Exelon Corporation (NASDAQ:EXC) is one of the largest regulated electric utilities in the United States, serving four of the largest cities in the nation. The utility sector in general has long been among the favored holdings for conservative risk-averse investors, such as retirees.

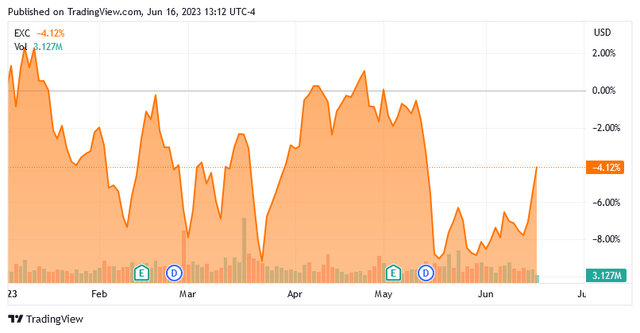

There are numerous reasons for this, particularly the fact that utilities typically have remarkably stable cash flows regardless of the conditions in the broader economy. Another important characteristic possessed by utilities is that many of them have higher yields than most other things in the market. Exelon Corporation is hardly an exception to this as the company’s 3.53% current dividend yield is likely to appeal to any investor that is seeking income. In my last article on this company, I outlined the basic thesis for investing in the company. The basic thesis has not changed in the several months that have passed since that time, but naturally, the company’s stock price has. Indeed, Exelon Corporation is down 4.12% year-to-date:

Seeking Alpha

This share price weakness has improved the company’s valuation since we last discussed it. That has improved the company’s overall investment thesis. When we combine this with its overall stability and the expectation that the economy will enter into a recession during the second half of the year, an investment in Exelon might make sense today.

About Exelon Corporation

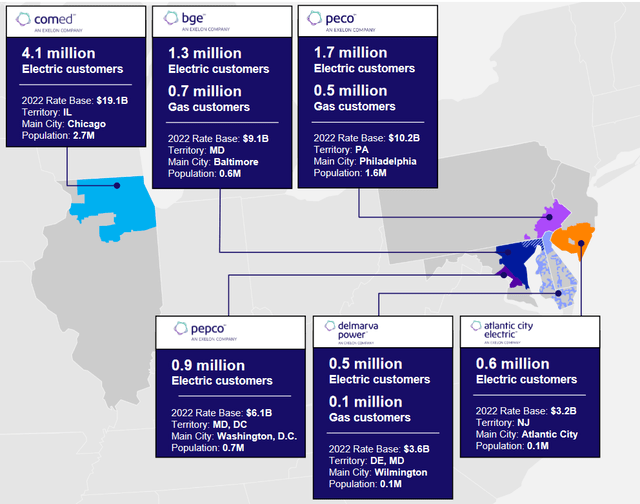

As stated in the introduction, Exelon Corporation is a regulated electric utility that serves four of the largest cities in the United States: Chicago, Philadelphia, Baltimore, and Washington, D.C.

Exelon Corporation

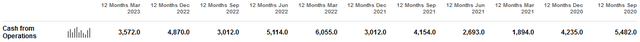

These are some of the most populated regions of the United States, which gives Exelon approximately 10.6 million customers within its footprint. This easily makes Exelon one of the largest utilities in the United States. However, as I have pointed out in numerous previous articles, a company’s customer count has little impact on its possession of some of the most important characteristics of a utility. The most important of these characteristics is that Exelon enjoys very stable cash flows regardless of any macroeconomic conditions. We can see this by looking at the company’s operating cash flows. Here are Exelon Corporation’s figures for each of the past eleven twelve-month periods:

Seeking Alpha

This is a period of time that includes a few different economic conditions. In particular, the earlier periods include the pandemic-related lockdowns that resulted in massive job losses and business closures. When those lockdowns ended and the economy reopened, inflation shot up to the highest levels that we have experienced in more than forty years. Although inflation has seemingly subsided a bit, the cost of living is continuing to increase at a rate that is well beyond what most households have experienced or are prepared for. As we can see, though, while Exelon Corporation did exhibit more variation with its cash flows than some of its peers, the company still managed to weather the different events acceptably.

The reason for this overall stability is that Exelon Corporation provides a service that is typically considered to be a necessity for our modern way of life. After all, how many people do not have electric service going to their homes and businesses? As such, most people will prioritize paying their utility bills ahead of making discretionary expenses during periods in which money gets tight. As I discussed in a recent blog post, the rapidly rising cost of living has certainly been making things much tighter for the average American household. Additionally, it is hardly going to be considered news to anyone hearing this that the economy is expected to fall into a recession during the second half of the year. That is one of the reasons why the stock market has been so strong recently, as investors believe that the Federal Reserve will cut interest rates when the recession finally hits. When the recession hits, consumers will likely reduce spending on discretionary items but they will almost assuredly keep paying their electric bills. This should position Exelon Corporation quite well to weather near-term economic weakness better than companies in many other sectors. Thus, this is exactly the kind of thing that we want to include in our portfolios right now.

