What being a value investor means.

Value investing to me has 3 steps:

1. Get a sense of the long-term earnings power of a company. Owning a stock is all about having the right to a company’s long-term earnings stream. So we start with estimating the likely direction of that earnings stream. That takes some work and is fraught with error, but who said investing is easy?

2. Calculate the present value of those expected long-term earnings. A simple calculation that is usually good enough is to apply the P/E ratio to the company’s near-term earnings. The P/E ratio reflects the company’s growth prospects and risks.

3. Compare the company’s current stock price to its estimated value. For example, if you estimate that the company’s near-term EPS is $10 and you expect moderate growth, a 12 P/E ratio seems reasonable. That suggests a $120 fair value. If the stock is well below that fair value – say $70 – buy it. If the stock is $200, short it.

Applying value investing to Zions.

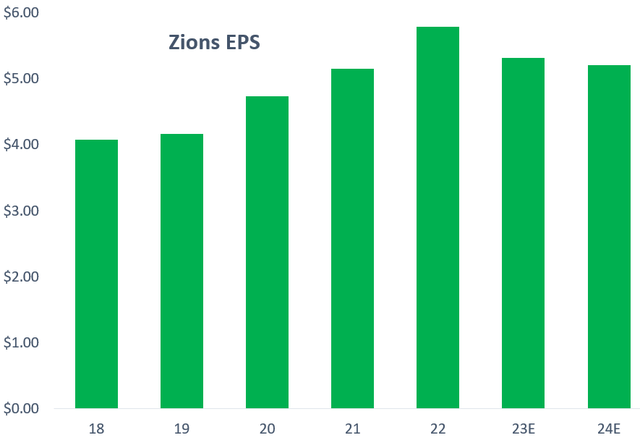

1. Long-term earnings. I’ll start with near-term EPS. Here is Zions’ EPS since 2018 (adjusted for COVID loss provision shifts between ’20 and ’21) and the current Seeking Alpha forecasts for this year and next year:

Zions financial reports

Source: Zions financial reports

Starting with earnings power of $5 per share seems reasonable.

2. Zions’ present value of future EPS. Zions’ EPS growth over the long-term should be modest. Banking is a mature business with plenty of competition. Zions’ EPS growth could come as much from share buybacks as from organic business growth. I will therefore use a 10 P/E for Zions and its peer regional banks as a fair valuation. That is only about half of the market’s overall P/E ratio. So fair value equals $50: $5 x 10.

3. Zions’ current stock price of $28 indicates an 80% upside. Buy it.

But what about all the bad news?

“Ok with all your value investor stuff, Gordon, but there are real reasons why Zions’ stock is down 42% year-to-date. Don’t you read the news?” Yes, I do. There is bad stuff:

- Large negative marks-to-market on Zions’ securities and loan portfolios due to the Federal Reserve’s aggressive interest rate increases to combat inflation.

- The flight of uninsured deposits in the wake of the Silicon Valley and First Republic Banks’ bankruptcies.

- Bank regulators are considering raising capital requirements in light of the bankruptcies.

- The Fed’s sharp rate increases are rapidly pushing Zions’ deposit costs higher and as a result squeezing its interest margin.

- Office vacancy rates have soared, which will certainly set off a wave of office loan defaults.

Valuing the bad news.

If I were a momentum investor, I keep selling until the tide turns and good news shows up. But as a value investor, I ask what impact this bad news will have on Zions’ fair value.

With the stock at $28, instead of Zions’ earnings power of $5 a share, this bad news will permanently reduce Zions’ EPS to $3. That’s $450 million in pre-tax earnings gone forever.

But what if, as I expect, the bad news will largely dissipate over the next few years? So Zions’ EPS will temporarily be $3 for, say, two years? In that case, I subtract off the lost $4 of cumulative EPS from the $50 fair value to get a new $46 fair value. I think this is the far more likely outcome. The new $46 fair value still suggests a 65% upside. Buy Zions’ stock.

To help convince you, let’s drill into the five pieces of bad news.

Bad news #1: The negative marks-to-market

During 2022 Zions wrote down the value of its securities by $3 billion. It also noted that its loan portfolio was worth $2 billion less than stated. But somehow Zion earned 14% more in interest income last year. That’s because of the “un-marked” value of its deposit base. Depositors take advantage of higher interest rates slowly, and for many consumer and corporate checking account customers, not at all. A mark-to-market of Zions’ deposit base would largely, if not fully, offset the asset mark-downs.

