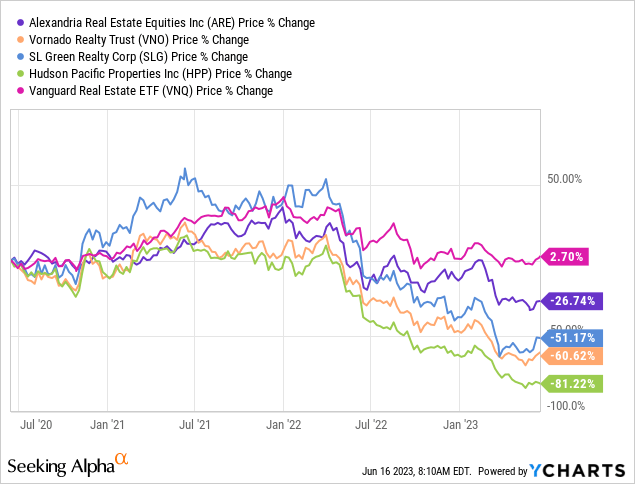

Office space (real estate, not the movie), has occupied a lot of investor attention in 2022 and 2023. While the initial rebound from the pandemic lows helped REITs of all shapes and sizes, the market definitely shunned the office sector in the last 15 months. Our stance has fortunately avoided the drubbing as we stayed clear from this sector and occasionally doled out a short-sell recommendation on the most vulnerable.

Alexandria Real Estate Equities Inc. (NYSE:ARE) is a curious one that has dropped recently alongside the office sector. While the returns over the last three years have not been as bad as Hudson Pacific Properties Inc. (HPP) or Vornado Realty Trust (VNO), they have lagged the broader Vanguard Real Estate ETF (VNQ).

The bull argument has been that the niche segment that Alexandria caters to, makes it immune from the turmoil. Let’s take a look and see whether this holds up to scrutiny.

The REIT

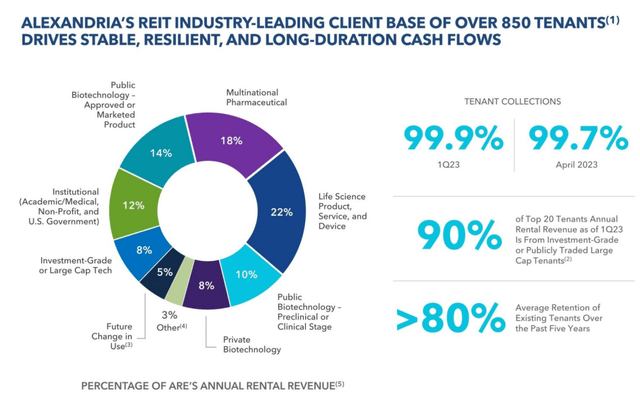

Alexandria is a unique Life-sciences focused REIT. Lab space, which often gets lumped in with office, has its own characteristics. These include a rather complete lack of working from home and specialized biohazard safety measures. Alexandria’s tenants are high quality and their rent collections are the best in the business.

ARE Q1-2023 Presentation

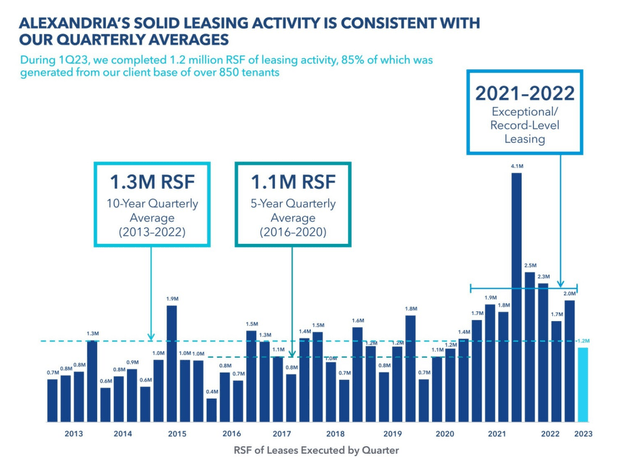

Over the course of the last decade, Alexandria has shown the value of this space in its rental renewals. These renewals actually perked up after the pandemic and again demonstrated that this is not the typical office space.