Growth Prospects

Naturally, as investors, we are unlikely to be satisfied with mere stability. This is because we like any company that we are invested in grow and prosper with the passage of time. Fortunately, Exelon Corporation is quite well-positioned to deliver on this goal.

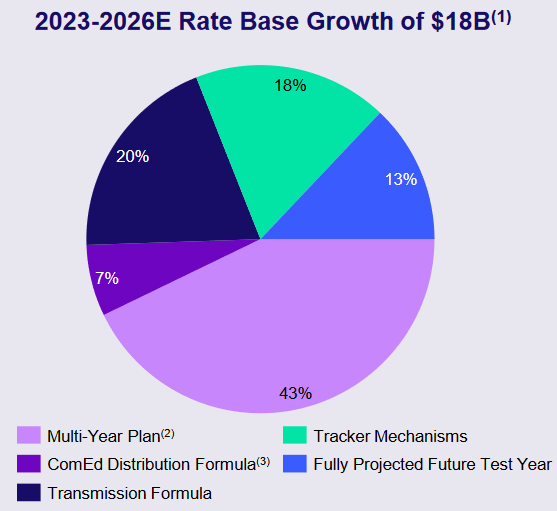

The usual way that a utility will grow its earnings is by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the prices that it charges to its customers in order to earn the regulatory-allowed rate of return. The normal way to increase the rate base is by investing capital into upgrading, modernizing, and perhaps even expanding the company’s utility-grade infrastructure. Exelon Corporation is planning to do exactly this, as the company is currently planning to invest $31.3 billion into the infrastructure that comprises its rate base. This is expected to increase its rate base by approximately $18 billion over the period:

Exelon Corporation

At this point, almost every reader will notice that the company’s rate base growth will be much less than the money that it is spending on it. This is normal and has two causes:

- Depreciation and Amortization: Depreciation is constantly reducing the value of a company’s assets in service. As a result, its rate base will actually decline if the company does not invest at least enough to cover depreciation every year. The fact that it is actually trying to grow the rate base means that it will need to invest enough to both offset all of the depreciation and still increase the value of the assets.

- Asset Retirements: Some of Exelon’s capital spending is intended to replace assets that will be taken out of service. As such, the value of these retired assets is completely removed from the rate base and offsets some of the company’s spending.

This plan should allow Exelon to grow its rate base at a 7.9% compound annual growth rate over the 2022 to 2026 period. This is certainly a respectable growth rate. I will admit that I would like to see the company’s plans for 2027 capital spending as many of its peers have provided. While Exelon’s presented spending plan is more thorough than FirstEnergy’s (FE) plan, which I complained about in a recent article, more visibility is always better. This is particularly true for retirees and similar investors that will likely be holding the stock for more than just a few years.

Unfortunately, Exelon Corporation’s earnings are highly unlikely to grow at the same pace as its rate base. This is due to the company’s need to finance its capital spendings, which we will discuss in just a few minutes. The company is projecting that earnings per share will grow at a 6% to 8% rate over the projection period. When we combine this with the current 3.53% dividend yield, Exelon is likely to deliver a 9.5% to 11.5% total average annual return through 2026. That is relatively in line with or better than most of the company’s peers, and it is certainly reasonable for a conservative utility stock. There appears to be little to be disappointed with here.

Financial Considerations

It is always important to investigate the way that a company finances its operations prior to investing money in it. This is because debt is a riskier way to finance a company than equity, due to the fact that debt must be repaid at maturity. That is normally accomplished by issuing new debt and using the proceeds to repay the existing debt. As new debt is issued with an interest rate that corresponds to the market interest rate, this process of rolling over debt can cause a company’s interest expenses to increase depending on the conditions in the market. As of the time of writing, interest rates in the United States are at the highest levels that we have seen since 2007 so it seems likely that any debt rollover today will cause interest expenses to jump. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. While utilities like Exelon Corporation usually have remarkably stable cash flows, there have been bankruptcies in the sector before so we should not ignore this risk.

One metric that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity will cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of March 31, 2023, Exelon Corporation had a net debt of $41.262 billion compared to $25.066 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.65 today. This is quite a bit higher than the 1.55 ratio that the company had the last time that we reviewed it, so it appears to be leveraging up. That is disappointing as it increases our risk as investors, especially as interest rates have risen year-to-date.

Here is how Exelon Corporation’s net debt-to-equity ratio compares to its peers:

| Company | Net Debt-to-Equity Ratio |

| Exelon Corporation | 1.65 |

| Entergy Corporation (ETR) | 1.91 |

| DTE Energy (DTE) | 1.83 |

| FirstEnergy Corporation (FE) | 2.10 |

| American Electric Power Company (AEP) | 1.79 |

As we can clearly see, despite the fact that Exelon Corporation’s leverage has increased over the past three months, the company is still using much less than many of its peers. This is a positive sign as it clearly tells us that the company is not over-reliant on debt to finance its operations. As such, its debt should not pose an outsized risk to investors.