Further, the inverted yield curve suggests that interest rates will decline beginning with a year or two. Combined with steady maturities of securities – $3 billion a quarter on $22 billion of securities outstanding – it is highly unlikely that negative marks will still be a risk in a few years, no less than 10 years or more.

Bad news #2 – The flight of uninsured deposits.

The Silicon Valley Bank bankruptcy set off a Twitter-panic that uninsured deposits (more than the $250,000 FDIC limit) could be at risk of being frozen or lost due to the bankruptcy. This was the fear that killed Zion’s stock this year. But neither worry actually occurred. In fact, to my knowledge it has never occurred since World War II. Through the S&L crisis, through the Great Financial Crisis… Never.

The clear reason is that allowing uninsured depositors to lose money would quickly crush the financial system and the economy. The Treasury Department, the Fed and pretty much everybody with authority to address the issue will do all they could to prevent it from happening. As they did this year.

I can’t say that another temporary Twitter panic won’t happen. But continuously? No.

Bad news #3: Potential higher capital requirements.

Silicon Valley and First Republic Banks both went bust because of excessive interest rate risk exposure going into a record bond market collapse. Logic says that regulators should address this risk by better enforcing interest rate risk management requirements. Instead, the media has hinted that bank regulators will raise required capital levels.

I’d say the worst case is that Zions’ capital requirement is increased by two percentage points, or $1.7 billion at today’s asset level. That’s about two years of earnings that would have to be retained rather than used to grow and reward shareholders. In this worst case, then, $10 per share would be received by investors in the future rather than near-term. That erodes shareholder value by maybe $5, worst case.

But Zions and its peers could improve their loan and deposit pricing to maintain the same return on capital as before. Or the regulators may be concerned that the forced capital retention will force banks to sharply curtail their lending, which will almost assuredly cause a recession.

Bad news #4: Higher fed funds are narrowing Zions’ interest margin.

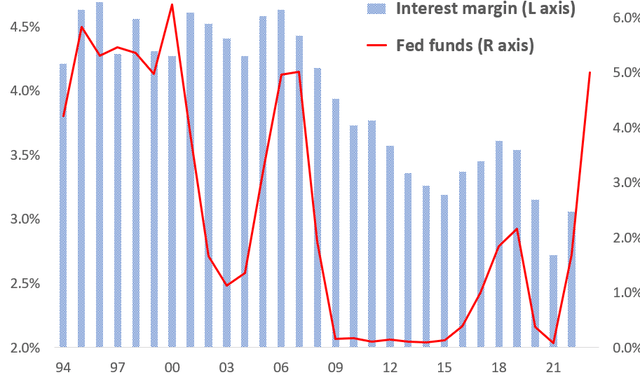

This chart helps us understand what direction Zions’ interest margin should be heading:

Zions financial reports and FRED

Sources: Zion financial reports and FRED

The chart teaches us two things:

- Zions’ interest margin is historically higher when fed funds rate is higher. The reason is those yield-insensitive consumer deposits.

- The recent Fed tightening is highly unusual. At first, the Fed’s tightening increased Zions’ interest margin, because its loan yields repriced upward faster than its deposit costs. This year, deposit costs are catching up, which is narrowing the interest margin, and should for a few more quarters.

Unless the Fed continues to rapidly increase interest rates, which few if any expect, the deposit repricing will stabilize and asset yields will continue to rise for a while. It is therefore highly unlikely that this Fed tightening will permanently lower Zions’ interest margin.

Bad news #5: Potential office building mortgage loan defaults.

I get it. Many white-collar workers are trading their white collars for PJs and working from home. Could defaults on these loans come close to erasing $450 million a year in loan charge-offs?

Not a chance. For several reasons:

- Zions has only $2.2 billion of office loans. If they went to zero in value, they would wipe out $8 in EPS.

- The average loan-to-value ratio is 56%. So many of the loans will be fine.

- The buildings are currently 87% leased and 99% are in suburban locations.

I believe that the reasonable downside is $300-400 million of losses over 4-5 years. That comes up to less than $2 per share. And by the way, do you think the Fed is still tightening in that downside scenario?

Summing up.

Two years from now, Zions’ bad news should have largely faded. The uninsured deposit panic is likely over already. Some of the bad news is contradictory. For example, the Fed will start lowering interest rates and hold back on raising capital requirements if a recession occurs that would increase loan losses.

So yes, Zions could certainly fall a few dollars per share short of $5 of normal EPS over the next few years. But not permanently. So I have a $45 target price on this $28 stock. Buy it.

Read the full article here