Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 3rd, 2023.

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines and they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all returned back into your pocket from that point forward.

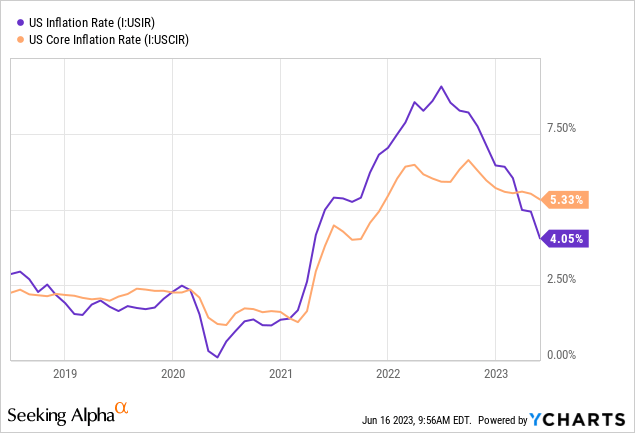

Dividend stocks, particularly REITs and utilities, compete with the risk-free rate. The Fed had been aggressively raising rates to combat sticky inflation. While inflation has remained sticky and is still elevated, we are now at a point where the Fed has paused. Although, the outlook is for two more rate hikes before 2023 is over before cutting rates in 2024 and into 2025. Of course, that’s the expectations at this time; that’s subject to change and most likely will change as we move forward.

Should data continue to come in hot such as jobs and inflation, even after bank failures earlier this year, the Fed may be in a position to hike further than expected. That could negatively impact income plays once again. However, that’s also where opportunities can be found for investors that have a long-term outlook.

Conversely, should data weaken as the Fed hopes, that could take those two anticipated hikes and turn them into one or two cuts sooner or more aggressively than originally expected. That could benefit income-oriented investments.

All of this being said is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are June’s five dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are among these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 549 stocks at this time from the 538 listed last month. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, from highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

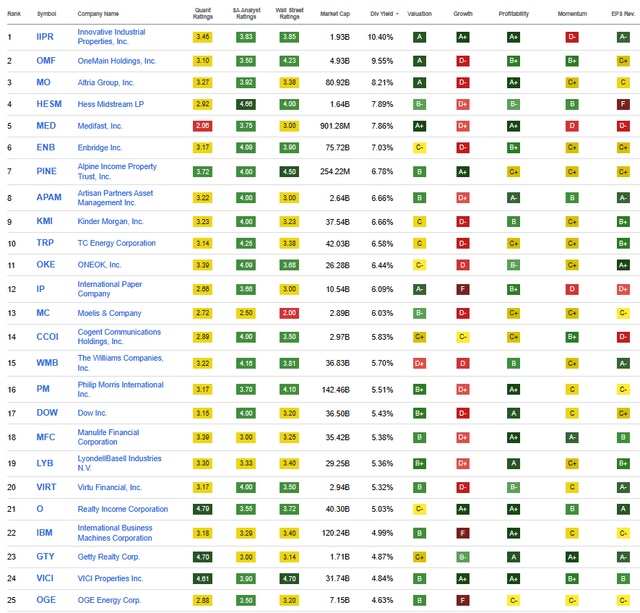

I will share the top 25 that showed up as of 06/03/2023.

Top 25 of Screener (Seeking Alpha)

This month we have quite a few familiar names that we regularly cover; this tends to be the case but even more so than usual with this latest month. Innovative Industrial Properties (IIPR), Altria Group (MO), Hess Midstream (HESM), Medifast (MED), Kinder Morgan (KMI), ONEOK (OKE), Moelis & Company (MC) and The Williams Companies Inc (WMB) are all names we covered in the last two months. So we’ll be skipping over touching on these names so soon again this month.

I skip over Artisan Partners Asset Management (APAM) because they have a variable dividend. International Paper Company (IP) we will also skip over since they cut a couple of years ago and haven’t raised since.

