidate and bottom out above the $110 levels, undergirding its previous bottoms in 2018 and 2020.

However, investors should note that a re-test of that level is still possible, which should help us determine whether buyers could return more robustly. A failure could see ARE de-rated downward further, causing more pain to holders.

I assessed that ARE’s price action is at a critical inflection point. High-conviction investors can consider adding exposure if they anticipate a more robust re-test against the $110 level. More conservative investors can consider waiting for a more constructive consolidation first before adding.

Rating: Hold (On the watch for a change).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Read the full article here