The Worst Avoided

Following the election of President Lula, many expected Petrobras (NYSE:PBR) to take on excess debt, refine at a loss, and invest in return-dilutive projects. However, Brazilian officials and executives are signaling a different outcome:

“The priorities to use cash flow must be, as in any company, solid projects.” – CEO Jean Paul Prates

“[Fuel prices will not fall] below profitability.” – CEO Jean Paul Prates

“We need to be sure that our investments will be self-funded with our operational cash flow.” – CFO Sergio Caetano Leite

“Petrobras will become more attractive to serious, long-term investors. We are now moving to a commercial-freedom policy.” – Energy Minister Alexandre Silveira

PBR’s valuation is re-rating as political fears abate. Insulated in a fundamentally strong Brazilian economy, Petrobras appears set to benefit from best-in-class assets, currency gains, and global instability.

Best-In-Class

In commodity businesses, where there is no product differentiation, the key moat is being the low-cost producer. Enter Petrobras, which owns some of the world’s best offshore oil assets. Petrobras extracts pre-salt oil at a very low cost. The company’s chief exploration and production officer, Fernando Borges recently said:

“Breakeven is nearly US $20 per barrel.”

This gives the company a huge cost moat over global peers. In comparison, the Permian Basin (In the U.S.) has break-even prices on existing wells of $30/barrel WTI (Roughly $32 Brent). Brazil’s offshore Campos Basin and Santos Basin are right up there with the Permian as some of the world’s best, low-cost oil fields. And, Petrobras is at the “forefront” of offshore and deepwater technology. Operating within these lucrative areas, Petrobras has crushed peers’ margins, as we’ll soon see.