That leaves us with OneMain Holdings (OMF), Enbridge (ENB), Alpine Income Property Trust (PINE), TC Energy Corp (TRP) and Cogent Communications Holdings Inc (CCOI). All of these names we’ve covered previously, leaving us with no new names to touch on this month.

OneMain Holdings 9.79% Yield

OMF is a name we touched on last in February of 2023, but it has been a name that gets brought up on this screen frequently. We also took a deeper dive into the company more recently.

Overall, the company felt like it had a lot of potential, but obviously, with this high of a yield, there are risks to consider. Namely, their core business is lending to consumers that are sub-prime. Fortunately, they have millions of customers, and they have a history of navigating successfully through economic downturns.

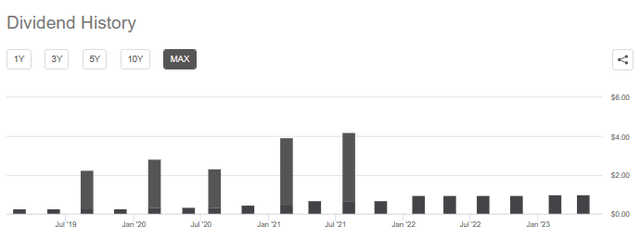

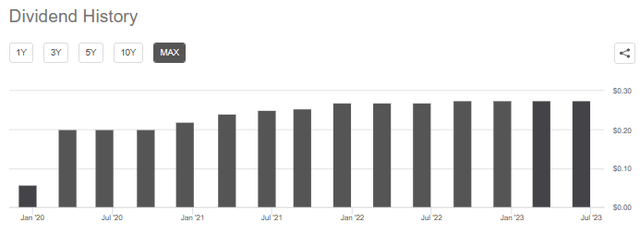

The history of their dividend has been fairly short-lived, as has the company’s history of trading publicly going back to an IPO in 2013. However, the company was founded in 1912. The dividend history also includes some significant specials, making it visually hard to tell, but they have been increasing their regular dividend at least annually.

OMF Dividend History (Seeking Alpha)

It was quite explosive growth too. That said, the latest increase, while encouraging to show confidence from management, was more lackluster. At the same time, it felt appropriate to slow down the pace of hikes while we are heading into an uncertain period where the economy is expected to get rough. That’s just prudent management since earnings are expected to take a big hit going forward.

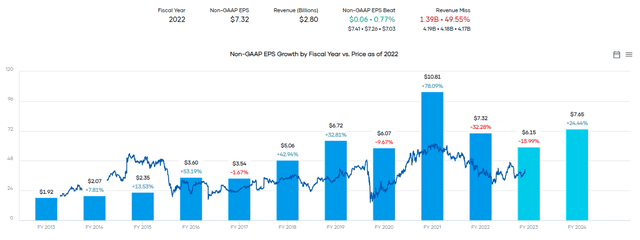

OMF Earnings And Forward Estimates (Portfolio Insight)

For now, the payout ratio seems fine. Even if they drop down to $6.15 in adjusted EPS, that should provide them with enough to cover the current dividend. I suspect their intention would be to not cut the dividend, being that they just raised it to start off this year.

Shares are down quite significantly from the heights they reached in 2021 and down to a forward P/E of 6.64x, making this a fairly interesting name to consider. Still, given the risks of a recession, the “E” could drop further than anticipated. I believe this is a riskier position to consider, and the high yield right now simply reinforces the uncertain outlook.

