Zuora (NYSE:ZUO) is a cloud-based subscription management platform that provides businesses with the tools and capabilities to launch, manage, and monetize subscription-based business models.

I first covered ZUO in 2020, when I rated the stock neutral. ZUO would outperform my expectation the following year in FY 2021 when the share price reached $20, though since then, share performance has been underwhelming, with ZUO trading between $10 – $12 per share most recently, down ~13% from the price at my first coverage.

Nonetheless, the fact that ZUO is currently trading at such a range indicates that it has been off to a good start in 2023. If we zoom out, the share price has actually been up by almost 80% YTD, as it was trading at merely the $6 range at the beginning of the year.

I expect the stock to continue benefiting from the broader subscription shift and to maintain its resilience, though competition will likely remain tight.

At this point, I maintain my neutral rating for the stock. My target price model suggests that it remains fully valued at present, though a potential upward revision in guidance in Q2 or later may create upside potential.

Catalyst

As of Q1, I think that ZUO has proven that it is well-positioned to capture the growth opportunity from the broader enterprise shift to a subscription economy. One thing that has caught my attention is ZUO’s resilient growth despite the ongoing macro downturn.

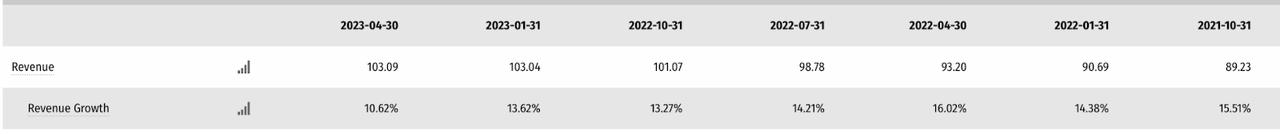

stockrow

Many cloud software stocks have been experiencing a significant slowdown in their businesses, but ZUO has maintained a steady double-digit growth of 10% – 15% since last year, demonstrating that it has been seeing a softer impact from the downturn than some of its cloud software peers in other industries.

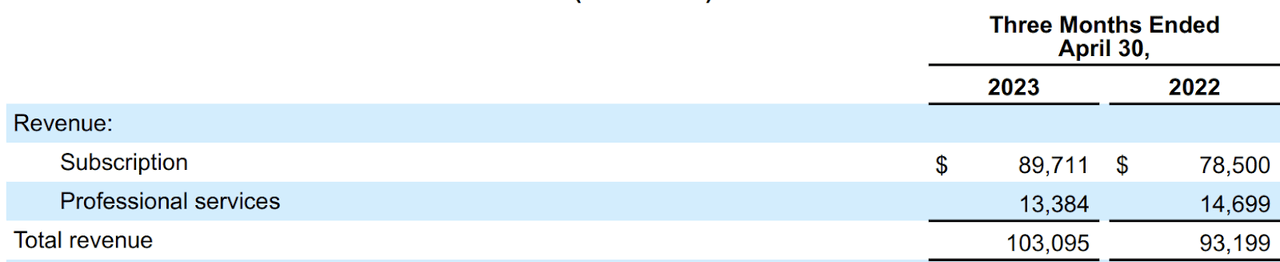

ZUO quarterly report

In Q1 2024, revenue grew ~11% YoY, reflecting a sequential deceleration from last quarter’s growth of ~14% YoY. However, higher-margin subscription revenue growth remains relatively robust at 18% YoY in constant currency/cc. At the same time last year, YoY growth was 20%, only slightly higher.

Given the recent performance in Q1, I think that it is possible for ZUO to finish the year above the low end of its revenue guidance. For FY 2024, ZUO guided revenue of $431 million – $440 million, reflecting a projected ~9% – 11% YoY growth. Obviously, ZUO already reported an 11% growth in Q1, while it also typically records stronger growth around the back half of the FY in Q3 and Q4.

As such, I expect the momentum seen in Q1 to continue, driven by the acquisition of new logos and key renewals. I think that ZUO’s recent product innovations, which have been relatively fruitful since last year, will strengthen its go-to-market across those fronts.

In Q1, for instance, the management pointed out that its key client, Zoom (ZM), not only renewed a 4-year contract but also added new modules, such as advanced consumption – a feature that was launched only at the beginning of 2023. Furthermore, the management also suggested that the product of its recent acquisition Zephr continued to be one of the solutions seeing most adoptions from new logos in Q1, alongside Billing and Revenue:

Nick, the last piece of color that I would add to Tien is, if I take a look at the new logos that we added last quarter, really good balance between Billing, Revenue and Zephr.