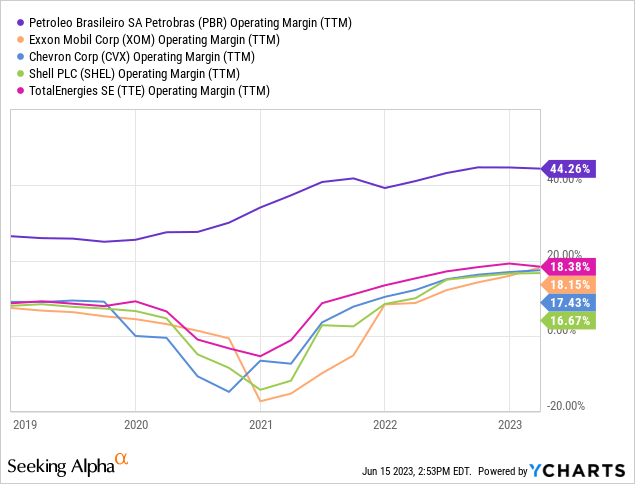

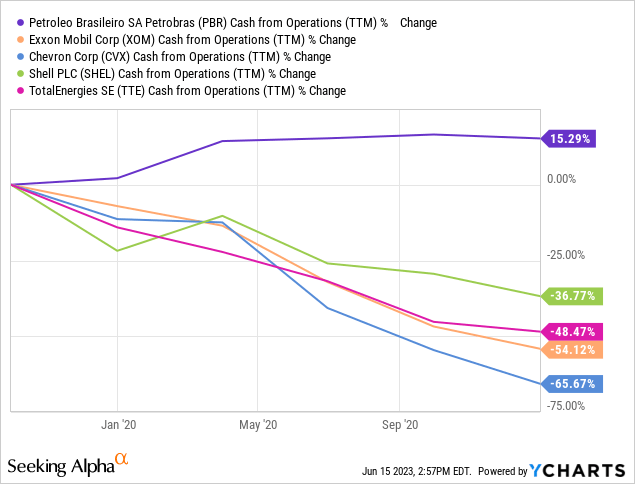

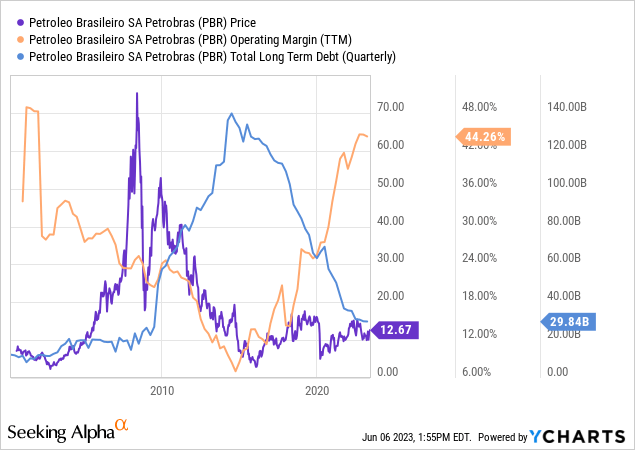

When oil prices fall, Petrobras is one of the last producers to suffer. This was evident in 2020 when the company produced $22 Billion of free cash flow. While other oil producers saw their operating margins plummet, Petrobras’ margins just kept climbing:

As did its cash flow:

The company also has monopoly-like scale in refining. With over 80% of Brazil’s refining capacity, the company is a price-setter, not a price-taker.

Petrobras makes most of its revenue from the refining, transportation, and marketing segment, but most of its profit comes from the exploration and production segment, producing the oil needed to propel South America forward. Petrobras’ net income by segment (2022):

| _______________________________ | USD, Billions |

| Exploration and Production | $32.07 |

| Refining, Transportation, and Marketing | $7.43 |

| Gas and Power | $1.04 |

| Corporate and Other | ($3.02) |

Image created by author with data from Petrobras’ 2022 Annual Report.

The Petrobras Discount

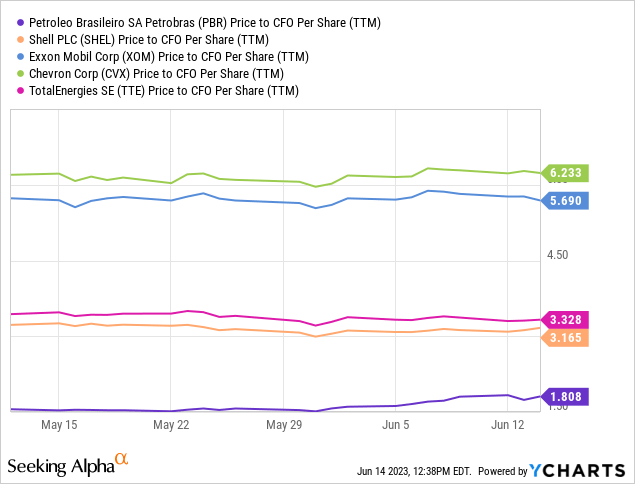

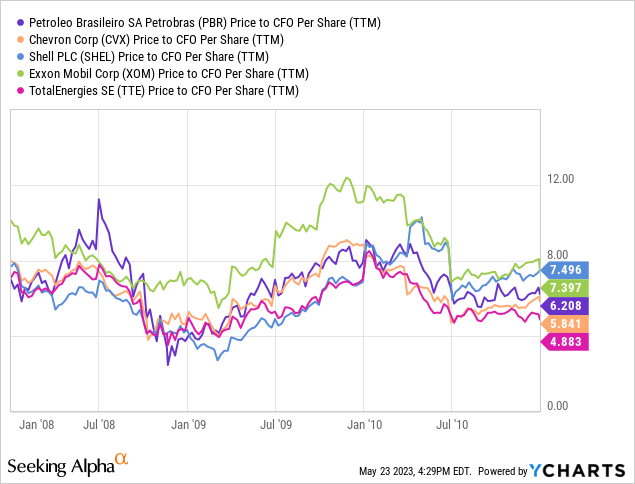

Given that Petrobras is such a dominant company, one should ask why it trades at such a large discount to peers:

After all, this wasn’t always the case. From 2008 to 2011, Petrobras traded on par with peers:

Petrobras is partially owned by the Brazilian government, which recently had a change of leadership. The government holds more than 50% of the voting shares and thus has a majority say in how the company is run.

With Lula’s Workers’ Party in power, the fear is that Petrobras will spend more on the energy transition, and it will. This was discussed at length in the Q1 earnings call. The company is investing in offshore wind, which mixes well with its offshore oil assets, and is proposing to spend between 6% and 15% of its CapEx on low-carbon projects. Petrobras is also exploring joint ventures into green hydrogen and fertilizers.