Enbridge 7.03% Yield

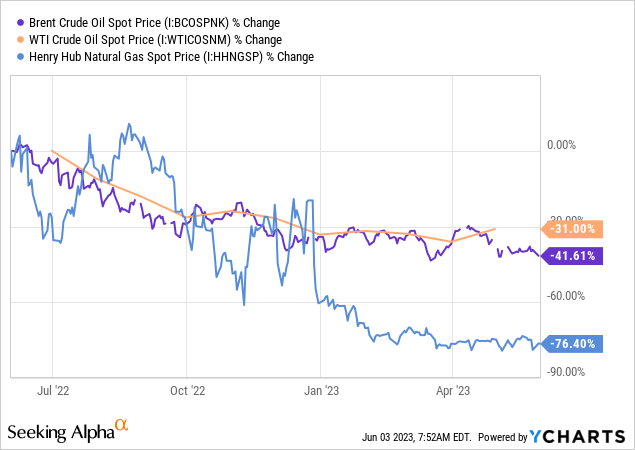

The last time we touched on ENB was back in March 2023. ENB is an income investor favorite, but it is down substantially. However, it’s not like they are alone as an energy infrastructure company. Energy has been the worst-performing sector on a YTD basis, driven by substantial drops in both oil and natural gas from their peaks last year. Natural gas saw the most brutal drop.

YCharts

Competition in the pipeline space seems to be picking up, too, with a late announcement after the June 2, 2023 market close announcing that ENB is going to slash their tolls for their Mainline system.

While pipeline companies are more sheltered from the prices of the underlying commodities due to fixed-fee contracts, that doesn’t mean they aren’t impacted at all. Cash flows should remain stable, but it is these sorts of announcements of competition while commodity prices are beaten down that can come up, impacting future cash flows when negotiating contracts. Additionally, we know when energy prices get too low; then producers just go bust. A company that goes bust has a hard time paying fixed fees or any fees.

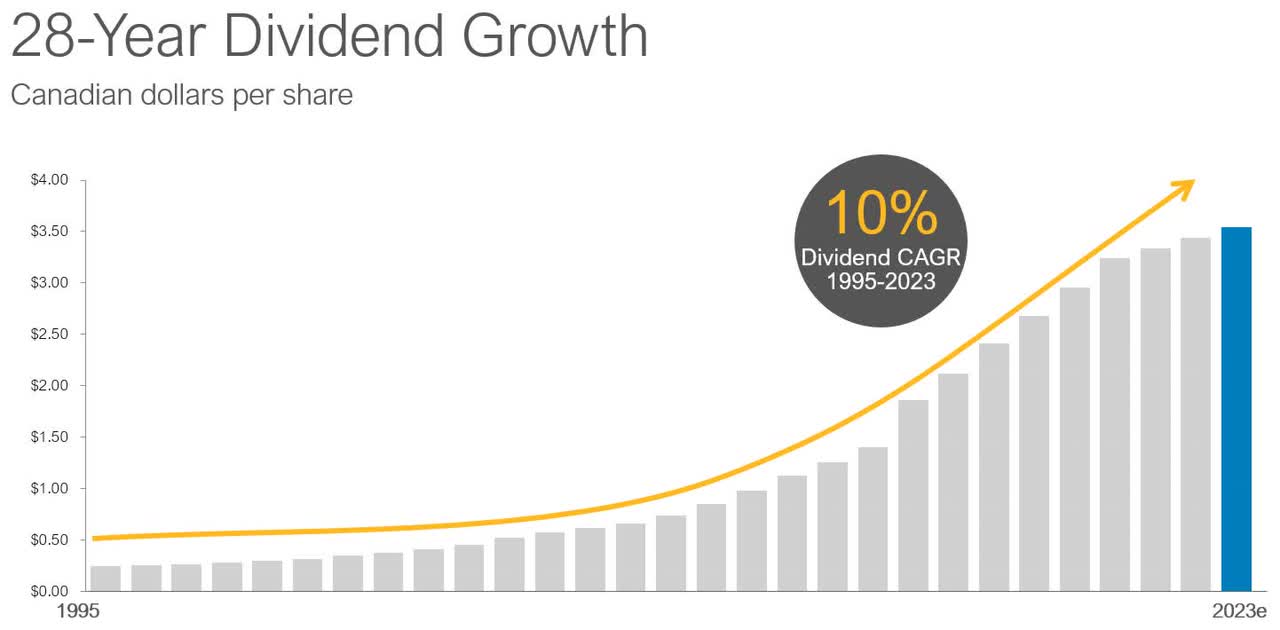

When looking at the dividend history of ENB, it could be confusing for newer investors because most will show it as if they have a variable payout. However, that’s due to USD/CAD conversion rates for websites that list the dividends in USD. When looking at the dividend chart paid in CAD from their website, we see they’ve been able to deliver a 28-year dividend growth history.