As a solution that enables digital publishing and media companies to develop paywall solutions, Zephr played a role in landing global media company Forbes in Q1. Given the relatively recent launches, I think that it is likely for ZUO to continue seeing product adoption-driven growth here in Q2 and beyond.

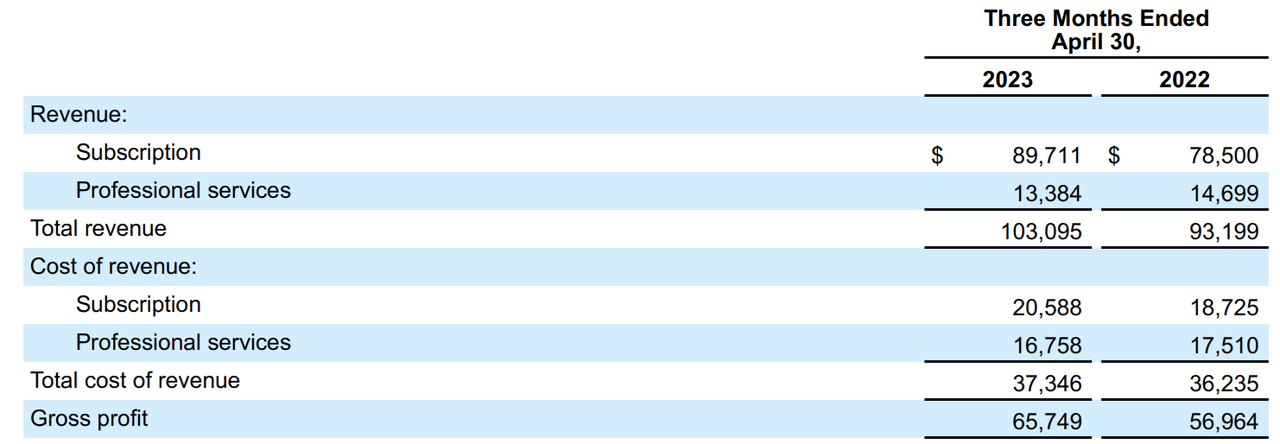

In addition, I also expect ZUO to continue seeing margin expansion, driven by its initiative to transition more professional services / PS work to its system integration / SI partners. Effectively, this will drive higher-margin subscription revenue growth further, increasing its share in the revenue mix and lift gross margin.

ZUO quarterly report

PS has been an unprofitable business for ZUO, since it seems to rather serve strategic purpose, which is to help clients integrate and deploy ZUO’s solution in their IT environment. In Q1, we continued to see PS revenue declining as ZUO shifted most of the work to its SI partners, which has also been doing well to unlock new deals for ZUO – more than 50% of go-lives in Q1 involved its SI partners.

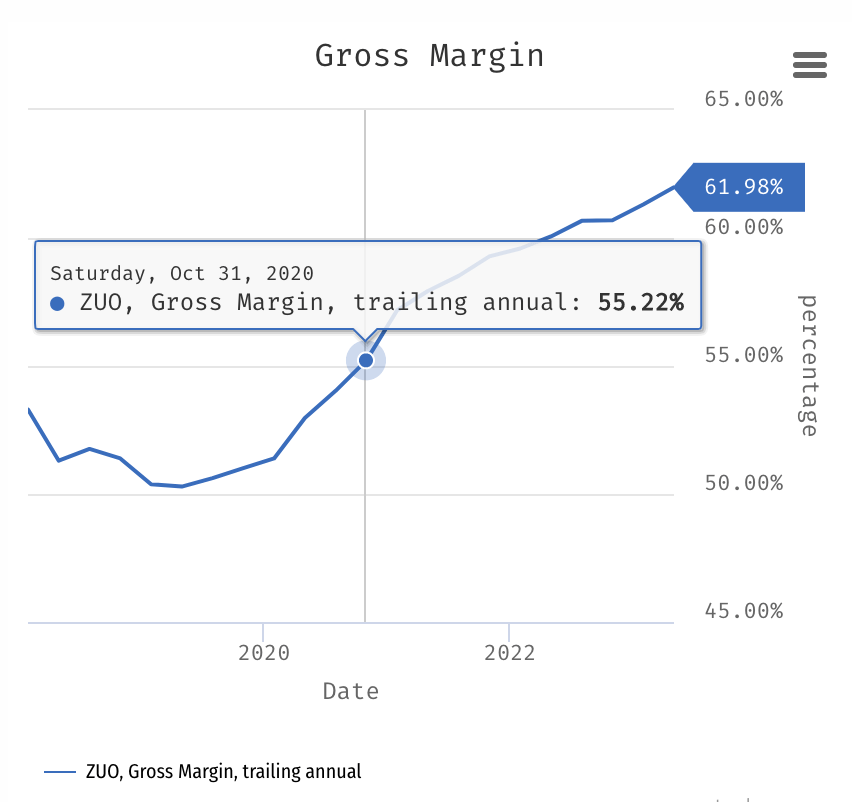

stockrow

Consequently, gross margin will likely continue to see expansion further, with a long-term target of probably around +75%, closer to the subscription gross margin. Overall, the transition has been very positive for ZUO. Gross margin has gradually expanded from ~55% around the time of my first coverage in 2020 to +60% in Q1.