With Brazil’s new administration in place, refining margins should decline. This is due to the company’s new pricing policy. Reuters reported:

“The new strategy will use market references such as the cost of alternative suppliers and the marginal value for Petrobras.”

However, according to CEO Prates, prices are not expected to fall below profitability:

“The new policy means a ‘communion of interests’ between the company and the new administration, rather than government intervention, Prates said. Prices won’t fall below profitability, he added.”

Many expected a worst-case scenario, hypothesizing that Petrobras would refine at a loss. Even with a new board and CEO in place, it sounds like the company will not go back to the policies that marred it from 2012-2018:

The company seems to have no interest in taking on excess debt, refining at a loss, or investing in return-dilutive projects. Instead, Petrobras appears to be finding a middle ground between the Brazilian people and investors.

I believe investor psyche is scarred by scandals of the past, prior mismanagement, and currency losses. Because the future is unknowable, most like to extrapolate the past into the future. While the risks outlined above are worth monitoring, we’ve thus far profited from buying the Petrobras discount at $9.30 per share.

The Macro Backdrop

Interest Rates And The Currency

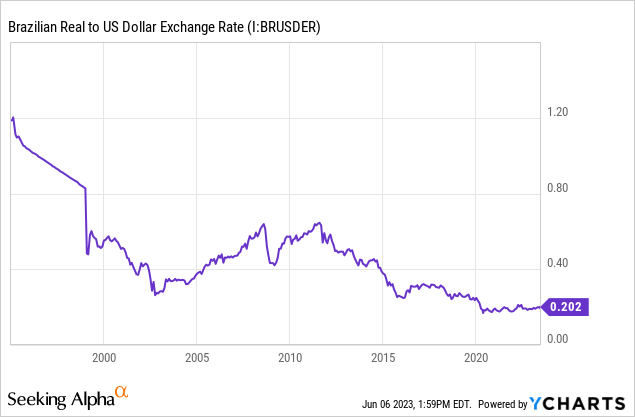

An investment in Petrobras is also an investment in the Brazilian Real. This is important because the vast majority of Petrobras’ underlying cash flows are earned in Brazil. As the Brazilian Real strengthens, Petrobras earns more in terms of U.S. dollars, boosting the value of the company.

Below, we compare the Brazilian economy to that of the United States:

Brazil has the advantage over the United States in all four categories.

Much like the United States in the 1970s, Brazil has an exorbitant interest rate of 13.75%. When compared to inflation, bond investors are getting an outsized real return. This is good news for the currency.

The Brazilian Real looks like it should gain against the U.S. dollar in the years ahead. This is good news not only for Petrobras but for the entire Brazilian stock market, including the iShares MCSI Brazil ETF (EWZ). Brazil’s balance of trade and government debt compares favorably to the United States. During the last commodity bull market, from 2008 to 2011, the Real was worth triple what it is today:

Oil Reserves

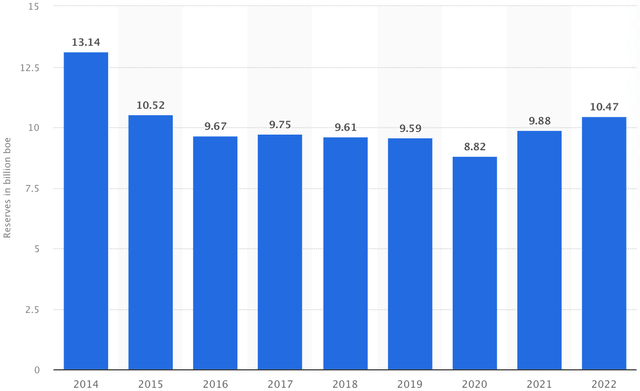

Petrobras has proven reserves of 10.66 billion barrels of oil equivalent. Multiply this by the current Brent Crude price of $76/barrel, and that’s $810 billion of potential future revenue for Petrobras. On 2022 annual production of 979.66 million BOE, that’s 11 years’ worth of reserves. And, Petrobras should have plenty more reserves on the way. Even after the recent amendment, the company’s spending a substantial portion of its CapEx on exploration and production.

The company’s proven reserves have been climbing since 2020:

Petrobras’ Proven Reserve – Billion Barrels Of Oil Equivalent (Statista)

Normalized Earnings

In past articles, I normalized Petrobras’ earnings using multiple methods. I get a similar number regardless of method ($14-18 billion).