ENB Dividend Growth (Enbridge)

Alpine Income Property Trust 6.81% Yield

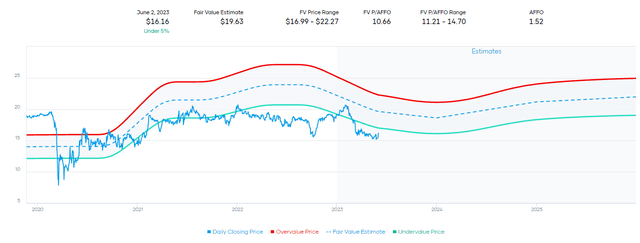

The last time we touched on PINE was in March 2023. This is a REIT, and that generally catches my attention as an income investor. We took a deep dive into the company previously, but it has been quite some time. This was primarily because it experienced a swift drop in October 2022, but then rebounded and stayed relatively expensive for a period of time. We are now once again at a level where it is trading at an interesting price again. PINE doesn’t have a long history yet, so the fair value range below really hasn’t been established.

PINE AFFO Historical Range (Portfolio Insight)

However, REITs across the board have been slammed by the banking crisis and continuing rising interest rates. So PINE isn’t necessarily the only attractively valued REIT right now for the long-term investor. Considering the small size and external management of PINE, those are risks that an investor should consider before investing. That said, CTO Realty Growth (CTO), which spun off PINE and is now the manager, owns a meaningful 14.8% stake in PINE. So not only are they reliant on PINE to perform well so they can benefit as managers, but also so they can benefit from their equity position as well.

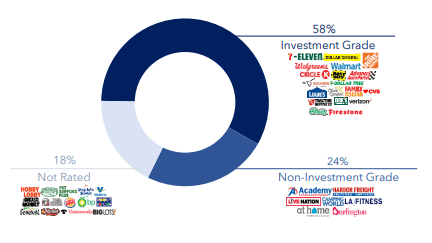

They have a total enterprise value of $434 million with 138 properties. Highlighting just how small this REIT is. Over half of their tenants are considered investment grade, which is a positive.

PINE Credit Quality of Tenants (Alpine Income Property Trust)

They started off with strong dividend growth, but they, too, have slowed the pace down due to uncertainty going forward.

PINE Dividend History (Seeking Alpha)

Again, this only seems prudent as AFFO estimates are anticipating a drop in this current fiscal year before potentially rebounding.

PINE AFFO And Forward Estimates (Portfolio Insight)

TC Energy Corp 6.58% Yield

TRP is another Canadian energy play to show up this month. However, it showed up in March 2023 alongside ENB last time too. This company has a large focus on natural gas pipelines but also has some liquids exposure too.