ARE Q1-2023 Presentation

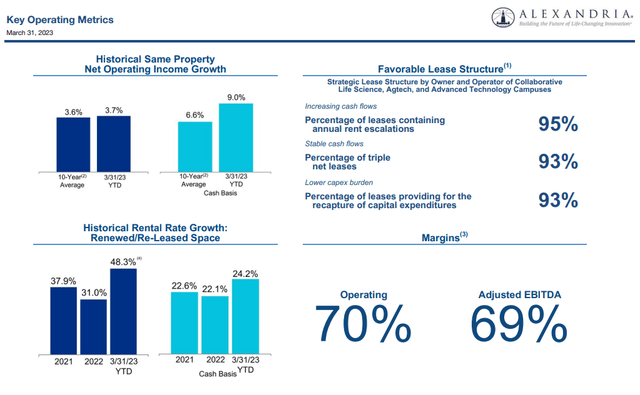

The recent quarters have been strong, with same property net operating income (NOI) growing in line with historical averages.

ARE Q1-2023 Presentation

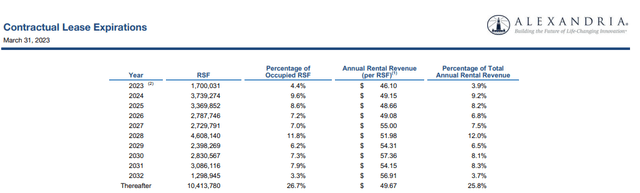

Lease expirations are modest and unlike some REITs which face half their portfolio coming up for renewal in the next three years, Alexandria has great stability.

ARE Q1-2023 Presentation

The most recent quarterly results showed Alexandria pulling back their investments slightly.

At quarter-end, projects under construction and near-term projects expected to commence construction over the next four quarters totaled 7.6 million square feet and are 74% leased or under negotiation. This is very similar to last quarter, but in response to the uncertainty and volatility in the markets, we have made a strategic decision to reduce 2023 construction spend by $250 million by pausing or delaying projects that had been classified as under construction, so we can focus our capital on the most strategic projects that have the most attractive terms, enabling our highly bedded and vast tenant base.

Source: ARE Conference Call Transcript

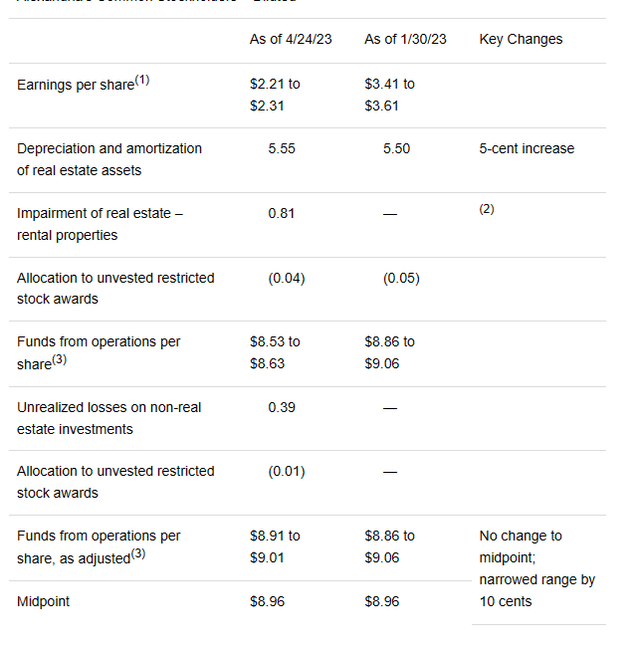

Their guidance was basically unchanged for the year, but the market has been sniffing that there might be more trouble ahead.

ARE Press Release

Our Outlook

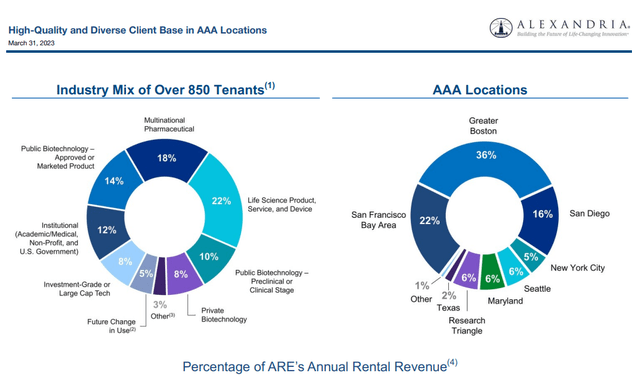

Sometimes the market can rush ahead and discount the best or worst case scenarios rather quickly. That has been the bull argument here, that Alexandria is priced for disaster. Certainly, on a funds from operations (FFO) multiple basis, Alexandria is trading at the largest discount to its own average. It generally traded at a premium to the wider REIT sector multiple over the last decade, and it is now about in line today. But before you rush and buy, have a look at its portfolio.