Risk

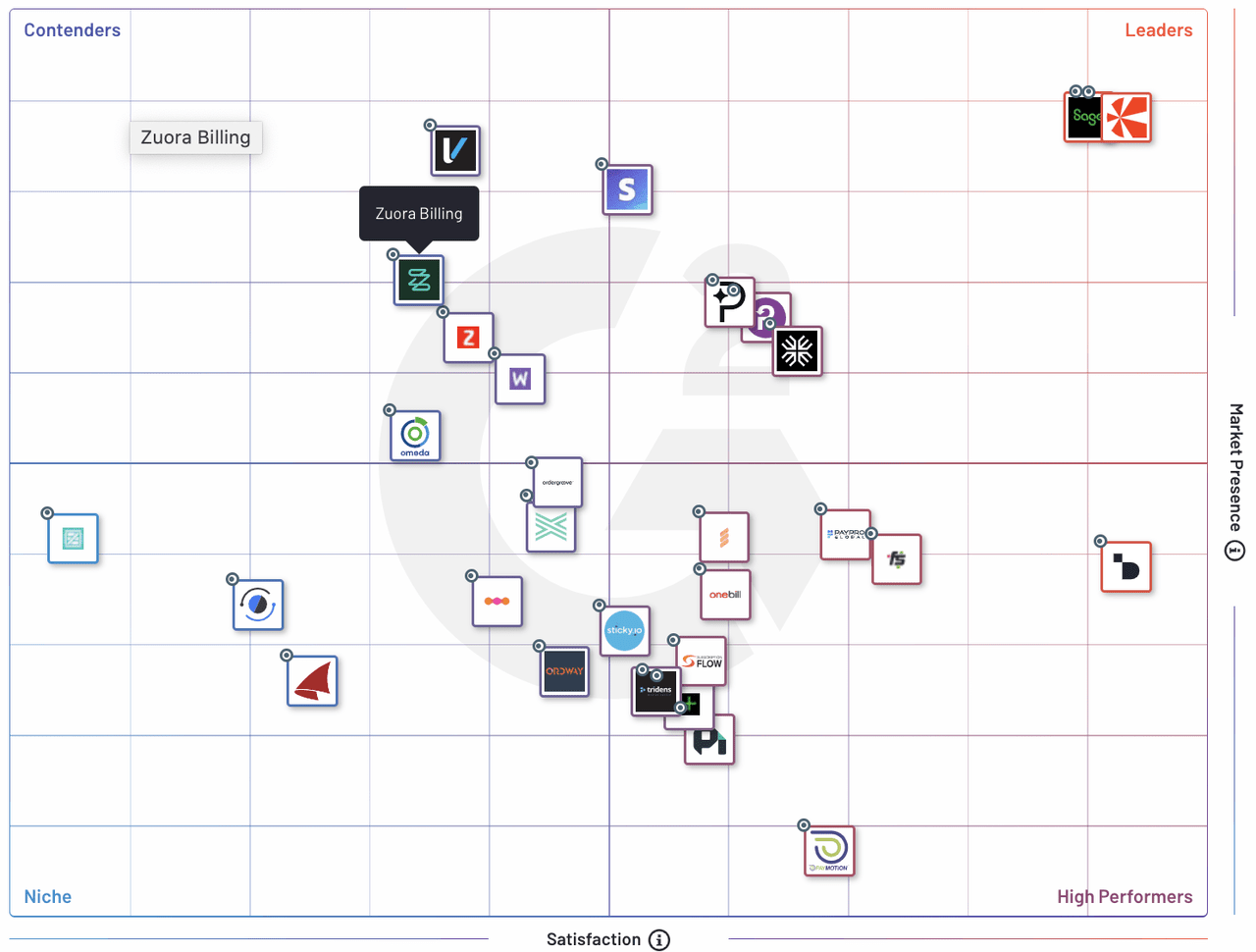

Though I might have underestimated ZUO’s TAM / Total addressable market at one point, the subscription management and billing space is quite crowded. A quick search for subscription management platform options on G2 yields over 100 results.