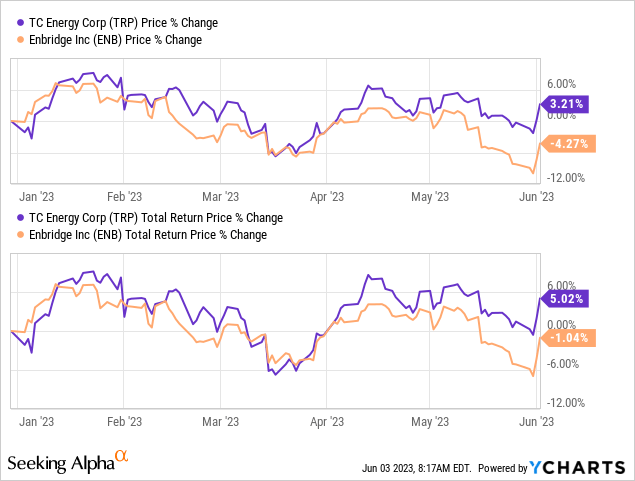

TRP hasn’t necessarily been having a strong year in terms of its performance either, but it has been able to stay positive on a YTD basis, unlike ENB. As mentioned previously, energy has been the worst-performing sector on a YTD basis. Both benefitted from a big boost in the overall market on June 2 trading. If ENB is going to be more aggressive with their pricing for pipelines, that could impact TRP going forward.

YCharts

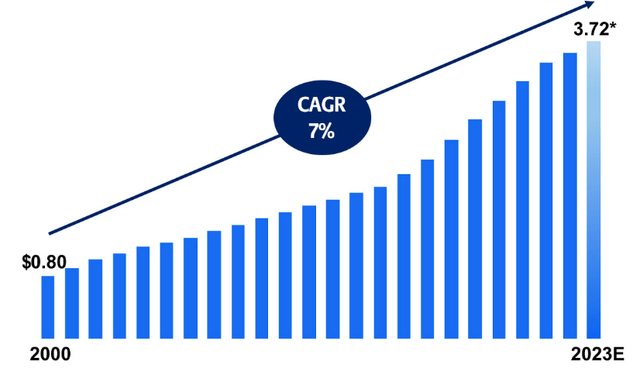

The dividend growth from TRP hasn’t been quite as strong as ENB, and it also doesn’t have the same length of history. Still, what TRP has been able to deliver has been attractive nonetheless. They expect dividend growth of 3-5% going forward, meaning they expect slower growth than they’ve been able to achieve historically.

TRP Dividend Growth (TC Energy Corp)

At the same time, they are looking for EBITDA to grow 5-7% higher this year. So the growth in earnings can support the dividend growth and potentially have some cash left over for other projects, debt reduction or buybacks. Which is what they noted in their previous earnings call.

As we’ve talked about before, once the project is in construction and we break ground, we’ve probably been add it for a couple of years from a perspective of permitting and project planning and having ordered long lead items. And one of the reasons why we’re going to strive for building some optionality below our $7 billion capital run rate going forward is that, we do want to make sure we maintain some capacity for further debt reduction or share buybacks going forward.

Cogent Communications Holdings Inc 5.93% Yield

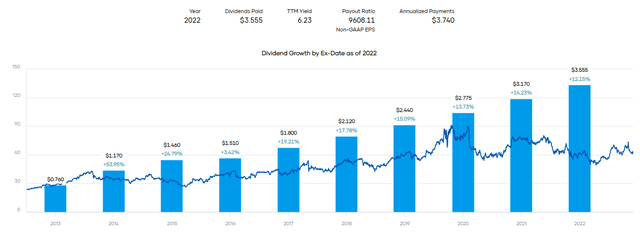

CCOI is an interesting dividend play because they’ve been able to raise their dividend every quarter. The hikes have been at a brisk pace, too, looking at the increases year to year. Though the latest was an increase of 1.1%, signaling they are potentially slowing down the rapid pace of increases.

CCOI Dividends Paid (Portfolio Insight)

While a company raising its dividend shouldn’t be a sole factor in making a decision for an investment or not, it can still be seen as a perk. That naturally piqued my interest, and I put this name on my watchlist. However, while I have been skeptical to add as I viewed it as a somewhat speculative play, it continues to go higher anyway.

Instead of buying, I had sold some puts previously, which ultimately expired worthless. Shortly after that, it was October 2022, when the overall market bottomed out in bear territory before rebounding. Just like PINE is an interesting name that also dipped in October 2022, there were just so many opportunities for buying and selling puts that you can’t pick up every position you might want.