ARE Q1-2023 Presentation

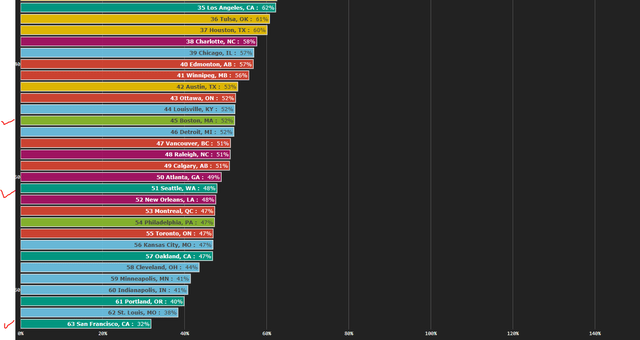

The portfolio is concentrated in just a few cities. All of those cities have extreme levels of stress for general office space, and three of them rank really poorly for activity recovery compared to pre-pandemic levels.

Downtown Recovery

The three have some brutal office vacancy levels. Seattle’s has been increasing rapidly and is now near 12%. Boston is about to cross 20%.

Office vacancy across Boston, Cambridge, and the suburbs has risen, with the regional vacancy rate hitting 19.1 percent at the start of this year, its highest in nearly two decades, according to real estate firm JLL.

Source: Boston Globe

San Francisco is even worse and has reached nearly 30%. All three could see occupancy levels get worse in the next 12 months. Of course, bulls may go, “So What?” Regular office space is irrelevant to lab space. That is only partially true. Conversions are coming at a breakneck pace.

And of the 125 office conversion projects currently underway, half are being adapted for life-science use, according to Jessica Morin, CBRE Americas head of office research.

The high percentage of office conversions to life science compared with other product types is understandable considering the overlap in these two uses, suggests Devin Bertsch, project director for San Francisco-based Project Management Advisors. Bertsch, who specializes in life science development and construction management, notes that the amount of floor space converted to lab use is usually 50 percent or less of the project, but conversions generate rents comparable to new ground-up life science projects.

The first quarter of 2021 saw a peak in life science conversion projects, accounting for 41.5 percent of lab products created, says CBRE associate research director for life sciences Taylor Stucky. Another 31 percent of the life science space delivered in the fourth quarter of 2022 was also conversions.

Source: Urban Land

Where are these conversions happening? Some are mentioned in the article above. Notice something?

New York City, with 77 percent of product in the pipeline attributable to conversions, has the highest percentage of these projects, followed by Washington, D.C./Baltimore, Denver-Boulder, and Boston-Cambridge.

San Francisco is also accelerating office to lab conversions.

Interestingly, the new supply is not just coming from office space.

Charleston Plaza, a shopping mall in Mountain View, California, is one such illustration. San Francisco-based Presidio Bay Ventures purchased the property last year for around $72 million. The company plans to develop it in two phases. The first phase consists of repositioning the property, which is on a 12-acre site, through adaptive use of the approximately 100,000 square feet (9,290 m sq) of big box retail: the former Bed, Bath & Beyond, former Best Buy, and former REI, according to Cyrus Sanandaji, founder and managing director at Presidio Bay Ventures.

The goal is to have the former big-box retail space occupied by life science and research and development users.

Source: Urban Land

Verdict

Some of these conversions are already hitting the market, and some of these are a few years away. Some may not get the approvals necessary, and some plans may get abandoned as costs may turn out to be too high. But the overall trend is in place. There is a lot of office supply in these cities, and you don’t need to move a lot into a specialized sector to impact rents. REITs are also very heavily impacted by interest rates. We view this in a slightly different way than what is commonly stated. Yes, REITs feel the impact from debt costs, but the bigger issue is the pure competition for investment from risk-free rates. Since the peak in 2021, you could explain the bulk of the decline in Alexandria simply by the rise in interest rates. If, as an investor, you wanted Alexandria to provide you with the dividend yield at least equivalent to the 10-year Treasury rate, you would be indifferent to buying it at $225 in 2021 or $125 today. Sure, you get capital appreciation potential with REITs, but you also have a far greater risk than Treasuries. So as the risk-free rate pushes the valuation knob, expect Alexandria to remain pressured. Time will decide whether this specialized space is indeed vulnerable for conversions or not. But for now, investors should not dismiss the data we are seeing.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here