G2

The finding here suggests that while ZUO seems to have secured a solid market positioning in the enterprise segment – as is apparent with the increasing share of its high ACV / annual contract value customers – ZUO ranks nowhere near the top of the result, with its customer reviews also being moderate. Meanwhile, noteworthy competitors like Stripe, Sage, or Chargebee also rank higher than ZUO.

I think that at the very least, the finding also suggests that competition will continue to be tight for ZUO, and the recent tweak to its go-to-market strategy to opportunistically target smaller deals may even potentially increase the risk of customer churn, creating near-term downside risk.

Valuation / Pricing

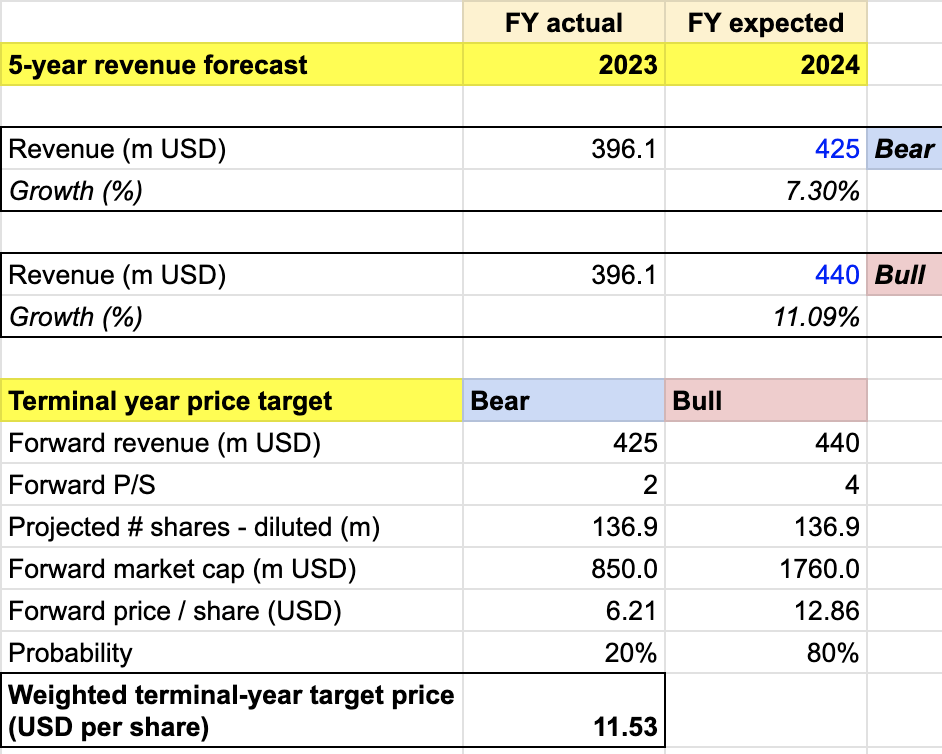

My target price for ZUO is driven by the following assumptions for the bull vs bear scenarios of the FY 2024 target price model:

-

Bull scenario (80% probability) assumptions – ZUO to see steady growth and finish FY 2024 with a revenue of $440 million, an ~11% projected YoY growth. I will also expect ZUO to maintain its current P/S of ~3.9x at the end of FY 2024.

-

Bear scenario (20% probability) assumptions – ZUO to miss its FY 2024 estimate with a revenue of $425 million, a 7.3% projected YoY growth, as opposed to the ~9% growth at the lowest end of the guidance. I expect ZUO’s P/S to contract to 2x, near its all-time-low.

author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of $11.53 per share. With ZUO trading between $10 – $12 per share in recent weeks, I conclude that the stock remains fully valued.

My target price also seems to be quite sensitive to the expected revenue growth for FY 2024. I think that ZUO may present an attractive upside if improving sales productivity in Q2 and beyond triggers an upward revision in the guidance. Otherwise, even if ZUO meets the highest-end of its revenue guidance, my bull-case target price of ~$12.86 suggests that the year-end upside will still only be ~10% at best.

Conclusion

In 2023, ZUO had a promising start, with the share price up almost 80% YTD. Despite a slowdown in the industry, ZUO maintained steady growth of 10% – 15% and aims to expand margins through increased reliance on SI partners. However, intense competition and opportunistic shift towards targeting smaller deals pose potential near-term risks.

My target price for ZUO is heavily influenced by the expected revenue growth in FY 2024. If there is an improvement in sales productivity in Q2 and beyond, resulting in an upward revision in guidance, ZUO may offer an appealing upside. At this time, the stock appears to be fully valued, and as such, I maintain my neutral rating for the stock.

Read the full article here