Dividend Analysis

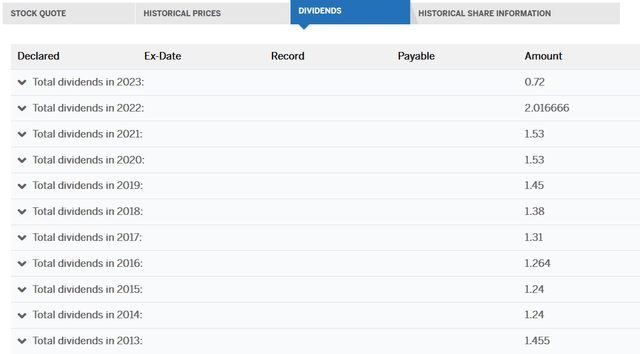

One of the biggest reasons why investors purchase shares of utilities like Exelon Corporation is the relatively high yields possessed by these companies. Exelon Corporation is certainly no exception to this, as its 3.53% current yield is well above the S&P 500 Index (SP500) or just about any other broad-market index. Exelon Corporation also generally has increased its dividend over time, although its track record is not perfect:

Exelon Corporation

We can see that the company did cut its dividend once and failed to increase it during the pandemic years. The general trend has been toward growth though, which is rather nice to see during inflationary periods such as the one that we are in today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. That can make it feel as though we are getting poorer and poorer with the passage of time, which is especially true for anyone that is depending on their portfolio for the income that they need to cover their bills. An increase in the dividend helps to offset this effect and maintains the purchasing power of the dividend.

As is always the case though, it is important that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would reduce our incomes and almost certainly cause the company’s stock price to decline. Thus, we would not only lose income but also principal.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. Free cash flow is the money that was generated by a company’s ordinary operations that is left over after it pays all of its bills and makes all necessary capital expenditures. This is therefore the money that is available for tasks that benefit the shareholders such as reducing debt, buying back stock, or paying a dividend. During the twelve-month period that ended on March 31, 2023, Exelon Corporation had a negative levered cash flow of $3.118 billion. That is obviously not enough to pay any dividends, but the company still paid out $1.360 billion to its shareholders in the form of dividends. At first glance, this is likely to be concerning as the company cannot cover its dividends out of free cash flow.

However, it is very common practice for a utility to finance its capital expenditures through the issuance of equity and debt. It will then pay the dividend out of operating cash flow. This is because the enormous costs of constructing, maintaining, and upgrading utility-grade infrastructure over a wide geographic area would otherwise preclude the company from providing a return to its investors if it could only use free cash flow to finance such returns. During the trailing twelve-month period, Exelon Corporation had an operating cash flow of $3.572 billion but only paid out $1.360 billion in dividends. Thus, the company had sufficient cash flow to cover the dividends and still have plenty of money left over for other tasks. Overall, it appears that its dividend is reasonably sustainable.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like Exelon Corporation, we can value it by looking at the company’s price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s forward earnings per share growth and vice versa. However, there are very few stocks that appear undervalued in today’s still-hot market. As such, the best way to use this ratio is to compare Exelon Corporation’s valuation to that of its peers in order to determine which company has the most attractive relative valuation.

According to Zacks Investment Research, Exelon will grow its earnings per share at a 6.68% rate over the next three to five years. This is relatively in line with the company’s own guidance as well as its likely growth rate based on its rate base growth, so we can regard it as a pretty solid estimate. This gives the stock a price-to-earnings growth ratio of 2.59 at the current share price. This is quite a bit less than the 2.66 ratio that the stock had the last time that we discussed it, as was mentioned in the introduction.

Here is how Exelon Corporation’s valuation compares to its peer group:

| Company | PEG Ratio |

| Exelon Corporation | 2.59 |

| Entergy Corporation | 2.69 |

| DTE Energy | 3.06 |

| FirstEnergy Corporation | 2.42 |

| American Electric Power Company | 2.87 |

As we can see, Exelon Corporation generally compares pretty well to its peer group in terms of valuation. While FirstEnergy is somewhat cheaper, that company also has higher risks due to its high debt. I discussed this in my last article on FirstEnergy, which was linked to earlier. The conclusion that we can draw here is that Exelon appears to have a very attractive valuation given its balance sheet strength and forward earnings per share growth.

Conclusion

In conclusion, Exelon Corporation could be a good addition to a portfolio today. The company boasts a strong balance sheet and respectable earnings per share growth, yet still has an attractive valuation. When we consider that this firm will probably prove to be somewhat stable in the face of economic challenges, it has the makings of a fine investment today.

Read the full article here