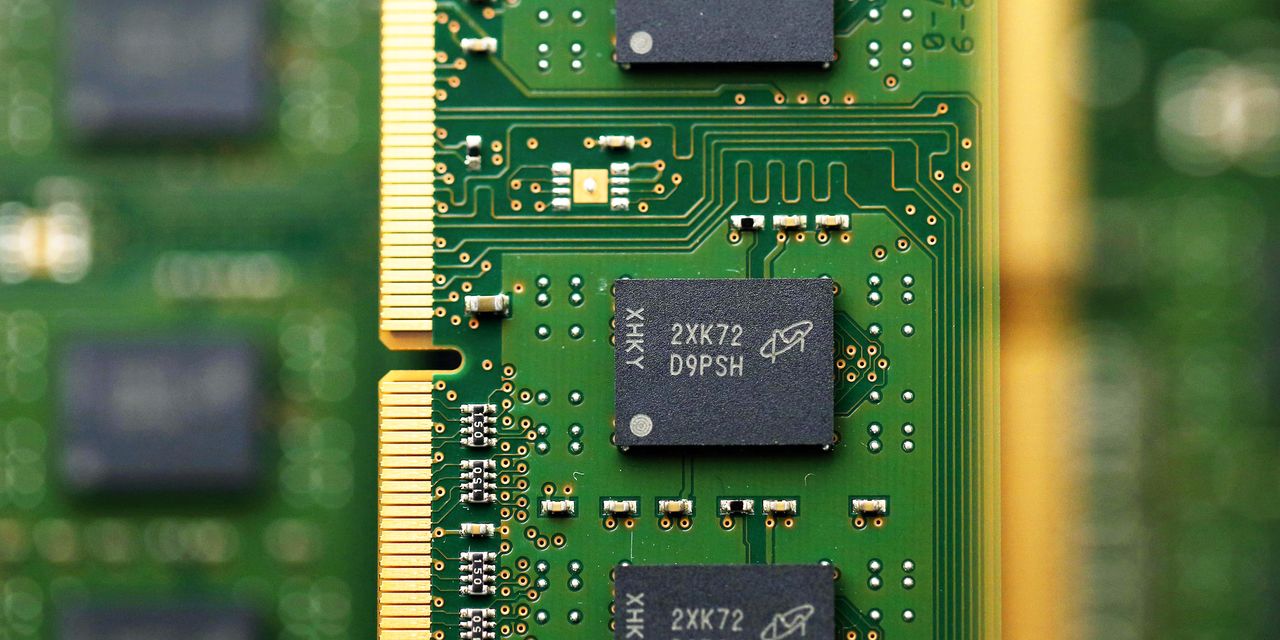

Micron Technology

warned Friday that around half of its China customer revenue could be impacted by a partial ban on the U.S. chip maker selling to some Chinese companies. The stock fell more than 2% in early trading.

Micron

(ticker: MU) said around a quarter of its worldwide revenue comes from companies based in mainland China and Hong Kong, adding that the ban puts a low-double-digit percentage of its global revenue at risk.

The company reiterated its commitment to China earlier Friday, announcing plans to invest 4.3 billion yuan ($605 million) in its Xi’an plant despite the ban.

The company said it will use the investment to acquire packaging equipment from Xi’an-based Licheng Semiconductor and build a new facility in its factory, in a post on Chinese social media platform

WeChat.

The stock rose close to 3% ahead of the open Friday.

Less than a month ago, China’s Cyberspace Administration banned companies involved in critical information systems from buying chips from Micron, saying they pose a “major security risk.”

Micron did not directly refer to the partial ban when it announced the investment.

“This investment project demonstrates Micron’s unwavering commitment to its China business and its China team members,” CEO Sanjay Mehrotra said in a statement on WeChat, seen by Barron’s.

It will also allow Micron to directly operate its packaging and testing business in Xi’an, the company added.

“We are pleased to be able to move forward with this important project. After the completion of the new plant, we will gradually introduce new equipment and processes in Xi’an,” Micron’s China general manager Wu Mingxia said.

Barron’s has reached out to Micron for additional comment.

Write to Callum Keown at [email protected]

Read the full article here