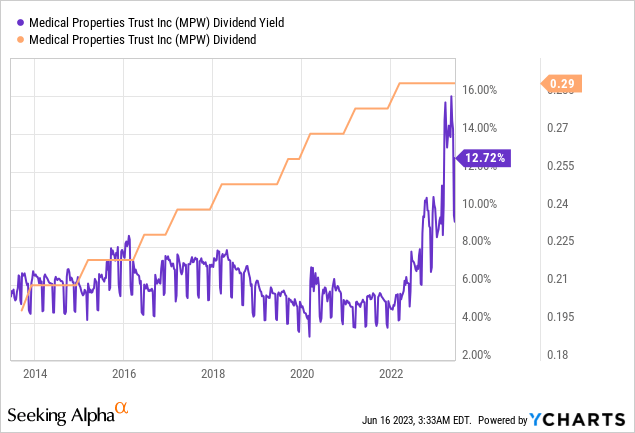

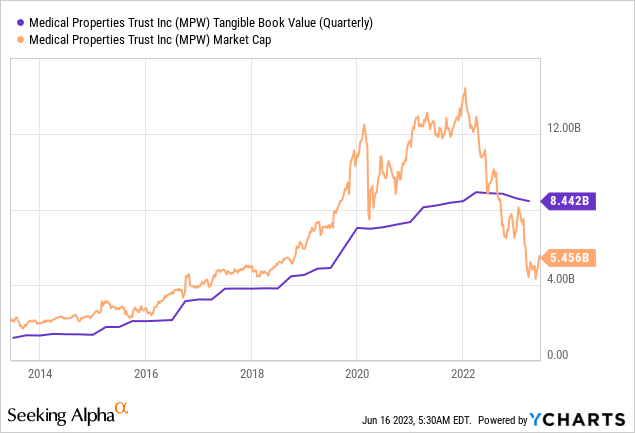

Medical Properties Trust’s (NYSE:MPW) rally is likely just getting started as the owner of acute care facilities is now swapping hands for 65 cents of the dollar. The equity REIT is trading at a roughly 35% discount to its tangible book value per share of $14.11 as of the end of its fiscal 2023 first quarter. This is on the back of common shares that have lost more than half of their value from their early 2022 peak. For bulls, the prize is a sustained recovery to its 2022 peak whilst they get paid a double-digit yield. The REIT’s quarterly dividend stands at $0.29 per share for a forward annualized yield of 12.72%. This double-digit yield is abnormal against the REIT’s historical dividend yield over the last decade.

The REIT is up by 22% on a total return basis since I last covered it, a young rally that was catalyzed by market expectations around a Fed interest rate pause following what had been ten consecutive rate hikes. An update is required for two reasons. Firstly, UnitedHealth Group (UNH) in a presentation on Tuesday stated that its medical care ratio will experience increased pressure in the second quarter. This ratio describes the share of premiums spent on healthcare costs and is set to rise after the pandemic kept seniors away from elective care surgeries. UnitedHealth stated that they’re seeing behaviors normalize to their pre-pandemic patterns across the US as mask mandates are dropped and more seniors are comfortable accessing surgeries for things like hips and knees. Further, MPW put out a presentation that fully augments the bullish argument that the REIT is trading at too steep a discount to its historical average as tenant headwinds improve.

Swapping Hands For 65 Cents On The Dollar

MPW’s two largest tenants Steward Health Care and Prospect Medical ran into financial difficulties during the pandemic as highly profitable elective surgeries were essentially replaced with COVID patients. Orthopedic surgeries like joint replacements tend to have high sustained demand and high reimbursement rates. This disrupted their incomes as costs also started to rise due to staff shortages. The US government did provide $100 billion in funding to hospitals through the CARES Act, but this was viewed to be too little as COVID patients often required specialized treatment and were hospitalized for an extended period of time.

MPW for much of the last decade saw its market cap trade above its tangible book value, this premium was built on impeccable dividend payouts and a growing global property portfolio of acute care hospitals, behavioral health facilities, and inpatient rehabilitation hospitals. Bears would be right to state that the REIT’s tangible book value has started to decline. It stood at $8.44 billion as of the end of MPW’s fiscal 2023 first quarter, a decline of 5.3% over its year-ago comp. However, this was also up sequentially and will be better stabilized later this year once Prospect Medical resumes partial rent payments in September and full rents from early next year. To be clear here, MPW is rightly trading at a historical discount to its intrinsic value on the back of tenant headwinds that are slowly receding, but the current dichotomy between market cap and book value is far too large and its closure now looks like a possibility through 2024. The UnitedHealth update seems to have been missed by the stock market even as it indicates a healthier operating environment for its US tenants.

How The Bears Might Be Right

Medical Properties Trust June Investor Presentation

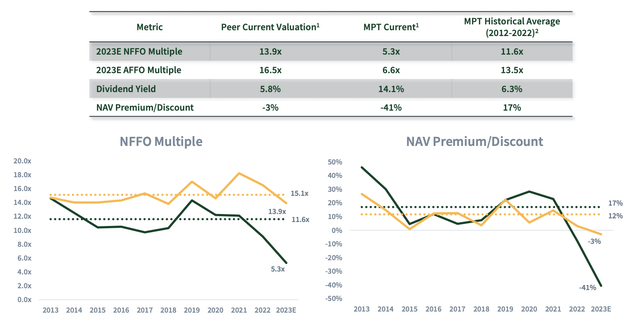

MPW will not trade at par with its peer group as long as it still experiences tenant headwinds. Bears would be justified to state that a top three tenant not currently paying any rent warrants a discount. Prospect has since been able to raise $375 million in new financing, an inflow of liquidity that’s been used to repay its asset-backed revolving credit facility and capitalize its managed care business. Whether this warrants MPW trading at a roughly 5.3x multiple to its estimated NFFO for 2023 is the question the bears should answer. Critically, the current macroeconomic environment has rendered the bearishness formed around MPW’s tenant issues more extreme than it otherwise would have been.

I think we’ve likely seen the worst of inflation, and an upcoming summer of interest rate pauses should give way to a possible cut in the first half of next year. I’m building a significant position in the REIT for a long-term hold as its large discount to book value gets closed and as I get paid an above-historical average dividend yield. The eventual normalization of current macroeconomic headwinds should get aggregated with the resumption of monthly rents from Prospect as rising elective surgeries and falling inflation drive better financial performance. This is a buy with a plan of holding through to 2025 at a minimum.

Read the full article here