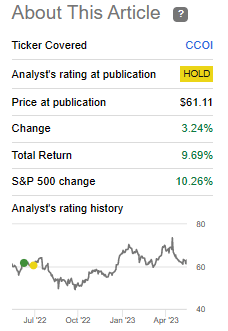

CCOI Since Previous Update (Seeking Alpha)

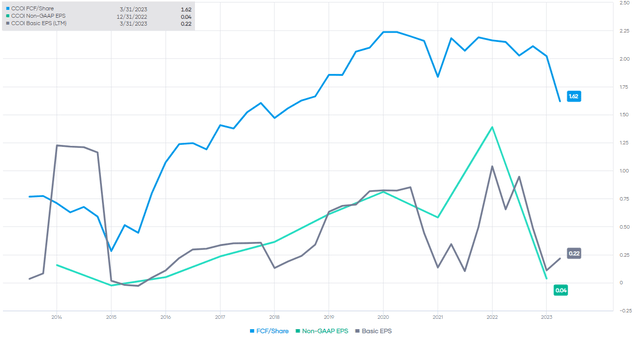

They’ve once again come back down to a level that makes shares interesting. However, the reason I feel that it is more skeptical despite what appears to be a rock-solid dividend history is due to dividend coverage. It isn’t covered on a GAAP or non-GAAP EPS basis due to significant depreciation; this makes sense. However, it isn’t covered through free cash flow either.

CCOI Earnings And Cash Flow (Portfolio Insight)

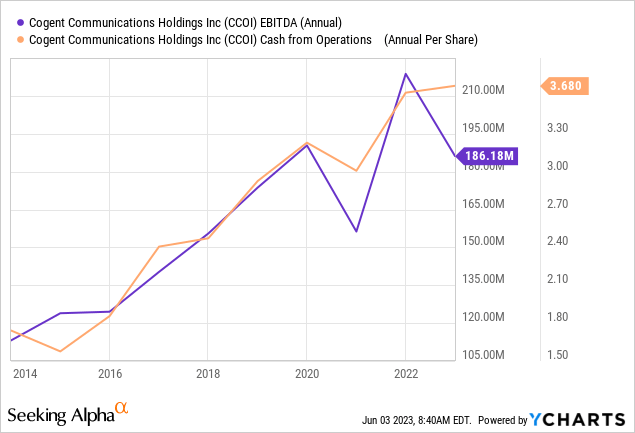

Instead, we have to look at EBITDA as we would similar to an energy company for an earnings trend. We can also look at the cash from operations on a per-share basis to start to come up with dividend coverage.

YCharts

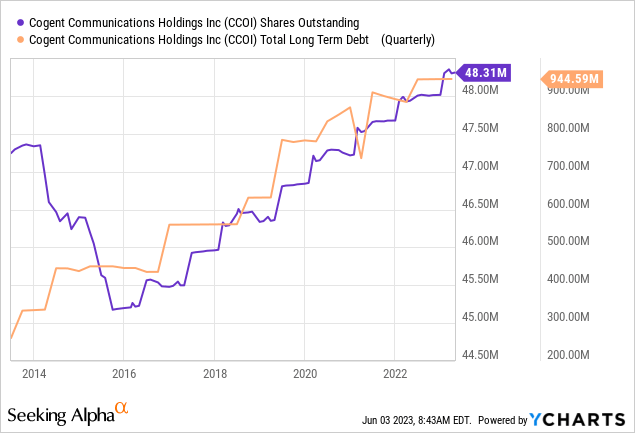

Currently, at an annualized dividend rate of $3.74, we see that even CFO per share was not enough to cover the dividend as it had been previously. Dividend “coverage” from CFO anyway meant that any growth projects were only going to be possible through debt and new shares being issued. This is the exact trend that we’ve seen, too, with shares outstanding and debt both rising.

YCharts

Now, with a further lack of cash flows covering the dividend, debt and equity will have to be used to pay shareholders. And that’s why I can’t get beyond this being a more speculative play with what would probably seems like an absurdly low $45 price target to others.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here