Below, I use figures from 2021, 2020, and 2019. The price of Brent Crude averaged $60 per barrel over this period. This is slightly above global break-even points, and I see it as a normalized oil price.

| All figures in billions USD ($) | 2021 | 2020 | 2019 |

| Cash From Operations | $37.79 | $28.89 | $25.60 |

| Less: Depreciation, Depletion, & Amortization | ($11.70) | ($11.45) | ($14.84) |

| Less: Refining Profits | ($5.75) | ($0.08) | ($0.92) |

| Normalized Earnings | $20.34 | $17.36 | $9.84 |

I subtracted depreciation, as I believe it is similar to the company’s maintenance CapEx. I also subtracted refining profits out of conservatism (Discussed in “The Petrobras Discount” section). This method uses a similar asset base to what we have today and provides an average, normalized earnings figure of roughly $16 billion ($2.45 per share).

Long-term Returns

In the decade ahead, I estimate returns between 14% and 17% per annum for Petrobras based on two different dividend scenarios:

| Annualized Returns (Dividends Reinvested) | 14% | 17% |

| Initial Annual Dividend (Note 2) | $0.61 | $1.47 |

| Normalized EPS | $2.45 | $2.45 |

| Compound Annual Growth Rate | 4.5% | 3.5% |

| Year 10 EPS | $3.80 | $3.45 |

| Terminal Multiple | 10x | 8.5x |

| Year 10 Share Price | $38 | $29 |

Note 1: This is a base-case estimate.

Note 2: Petrobras’ dividend policy is subject to change. My initial dividend amounts are based on 25% and 60% of normalized EPS. Currently, Petrobras pays variable dividends representing 25% of its adjusted net income, at a minimum. Petrobras has stated it will pay special dividends, representing 60% of free cash flow, whenever gross debt is less than $60 billion. The company’s total debt is currently at $53 billion.

Decreased dividends would likely result in greater reinvestment, greater growth, and greater capital gains. I expect Petrobras to reinvest at a low rate of return, but for this reinvestment to boost earnings slightly and bolster the company’s long-term prospects.

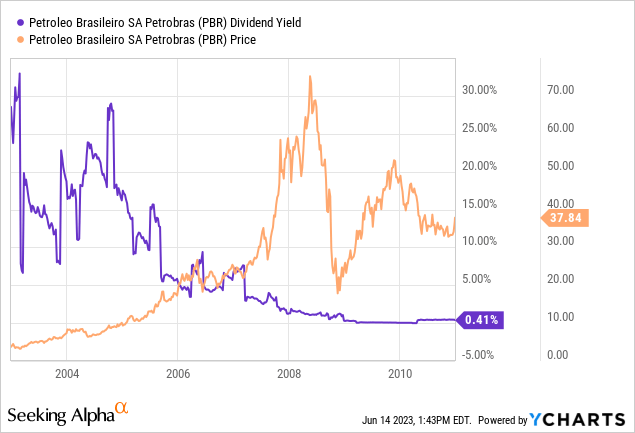

During Lula’s first term (From 2003 to 2011), Petrobras slowly phased out dividends in favor of growth. PBR shares increased 900% in value during this time.

Petrobras’ share price and dividend yield, 2003-2011:

Thesis Risk

To account for political interference, my projected returns for Petrobras assume a low return on invested capital, zero refining profits, and poor management. I also assume no change in the USD/Real exchange rate over a 10-year period. Returns may be lower than my base-case scenario if Petrobras invests in cash-burning projects, takes on excess debt, refines at a loss, experiences currency depreciation, and/or pays excessive tax. I have assigned a low probability to this outcome.

In Conclusion

Petrobras’ improved business sports low debt and best-in-class assets. The company’s upstream business is superior to global peers Exxon (XOM), Chevron (CVX), TotalEnergies (TTE), and Shell (SHEL); it has a wide cost moat. Meanwhile, the company trades at a large discount to peers and is re-rating as political fears abate. Operating in a fundamentally strong economy, gains in the Brazilian Real would be icing on the cake for PBR.

With the worst thus far avoided, I maintain a “Strong buy” rating on PBR.

Until next time, happy investing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here